Cosmeceuticals Market Size & Growth Analysis

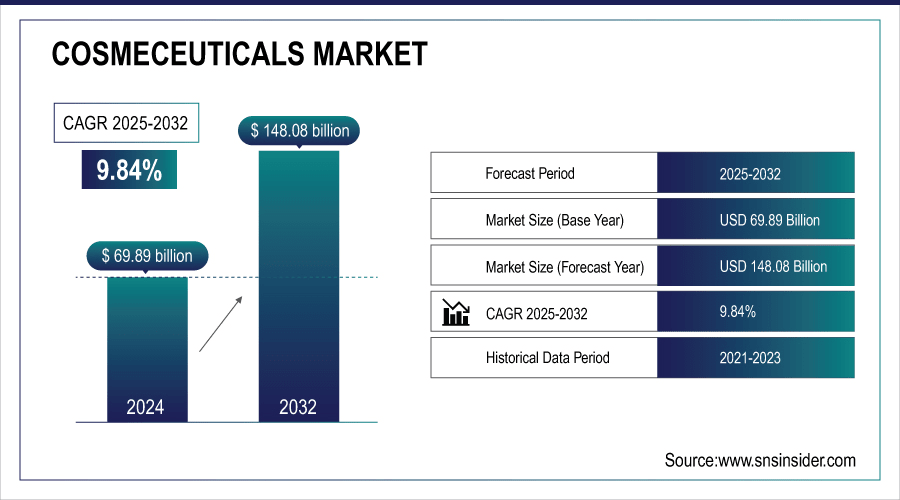

The Cosmeceuticals Market was valued at USD 69.89 billion in 2024 and is expected to reach USD 148.08 billion by 2032, growing at a CAGR of 9.84% from 2025-2032.

The global cosmeceuticals market is expanding due to rising consumer focus on youthfulness and anti-aging, particularly among the aging population. Anti-age skin products, positioned between cosmetics and pharmaceuticals, contain biologically active ingredients to improve appearance. Aging populations in countries like Japan and China, alongside heightened awareness of skin care, are driving demand. Mature consumers experience anxiety over aging signs, fueling adoption of these products. North America and Europe hold significant market shares, while Asia-Pacific countries, including China, India, and Vietnam, offer growth opportunities due to millennial adoption. E-commerce channels are increasingly targeted for their convenience and accessibility.

To Get More Information On Cosmeceuticals Market - Request Free Sample Report

Latest Trends in the Cosmeceuticals Market

-

Rising consumer focus on skincare and anti-aging solutions is driving cosmeceutical demand.

-

Integration of natural, organic, and bioactive ingredients is enhancing product effectiveness.

-

Increasing adoption of personalized and targeted formulations is boosting market growth.

-

E-commerce and digital marketing are expanding accessibility and consumer reach.

-

Growing awareness of preventive skincare and dermatological benefits is fueling adoption.

-

Innovations in delivery systems, such as nanotechnology and liposomes, are improving efficacy.

-

Collaborations between cosmetic and pharmaceutical companies are accelerating product development and market expansion.

Cosmeceuticals Market Growth Drivers:

-

Rising Consumer Demand for Anti-Aging Products is Driving the Demand for Cosmeceuticals.

-

Growing Interest in Natural and Organic Cosmeceuticals Drives Market Demand

The cosmeceuticals market is witnessing increased demand as consumers shift toward natural and organic products. Rising awareness of chemical-free skincare, sustainability, and eco-friendly ingredients encourages preference for botanicals, plant extracts, and herbal formulations. Consumers perceive natural cosmeceuticals as safer, reducing the risk of side effects while offering anti-aging, moisturizing, and skin-repair benefits. This trend is prominent among millennials and health-conscious individuals seeking ethical and transparent beauty solutions. Consequently, manufacturers are innovating with organic formulations, clean-label products, and certified natural ingredients, further boosting market growth and expanding consumer adoption globally.

Cosmeceuticals Market Restraints:

-

Cosmeceuticals Face Strict and Inconsistent Regulations, Complicating Market Entry and Product Claims Can Limit the Growth of the Market.

-

High Costs and Limited Access Hinder Cosmeceuticals Market Growth

The cosmeceuticals market faces growth restraints due to expensive ingredients and advanced technologies used in product formulations. Biologically active compounds, peptides, and specialized delivery systems increase production costs, leading to higher retail prices that may limit affordability for many consumers. Additionally, limited availability of premium products in certain regions restricts consumer access, slowing widespread adoption. These factors are particularly challenging in emerging markets where price sensitivity is high. As a result, while demand for innovative cosmeceuticals remains strong, cost barriers and accessibility issues continue to restrain overall market expansion globally.

Opportunity:

-

Biotechnology Innovations Create Opportunities in Cosmeceuticals

Advancements in biotechnology are opening new opportunities in the cosmeceuticals market. The development of advanced ingredients, including peptides, growth factors, and stem cells, enhances product efficacy by targeting skin regeneration, anti-aging, and repair at a cellular level. These innovations allow manufacturers to create high-performance formulations that deliver visible results, attracting consumers seeking effective skincare solutions. Additionally, ongoing research and technological breakthroughs enable personalized and specialized cosmeceuticals, expanding product offerings. As scientific innovations continue, companies can differentiate their portfolios, strengthen brand value, and capture growing demand for cutting-edge, results-driven skincare products globally.

Cosmeceuticals Market Segmentation Analysis

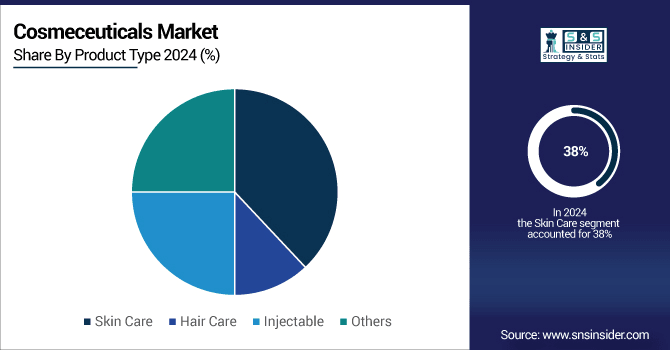

By Product Type: Skincare Dominates, Injectables Grow Fastest

The market is divided on product type basis into skincare, hair care, injectables, and others. In 2024, the skincare product type accounted for a 38% share. The growth dominance of the segment is attributed to the increase in the adoption of personal care products and the growing prevalence of skin diseases among the general population. For instance, in a report launched by JMIR Dermatology in August 2021, the global prevalence of melanoma is 10.11% of the world’s population, whereas psoriasis and dermatitis are 9.81% and 9.77% respectively. The rise in the prevalence of such skin disorders coupled with the active initiatives promoted by the key market players are responsible for the growth of the segment.

The injectable product type is anticipated to register the fastest CAGR in the upcoming period owing to the growth in the applications of injectable cosmeceuticals in medical practices. This is attributed to the growth witnessed in the applications of cosmeceutical and aesthetic products, and emerging players are entering the injectable product type by launching unique products. For instance, in May 2019, Evolus announced the launch of Jeuveau, a botulinum toxin injectable. XEOMIN was approved in 2010 previously by Merz Pharma and after the approval it launched in the market. The market will witness growth owing to a rise in the demand for botulinum toxin in medical aesthetics and increasing medical tourism.

The hair care product type growth is attributed to the growth in the introduction of dandruff shampoos in multiple hair care clinics to eliminate dandruff from hair and provide vitality and rejuvenating experience. For instance, in January 2024, Kaya Skin Clinic launched three anti-dandruff products to treat dandruff and improve the health of the scalp.

By Distribution Channel: Pharmacy & Online Stores Lead

In 2024, pharmacies and drug stores dominated the cosmeceuticals market as the leading distribution channel. Consumers prefer these outlets for their reliability, professional guidance, and access to clinically tested products. While online stores are rapidly growing due to convenience and wider product availability, physical retail remains the primary choice for purchasing cosmeceuticals, particularly for anti-aging and premium skincare products, ensuring trust and immediate accessibility.

Regional Analysis of the Cosmeceuticals Market

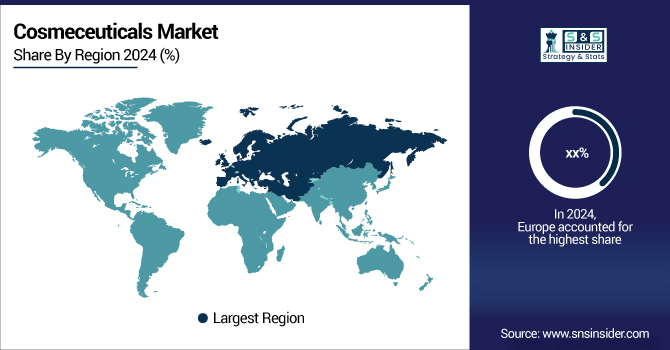

Europe Cosmeceuticals Market Insights

In 2024, Europe held the largest share of the global cosmeceuticals market, driven by high consumer awareness, strong purchasing power, and demand for premium skincare products. The region’s focus on anti-aging, natural formulations, and technologically advanced ingredients supported market growth. Additionally, well-established cosmetic and pharmaceutical industries, along with widespread adoption of e-commerce channels, further strengthened Europe’s dominance in the cosmeceuticals sector.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Cosmeceuticals Market Insights

North America holds a significant share in the global cosmeceuticals market, driven by high consumer awareness, advanced skincare research, and strong purchasing power. The region shows growing demand for anti-aging, innovative, and natural skincare products. Well-established cosmetic and pharmaceutical industries, coupled with widespread e-commerce adoption, facilitate easy access to premium products. Additionally, increasing focus on personal grooming and wellness continues to support market expansion in North America.

Asia Pacific Cosmeceuticals Market Insights

The Asia-Pacific region is projected to register the fastest CAGR in the cosmeceuticals market due to rising disposable incomes, increasing beauty consciousness, and a growing aging population. Countries like China, India, and Vietnam show strong demand for anti-aging and natural skincare products. Rapid adoption of e-commerce, urbanization, and expanding middle-class consumer base further fuel market growth, making Asia-Pacific a key growth hotspot globally.

Middle East & Africa and Latin America Cosmeceuticals Market Insights

The Middle East & Africa and Latin America hold emerging roles in the global cosmeceuticals market. Rising beauty consciousness, growing disposable incomes, and increasing demand for anti-aging and natural skincare products drive growth. Urbanization and expanding e-commerce channels improve product accessibility. While these regions currently contribute smaller market shares compared to North America and Europe, increasing consumer awareness and investment by key players are expected to boost market expansion.

Competitive Landscape:

L’Oréal Groupe

L’Oréal Groupe is a leading player in the global cosmeceuticals market, offering advanced skincare products that combine cosmetic appeal with pharmaceutical benefits. The company focuses on anti-aging, skin repair, and innovative formulations using active ingredients like peptides and hyaluronic acid. Strong research and development capabilities, global presence, and strategic acquisitions enhance its market position. L’Oréal’s extensive portfolio and focus on science-backed products continue to drive growth and consumer trust worldwide.

-

In 2025, L’Oréal launched the €20 million “Act for Dermatology” program with the WHO Foundation, aiming to improve global skin health access in regions lacking dermatologists.

-

In 2025, L’Oréal introduced Cell BioPrint at CES, a tabletop device providing personalized skin analysis in under five minutes, using advanced proteomics for aging insights at point-of-care.

-

In 2025, L’Oréal opened the Sustainable Innovation Accelerator, a €100 million, five-year initiative with Cambridge CISL to drive eco-conscious beauty innovations and circular, low-carbon business models.

Unilever

Unilever is a prominent player in the cosmeceuticals market, offering skincare products that blend cosmetic appeal with active ingredients for anti-aging, hydration, and skin repair. The company leverages strong research and innovation to develop science-backed formulations. With a global presence and diverse brand portfolio, including Dermalogica and Vaseline, Unilever focuses on sustainable practices, digital engagement, and e-commerce channels, driving market growth and meeting evolving consumer demand for effective and ethical skincare solutions.

-

In 2025, researchers revealed the first evidence linking the skin microbiome and mental wellbeing, showing higher Cutibacterium levels correlate with reduced stress and improved mood.

-

In 2024, Pond’s Skin Institute launched its first niacinamide-enriched suncare range, providing UV protection and skin repair benefits while avoiding a white cast.

Beiersdorf

Beiersdorf is a key player in the cosmeceuticals market, renowned for its dermatologically tested skincare products, including Nivea and Eucerin. The company focuses on anti-aging, moisturizing, and sensitive-skin solutions using active ingredients like hyaluronic acid and ceramides. Strong research and innovation, combined with global distribution channels and digital engagement, enable Beiersdorf to deliver effective, science-backed products, reinforcing consumer trust and driving growth in the premium cosmeceuticals segment worldwide.

-

In 2025, Beiersdorf partnered with the Polytechnic University of Marche to launch a dual academic-industry program in Skin Biology and Anti-Aging Cosmetology, combining theoretical modules in Italy and lab experience at its Hamburg R&D center.

-

In 2025, Beiersdorf began constructing a new Innovation Center in Hamburg to enhance its R&D capabilities in skin science and advanced cosmetic research.

-

In 2024, Beiersdorf introduced microbiome-targeted active ingredients to restore skin flora balance, addressing acne, psoriasis, and other conditions with advanced scientific formulations.

Key Players in the Cosmeceuticals Market

-

Unilever

-

Estée Lauder Companies Inc.

-

Shiseido Company Limited

-

Elementis Plc

-

Procter and Gamble

-

Allergan

-

BASF SE

-

Johnson & Johnson Services, Inc.

-

Galderma

-

Medik8

-

Sabinsa Corporation

-

Amorepacific Corporation

-

Akums Drugs and Pharmaceuticals

-

AlumierMD

-

AnteAGE

-

AQ Skin Solutions

-

Biophora Inc

-

Rohto Pharmaceutical Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 69.89 Billion |

| Market Size by 2032 | USD 148.08 Billion |

| CAGR | CAGR of 9.84% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Skin Care, Hair Care, Injectables, and Others) •By Distribution Channel (Pharmacy/Drug Stores, Online Stores, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Beiersdorf, L’Oréal, Unilever, Estée Lauder Companies Inc., Shiseido Company Limited, Elementis Plc, Procter and Gamble, Allergan, BASF SE, Johnson & Johnson Services, Inc., Galderma, Medik8, Sabinsa Corporation, Amorepacific Corporation, Akums Drugs and Pharmaceuticals, AlumierMD, AnteAGE, AQ Skin Solutions, Biophora Inc, Rohto Pharmaceutical Co., Ltd. |