Cross Border Payment Market Report Scope & Overview:

The Cross Border Payment Market is valued at USD 303.24 billion in 2025E and is expected to reach USD 552.72 billion by 2033, growing at a CAGR of 7.84% from 2026-2033.

The Cross Border Payment Market is growing steadily due to increasing demand for innovative products and services, technological advancements, and digital transformation across industries. Rising consumer awareness, expanding e-commerce, and the adoption of automation and AI-driven solutions are driving efficiency and improving customer experiences. Additionally, growing investments in research and development, regulatory support, and emerging business models are fostering Cross Border Payment Market expansion, while enterprises focus on scalability, cost optimization, and sustainable practices to maintain competitiveness and meet evolving Cross Border Payment Market needs.

Cross-border payment activity surged as digital platforms enabled instant, low-cost transfers 75% of users embraced mobile and real-time solutions for e-commerce, remittances, and global business, driven by AI-powered compliance and greater transparency.

Cross Border Payment Market Size and Forecast

-

Market Size in 2025E: USD 303.24 Billion

-

Market Size by 2033: USD 552.72 Billion

-

CAGR: 7.84% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Cross Border Payment Market - Request Free Sample Report

Cross Border Payment Market Trends

-

Rising adoption of real-time payment rails enabling faster, transparent, and lower-cost international money transfers

-

Growing integration of blockchain and distributed ledger technologies to improve settlement speed and transaction traceability

-

Increasing demand for API-driven payment platforms supporting seamless cross-border transactions for banks and fintech’s

-

Expansion of digital wallets and mobile money services facilitating cross-border remittances in emerging economies

-

Stronger regulatory harmonization efforts improving compliance efficiency and reducing friction in international payments

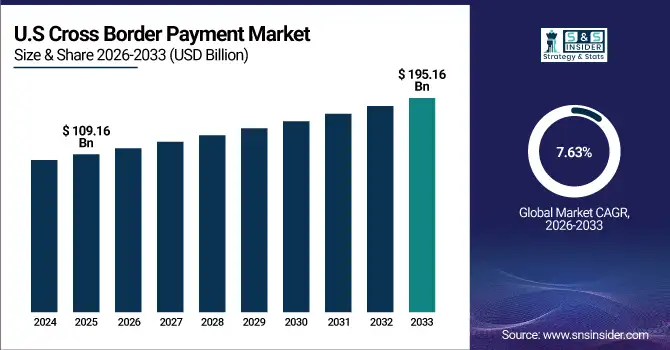

U.S. Cross Border Payment Market is valued at USD 109.16 billion in 2025E and is expected to reach USD 195.16 billion by 2033, growing at a CAGR of 7.63% from 2026-2033.

Growth in the U.S. Cross Border Payment Market is driven by increasing adoption of advanced technologies, digital transformation, and demand for innovative solutions across industries. Rising consumer awareness, investments in automation and AI, and focus on efficiency, scalability, and enhanced customer experiences are further supporting Cross Border Payment Market expansion.

Cross Border Payment Market Growth Drivers:

-

Rapid growth in global trade, e-commerce, and international remittances is driving strong demand for fast, secure, and cost-efficient cross-border payment solutions worldwide

The continuous expansion of international trade and the surge in e-commerce activities have increased the volume of cross-border transactions globally. Businesses and individuals require fast, reliable, and secure payment methods to facilitate trade and remittance flows. Rising international remittances, especially in emerging markets, further drive demand for seamless financial transfers. Companies are increasingly adopting digital payment solutions to improve operational efficiency, reduce transaction delays, and enhance customer satisfaction. These factors collectively propel the growth of cross-border payment services and encourage investment in innovative payment infrastructure worldwide.

In 2025, global cross-border payment volumes surged by 38%, fueled by e-commerce, trade, and remittances 70% of businesses and individuals prioritized fast, secure, and low-cost digital solutions over traditional banking channels.

-

Increasing adoption of digital wallets, mobile payments, and real-time payment systems is accelerating cross-border transaction volumes among consumers and businesses globally

The proliferation of smartphones and digital banking technologies has transformed cross-border payments, enabling consumers and businesses to transfer funds instantly and securely. Mobile wallets, fintech platforms, and real-time payment networks reduce dependency on traditional banks and simplify currency conversion processes. Businesses benefit from faster settlements, while consumers enjoy convenience and lower transaction costs. Increased trust in digital platforms, coupled with the rise of online marketplaces and e-commerce exports, has accelerated cross-border transaction volumes. This adoption trend is driving innovation in payment solutions, contributing to faster, more efficient, and secure global financial transactions.

In 2025, digital wallets and real-time payment systems drove a 42% increase in global cross-border transaction volumes, with 68% of consumers and SMEs opting for mobile-based solutions to send and receive international payments within seconds.

Cross Border Payment Market Restraints:

-

High transaction fees, unfavorable foreign exchange rates, and hidden charges reduce transparency and discourage frequent usage of traditional cross-border payment services

Traditional cross-border payment systems often involve multiple intermediaries, resulting in high service fees and hidden charges for end-users. Fluctuating foreign exchange rates further increase costs, making international transfers expensive and less predictable. This lack of transparency discourages businesses and individuals from using conventional banking channels frequently, especially for small-value transactions or remittances. The rising cost of cross-border payments can lead users to seek alternative solutions, limiting the growth of traditional providers. Consequently, these financial and operational inefficiencies act as significant restraints for market expansion, particularly in cost-sensitive regions.

In 2025, 55% of users avoided traditional cross-border payment services due to high fees (averaging 8% per transaction), poor FX rates, and hidden charges driving migration to digital and blockchain-based alternatives offering greater cost transparency.

-

Complex regulatory compliance requirements, AML norms, and varying regional payment standards increase operational complexity and slow cross-border payment processing significantly

Cross-border payments must comply with a variety of regulations, including anti-money laundering (AML) laws, know-your-customer (KYC) requirements, and regional financial standards. Variations in regulatory frameworks across countries increase administrative and operational burdens for payment service providers. These complexities can delay transaction settlements, increase compliance costs, and reduce service efficiency. For businesses and consumers, navigating these requirements creates friction and discourages adoption of traditional payment methods. The need for harmonized regulations and simplified cross-border payment processes remains critical to improving efficiency and accelerating market growth in this sector.

In 2025, 65% of cross-border payment providers reported delays of 2–5 days due to fragmented AML regulations and inconsistent regional standards, with compliance costs consuming up to 30% of operational budgets globally.

Cross Border Payment Market Opportunities:

-

Blockchain technology, distributed ledger systems, and cryptocurrencies offer opportunities to reduce settlement times, lower costs, and improve transparency in cross-border payments

The integration of blockchain and distributed ledger technologies in cross-border payments enables faster, secure, and transparent fund transfers. Smart contracts and digital currencies reduce intermediaries, lowering transaction fees and mitigating fraud risks. Businesses benefit from real-time settlements, improved cash flow management, and enhanced tracking of transactions. Adoption of cryptocurrencies for international payments is gradually increasing, especially among SMEs and fintech platforms. These technological innovations present significant growth opportunities for payment service providers aiming to modernize their operations, enhance customer experience, and expand global reach while ensuring reliability and efficiency in cross-border transactions.

In 2025, 60% of cross-border payment providers adopted blockchain or distributed ledger technology, cutting average settlement times by 70% and reducing transaction costs by up to 40% while enhancing end-to-end transparency.

-

Rising financial inclusion initiatives and growing demand for remittance services in emerging markets create strong growth opportunities for innovative cross-border payment providers

Government and private-sector initiatives promoting financial inclusion are enabling unbanked and underbanked populations to access cross-border payment services. The increasing volume of international remittances from migrant workers to developing economies further drives demand. Payment providers that offer low-cost, efficient, and mobile-enabled solutions can capture significant market share in these regions. Additionally, partnerships with fintech firms and mobile network operators create opportunities to reach rural and remote customers. These trends position cross-border payment providers to expand operations, increase revenue, and facilitate financial access for millions of consumers globally.

In 2025, cross-border payment providers saw a 35% increase in transaction volumes from emerging markets, driven by national financial inclusion programs and rising demand for fast, low-cost remittance services among unbanked and underbanked populations.

Cross Border Payment Market Segment Highlights

-

By Transaction Type: Business to Business (B2B) led with 47.5% share, while Customer to Customer (C2C) is the fastest-growing segment with CAGR of 11.2%.

-

By Channel: Bank Transfer led with 42.8% share, while Card Payment is the fastest-growing segment with CAGR of 12.0%.

-

By Payment Type: Bank Transfers led with 44.3% share, while Digital Wallets is the fastest-growing segment with CAGR of 13.5%.

-

By End User: Large Enterprises led with 48.1% share, while SMEs are the fastest-growing segment with CAGR of 12.7%.

Cross Border Payment Market Segment Analysis

By Channel: Bank Transfer led, while Card Payment is the fastest-growing segment.

Bank transfers lead due to trust, security, and regulatory compliance, particularly for large-value corporate and institutional transactions. Established banking networks, SWIFT-enabled channels, and high reliability make bank transfers the preferred medium for cross-border payments. Corporates and institutions continue to use bank transfer for scheduled payments, vendor settlements, and payroll across regions. Their wide adoption, robust infrastructure, and regulatory alignment ensure dominance in transaction volume and revenue contribution.

Card payments are rapidly growing, fueled by online commerce, consumer convenience, and instant settlement features. Both debit and credit cards enable cross-border retail and e-commerce transactions with high adoption in emerging markets. Integration with digital wallets, mobile apps, and contactless payments enhances accessibility and user experience. Consumer preference for faster, low-cost, and flexible payment options accelerates the growth of card-based cross-border payments globally.

By Transaction Type: Business to Business (B2B) led, while Customer to Customer (C2C) is the fastest-growing segment.

B2B transactions dominate the cross-border payment market due to high transaction volumes, large monetary value transfers, and long-standing business relationships between international companies. Corporates prioritize secure, reliable, and cost-effective channels for supplier and partner payments. The segment benefits from well-established banking networks, dedicated business platforms, and recurring payment requirements, ensuring consistent revenue and market share. B2B remains the preferred method for institutional and enterprise-level payments globally.

C2C payments are the fastest-growing segment as peer-to-peer transfers gain traction through mobile apps, social platforms, and fintech solutions. The rise of global remittances, gig economy payments, and easy-to-use digital wallets drives rapid adoption. Consumers increasingly prefer instant, low-cost, and convenient peer-to-peer transactions, especially across borders. Technological integration, app-based notifications, and minimal bank intervention encourage growth, making C2C the fastest-expanding transaction type in the market.

By Payment Type: Bank Transfers led, while Digital Wallets is the fastest-growing segment.

Bank transfers dominate as the most widely used payment type for B2B and institutional cross-border transactions. They provide security, transparency, and traceability for large-value payments. Their widespread adoption by corporates, financial institutions, and government entities ensures consistent revenue contribution. Established banking protocols and SWIFT infrastructure reinforce trust, making bank transfers the backbone of global cross-border financial operations.

Digital wallets are the fastest-growing payment type due to the rise of mobile-first users, fintech solutions, and e-commerce expansion. They offer instant, convenient, and low-cost international transfers for individuals and SMEs. Integration with mobile apps, QR codes, and peer-to-peer functionality drives adoption, especially in Asia and emerging markets. Convenience, accessibility, and expanding merchant acceptance support rapid growth.

By End User: Large Enterprises led, while SMEs are the fastest-growing segment.

Large enterprises dominate cross-border payments as they handle high transaction volumes for global trade, supplier settlements, and payroll. They rely on secure, regulated, and efficient channels for consistent financial operations. Their recurring payment needs and scale of transactions ensure they contribute the largest revenue and market share in the sector.

SMEs are the fastest-growing end-user segment, driven by globalization, cross-border e-commerce, and trade expansion. Increasing adoption of fintech solutions, digital wallets, and mobile payment platforms enables SMEs to transact efficiently with minimal cost. Rising international trade participation, simplified compliance processes, and easy access to payment gateways accelerate the growth of SMEs in cross-border transactions.

Cross Border Payment Market Regional Analysis

North America Cross Border Payment Market Insights:

North America dominated the Cross Border Payment Market with a 45.00% share in 2025 due to its advanced financial infrastructure, high adoption of digital payment solutions, and strong presence of global banks and fintech companies. Widespread use of e-commerce, B2B trade, and supportive regulatory frameworks further reinforced the region’s market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Cross Border Payment Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 10.04% from 2026–2033, driven by rapid digital payment adoption, increasing international trade, and growing smartphone and internet penetration. Rising e-commerce activities, expanding cross-border remittance flows, and government initiatives promoting financial inclusion and digital banking accelerate the region’s rapid market growth.

Europe Cross Border Payment Market Insights

Europe held a significant share in the Cross Border Payment Market in 2025, supported by a mature banking and financial ecosystem, high adoption of digital payment solutions, and strong international trade activities. Advanced payment infrastructure, regulatory support for secure cross-border transactions, and the presence of leading fintech providers strengthened Europe’s market position.

Middle East & Africa and Latin America Cross Border Payment Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Cross Border Payment Market in 2025, driven by rising cross-border trade, increasing remittance flows, and growing adoption of digital payment solutions. Improving financial infrastructure, expanding e-commerce, and supportive government initiatives for financial inclusion further contributed to the regions’ emerging presence in the market.

Cross Border Payment Market Competitive Landscape:

Visa Inc.

Visa Inc. is a global leader in digital payments, facilitating secure and fast electronic transactions across more than 200 countries. It offers a broad range of payment solutions, including credit, debit, and prepaid cards, as well as cross-border payment services for businesses and consumers. Visa focuses on innovation, security, and efficiency, enabling seamless international money transfers. Its extensive network and partnerships with banks, fintechs, and merchants make it one of the most trusted brands in global payments.

-

May 2024, Visa expanded Visa Direct, its real-time push payments network, to support instant cross-border disbursements in 100+ currencies with transparent, upfront foreign exchange (FX) rates.

Mastercard Incorporated

Mastercard Incorporated is a multinational financial services company specializing in payment processing and cross-border transactions. It provides secure, efficient, and innovative solutions for consumers, businesses, and governments worldwide. Mastercard’s offerings include credit, debit, and prepaid card services, as well as digital payment technologies. By leveraging advanced analytics, fraud prevention tools, and global partnerships, Mastercard ensures fast, reliable, and transparent cross-border payment processing, strengthening its position as a key player in the international payment’s ecosystem.

-

January 2025, Mastercard launched Mastercard Move, a wallet-to-wallet cross-border payment service enabling consumers and small businesses to send money globally in seconds via mobile apps.

PayPal Holdings Inc.

PayPal Holdings Inc. is a leading global fintech company providing digital payment and money transfer services. It enables secure, convenient cross-border transactions for individuals, businesses, and e-commerce platforms. PayPal supports multiple currencies, mobile payments, and peer-to-peer transfers, making it a preferred solution for international commerce. The company emphasizes safety, user experience, and technological innovation, with services like PayPal Checkout, PayPal Payouts, and One Touch, allowing millions of users worldwide to send, receive, and manage payments efficiently.

-

October 2023, PayPal introduced Open Exchange, a real-time foreign exchange engine that gives users interbank wholesale rates with no hidden fees on cross-border transactions.

Cross Border Payment Market Key Players

Some of the Cross Border Payment Market Companies

-

Visa Inc.

-

Mastercard Incorporated

-

PayPal Holdings Inc.

-

Western Union Company

-

MoneyGram International Inc.

-

Wise Plc

-

Stripe Inc.

-

Adyen N.V.

-

Payoneer Global Inc.

-

Worldpay Inc.

-

FIS Global

-

Fiserv Inc.

-

JPMorgan Chase & Co.

-

Citigroup Inc.

-

HSBC Holdings Plc

-

SWIFT

-

Ripple Labs Inc.

-

Ant Group

-

Tencent Holdings Ltd.

-

Remitly Global Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 303.24 Billion |

| Market Size by 2033 | USD 552.72 Billion |

| CAGR | CAGR of 7.84% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Transaction Type (Business to Business (B2B), Customer to Business (C2B), Business to Customer (B2C), Customer to Customer (C2C)) • By Channel (Bank Transfer, Money Transfer Operator, Card Payment, Others) • By Payment Type (Bank Transfers, Card-Based Payments, Digital Wallets, Cryptocurrency Payments, Mobile Money) • By End User (Individuals / Migrant Workers, SMEs, Large Enterprises, E-commerce Platforms, Financial Institutions) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Visa Inc., Mastercard Incorporated, PayPal Holdings Inc., Western Union Company, MoneyGram International Inc., Wise Plc, Stripe Inc., Adyen N.V., Payoneer Global Inc., Worldpay Inc., FIS Global, Fiserv Inc., JPMorgan Chase & Co., Citigroup Inc., HSBC Holdings Plc, SWIFT, Ripple Labs Inc., Ant Group, Tencent Holdings Ltd., Remitly Global Inc. |