Coworking Spaces Market Report Scope & Overview:

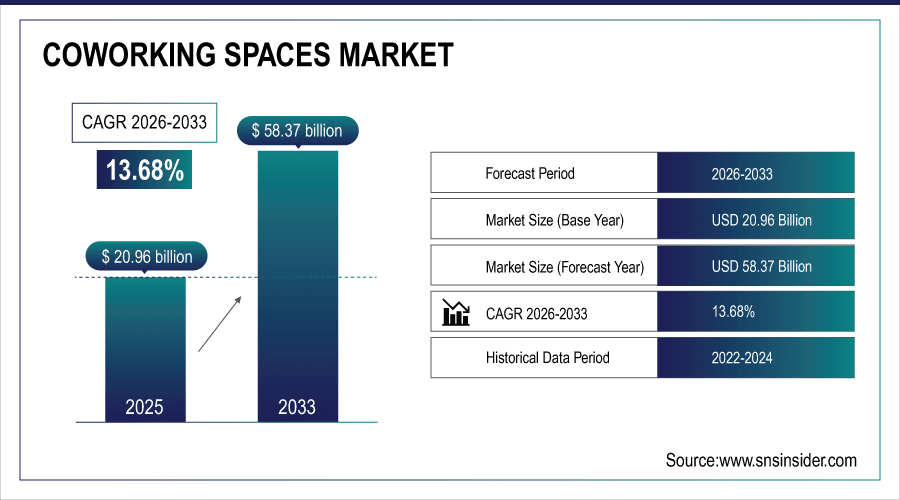

The Coworking Spaces Market Size was valued at USD 20.96 Billion in 2025E and is expected to reach USD 58.37 Billion by 2033 and grow at a CAGR of 13.68% over the forecast period 2026-2033.

The Coworking Spaces Market growth is driven by the rising adoption of flexible work arrangements across industries. Companies, especially SMEs and startups, are increasingly seeking cost-effective alternatives to traditional office setups, which reduces real estate expenses and operational overheads. Additionally, the growing trend of remote work and hybrid work models has fueled demand for shared office environments that offer flexibility, scalability, and access to modern infrastructure. Urbanization and the expansion of business hubs in tier-2 and tier-3 cities have also contributed to the market’s expansion, providing opportunities for coworking operators to tap into new geographies. According to study, over 60% of SMEs and startups preferring shared office solutions over traditional leases to reduce real estate costs and operational overhead.

To Get More Information On Coworking Spaces Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 20.96 Billion

-

Market Size by 2033: USD 58.37 Billion

-

CAGR: 13.68% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Coworking Spaces Market Trends

-

Growing adoption of hybrid and remote work models driving flexible office demand.

-

Startups and SMEs increasingly prefer coworking spaces over traditional long-term leases.

-

Enhanced member experience through modern infrastructure, amenities, and technology integration.

-

Expansion of coworking operators into tier-2 and tier-3 cities accelerating growth.

-

Niche and industry-specific coworking solutions gaining popularity among specialized business sectors.

-

Increased focus on community-building and networking events to attract and retain members.

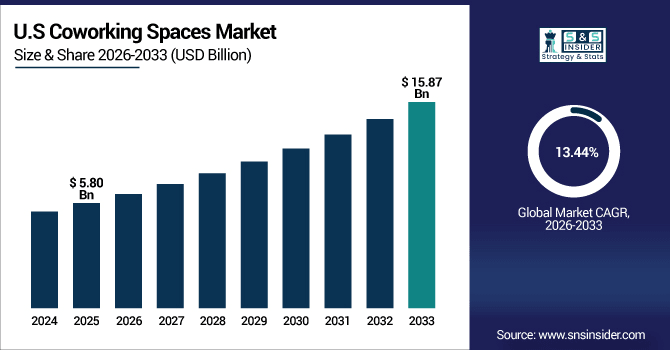

The U.S. Coworking Spaces Market size was USD 5.80 Billion in 2025E and is expected to reach USD 15.87 Billion by 2033, growing at a CAGR of 13.44% over the forecast period of 2026-2033, driven by advanced technological adoption, widespread hybrid work models, strong startup and SME presence, and extensive coworking networks offering flexible, fully equipped workspaces with collaborative environments and value-added amenities nationwide.

Coworking Spaces Market Growth Drivers:

-

Rising Demand for Flexible Workspaces Boosts Global Coworking Market Growth

The primary driver of the coworking spaces market is the increasing demand for flexible, scalable office solutions. Companies, particularly SMEs, startups, and freelancers, prefer coworking spaces as they offer short-term leases, flexible desk arrangements, and plug-and-play infrastructure, reducing the financial burden of long-term office rentals. The global shift toward remote and hybrid work models has further accelerated this demand, as employees and businesses seek dynamic work environments that support collaboration, productivity, and innovation without committing to permanent real estate investments. Additionally, coworking spaces often provide value-added amenities such as high-speed internet, conference rooms, and community events, making them more attractive than traditional office setups.

approximately 70% of coworking members prioritize access to collaborative and innovative spaces over permanent office ownership.

Coworking Spaces Market Restraints:

-

High Operational Costs and Competition Challenge Coworking Space Profitability

A significant restraint in the coworking spaces market is the high operational and maintenance costs associated with running premium shared office facilities. Operators need to invest heavily in modern infrastructure, technology integration, and amenities to attract and retain clients. Coupled with intense competition among global and regional players, this can pressure profit margins, especially in saturated metropolitan areas. Economic uncertainties, such as rising real estate costs or market slowdowns, may also affect occupancy rates and membership renewals, further challenging operators to maintain sustainable revenue streams.

Coworking Spaces Market Opportunities:

-

Expansion into Tier-2, Tier-3 Cities Unlocks Untapped Coworking Potential

A major growth opportunity lies in penetrating tier-2 and tier-3 cities, where coworking adoption is still nascent. As urbanization spreads and business activity grows beyond major metropolitan areas, there is rising demand for cost-effective and flexible office solutions in these emerging cities. Coworking operators can capitalize on lower real estate costs, untapped corporate clients, and the growing startup ecosystem to expand their footprint. Additionally, offering industry-specific or niche coworking solutions (e.g., tech hubs, healthcare-focused spaces) in these regions can further drive membership growth and create new revenue streams.

Real estate costs in emerging cities are 30–50% lower than in primary metropolitan areas, enabling operators to offer competitive pricing.

Coworking Spaces Market Segmentation Analysis:

-

By Nature: In 2025, Managed led the market with the largest share 24.40%, while Hybrid is the fastest-growing segment with a CAGR 14.30%.

-

By Type: In 2025, Corporate / Professional led the market with the largest share 27.60%, while Conventional is the fastest-growing segment with a CAGR 14.1%.

-

By Application: In 2025, SMEs led the market with the largest share 29.50%, while Freelancers is the fastest-growing segment with a CAGR 14.66%.

-

By Industry Vertical: In 2025, BFSI led the market with the largest share 32.40%, while Information Technology is the fastest-growing segment with a CAGR 15.40%.

By Nature, Managed Leads Market and Hybrid Fastest Growth

In the Coworking Spaces Market, the Managed segment led the market in 2025 with the largest share, driven by enterprises and startups seeking fully serviced and professionally managed workspaces. These spaces provide end-to-end services, including reception, IT support, cleaning, and facility management, allowing companies to focus on core operations while benefiting from a ready-to-use infrastructure. Conversely, the Hybrid segment is experiencing the fastest growth, fueled by increasing demand for flexible arrangements that combine independent and managed work environments. This model appeals to freelancers, SMEs, and remote teams who require customizable office solutions, offering scalability and cost-efficiency. The growing trend of hybrid and flexible work models continues to bolster the adoption of such hybrid coworking spaces globally.

By Type, Corporate / Professional Leads Market and Conventional Fastest Growth

In the Coworking Spaces Market, the Corporate / Professional segment led the market in 2025 with the largest share, reflecting strong demand from SMEs, startups, and established enterprises seeking flexible, fully equipped office environments. These spaces offer plug-and-play infrastructure, meeting rooms, high-speed internet, and collaborative amenities, making them highly attractive for businesses aiming to reduce operational costs and support hybrid work models. On the other hand, the Conventional coworking segment is witnessing the fastest growth, driven by rising adoption in tier-2 and tier-3 cities where cost-effective, basic shared office solutions are preferred. The segment benefits from increasing freelance and small business participation, reflecting a shift toward scalable, affordable, and flexible work environments globally.

By Application, SMEs Leads Market and Freelancers Fastest Growth

In the Coworking Spaces Market, the SMEs segment led the market in 2025 with the largest share, reflecting strong adoption by small and medium enterprises seeking cost-effective, flexible, and fully equipped office environments. SMEs benefit from plug-and-play infrastructure, shared meeting rooms, high-speed internet, and collaborative amenities, which reduce operational costs while supporting hybrid work models and scalability. Meanwhile, the Freelancers segment is witnessing the fastest growth, driven by the increasing number of independent professionals, remote workers, and gig economy participants seeking flexible, short-term workspace solutions. The rise of digital nomads and the growing preference for collaborative, community-oriented environments further fuels the expansion of freelancer-focused coworking spaces globally.

By Industry Vertical, BFSI Leads Market and Information Technology Fastest Growth

In the Coworking Spaces Market, the BFSI (Banking, Financial Services, and Insurance) segment led the market in 2025 with the largest share, driven by large enterprises and financial institutions seeking flexible, fully serviced workspaces to support branch operations, project teams, and collaborative initiatives. BFSI companies benefit from plug-and-play infrastructure, high-speed connectivity, and secure office environments, which reduce operational costs while enabling scalability and hybrid work adoption. Simultaneously, the Information Technology segment is experiencing the fastest growth, fueled by the rapid expansion of IT startups, software firms, and digital service providers seeking innovative, technology-enabled coworking solutions. The demand is further supported by the need for collaborative spaces, agile teams, and access to a skilled talent pool in dynamic IT hubs globally.

Coworking Spaces Market Regional Analysis:

North America Coworking Spaces Market Insights:

The Coworking Spaces Market in North America held the largest share 38.40% in 2025, driven by high adoption among SMEs, startups, and freelancers. The region benefits from mature infrastructure, advanced digital connectivity, and widespread acceptance of remote and hybrid work models. Major urban centers, including New York, San Francisco, and Toronto, host a dense concentration of coworking facilities, offering premium amenities, technology-enabled services, and collaborative work environments. The presence of leading global operators, coupled with a strong entrepreneurial ecosystem, supports continuous market growth. Increasing demand for flexible, cost-efficient office solutions and expansion into secondary cities further strengthens North America’s market dominance.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Coworking Spaces Market with Advanced Technological Adoption

U.S. dominates the Coworking Spaces Market, driven by advanced technological adoption, high demand for flexible workspaces, strong startup ecosystem, widespread hybrid work models, and presence of major operators offering premium amenities, collaborative environments, and scalable office solutions nationwide.

Asia-Pacific Coworking Spaces Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Coworking Spaces Market, projected to expand at a CAGR of 14.66%, due to rapid urbanization, digital transformation, and a thriving startup ecosystem. The rising adoption of flexible, cost-effective office solutions among SMEs, freelancers, and remote workers is driving strong demand. Expansion into emerging cities and untapped urban areas presents significant growth opportunities for operators. Technology-enabled workspaces, collaborative environments, and industry-specific solutions are increasingly attracting diverse clientele. Additionally, supportive government policies and initiatives promoting entrepreneurship and innovation further enhance market penetration, making Asia-Pacific a key growth hotspot in the global coworking spaces market.

China and India Propel Rapid Growth in Coworking Spaces Market

China and India drive rapid growth in the coworking spaces market, fueled by increasing demand for flexible, cost-effective workspaces, expanding startup ecosystems, rising hybrid work adoption, and the expansion of coworking operators into emerging urban and secondary cities.

Europe Coworking Spaces Market Insights

Europe holds a significant share in the Coworking Spaces Market, driven by high adoption of flexible work arrangements, hybrid work models, and growing demand from SMEs and startups. The region benefits from well-established infrastructure, advanced digital connectivity, and professional service offerings in coworking facilities. Operators are increasingly providing value-added amenities, collaborative spaces, and technology-enabled services to attract corporate clients and freelancers. Rising focus on sustainability, community-building, and networking events further enhances market appeal. Continuous expansion of coworking networks in both primary and secondary cities, combined with strong entrepreneurial ecosystems, supports steady growth and positions Europe as a key contributor to the global coworking spaces market.

Germany and U.K. Lead Coworking Spaces Market Expansion Across Europe

Germany and the U.K. lead Europe’s coworking market expansion, driven by strong demand for flexible workspaces, hybrid work adoption, technology-enabled offices, and growing startup ecosystems, positioning both countries as key contributors to regional market growth and coworking network development.

Latin America (LATAM) and Middle East & Africa (MEA) Coworking Spaces Market Insights

The Coworking Spaces Market in Latin America and Middle East & Africa is witnessing steady growth, driven by increasing industrialization, urban infrastructure development, and rising adoption of energy-efficient motor control solutions. In LATAM, countries such as Brazil and Mexico are investing in manufacturing, mining, and water treatment projects, boosting demand for low and medium voltage soft starters. Similarly, MEA markets, led by Saudi Arabia, UAE, and South Africa, are focusing on industrial modernization, renewable energy projects, and automation initiatives. Despite challenges like limited technical expertise and price sensitivity, regional growth is supported by strategic investments, technological adoption, and expansion by key global and regional companies.

Coworking Spaces Market Competitive Landscape

WeWork leads the coworking sector through an extensive network of flexible office spaces, supporting startups, freelancers, and enterprises. Its offerings include shared workspaces, meeting rooms, and community-driven events. The company’s growth is fueled by the global shift toward hybrid work models, flexible lease structures, and increasing adoption of collaborative, scalable office environments.

-

In October 2024, WeWork launched its Coworking Partner Network, broadening its North American workspace offerings for members.

Industrious emphasizes premium coworking experiences with fully managed offices, plug-and-play infrastructure, and AI-enabled personalization. Its spaces cater to startups, SMEs, and corporate clients, offering wellness-focused designs and collaborative environments. The company’s expansion aligns with growing trends in hybrid work, flexible office demand, and technology-driven productivity, strengthening its position in the global coworking market.

-

In January 2024, Industrious expanded its coworking spaces with AI personalization, IoT connectivity, and nature-focused designs enhancing member well-being.

Venture X provides flexible, technology-enabled coworking solutions targeting SMEs, freelancers, and remote teams. Its focus on collaborative workspaces, community engagement, and modern amenities supports productivity and networking. The company’s growth reflects the rising demand for scalable, cost-effective office environments, particularly among businesses adopting hybrid and remote work models globally.

-

In September 2024, Venture X emphasized collaborative workspaces fostering community engagement and flexible office solutions for modern businesses.

Coworking Spaces Market Key Players:

Some of the Coworking Spaces Market Companies are:

-

IWG

-

WeWork

-

Industrious

-

Servcorp

-

Convene

-

Mindspace

-

The Executive Centre (TEC)

-

Knotel

-

Impact Hub

-

Venture X

-

Premier Workspaces

-

Office Evolution

-

Serendipity Labs

-

CommonGrounds Workplace

-

TechSpace

-

Awfis

-

Smartworks

-

91springboard

-

The Hive

-

Talent Garden

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 20.96 Billion |

| Market Size by 2033 | USD 58.37 Billion |

| CAGR | CAGR of 13.68% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Corporate / Professional, Conventional, Industry-specific, Others) •By Nature (Managed, Independent, Hybrid) •By Application (SMEs, Large Size Enterprises, Freelancers, Others) •By Industry Vertical (BFSI, Professional Services, Information Technology, Property, Recruitment, Healthcare, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IWG (Regus / Spaces), WeWork, Industrious, Servcorp, Convene, Mindspace, The Executive Centre (TEC), Knotel, Impact Hub, Venture X, Premier Workspaces, Office Evolution, Serendipity Labs, CommonGrounds Workplace, TechSpace, Awfis, Smartworks, 91springboard, The Hive, Talent Garden., and Others. |