Blockchain Market Report Scope & Overview:

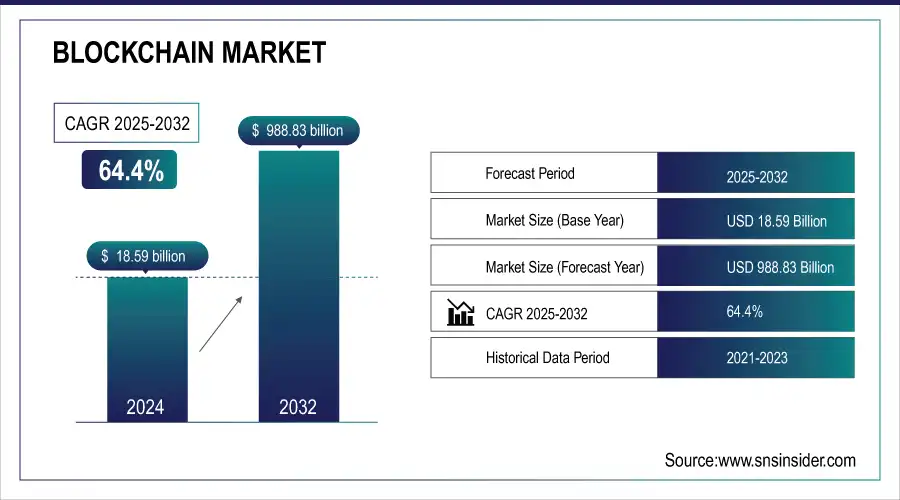

The Blockchain Market Size was valued at USD 18.59 Billion in 2024 and is expected to reach USD 988.83 Billion by 2032 and grow at a CAGR of 64.4% over the forecast period 2025-2032.

The market encompasses various statistical insights, including industry-wide adoption rates, and investment patterns, blockchain startups are emerging, patents are being registered, transaction volumes increasing, and regulatory efforts are advancing. Key metrics include the number of enterprises that are deploying blockchain solutions, the volume of blockchain-powered cross-border payments, the growth in decentralized finance, the shift and dynamics of NFT markets, and the growing Blockchain developer community.

Get more information on Blockchain Market - Request Sample Report

Blockchain Market Size and Forecast:

-

Market Size in 2024: USD 18.59 Billion

-

Market Size by 2032: USD 988.83 Billion

-

CAGR: 64.4% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Blockchain Market Trends:

-

Integration of blockchain with AI and IoT enhances data security, transparency, and automation across financial services, supply chains, and healthcare industries.

-

Rising adoption of decentralized finance (DeFi) platforms drives blockchain innovation, enabling peer-to-peer lending, digital asset trading, and smart contract-based financial solutions.

-

Enterprise blockchain solutions gain traction as companies implement private and hybrid networks for secure transactions, identity verification, and process optimization.

-

Government regulations and central bank digital currency (CBDC) initiatives accelerate blockchain adoption in payments, compliance, and cross-border settlements.

-

Growing use of non-fungible tokens (NFTs) expands blockchain applications in digital art, gaming, real estate tokenization, and intellectual property management.

-

Blockchain interoperability solutions improve cross-chain communication, enhancing scalability, multi-network integration, and enterprise adoption of distributed ledger technologies.

-

Sustainability-focused blockchain applications emerge, enabling transparent carbon credit tracking, renewable energy trading, and ESG compliance verification.

-

Cloud-based blockchain-as-a-service (BaaS) offerings by major tech providers simplify deployment, reduce costs, and expand enterprise adoption across industries.

Blockchain Market Drivers:

-

Increasing Adoption of Blockchain for Secure and Transparent Transactions Drives the Blockchain Market Growth

The rising demand for secure, transparent, and tamper-proof transactions across industries such as finance, healthcare, supply chain, and government are a major driver of blockchain market growth. Enterprises are leveraging blockchain for fraud prevention, enhanced security, and real-time tracking, reducing inefficiencies in traditional systems. Additionally, the adoption of smart contracts and decentralized applications (DApps) is fueling demand. Governments and financial institutions are exploring blockchain for cross-border payments and digital identity verification, further accelerating adoption. As cybersecurity threats increase, blockchain’s ability to eliminate intermediaries, enhance data integrity, and improve operational efficiency continues to attract global investment.

Blockchain Market Restraints:

-

High Energy Consumption and Environmental Concerns Restrain the Blockchain Market Growth

Facing blockchain adoption is its high energy consumption, particularly for proof-of-work (PoW) consensus mechanisms used in cryptocurrencies like Bitcoin. Large-scale mining operations require massive computational power, leading to significant carbon emissions and environmental concerns. Governments and regulatory bodies are imposing stricter sustainability policies, forcing companies to explore more energy-efficient alternatives such as proof-of-stake (PoS) and hybrid consensus models. However, the transition to greener blockchain solutions is slow due to technical limitations and resistance from existing mining communities. These concerns create hurdles for widespread adoption, particularly in industries prioritizing sustainability.

Blockchain Market Opportunities:

-

Growing Integration of Blockchain with Artificial Intelligence and IoT Creates Lucrative Opportunities in the Blockchain Market

The convergence of blockchain with artificial intelligence (AI) and the Internet of Things (IoT) presents significant growth opportunities. Blockchain enhances IoT security by ensuring data integrity, preventing cyber threats, and enabling seamless automation through smart contracts. In AI, blockchain provides decentralized and transparent data management, improving trust in AI-driven decision-making. Industries such as healthcare, supply chain, and financial services are leveraging these integrations for real-time data tracking, fraud prevention, and predictive analytics. As businesses invest in next-gen technologies, blockchain’s role in securing AI and IoT ecosystems is expected to expand, opening new revenue streams.

Blockchain Market Challenges:

-

Regulatory Uncertainties and Compliance Challenges Hamper the Blockchain Market Growth

The lack of standardized regulations across different regions creates uncertainty for blockchain adoption. Governments are struggling to define legal frameworks for blockchain-based applications, particularly in cryptocurrencies, DeFi, and digital identities. Regulatory ambiguity makes it difficult for businesses to ensure compliance, manage risks, and attract institutional investors. Additionally, the potential for strict government interventions, bans on crypto transactions, and varying taxation policies adds to market instability. As blockchain gains traction in sectors like finance and healthcare, companies must navigate complex regulatory landscapes while ensuring transparency and data security. Addressing these compliance challenges is crucial for blockchain’s long-term success.

Blockchain Market Segmentation Analysis:

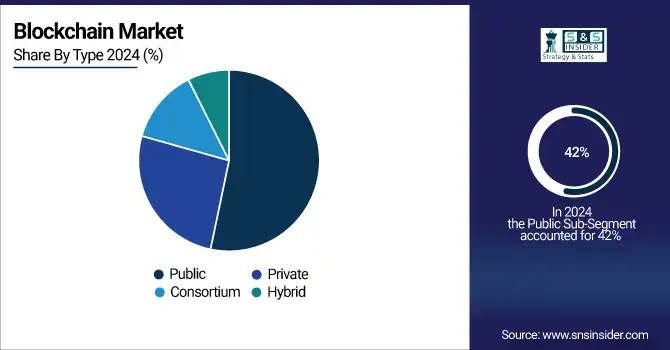

By Type, Public Blockchain Leads with 42% Market Share, Hybrid Blockchain Records Fastest Growth at 67.5% CAGR

In 2024, the Public Blockchain segment commanded a significant 42% share of the blockchain market, underscoring its prominence in decentralized applications and cryptocurrencies. Public blockchains, characterized by their open and permissionless nature, have been pivotal in fostering innovation and transparency.

For instance, IBM's Food Trust utilizes the public blockchain to enhance transparency in the food supply chain. These advancements have solidified public blockchains' role in various sectors, including finance, supply chain, and healthcare, by providing secure and transparent transaction frameworks.

The Hybrid Blockchain segment is experiencing a remarkable CAGR of 67.5% during the forecasted period, reflecting its growing appeal among enterprises seeking the combined benefits of public and private blockchain features. Hybrid blockchains offer controlled access and enhanced security while maintaining transparency, making them ideal for industries with stringent compliance requirements. A significant development in this area is the collaboration between Microsoft and Nasdaq to integrate blockchain capabilities into Nasdaq's financial framework, aiming to streamline transactions and enhance security.

By Application, Supply Chain Management Drives Blockchain Adoption with 28% Market Revenue Share

In 2024, the Supply Chain Management (SCM) segment accounted for 28% of the blockchain market's revenue, reflecting its significant role in enhancing transparency, traceability, and efficiency across global supply chains. Blockchain's immutable ledger technology enables real-time tracking of products, reducing fraud and errors, and ensuring authenticity. Companies are actively developing blockchain solutions to optimize supply chain operations.

For instance, IBM's Food Trust platform utilizes blockchain to trace food products from farm to table, enhancing safety and reducing waste. Similarly, Maersk, in collaboration with IBM, launched TradeLens, a blockchain-based shipping solution that streamlines global trade by providing end-to-end supply chain visibility.

By Industry, BFSI Dominates Blockchain Adoption While Healthcare and Life Sciences See Fastest Growth

In 2024, the BFSI segment Dominate the blockchain market in revenue, driven by the technology's ability to enhance transaction security, reduce fraud, and streamline processes. Blockchain's decentralized ledger offers transparency and efficiency, making it ideal for financial applications. For instance, JPMorgan Chase developed its own digital currency, JPM Coin, to facilitate instantaneous cross-border payments. Similarly, HSBC implemented blockchain technology to digitize letters of credit, significantly reducing processing times in trade finance.

The Healthcare and Life Sciences Segment is experiencing the Fastest Compound Annual Growth Rate (CAGR) in blockchain adoption during the forecasted period. Blockchain's immutable and transparent ledger addresses critical challenges in healthcare, such as data security, interoperability, and supply chain transparency.

For example, the U.S. Food and Drug Administration (FDA) partnered with IBM to explore blockchain for secure health data exchange, aiming to enhance patient privacy and data accuracy.

By Deployment, Proof-of-Concept Leads Blockchain Deployment, While Pilot Projects Grow at Fastest Pace

In 2024, the Proof-of-Concept deployment segment dominated the blockchain market, accounting for the largest share of revenue. PoC is a crucial stage for blockchain adoption, allowing businesses to validate the feasibility and effectiveness of blockchain applications before full-scale implementation. It provides a way to test blockchain’s potential to solve specific challenges, such as enhancing transparency, improving data security, and reducing inefficiencies in industries like finance, supply chain, and healthcare. Many companies across sectors have launched PoC projects to assess blockchain’s value proposition.

The Pilot deployment segment is experiencing the fastest growth in the blockchain market during the forecasted period, driven by increasing industry interest in exploring blockchain’s potential on a larger scale. The Pilot phase allows businesses to test blockchain solutions in controlled, real-world environments before full-scale implementation, ensuring that the technology performs as expected and meets business requirements. This phase typically includes small-scale rollouts to select stakeholders or customers, allowing for real-time testing and feedback.

By Component, Platform/Solution Segment Dominates, While Blockchain-as-a-Service (BaaS) Emerges as Fastest-Growing Offering

In 2024, the Platform/Solution segment held the largest share of revenue in the blockchain market, reflecting its critical role in providing businesses with the tools and infrastructure necessary to build and deploy blockchain applications. This segment includes comprehensive blockchain platforms that enable enterprises to create custom blockchain solutions for a range of use cases, such as digital identity, supply chain tracking, and financial services. Companies have increasingly launched platform solutions to address specific industry needs, offering features like scalability, security, and ease of integration with existing systems.

The Blockchain as a Service (BaaS) segment is expected to experience the largest CAGR during the forecasted period, driven by the growing demand for cloud-based blockchain solutions. BaaS enables businesses to develop and manage blockchain networks without the complexities of building the underlying infrastructure themselves, making it an attractive option for enterprises seeking to adopt blockchain technology quickly and cost-effectively. This segment has seen rapid growth as more companies turn to third-party providers for scalable blockchain solutions. BaaS offerings often include pre-built blockchain platforms, smart contract templates, and seamless integration with other cloud-based services, facilitating faster time-to-market for blockchain applications.

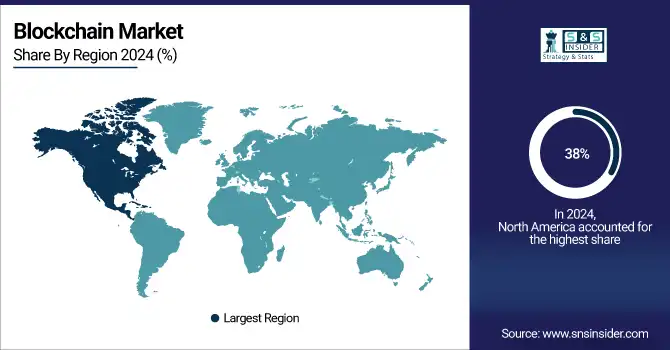

Blockchain Market Regional Analysis:

North America Dominates Blockchain Market in 2024

North America holds an estimated 38% market share in 2024, driven by strong enterprise adoption, fintech innovation, and regulatory clarity. This causes businesses to prioritize blockchain integration, enhancing transaction security, operational efficiency, and transparency across industries.

Need any customization research on Blockchain Market- Enquiry Now

-

United States Leads North America’s Blockchain Market

The U.S. dominates due to its robust startup ecosystem, venture capital investments, and widespread enterprise adoption. Major financial institutions implement blockchain for cross-border payments, trade finance, and digital assets. Technology giants such as IBM, Microsoft, and AWS provide scalable blockchain solutions. Government initiatives and regulatory frameworks encourage experimentation, fostering innovation. With advanced R&D, a mature tech ecosystem, and strong regulatory support, the U.S. remains the largest contributor to North America’s blockchain market leadership.

Asia Pacific is the Fastest-Growing Region in Blockchain Market in 2024

The region is expected to grow at a CAGR of 67.8% from 2025–2032, fueled by digital transformation initiatives, fintech expansion, and smart city projects. This causes organizations to adopt hybrid and public blockchain solutions, improving transparency, traceability, and operational efficiency.

-

China Leads Asia Pacific’s Blockchain Market

China dominates due to government-backed initiatives like the Blockchain Service Network (BSN) and investments in digital currencies. These programs accelerate adoption across finance, supply chain, and healthcare sectors. Strong infrastructure, rapid urbanization, and support for tech startups further enhance implementation. Collaboration between enterprises and government agencies promotes innovation in blockchain platforms, smart contracts, and secure data exchange. China’s focus on scalability, security, and national digitalization projects makes it the regional leader in blockchain adoption and technological advancement.

Europe Blockchain Market Insights, 2024

Europe is experiencing steady blockchain growth, driven by regulatory support, fintech innovation, and cross-border trade applications. Germany’s investments in digital infrastructure and blockchain-enabled finance improve operational efficiency, causing faster adoption across Europe.

-

Germany Leads Europe’s Blockchain Market

Germany dominates due to strong government initiatives promoting Industry 4.0, digital finance, and supply chain transparency. Enterprises leverage blockchain for secure transactions, smart contracts, and logistics optimization. Regulatory clarity, public-private partnerships, and a mature technology ecosystem accelerate adoption. Germany’s leadership in digital innovation and financial technology ensures efficient implementation of blockchain solutions, making it the central hub for Europe’s blockchain market in 2024.

Middle East & Africa and Latin America Blockchain Market Insights, 2024

The blockchain market in these regions is expanding steadily, supported by fintech adoption, cross-border remittances, and government-led digitalization initiatives. In the Middle East, the UAE and Saudi Arabia are implementing blockchain for finance, smart cities, and logistics. Africa focuses on financial inclusion and agricultural supply chains, while Latin America, led by Brazil and Mexico, leverages blockchain for trade finance and cryptocurrency adoption. International collaborations and technology investments accelerate market penetration, fostering secure, transparent, and efficient digital operations across these regions.

Competitive Landscape for the Blockchain Market:

Amazon Web Services (AWS)

Amazon Web Services (AWS) is a U.S.-based leader in cloud computing and enterprise blockchain solutions. The company provides scalable blockchain platforms, managed services, and enterprise-grade infrastructure to help organizations develop and deploy blockchain applications. AWS focuses on supporting industries such as finance, supply chain, and healthcare with secure, decentralized, and transparent solutions. Its role in the blockchain market is critical, as it enables enterprises to integrate blockchain without building the underlying infrastructure, ensuring rapid deployment, operational efficiency, and enhanced security.

-

In 2024, AWS previewed its latest blockchain service updates, including pre-built templates for Hyperledger Fabric and Ethereum, facilitating faster enterprise adoption and seamless cloud integration.

Oracle

Oracle is a global technology company specializing in cloud services, database management, and enterprise blockchain solutions. Its blockchain platform helps organizations deploy secure, scalable, and interoperable networks to manage transactions, contracts, and supply chains. Oracle provides tools for governance, smart contracts, and analytics, ensuring compliance and operational efficiency. Its role in the blockchain market is vital, enabling enterprises to adopt distributed ledger technology while leveraging Oracle’s existing enterprise software ecosystem.

-

In 2024, Oracle launched enhanced blockchain cloud services, offering low-latency performance, multi-cloud support, and integration with enterprise ERP and logistics systems.

IBM

IBM is a U.S.-based pioneer in blockchain technology, offering comprehensive platforms such as IBM Blockchain Platform and Food Trust. The company enables enterprises to build, govern, and scale blockchain networks across industries, including finance, healthcare, and supply chain. IBM’s role in the blockchain market is significant, as it combines deep enterprise expertise with secure, transparent ledger solutions to enhance operational efficiency, reduce fraud, and streamline processes.

-

In 2024, IBM expanded its blockchain services with new AI-driven analytics, interoperability tools, and supply chain traceability solutions to strengthen enterprise adoption.

Huawei

Huawei is a China-based global technology leader providing blockchain solutions integrated with cloud computing, AI, and telecom infrastructure. Its blockchain platform supports enterprise adoption in sectors such as finance, logistics, and government, offering secure, high-performance distributed ledger technology. Huawei’s role in the blockchain market is crucial, as it enables organizations to implement scalable and efficient blockchain networks while leveraging Huawei’s extensive telecom and cloud ecosystem.

-

In 2024, Huawei introduced upgraded blockchain-as-a-service offerings, supporting hybrid deployment models, smart contracts, and cross-industry integration for faster enterprise deployment.

Blockchain Market Key Players:

-

Amazon Web Services

-

Oracle

-

IBM

-

Huawei

-

Accenture

-

TCS

-

Google

-

Alibaba

-

Microsoft

-

OVHcloud

-

SAP

-

HPE

-

Tencent

-

Wipro

-

Infosys

-

Lumen Technologies

-

DigitalOcean

-

VMware

-

Deloitte

-

Ripple Labs Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 18.59 Billion |

| Market Size by 2032 | US$ 988.83 Billion |

| CAGR | CAGR of 64.4 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Platform/Solution, Blockchain as a Service (BaaS)) • By Type (Public, Private, Hybrid, Consortium) • By Application (Digital Identity, Payments, Smart Contracts, Supply Chain Management, Internet of Things, Others) • By Deployment (Proof of Concept, Pilot, Production) • By Industry (BFSI, Energy & Utilities, Government, Healthcare and Life Sciences, Manufacturing, Telecom, Media & Entertainment, Retail & Consumer Goods, Travel and Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AWS, Oracle, IBM, Huawei, Accenture, TCS, Google, Alibaba, Microsoft, OVHcloud, SAP, HPE, Tencent, Wipro, Infosys, Lumen Technologies, DigitalOcean, Vmware |