Crown Closure Market Report Scope And Overview:

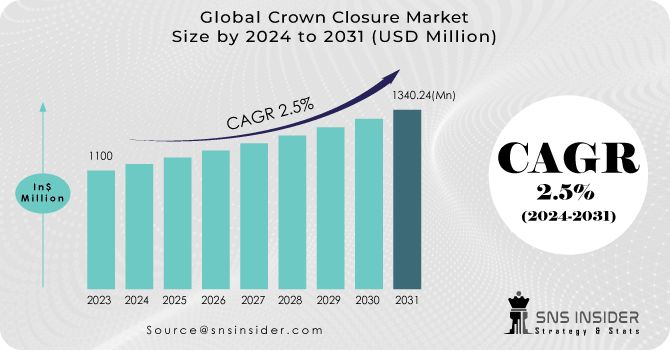

The Crown Closure Market size was USD 1100 million in 2023 and is expected to Reach USD 1340.24 million by 2031 and grow at a CAGR of 2.5% over the forecast period of 2024-2031.

Market Dynamics

Crown caps are vital for sealing various products, ensuring their integrity and adding a touch of visual appeal. They're used across numerous industries, from food and beverages to pharmaceuticals. The market is driven by factors like partnerships, product innovation, and a growing focus on sustainability. Manufacturers are increasingly using recycled materials and promoting recyclability to attract eco-conscious consumers. With rising demand for packaged goods and easy-to-open solutions, the future of crown closures looks bright.

Get More Information on Crown Closure Market - Request Sample Report

The crown closure market is expected to see modest growth despite facing some challenges. Anti-contamination closures are a recent innovation gaining traction in the market. Leading closure manufacturer BERICAP's recognition as a top innovator in Germany for their work on these closures in February 2022 highlights this growing trend. While the shift from glass bottles to PET bottles could hinder sales, factors like the demand for anti-contaminating closures and continued popularity of glass bottles in beverages are providing a boost.

KEY DRIVERS:

-

The demand for packaged foods is experiencing significant growth.

The booming middle class with more disposable income is driving a surge in packaged goods, and beverage packaging is a prime example. Glass bottles with crown closures remain popular for beer and other alcoholic beverages, further fueled by manufacturers using these caps as mini-billboards to entice impulse purchases. This, coupled with the growing demand for packaged beverages in general, and the versatility of crown closures across various industries, is propelling the market forward.

-

Healthier drink options are gaining popularity as people become more health-conscious, while rising disposable income in developing economies fuels this trend.

RESTRAIN:

-

Tighter environmental rules and restrictions on landfills are slowing the growth of the crown closure industry.

-

Growing worries about plastic's biodegradability and potential health risks are dampening the use of plastic crown closures, hindering market growth.

OPPORTUNITY:

-

The crown closure market is experiencing a surge in innovation, with a focus on creating user-friendly designs that enhance consumer experience.

The crown closure market is poised for promising growth thanks to a focus on innovation and user-friendly design. Key players are actively developing new and improved crown closure variants, creating lucrative opportunities. These advancements, coupled with the existing benefits of user-friendliness and recyclability, position crown closures for a bright future with expanding market reach.

-

Mergers and acquisitions in the crown closure industry are expected to rise, creating exciting growth opportunities for major players.

CHALLENGES:

-

Surging plastic waste has prompted stricter packaging rules for beverages and other products.

IMPACT OF RUSSIAN UKRAINE WAR

The war in Ukraine threatens to disrupt the crown closure market in several ways. Soaring energy prices, a consequence of the conflict, could increase production costs for crown closures across the entire manufacturing chain, from plastic resin to metal components. Furthermore, some Middle Eastern and North African countries, reliant on wheat imports from Ukraine and Russia, could face food insecurity, potentially impacting their disposable income and ultimately, their consumption of beverages is a key market for crown closures. Disruptions in global supply chains due to the war could also make it harder to obtain raw materials needed for crown closure production, leading to potential shortages and price hikes. Additionally, the war could lead to political instability in some regions, further dampening economic activity and consumer spending on non-essential goods like beverages.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown in a major developed economy could dampen demand for crown closures. Rising interest rates and potential government shutdowns could tighten consumer spending, particularly on non-essential goods like beverages, a key market for crown closures. Furthermore, supply chain disruptions stemming from geopolitical tensions could make it harder to obtain raw materials, potentially leading to shortages and price hikes for crown closures. While demographics in some developed nations remain more favorable, many countries are grappling with aging populations and slowing labor force growth. This could put a strain on disposable income and overall economic activity, further impacting consumer spending on beverages and consequently, the demand for crown closures. Ultimately, the health of the crown closure market hinges on whether developed economies can reignite productivity growth, a key factor in boosting living standards and consumer spending power.

KEY MARKET SEGMENTS

By Diameter

-

26 mm Crown Closures

-

29 mm Crown Closures

By Material

-

Aluminum

-

Steel

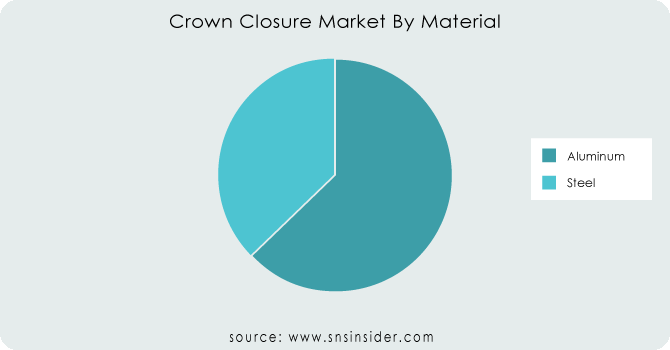

Aluminum leads the crown closures market, making up over 69.8% of the market. This dominance is likely to hold as aluminum offers both aesthetics and convenience, while keeping products fresh. Steel, however, is gaining ground due to its sustainability and durability, finding use in beverage bottles, food cans, and even pharmaceuticals.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By End-user Industry

-

Beer

-

Carbonated Soft Drinks

-

Food

-

Others

Beer dominates in the crown closure market with market share of 68%, driven by the booming beverage industry and changing consumer preferences for alcoholic drinks. Aluminum closures, with their visual appeal and convenience, are a popular choice for brewers, further solidifying beer's dominance. Even fancier closures are emerging, with brands using them to stand out and create a unique experience for beer drinkers.

REGIONAL ANALYSIS

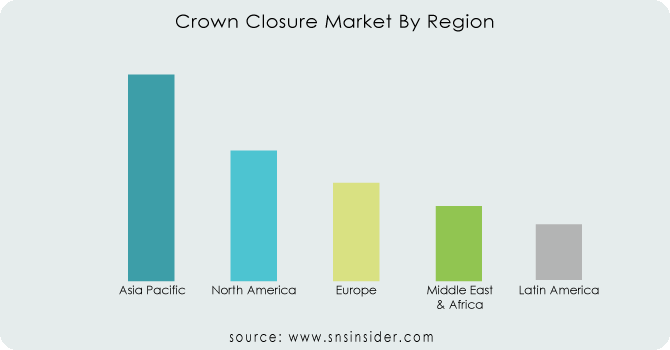

Asia-Pacific is leading the crown closure market, projected to grab 39% share. This dominance stems from two factors like massive populations in China and India, and their growing disposable incomes. These trends are fueling a thirst for beverages, particularly beer, which is increasingly popular among a youthful demographic. Beyond consumption, the rise of custom crown closures reflects a shift in consumer preferences. These unique caps allow breweries to stand out and create a memorable experience for their customers. As beer consumption soars across Asia-Pacific, regional manufacturers are not only satisfying domestic demand but also exporting to quench the thirst of international markets.

Fueled by rising consumption of beverages, both alcoholic and non-alcoholic, and the demand for innovative packaging solutions across various industries, all regions are expected to witness growth in the crown closures market. Latin America is projected to see a steady increase driven by beer and sparkling wine production. North America's market is bolstered by its established beverage consumption habits and the introduction of new drinks like CBD-infused beverages. The Middle East and Africa are poised for significant growth due to a surge in demand for packaged goods across multiple sectors, including food and beverage.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Major players in the Crown Closure Market are Crown Holdings Inc., Group Plc, Amcor plc, Berry Global Inc., Guala Closures S.p.a, Rexam PLC, Reynolds Group Ltd., Silgan Holdings Inc., BERICAP, AptarGroup Inc. and others.

Crown Holdings Inc-Company Financial Analysis

RECENT DEVELOPMENT

-

As of April 2021, Crown Holdings Inc., a major caps and closures company, sold its European Tinplate division to KPS Capital Partners. Crown retained a 20% stake in the business, which operates 44 facilities across 17 countries.

-

In June 2021, closure manufacturer BERICAP GmbH & Co. KG acquired German aluminum closure producer Mala Verschluss-Systeme. This move aims to develop innovative, sustainable closure solutions by combining plastic and aluminum.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1100 Million |

| Market Size by 2031 | US$ 1340.24 Million |

| CAGR | CAGR of 2.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Diameter (26 Mm Crown Closures, 29 Mm Crown Closures) • By Material (Aluminum, Steel) • By End-User Industry (Beer, Carbonated Soft Drinks, Food, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Crown Holdings Inc., Group Plc, Amcor plc, Berry Global Inc., Guala Closures S.p.a, Rexam PLC, Reynolds Group Ltd., Silgan Holdings Inc., BERICAP, AptarGroup Inc. |

| Key Drivers | • The demand for packaged foods is experiencing significant growth. • Healthier drink options are gaining popularity as people become more health-conscious, while rising disposable income in developing economies fuels this trend. |

| Opportunity | • The crown closure market is experiencing a surge in innovation, with a focus on creating user-friendly designs that enhance consumer experience. • Mergers and acquisitions in the crown closure industry are expected to rise, creating exciting growth opportunities for major players. |