Corrugated Packaging Market Report Scope & Overview:

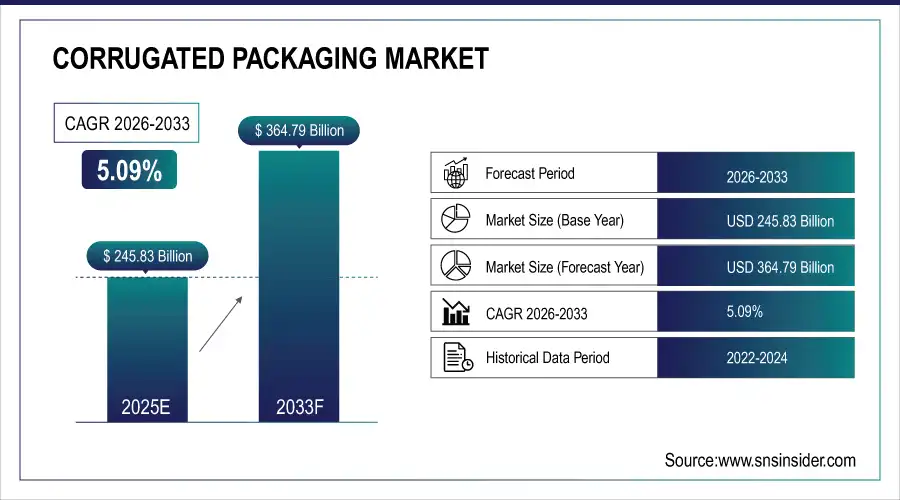

The Corrugated Packaging Market Size was valued at USD 245.83 Billion in 2025E and is projected to reach USD 364.79 Billion by 2033, growing at a CAGR of 5.09% during the forecast period 2026–2033.

The Corrugated Packaging Market analysis highlights growth driven by rising trade, increasing demand for sustainable and protective packaging, and advancements in material design. The market is becoming larger as suppliers develop lightweight, durable and sustainable solutions to keep pace with changing consumer and supply-chain demands.

Corrugated packaging production reached 140 billion square meters in 2025, driven by rising trade and growing demand for sustainable, protective packaging.

Market Size and Forecast:

-

Market Size in 2025: USD 245.83 Billion

-

Market Size by 2033: USD 364.79 Billion

-

CAGR: 5.09% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Corrugated Packaging Market - Request Free Sample Report

Corrugated Packaging Market Trends:

-

Growing e-commerce and logistics is fueling sales of corrugated packaging, prompting the production of stronger protective materials.

-

Lighter, stronger, and recyclable board innovations are boosting efficiency, lowering cost and upgrading supply chain sustainability.

-

Increased demand for sustainable packaging methods is driving the growth of recycling and biodegradable material adoption across sectors.

-

Automation in packaging, printing & folding machinery is increasing process-efficiency and customization options.

-

Attention is turning on the market to high quality, sustainable and adaptable corrugated packaging that adapts to changing consumer and logistics needs.

U.S. Corrugated Packaging Market Insights:

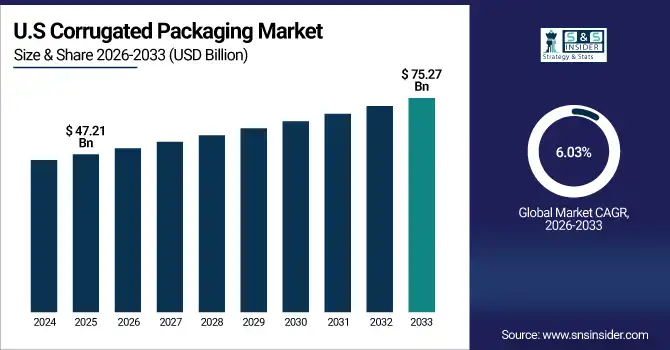

The U.S. Corrugated Packaging Market is projected to grow from USD 47.21 Billion in 2025E to USD 75.27 Billion by 2033, at a CAGR of 6.03%. Growing e-commerce, logistics and retail sales, and the acceptance of eco-friendly protective packaging as a replacement for foam materials is fueling market growth.

Corrugated Packaging Market Growth Drivers:

-

Rising e-commerce and logistics demand for protective, lightweight, and sustainable packaging is driving market growth.

Rising e-commerce and logistics demand is the primary driver of the Corrugated Packaging market growth. The rising demand for sustainable, lightweight and protective packaging is proliferating across transportation, retail and warehousing apps. The automation of packaging machinery and development of new folding, printing technologies are driving efficiency and personalization. The growing trend of sustainable, recyclable or eco-friendly material design is also helping drive market demands and opening new opportunities supporting the long-term growth.

Adoption of high-strength corrugated packaging grew 6% in 2025, driven by rising e-commerce fulfillment, trade, and logistics expansion globally.

Corrugated Packaging Market Restraints:

-

Volatile paperboard prices and high production costs are restricting large-scale adoption of advanced corrugated packaging solutions.

Volatile paperboard prices and high production costs are key factors restraining the growth of the Corrugated Packaging market. Big use of virgin and recycled paper stock leaves producers prone to swings in raw material prices or supply problems. Sophisticated production equipment and automated machinery are costly to purchase and maintain, making it difficult for smaller players to grow their operations. These limitations limit flexibility, raise operational expenses and retard the market penetration of new high-quality packaging systems.

Corrugated Packaging Market Opportunities:

-

Increasing demand for sustainable, recyclable, and customized packaging solutions presents opportunities for innovation and market expansion.

Increasing demand for sustainable, recyclable, and customized corrugated packaging presents a major opportunity for market expansion. Lightweight yet strong materials, automated production and advanced printing techniques are improving strength, modularity and customisation as we have already seen exponential advances in all areas. Increased awareness for green packaging and rise in e-Commerce and logistic activities will drive the product growth, leading to adoption of performance-oriented packaging lines which is anticipated long-term industry growth.

Sustainable and customized corrugated packaging accounted for 18% of packaging innovations in 2025, driven by e-commerce growth and logistics demand.

Corrugated Packaging Market Segmentation Analysis:

-

By Material, Single Wall held the largest market share of 58.42% in 2025, while Recycled is expected to grow at the fastest CAGR of 6.03%.

-

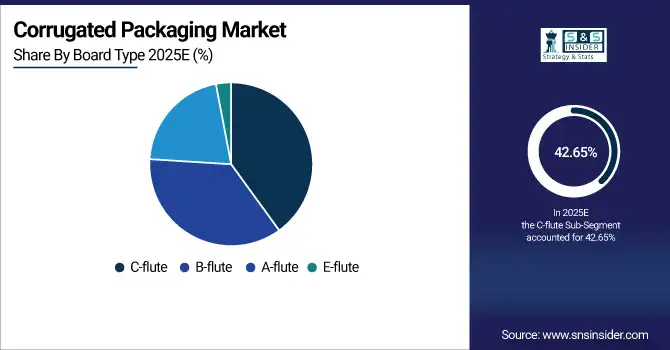

By Board Type, C-flute dominated with a 42.65% share in 2025, while E-flute is projected to expand at the fastest CAGR of 6.21%.

-

By Product Type, Boxes accounted for the highest market share of 73.54% in 2025, and Trays are expected to record the fastest CAGR of 6.12%.

-

By End-Use Industry, E-commerce & Retail held the largest share of 38.26% in 2025, while Pharmaceuticals is projected to grow at the fastest CAGR of 6.35%.

By Material, Single Wall Dominates While Recycled Expands Rapidly:

Single Wall segment dominated the market as it is cheaper to produce, simple in production process and meet wide variety of packaging needs. Due to its structural integrity, stack ability, and cost-effectiveness manufacturing-wise, the material is the most prevalently used in businesses all across supply chains. Recycled is the fastest growing segment, driven by more stringent environmental regulations, eco-friendly drives and demand for sustainable packaging. Growing focus on circular economy practices will also propel the usage of recycled corrugated materials.

By Board Type, C-flute Dominates While E-flute Expands Rapidly:

C-flute segment dominated the market in terms of value, owing to their good cushioning properties, and stacking strength, versatility for shipping and storing applications. They are commonly used in e-commerce and industrial logistics due to their reliability and cost-effectiveness. E-flute are the fastest growing segment, as companies want lightweight high quality printing surfaces for their branding and promotional packaging. Increasing consumer demand for attractive, compact and personalized packaging options is driving the emergent use of E-flute boards.

By Product Type, Boxes Dominate While Trays Expand Rapidly:

Boxes segment dominated the market due to high protection, stacking ability and cost effectiveness, they are used in most of the regions in the world. Their versatility to a multitude of products from electronic items, food, retail goods etc adds strength to the forces in dominating market. Trays are the fastest growing segment, which is attributed to expanding food, electronics and retail industries that demand customized packaging for displaying, storing and transporting goods. Folding, printing and customization are also driving adoption.

By End-Use Industry, E-commerce & Retail Dominates While Pharmaceuticals Expands Rapidly:

E-commerce & Retail segment dominated the market owing to rise in online sales and enhanced logistics activities. High demand for robust, protective, and cost-efficient packaging triggered by large-scale shipments and distribution networks. Pharmaceuticals is the fastest growing segment, with demands for secure tamper-evident and regulatory-compliant packaging. Growing need for temperature-sensitive, high-quality packaging requiring share and long-life in healthcare and medical are driving an increase in adoption.

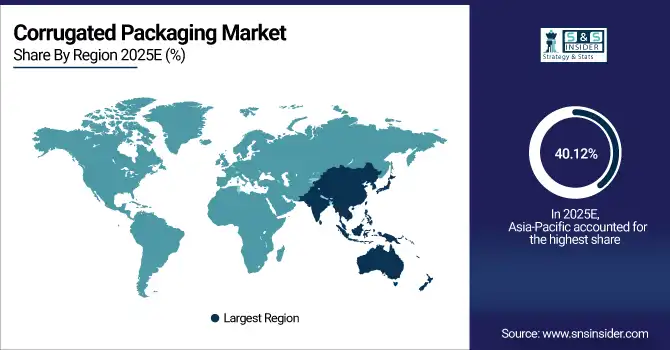

Corrugated Packaging Market Regional Analysis:

Asia-Pacific Corrugated Packaging Market Insights:

The Asia-Pacific Corrugated Packaging Market is dominant region with market share of 40.12% in 2025 due to the quick expansion of e-commerce, logistic & manufacturing industry. Increasing demand of protective, inexpensive & sustainable packaging in China, India, Japan and South Korea is driving the adoption. Rising adoption of automated packing solutions, urbanization and growth in retail and industrial supply chain are some other factors supporting the battle between local companies.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Corrugated Packaging Market Insights:

The China Corrugated Packaging Market growth is driven by rapid industrialization, expanding e-commerce, and rising demand for protective and sustainable packaging. Growing uptake of automated manufacturing, superior quality material and sophisticated packaging solutions supported by robust industrial base and urbanization makes China a key regional market in the Asia Pacific.

North America Corrugated Packaging Market Insights:

The North American region is the fastest-growing market for Corrugated Packaging with CAGR of 6.14% owing to the growing e-commerce market, growth in logistics and demand for a sustainable form of protective packaging. Rapid implementation of automated manufacturing, novel materials and quality packaging solutions in the retail, food & industrial sectors is fuelling market demand. Increasing eco-friendly, lightweight and customised packaging demand is also boosting the regional market growth.

U.S. Corrugated Packaging Market Insights:

The U.S. Corrugated Packaging Market is expected to be propelled by increasing adoption of durable, high-quality, and sustainable packaging across e-commerce, retail, and industrial sectors. Emerging logistics and distribution infrastructure, increased demand for environmentally friendly alternatives, investment in automated innovative packaging technologies are some factors fuelling the market growth.

Europe Corrugated Packaging Market Insights:

The Europe Corrugated Packaging markets are growing on the back of robust packaging requirements that enhance product safety and lower cost for retail and industrial industries. Main target markets are Germany, France and the UK. Growth is underpinned by the deployment of automation in production processes, advancements in lightweight and recyclable materials, robust domestic manufacturing capacities, growing industrial modernization efforts and mounting concerns surrounding eco-friendly packaging, energy efficiency and strict EU regulations.

Germany Corrugated Packaging Market Insights:

Germany is a strategic market for Corrugated Packaging with robust demand in e-commerce, retail and industrial logistics. Growth is attributed to economic benefit of the high-quality manufactured articles, willingness to invest into automated production and the use of durable packaging. The market is also driven by focus on effectiveness, material eco-friendliness materials and modern infrastructure.

Latin America Corrugated Packaging Market Insights:

The Latin America Corrugated Packaging Market is emerging as a promising segment, driven by rising demand for durable, protective, and sustainable packaging across retail, e-commerce, and industrial sectors. Growth is being driven by investment in infrastructure, new manufacturing capacities and replacing traditional pack types with quality corrugated solutions. Innovations, IOT & industrial automation solutions, green initiatives all create opportunities in major markets such as Brazil, Mexico and Argentina.

Middle East and Africa Corrugated Packaging Market Insights:

The Middle East & Africa Corrugated Packaging Market is expected to expand, as there is higher demand of the same in the e-commerce industry, retail sector and industrial sector. Growth is supported by infrastructure development, urbanisation, and an increase in the use of tough, good-quality and environmentally friendly packaging. Technology developments, automation and green features helping for the growth of regional market.

Corrugated Packaging Market Competitive Landscape:

Smurfit WestRock, formed by the merger of Smurfit Kappa and WestRock, is the world’s largest corrugated packaging manufacturer with operations spanning over 40 countries. The Company is a market leader in sustainable fiber-based consumer packaging solutions, with an unrivalled R&D and innovation capability that offers products integrated with natural, virgin, and recycled fibres. Its digital packaging design, automation, and renewable materials enable customers to optimize the supply chain effectiveness and reduce environmental impact across the end-to-end value chain.

-

In September 2025, Smurfit WestRock launched its Bag-in-Box Power grip, a cardboard vacuum-bag system reducing plastic and improving recyclability, supporting sustainability initiatives and compliance with European packaging regulations, while meeting rising demand for eco-friendly, efficient liquid packaging solutions.

International Paper Company, headquartered in the U.S., is a leader in renewable fiber-based packaging, pulp, and paper products. It is a leader in the corrugated packaging market, with large production capacity and integrated recycling operations to its strong customer base in retail, industrial and logistics. Its continued focus on sustainable packaging, digital transformation and energy-efficient operations will make the company even more competitive in the market and achieving long-term growth in demand for packaging.

-

In May 2025, International Paper opened a new corrugated box plant in Waterloo, Iowa, using advanced automation and sustainable manufacturing practices to serve growing e-commerce and food packaging demand, reinforcing its leadership in high-performance, environmentally responsible corrugated solutions.

Nine Dragons Paper Holdings Limited, headquartered in China, is Asia’s largest manufacturer of recycled paperboard and corrugated packaging solutions. It leads the pack in its domestic market with vertically integrated operations, large recycling operations and some of the lowest costs around. The company's dedication to green manufacturing, increasing production capacity and adoption of advanced technologies have made the company’s products ideal for green homes. An environmental conscious and pioneering company, Nine Dragons remains the leader in China packaging industry development.

-

In July 2025, Nine Dragons Paper launched a new pulp mill in Hubei Jianli, China, boosting integrated pulp-to-paper production and enhancing cost efficiency, thereby strengthening its position in the Asia-Pacific corrugated packaging market.

Corrugated Packaging Market Key Players:

Some of the Corrugated Packaging Market Companies are:

-

Smurfit WestRock

-

International Paper Company

-

Nine Dragons Paper Holdings

-

WestRock Company

-

Smurfit Kappa Group

-

Packaging Corporation of America

-

DS Smith PLC

-

Georgia-Pacific LLC

-

Mondi Group

-

Oji Holdings Corporation

-

Rengo Co. Ltd.

-

Cascades Inc.

-

Stora Enso

-

Graphic Packaging International

-

Ball Corporation

-

Berry Global Group, Inc.

-

Crown Holdings, Inc.

-

Avery Dennison Corporation

-

Sonoco Products Company

-

Sealed Air Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 245.83 Billion |

| Market Size by 2033 | USD 364.79 Billion |

| CAGR | CAGR of 5.09% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Single Wall, Double Wall, Triple Wall, Kraft, Recycled) • By Board Type (A-flute, B-flute, C-flute, E-flute) • By Product Type (Boxes, Trays, Sheets, Pads, Others) • By End-Use Industry (E-commerce & Retail, Food & Beverage, Electronics, Automotive, Pharmaceuticals, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Smurfit WestRock, International Paper Company, Nine Dragons Paper Holdings, WestRock Company, Smurfit Kappa Group, Packaging Corporation of America, DS Smith PLC, Georgia-Pacific LLC, Mondi Group, Oji Holdings Corporation, Rengo Co. Ltd., Cascades Inc., Stora Enso, Graphic Packaging International, Ball Corporation, Berry Global Group, Inc., Crown Holdings, Inc., Avery Dennison Corporation, Sonoco Products Company, Sealed Air Corporation |