Cup Sleeves Market Cup Sleeves Market Report Scope & Overview:

Get More Information on Cup Sleeves Market - Request Sample Report

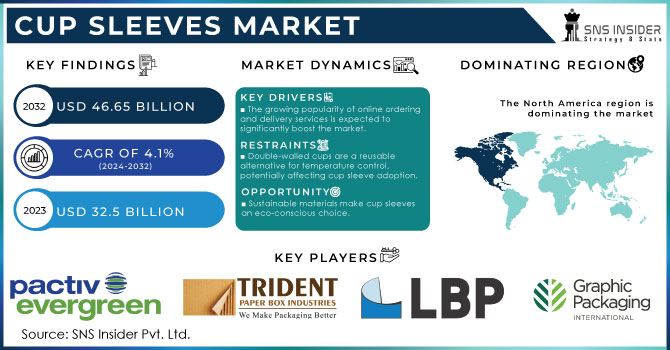

The Cup Sleeves Market Size was valued at USD 32.5 billion in 2023 and is projected to reach USD 46.65 billion by 2032 and grow at a CAGR of 4.1% over the forecast periods 2024 -2032.

Consumers are increasingly environmentally conscious, leading to a demand for eco-friendly packaging solutions. Sustainable cup sleeves made from recycled, biodegradable, or compostable materials are gaining traction due to their reduced environmental footprint. These materials help minimize landfill waste and promote a circular economy. Additionally, sustainable options often boast a lower carbon footprint compared to those made from conventional materials.

Beyond functionality, cup sleeves are evolving into powerful branding tools. Businesses are leveraging their design potential to showcase creativity, connect with customers, and enhance brand recognition. Cup sleeves provide a valuable space to display logos, colors, and unique designs. Eye-catching artwork reinforces brand identity and fosters brand association with the product. In a competitive market, innovative cup sleeve designs offer a unique opportunity for differentiation, leaving a lasting impression on customers.

MARKET DYNAMICS

KEY DRIVERS:

-

The growing popularity of online ordering and delivery services is expected to significantly boost the market.

The explosion of online food delivery services has transformed how we indulge in our favorite drinks and meals. Consumers, especially those craving coffee, tea, or other hot and cold beverages, are increasingly embracing takeaway and delivery options. This shift towards online convenience has significantly boosted the demand for reliable and efficient packaging solutions, propelling the cup sleeve market forward.

-

The flourishing coffee culture is expected to be a key driver of growth in the market.

RESTRAINTS:

-

Double-walled cups are a reusable alternative for temperature control, potentially affecting cup sleeve adoption.

Double-walled cups pose a significant challenge to cup sleeves. Manufacturers argue that these cups effectively maintain beverage temperature without needing a sleeve, offering additional insulation and features like embossing and spot colors. Furthermore, double-walled cups can be more cost-effective, considering they eliminate the need for a separate sleeve and potentially boast special temperature control properties. Their ready availability, reasonable pricing, and short lead times for smaller orders make them an attractive alternative.

-

Disposable cup sleeves, often made from hard-to-recycle materials, contribute to landfill waste.

OPPORTUNITY:

-

Sustainable materials make cup sleeves an eco-conscious choice.

Eco-friendly materials are a major reason behind the rise of sustainable cup sleeves. Consumers are increasingly opting for these sleeves made from recycled content, biodegradable options, or compostable materials, all of which boast a smaller environmental footprint. These eco-conscious choices help reduce overall waste and promote a circular economy.

-

Cup sleeves are now a canvas for innovative designs and artwork, transforming them into powerful branding tools.

CHALLENGES:

-

Balancing affordability is a major challenge for the cup sleeve market.

While cup sleeves offer branding and marketing opportunities, they add an extra cost to the packaging compared to using a sleeve-less cup. Manufacturers need to carefully consider material selection, production processes, and potential minimum order quantities to create cost-effective cup sleeve solutions. This is especially important to remain competitive with double-walled cups, which may offer a lower perceived cost per use for consumers.

-

Complying with varying regional regulations on materials and compostability can add complexity.

IMPACT OF RUSSIA-UKRAINE WAR

The war has led to the closure of packaging and production facilities in both Ukraine and Russia, impacting the supply of raw materials like PET (polyethylene terephthalate) used in some cup sleeves. Companies with strong financial ties to the region may face difficulties sourcing materials or finished cup sleeves. Sanctions and logistical challenges can further disrupt global supply chains, impacting the availability and potentially raising the cost of materials needed for cup sleeve production. The war has caused a surge in energy prices, a key input for many manufacturing processes. This translates to potentially higher production costs for cup sleeves. Companies may need to adjust production processes or source materials from alternative locations, potentially leading to increased expenses. Supply chain disruptions, rising production costs, and potential changes in consumer spending could hinder growth.

IMPACT OF ECONOMIC SLOWDOWN

During economic downturns, consumers tend to tighten their belts and prioritize essential goods over non-essential items like takeaway beverages and the cup sleeves that accompany them. This could lead to a decrease in demand for cup sleeves. Businesses facing declining sales and profits may implement cost-cutting measures that impact cup sleeve usage. Restaurants, cafes, and other food service establishments might see a decline in customer traffic during a recession. This can lead to a decrease in demand for cup sleeves as these businesses purchase fewer cups and, consequently, fewer cup sleeves. Overall, an economic slowdown can pose challenges for the cup sleeves market. Reduced consumer spending, business cutbacks, and lower demand from the food service industry can lead to a decline in sales. However, the severity of the impact and potential areas of resilience will depend on the specific nature and duration of the economic downturn.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Paper & Paperboard

-

Rubber

Paper & paperboard dominating in the cup sleeve market, fueled by a growing emphasis on hygiene, especially post-pandemic. Consumers increasingly prioritize sanitary food and beverage options, driving demand for paper takeout cups and their accompanying paper & paperboard sleeves.

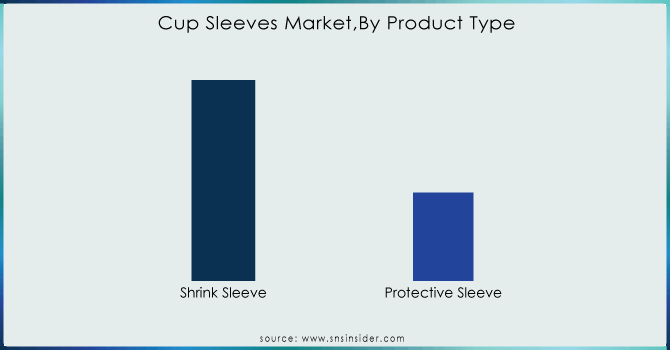

By Product Type

-

Shrink Sleeve

-

Protective Sleeve

Protective sleeves lead the cup sleeve market with share of 60%, offering an extra layer of defense for fresh fruit trays. During handling, shipping, and storage, these sleeves shield fruits from physical damage, dust, and pollutants. This not only reduces food waste and spoilage but also helps maintain the quality and freshness of fruits and vegetables. Additionally, protective sleeves act as a barrier, allowing retailers to extend the display and shelf life of their produce.

Get More Information on Cup Sleeves Market - Enquiry Now

By Capacity

-

200-235 Ml

-

380-420 Ml

-

480-540 Ml

-

530-570 Ml

-

620-680 Ml

The cup sleeve market caters to various cup sizes, ranging from 200ml to 680ml. However, the 380-420ml segment dominates, holding a 45% market share. This popularity can be attributed to the convenience and versatility of medium-sized cups. Manufacturers prioritize user experience by offering sturdy, leak-proof, and cut-resistant designs for these cups, allowing comfortable handling of beverages for extended periods. Additionally, the eco-friendly nature of paper cups, made from renewable resources, further fuels their popularity within this dominant size segment.

By Channel

-

Online

-

Offline

-

Retail

-

Direct

-

The cup sleeves market is currently dominated by offline channels, holding a 63% market share due to the prevalence of retail stores and direct sales. This trend is likely fueled by several factors associated with modern lifestyles such as increasing urbanization, continuous advancements in technology, and a significant change in how consumers shop. Online platforms are attracting buyers with features like scheduled or expedited deliveries, on-demand or subscription services, rising disposable income, and enticing discounts.

By End User

-

Food & Beverage Industry

-

Hotels & Restaurants

-

Cafes & Kiosks

-

Quick-Service Restaurants

-

Canteens

The food & beverage industry drives cup sleeve demand due to their temperature control benefits. Single-wall cups paired with cup sleeves offer a cost-effective and insulated solution for both hot and cold takeaway beverages, making them popular with retailers.

REGIONAL ANALYSIS

The North American market is poised to dominate the cup sleeve industry, fueled by a surging coffee culture. The proliferation of coffee shops, cafes, and quick-service restaurants catering to this daily habit has significantly increased demand for cup sleeves. Europe captures the second-largest market share in cup sleeves, driven by its thriving travel and hotel industries. The influx of tourists visiting European countries significantly boosts demand for takeaway coffee and beverages, consequently increasing the need for cup sleeves. Notably, Germany leads the region in cup sleeve market share, while the UK market exhibits the fastest growth.

The Asia-Pacific market is predicted to experience the fastest growth. This surge is driven by two key factors that are a growing environmental consciousness among consumers and stricter government regulations on single-use plastics. As awareness of the negative impact of disposable plastics increases, consumers are more receptive to sustainable options like cup sleeves. Additionally, stricter regulations on disposable cups in the region are creating a favorable market for cup sleeves. China, currently holding the largest market share in the Asia-Pacific region, and India, with the fastest growth, exemplify this trend.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some the major players in Cup Sleeves Market are Graphic Packaging International, LLC, BriteVision Media, LLC, Pactiv LLC, HotShot Coffee Sleeves USA, LBP Manufacturing LLC, Trident Paper Box Industries, Sabert Corporation, Starbucks Corporation, Printed Cup Company, Novolex And Others Players.

RECENT DEVELOPMENT

-

In 2023, packaging leader Mondi Group unveiled its innovative insulated cup sleeve, designed to extend the temperature control of both hot and cold beverages.

-

Sonoco, a global manufacturer of packaging solutions, announced its commitment to sustainability in 2023 with the launch of a new cup sleeve. The sleeve utilizes 100% recycled materials and is compostable in industrial facilities, offering an eco-conscious alternative for hot and cold beverages.

-

Sustainability leader BioPak joined forces with investment firm Five V Capital in December 2022. This strategic alliance, combining BioPak's eco-friendly packaging expertise with Five V Capital's over AUD 1.5 billion in assets, aims to fuel BioPak's growth and accelerate the shift towards a sustainable future and circular economy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 32.5 Bn |

| Market Size by 2032 | US$ 46.65 Bn |

| CAGR | CAGR of 4.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Paper & Paperboard, Rubber) • By Product Type (Shrink Sleeve, Protective Sleeve) • By Capacity (200-235 Ml, 380-420 Ml, 480-540 Ml, 530-570 Ml, 620-680 Ml) • By Channel [Online, Offline (Retail, Direct)] • By End User (Food & Beverage Industry, Hotels & Restaurants, Cafes & Kiosks, Quick-Service Restaurants, Canteens) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Graphic Packaging International, LLC, BriteVision Media, LLC, Pactiv LLC, HotShot Coffee Sleeves USA, LBP Manufacturing LLC, Trident Paper Box Industries, Sabert Corporation, Starbucks Corporation, Printed Cup Company, Novolex |

| Key Drivers | • The growing popularity of online ordering and delivery services is expected to significantly boost the market. • The flourishing coffee culture is expected to be a key driver of growth in the market. |

| Key Restraints | • Double-walled cups are a reusable alternative for temperature control, potentially affecting cup sleeve adoption. • Disposable cup sleeves, often made from hard-to-recycle materials, contribute to landfill waste. |