Creator Economy Market Report Scope & Overview:

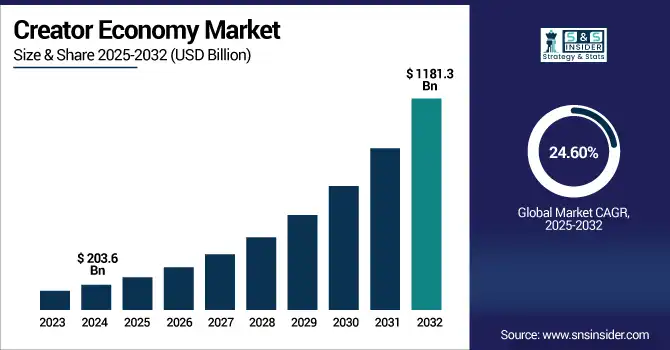

The creator economy market size was valued at USD 203.6 billion in 2024 and is expected to reach USD 1181.3 billion by 2032, growing at a CAGR of 24.60% during 2025-2032.

Creator economy market growth is driven by the rapid expansion of social media platforms, growing demand for personalized content, and the democratization of monetization tools, which allow individual creators to monetize through diverse digital channels, driving the growth of the creator economy market. There are influencers, streamers, bloggers, podcasters, and video creators flooding the market using platforms, such as YouTube, TikTok, Instagram, and Patreon to create a more direct connection to their audiences. Emergence of decentralized platforms, Web3 technologies, and NFT-based content ownership are again redefining revenue models for brands and creators with newer collaboration and community engagement opportunities.

To Get more information on Creator Economy Market - Request Free Sample Report

The U.S. creator economy market is driven by an increase in influencer marketing budgets, expansion of niche content communities, and broader adoption of various monetization tools across platforms. In 2024, the market is valued at approximately USD 56.3 billion and is projected to reach USD 321.9 billion by 2032, growing at a CAGR of 24.37%. Key Creator Economy Market trends include AI-powered content creation, platform diversification, and direct-to-fan revenue models.

Creator Economy Market Dynamics:

Drivers:

-

Enhanced Monetization Tools Across Platforms Are Enabling Creators to Earn Directly, Fueling Market Expansion

The increasing access to monetization tools has been one of the primary factors contributing to the growth of the Creator Economy Market, which was observed across platforms, such as YouTube, TikTok, Patreon, Substack, and Instagram. From tipping to subscriptions and brand collaborations to ad revenue, these capabilities have helped creators establish consistent incomes without the need for conventional gatekeepers. These platforms have analytics, content scheduling, and even AI-driven tools that these days even makers with a micro-amount of audience can make their operation big. Creators across gaming, education, fitness, finance, and more have flocked to this democratization. With users increasingly opting for creator-supported content as opposed to traditional media, monetization ecosystems are expanding, paving the way for sustainable career tracks and then driving growth for services and tools catering to the creator economy.

As of March 2024, the YouTube Partner Program included over 3 million creators globally and paid out USD 70 billion over the preceding three years

Restraints:

- Heavy Reliance on Centralized Platforms Exposes Creators to Sudden Policy Changes and Revenue Fluctuations

Despite its impressive growth, creators have to deal with unstable incomes from algorithm shifts, clouds of demonetization, and overbearing revenue share structures dictated by the platforms. Planning can be a challenge when income varies so dramatically from month to month. Relying on just one or two platforms is risky, especially if it faces a policy change or an account ban, including the TikTok or YouTube ban. The issue is compounded by the fact that most brand deals have so much inconsistency, and they also have no understanding of finances. If a creator fails to diversify income streams, they are at risk of external forces that they cannot control. Such unpredictability in income restricts creator retention and professionalisation, hence putting a cap on what the overall creator economy market can offer to investors and stakeholders in terms of maturity and reliability.

Over 5% of videos were demonetized in the prior six months, and some creators report losing up to 90% of ad revenue on flagged content, even when it is not explicitly policy-violating.

Opportunities:

- Rise of Web3 Tools Empowers Creators with Ownership, Control, and Alternative Income Models

Web3 tech, from NFTs to decentralized social platforms to blockchain-based ownership models, is paving fresh paths for creators to monetize their work. Some of these tools allow creators to better control their content, data, and salary, and be able to transact directly with the audience, without intermediary platforms. Creators can tokenize exclusive content into NFTs, launch DAOs to finance community-based projects, and do other things. That lowers the dependency on ad revenue and introduces some long-term ownership of the assets. These younger audiences are open to decentralized engagement and new monetization avenues for creators to connect with followers who either consume or contribute to the media. That transition toward Web3 will completely reinvent content ownership and the infrastructure of the creator economy market.

As of 2025, over 70% of new creator-focused startups integrate Web3 components, such as NFTs, DAOs, or token mechanics, music, publishing, and social platforms embracing decentralized monetization layers

Challenges:

- Excessive Content Volume Reduces Discoverability and Increases User Fatigue, Challenging Sustained Growth

As a result of millions of creators creating daily across platforms, audiences are slowly becoming fragmented, and retention continues to be a challenge. The proliferation of content, coupled with audience fatigue with the quality of the content available to them, has led to a situation, where it is proving to be more difficult for new or smaller creators to be discovered. With engagement metrics becoming increasingly difficult to sustain, creators are forced to constantly reinvent the wheel to stand out, resulting in burnout and unpredictable output. On top of that, exposure based on algorithms usually promotes trend-chasing instead of real creation, which further diminishes the value of content. Short audience loyalty and limited stickiness of platforms are limited due to this saturation in the long run, which is one of the most significant challenges to sustaining growth in the creator economy market.

Creator Economy Market Segmentation Analysis:

By Platform Type:

In 2024, the video streaming segment dominated the creator economy market and accounted for 39% of revenue share due to the popularity of platforms, such as YouTube, Twitch, and TikTok, which offer robust monetization options. Increasing video consumption, ad revenues, and subscription models are fueling sustained demand. This segment is projected to maintain steady growth through 2032, driven by AI editing tools and mobile-first content strategies.

In April 2024, Naver launched CHZZK, a South Korean video streaming service targeting streamers migrating from Twitch, supporting high-quality streaming and integrated creator monetization via sponsorships and clips.

The podcasting platform segment is expected to register the fastest CAGR, driven by the impressive growth of long-form audio content and increasing diversification of monetization, including ads, sponsorships, and listener subscriptions. More niche and regional content is being made available as creator tools for podcasting become more accessible. Due to these factors, this segment will be set for strong growth through to 2032, particularly in education, health, and creator-led storytelling formats.

By Creative Service:

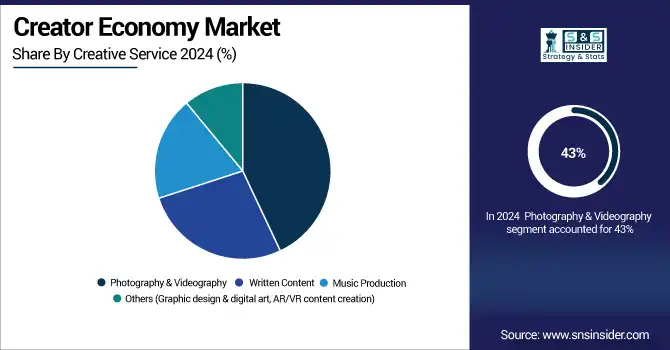

In 2024, the photography & videography segment dominated the market and accounted for 43% of the creator economy market share, as demand surged across social media, brand campaigns, influencer marketing, and UGC content. Smartphone cinematography, drone footage, and real-time editing tools have expanded the creator's output ability. Driven by the growing trend of short-form videos, aided by AI tools to simplify their workflows, this segment is anticipated to continue to dominate through 2032.

The music production segment is expected to register the fastest CAGR, driven by the increasing accessibility of royalty-free sound libraries, artificial intelligence (AI)-powered music generators, and mobile-based digital audio workstations (DAWs) for creators. TikTok and YouTube Shorts have helped make music a centerpiece of content. Independent artists are increasingly able to monetize directly through streaming and NFTs, this segment will experience significant growth until 2032.

By Revenue Channel:

In 2024, the advertising segment dominated the creator economy market and accounted for a significant revenue share due to increasing influencer marketing post-pandemic, coupled with rising demand for pre-roll and in-stream ads, and branded content integrations across YouTube, TikTok, and Instagram platforms.

In June 2024, WPP Media projected that in 2025, over 50% of content-based advertising revenue will originate from user-generated platforms, such as TikTok, YouTube, and Instagram Reels, surpassing professional media outlets

The subscriptions segment is expected to register the fastest CAGR, fueled by the rising customer preference for exclusive content, behind-the-scenes access, and an ad-free experience. New ideas, such as Patreon and Substack, and OnlyFans have begun to facilitate recurring revenue models for creators. By 2032, subscriptions will be a source of revenue for niche and full-time creators, as platforms enhance retention and personalize audiences and content driven by sophisticated platform tools.

By End-User:

In 2024, the individual content creators segment dominated the creator economy market and accounted for a significant revenue share. With more monetization tools available for individuals to leverage, alongside widely used smartphones and creator-oriented platforms, such as TikTok, YouTube, and Substack. The ease of getting into content creation, combined with the micro influencer boom, has caused an exponential creation of content. AI-based editing and integrations with platforms would ensure that this segment continues to dominate through 2032.

The businesses/brands segment is expected to register the fastest CAGR. Due to the shift toward in-house production of content and direct audience engagement through branded accounts by creators, the businesses/brands segment is projected to have rapid growth. Brands are taking cues from influencers as they aim to dehumanize brand voice and achieve a better ROI. As the number of AI tools and creator group partnerships expands, this segment will experience substantial growth through 2032, for B2C and B2B marketing purposes.

Creator Economy Market Regional Outlook:

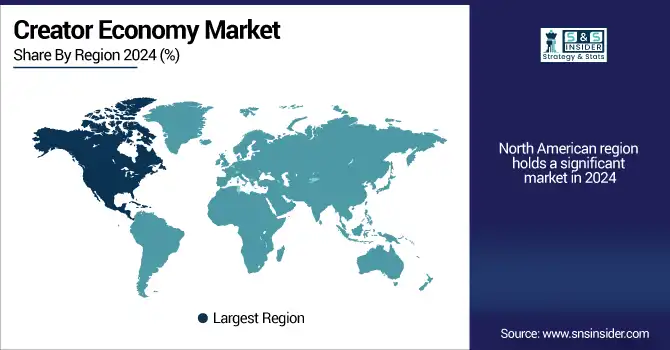

In 2024, the North America region dominated the creator economy market and accounted for a significant revenue share owing to significant digital infrastructure, excellent social media penetration, and support for monetizing platforms. The U.S. is ahead in mature creator platforms, such as YouTube, TikTok, and Patreon. North America will continue to lead through 2032, due to sustained brand investments, creator education programs, and higher onboarding of AI tools.

According to the creator economy market analysis, the Asia-Pacific region is expected to register the fastest CAGR, due to a rise in mobile-first creators, short-form video adoption, and digital literacy levels in countries, such as India, Indonesia, and Southeast Asia. Regional creators have been further bolstered by the likes of Kuaishou, TikTok, and ShareChat. With the support of the government on digital inclusion and the increasing local brand partnerships, this region will experience exponential growth until 2032.

Europe is witnessing steady growth in the creator economy due to growing demand for localized content, a regulatory framework benefitting digital creators, and the adoption of platform-based monetization. Europe is steadily emerging as a hotbed for growth in the creator economy. AI integration and cross-border brand partnerships will continue to propel the region's expansion through 2032.

The U.K. dominated the European creator economy market, supported by Several factors, including well-established influencer marketing ecosystems, widespread social media use, and supportive taxation policies. Growth is projected to continue through 2032, with U.K. creators increasing earnings via subscriptions, branded content, and innovative verticals, such as fintech, education, and sustainable living.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major generative creator economy market companies are YouTube, TikTok, Meta (Instagram, Facebook), Twitch, Patreon, Substack, Spotify, OnlyFans, Ko-fi, Buy Me a Coffee, Linktree, Canva, Adobe, Anchor (by Spotify), Teachable, Gumroad, Kajabi, Shopify, Discord, Snapchat, and others.

Recent Developments:

- In May 2025, Meta launched its “Creator Monetization Suite” across Instagram and Facebook, integrating in-stream ads, Reels bonuses, and brand collaboration tools into a unified dashboard to simplify income generation for creators and improve content discoverability.

- In February 2024, YouTube announced updates to its Partner Program eligibility and introduced ad revenue sharing for Shorts creators globally, enabling short-form video creators to monetize more effectively through direct ad payouts and creator fund expansions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 203.6 Billion |

| Market Size by 2032 | US$ 1181.3 Billion |

| CAGR | CAGR of 24.60% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Machine Learning, Generative Models (GAN & VAE), Deep Learning, Molecular Docking (Quantum Computing), GNN, Others (NLP, Reinforcement Learning)) • By Application (Molecular Design & Drug Discovery, Materials Discovery, Reaction Prediction & Retrosynthesis, Others (Chemical Manufacturing, Predictive Analysis)) • By Deployment Mode (Cloud-Based, On-Premise, Hybrid) • By End-User Industry (Pharmaceuticals & Biotechnology, Agrichemicals, Petrochemicals, Consumer Goods & Specialty Chemicals, Academic & Research Institutions) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

| Company Profiles | YouTube, TikTok, Meta (Instagram, Facebook), Twitch, Patreon, Substack, Spotify, OnlyFans, Ko-fi, Buy Me a Coffee, Linktree, Canva, Adobe, Anchor (by Spotify), Teachable, Gumroad, Kajabi, Shopify, Discord, Snapchat and others in the report |