Advertising Based Video On Demand (AVOD) Market Report Scope & Overview:

The Advertising Based Video On Demand (AVOD) Market was valued at USD 54.14 billion in 2025E and is expected to reach USD 218.31 billion by 2033, growing at a CAGR of 19.12% from 2026-2033.

AVOD Market is expanding rapidly due to increasing consumer preference for free, ad-supported streaming content and the rising shift away from traditional cable TV. Growth in smart TV adoption, improved internet accessibility, and the surge in mobile video consumption are further driving market demand. Advertisers are increasingly investing in digital video platforms for better targeting and measurable performance. Additionally, global content expansion and strategic partnerships between streaming providers and brands are boosting overall market growth.

In 2024, over 70% of new internet users accessed free ad-supported video content, smart TV ownership enabled 85% of households to stream AVOD services, and mobile devices accounted for 60% of total AVOD viewing time globally.

To Get More Information On Advertising Based Video On Demand (AVOD) Market - Request Free Sample Report

Advertising Based Video On Demand (AVOD) Market Size and Forecast

-

Market Size in 2025E: USD 54.14 Billion

-

Market Size by 2033: USD 218.31 Billion

-

CAGR: 19.12% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Advertising Based Video On Demand (AVOD) Market Trends

-

Growing shift from traditional TV to streaming, boosting ad-supported video consumption across global audiences

-

Rapid rise in mobile video viewing driving higher engagement and increased demand for targeted AVOD advertising

-

Adoption of AI-driven ad personalization improving viewer experience and maximizing revenue for AVOD platforms

-

Expansion of connected TV usage accelerating premium ad inventory and enhancing cross-device audience targeting capabilities

-

Increasing preference for free, ad-supported content as subscription fatigue grows among global streaming users

-

Brands leveraging interactive and shoppable video ads to boost engagement and measure real-time consumer responses effectively

The U.S. Advertising Based Video On Demand (AVOD) Market was valued at USD 18.52 billion in 2025E and is expected to reach USD 73.42 billion by 2033, growing at a CAGR of 18.87% from 2026-2033.

Growth in the U.S. AVOD Market is driven by rising demand for free, ad-supported streaming content, increasing cord-cutting trends, and expanding smart TV and mobile video consumption. Advertisers are shifting budgets toward digital platforms for better targeting and analytics, further accelerating market expansion.

Advertising Based Video On Demand (AVOD) Market Growth Drivers:

-

Rising shift from traditional TV to digital streaming is boosting AVOD adoption as consumers prefer free, ad-supported entertainment across devices

As audiences move away from traditional cable and satellite TV, digital streaming has become the preferred mode of content consumption. AVOD platforms benefit significantly from this transition, offering free access to movies, shows, and live content supported by advertising. The growing use of smartphones, smart TVs, and connected devices further accelerates AVOD viewership. With consumers seeking flexible, on-demand entertainment at no cost, AVOD services are experiencing rapid growth. This shift is reshaping media consumption patterns and opening strong revenue opportunities for ad-supported streaming platforms.

Global AVOD viewership reached 1.4 billion in 2024, with 68% of users accessing content via smartphones or smart TVs; over 55% of cord-cutters now prefer free, ad-supported streaming over paid alternatives.

-

Growing advertiser demand for targeted, data-driven video ads is driving AVOD platforms to expand inventory and improve audience monetization

Advertisers increasingly favor digital video channels that offer precise targeting, measurable performance, and higher engagement compared to traditional advertising formats. AVOD platforms leverage user data, viewing patterns, and AI-driven insights to deliver personalized ads that maximize impact. As demand for targeted advertising rises, AVOD providers are expanding ad inventory, enhancing programmatic capabilities, and improving ad placement efficiency. This trend boosts revenue potential while enabling brands to reach relevant audiences. The combination of scalability, transparency, and improved ROI positions AVOD as a powerful advertising channel in the digital ecosystem.

In 2024, 78% of advertisers prioritized AVOD platforms for their precise targeting and measurable ROI; programmatic ad buys on AVOD grew by 32%, with CPMs rising 15% due to enhanced audience segmentation and AI-driven ad optimization.

Advertising Based Video On Demand (AVOD) Market Restraints:

-

Rising ad-blocker usage reduces ad impressions and revenue potential, limiting monetization opportunities for AVOD platforms across global audiences

The increasing adoption of ad-blocking software on mobile devices, browsers, and smart TVs significantly reduces the number of ads delivered to viewers. As a result, AVOD platforms face declining ad impressions, lower fill rates, and reduced revenue generation. This directly impacts their ability to monetize viewership at scale. With younger and tech-savvy audiences more likely to use ad blockers, platforms struggle to maintain consistent advertising reach. The challenge pushes AVOD providers to find alternative ad formats, implement anti-ad-block solutions, and enhance user experience without compromising revenue.

Ad-blocker usage affects over 42% of global AVOD viewers, reducing ad impressions by nearly 35% and significantly limiting revenue potential for ad-supported streaming platforms worldwide.

-

Increasing competition from subscription-based and hybrid streaming models decreases viewer engagement and limits AVOD platforms’ ability to retain long-term audiences

The streaming landscape is becoming increasingly competitive, with SVOD and hybrid models offering ad-free or reduced-ad experiences. These platforms attract viewers seeking uninterrupted content, reducing the time audiences spend on AVOD services. As premium content becomes more concentrated on subscription platforms, AVOD players struggle to match content quality and retain viewers. This shift limits user engagement and reduces advertising revenue. To remain competitive, AVOD platforms must diversify their content libraries, invest in originals, and enhance ad relevance while maintaining a free viewing experience appealing to cost-conscious users.

AVOD platforms experience 18% lower user retention compared to subscription services, with over 60% of viewers splitting attention across hybrid and subscription models, weakening long-term audience loyalty.

Advertising Based Video On Demand (AVOD) Market Opportunities:

-

Advances in AI-driven ad personalization enhance viewer experience, enabling more effective targeting and higher conversion rates for advertisers on AVOD platforms

Rapid advancements in AI and data analytics are transforming how AVOD platforms deliver advertisements. By analyzing viewer behavior, interests, and watch patterns, AI enables highly personalized and contextually relevant ads, improving user satisfaction and reducing ad fatigue. Advertisers benefit from more accurate targeting, better campaign performance, and measurable outcomes. This enhanced precision increases click-through rates and conversion potential, making AVOD a more attractive channel for brands. As personalization technology evolves, platforms can further optimize ad placements, strengthen engagement, and boost revenue opportunities.

In 2024, AI-driven ad personalization boosted AVOD ad engagement by 32%; by 2025, conversion rates are projected to rise by 28% as platforms refine real-time viewer targeting and content relevance.

-

Increasing collaboration between content creators and AVOD providers supports exclusive content development, driving user growth and improving monetization potential

Partnerships between AVOD platforms and production studios, independent creators, and media companies are rising as demand for exclusive and diverse content grows. These collaborations allow platforms to differentiate themselves, attract larger audiences, and increase viewer retention. Exclusive shows, regional storytelling, and niche genres enhance content libraries and create new advertising opportunities. For creators, AVOD provides wider outreach and additional revenue streams. For platforms, unique content strengthens competitive positioning and increases ad inventory value, enabling better monetization and long-term revenue growth in the evolving streaming landscape.

In 2024, AVOD-exclusive content collaborations grew by 40%; in 2025, over 60% of top creators partner with AVOD platforms, boosting user engagement and ad-driven revenue by 25% YoY.

Advertising Based Video On Demand (AVOD) Market Segment Highlights

-

By Advertisement Position: In 2025, Pre-roll led the AVOD market with 50% share and is also the fastest-growing segment due to high visibility, strong brand recall, and increasing platform optimization for targeted pre-roll delivery (2026–2033).

-

By Enterprise Size: In 2025, Large Enterprises led with 70% share, while SMEs grow fastest due to rising adoption of affordable, targeted, self-serve AVOD advertising tools (2026–2033).

-

By Device: In 2025, TV led the market with 53% share and is also the fastest-growing segment driven by rapid CTV adoption, smart TV penetration, and higher ad engagement (2026–2033).

-

By Industry: In 2025, Media & Entertainment led with 40% share, while Retail & Consumer Goods grows fastest due to increasing e-commerce activity and targeted video ad demand (2026–2033).

Advertising Based Video On Demand (AVOD) Market Segment Analysis

By Advertisement Position, Pre-roll segment led in 2025; Pre-roll segment expected fastest growth 2026–2033

Pre-roll segment dominated the Advertising Based Video On Demand (AVOD) Market with the highest revenue share of about 50% in 2025 and is expected to grow at the fastest CAGR from 2026-2033 because advertisers prefer its high viewer retention and guaranteed visibility before content playback. Pre-roll ads generate stronger engagement, offer better brand recall, and provide measurable performance metrics. Their effectiveness across mobile, TV, and streaming platforms continues to expand as viewer consumption of short-form and long-form digital content rises worldwide.

By Enterprise Size, Large Enterprises segment led in 2025; SMEs segment expected fastest growth 2026–2033

Large Enterprise segment dominated the Advertising Based Video On Demand (AVOD) Market with the highest revenue share of about 70% in 2025 due to substantial advertising budgets, strong focus on digital branding, and widespread adoption of AVOD platforms for large-scale audience targeting.

Small and Medium Enterprise (SME) segment is expected to grow at the fastest CAGR from 2026-2033 as SMEs increasingly adopt cost-effective digital advertising, leverage targeted AVOD campaigns, and expand online presence to reach specific customer segments with measurable outcomes.

By Device, TV segment led in 2025; TV segment expected fastest growth 2026–2033

TV segment dominated the Advertising Based Video On Demand (AVOD) Market with the highest revenue share of about 53% in 2025 and is expected to grow at the fastest CAGR from 2026-2033 as smart TV adoption accelerates, boosting long-form content consumption. Advertisers benefit from high screen engagement, premium inventory availability, and improved targeting capabilities. As connected TV usage rises globally, AVOD platforms experience stronger ad impressions, greater viewability, and higher brand impact, driving continued dominance and rapid growth of TV-based AVOD advertising.

By Industry, Media & Entertainment segment led in 2025; Retail & Consumer Goods segment expected fastest growth 2026–2033

Media & Entertainment segment dominated the Advertising Based Video On Demand (AVOD) Market with the highest revenue share of about 40% in 2025 due to massive content consumption, frequent streaming activity, and high viewer engagement across music videos, movies, web series, and live events.

Retail & Consumer Goods segment is expected to grow at the fastest CAGR from 2026-2033 driven by rising digital shopping behavior, increasing demand for targeted product ads, and growing use of AVOD platforms for personalized consumer outreach and brand visibility.

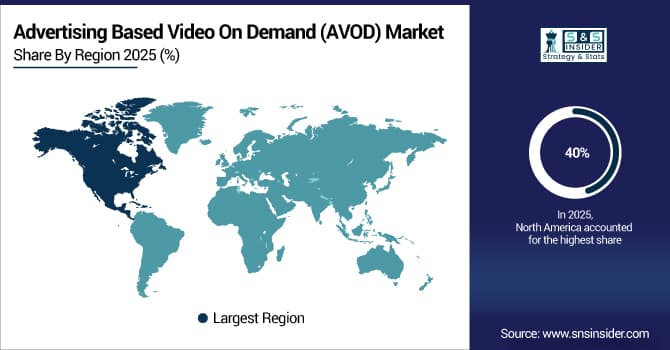

Advertising Based Video On Demand (AVOD) Market Regional Analysis

North America Advertising Based Video On Demand (AVOD) Market Insights

North America dominated the Advertising Based Video On Demand (AVOD) Market with about 40% revenue share in 2025 due to the strong presence of leading streaming platforms, high digital advertising spending, widespread broadband penetration, and mature consumer adoption of ad-supported video services. Robust advertiser demand and advanced audience-targeting technologies further reinforced the region’s leadership.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Advertising Based Video On Demand (AVOD) Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 21.38% from 2026–2033, supported by rapid internet expansion, rising smartphone video consumption, and a booming young population shifting to free, ad-supported platforms. Growing OTT investments, regional content production, and strong digital advertising growth further accelerate the market’s expansion across emerging APAC economies.

Europe Advertising Based Video On Demand (AVOD) Market Insights

Europe held a strong position in the Advertising Based Video On Demand (AVOD) Market in 2025, driven by high broadband penetration, increasing adoption of connected TVs, and strong demand for localized ad-supported video content. Regulatory support for digital advertising transparency, coupled with rising investments from regional broadcasters and OTT platforms, further strengthened the region’s overall market contribution.

Middle East & Africa and Latin America Advertising Based Video On Demand (AVOD) Market Insights

Middle East & Africa and Latin America together showed steady progress in the Advertising Based Video On Demand (AVOD) Market in 2025, supported by growing smartphone penetration, expanding internet accessibility, and rising consumption of free, ad-supported video content. Increasing localization of OTT platforms, young digital-first populations, and advertiser interest in emerging markets further contributed to the region’s strengthening AVOD adoption.

Advertising Based Video On Demand (AVOD) Market Competitive Landscape:

YouTube

YouTube, owned by Google, is the world’s largest AVOD platform, offering user-generated content, premium channels, music, news, entertainment, and live streaming. Supported by a powerful advertising ecosystem, YouTube provides targeted ad solutions powered by Google Ads and AI-driven analytics. It serves billions of users globally and supports creators, broadcasters, and enterprises, making it a dominant force in the AVOD market with unmatched reach, engagement, and monetization opportunities.

-

2024, YouTube rolled out nine new AI-driven features designed to improve recommendations, accessibility, and creative expression.

Tubi

Tubi, owned by Fox Corporation, is a leading free streaming service offering thousands of movies, TV shows, and original programs supported entirely by advertising. With a fast-growing global user base, Tubi provides personalized recommendations and delivers ad inventory optimized through Fox’s advanced ad-tech capabilities. Its extensive content library, accessibility across devices, and cost-free model position it as one of the most competitive AVOD platforms in North America and emerging international markets.

-

2025 at a Fox Upfront, Tubi announced new Originals for Gen Z, interactive ad formats (like shoppable Carousels), and advanced CTV ad-buying tools.

Pluto TV

Pluto TV, operated by Paramount Global, is a major AVOD and FAST streaming platform offering over 250 live channels and a vast catalog of on-demand entertainment. It delivers curated channels across news, sports, movies, comedy, kids, and lifestyle categories. Supported by ad-based monetization, Pluto TV is widely accessible on smart TVs, mobile devices, and streaming hardware. Its strong partnerships, diversified content, and global expansion make it a leading player in free streaming.

-

2025, Paramount Global and Nielsen signed a multi-year deal to measure streaming across Paramount platforms, including Pluto TV, using Nielsen’s advanced Ad-Supported Streaming Platform Ratings.

The Roku Channel

The Roku Channel, developed by Roku, is a prominent AVOD and FAST platform offering free movies, series, live TV channels, and Roku Originals. Integrated directly into Roku devices and available across major platforms, it provides seamless access to curated entertainment without subscription fees. The channel benefits from Roku’s advanced advertising technologies and user data insights, enabling targeted ad delivery. Its rapid content expansion and growing audience solidify its position as a key AVOD competitor.

-

2024, The Roku Channel became the most-watched U.S. FAST platform (per comScore), and it secured multiyear rights deals for Formula E and MLB Sunday Leadoff.

Advertising Based Video On Demand (AVOD) Market Key Players

Some of the Advertising Based Video On Demand (AVOD) Market Companies are:

-

YouTube

-

Tubi

-

Pluto TV

-

The Roku Channel

-

Hulu (Ad-Supported)

-

Peacock

-

Crackle

-

Xumo Play

-

Plex

-

Amazon Freevee

-

Vudu

-

Rakuten TV

-

Samsung TV Plus

-

LG Channels

-

Popcornflix

-

Fubo (Ad-Supported)

-

Vizio WatchFree+

-

MX Player

-

TVer

-

AbemaTV

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 54.14 Billion |

| Market Size by 2033 | USD 218.31 Billion |

| CAGR | CAGR of 19.12% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Advertisement Position (Pre-roll, Mid-roll, Post-roll) • By Enterprise Size (Small and Medium Enterprise (SME), Large Enterprise) • By Device (Laptops and Tablet PCs, Mobile, Console, TV) • By Industry (Media & Entertainment, BFSI, Education, Retail & Consumer Goods, IT & Telecom, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | YouTube (Google), Tubi (Fox Corporation), Pluto TV (Paramount Global), The Roku Channel (Roku Inc.), Hulu (Disney – Ad-Supported), Peacock (NBCUniversal), Freevee (Amazon), Crackle (Chicken Soup for the Soul Entertainment), Xumo Play (Comcast & Spectrum), Vudu (Fandango/Walmart legacy), Samsung TV Plus (Samsung), LG Channels (LG Electronics), Rakuten TV (Rakuten Group), Plex, Popcornflix, Fubo (Ad-Supported Tier), Vizio WatchFree+ (Vizio Inc.), MX Player (Times Internet), TVer (Japan Consortium), AbemaTV (CyberAgent & TV Asahi) |