Cyclosporine Market Report Scope & Overview:

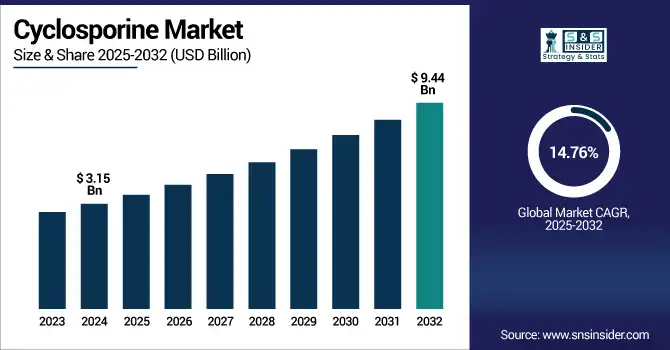

The cyclosporine market was valued at USD 3.15 billion in 2024 and is expected to reach USD 9.44 billion by 2032, growing at a CAGR of 14.76% over the forecast period of 2025-2032.

To Get more information on Cyclosporine market - Request Free Sample Report

The global cyclosporine market is increasing on the heels of the importance of the drug in the prevention of transplant rejection. Cyclosporine is critical for immunosuppression to prevent rejection of transplanted organs and constitutes the basis of post-transplant care. The number of transplantations continues to rise, with a global increase in organ failure cases and increasing access to transplants. This, in turn, will drive the demand for cyclosporine, as it means long-term graft survival and life-threatening rejection episodes can be avoided, leading to continued cyclosporine market growth.

For instance, in January 2025, Global organ transplants exceeded 160,500 procedures, a 7.2% increase from 2023, boosting demand for cyclosporine as a critical transplant rejection prophylaxis drug.

The U.S. cyclosporine market was valued at USD 1.00 billion in 2024 and is expected to reach USD 2.98 billion by 2032, growing at a CAGR of 14.67% over 2025-2032.

The U.S. is the leader in the cyclosporine market as the FDA requirements are stringent, requiring that the therapeutic drug must not compromise on its safety, efficacy, and quality, critical as well, for an immunosuppressive agent due to its narrow therapeutic index. Stringent registration criteria and therapeutic drug monitoring promote confidence in branded preparations with providers and patients.

For instance, in September 2024, the U.S. cyclosporine market reached USD 1.4 billion, with branded drugs holding a 65% share, driven by regulatory trust and clinical preference in transplant care.

Market Dynamics:

Drivers:

-

Rising Number of Organ Transplants is Driving the Cyclosporine Market Growth

The cyclosporine market is growing as more people receive organ transplants due to higher organ donation levels, aging populations, and chronic conditions, including kidney failure. Cyclosporine is essential in the prevention of transplant rejection, so it is essential post-operatively. Investments in health care and better surgical outcomes also contribute to use. These factors will lead to an increased cyclosporine market share in the industry. On account of the cost effectiveness, patients’ convenience, and the increasing demand for immunosuppressive treatment in the future.

For instance, in March 2025, Global organ transplants reached 160,500 in 2024, a 7.2% increase, driving higher cyclosporine market share due to its critical role in rejection prevention.

Restraints:

-

Side Effects, Including Nephrotoxicity and Hypertension, are a Significant Restraint on the Cyclosporine Market

Market growth for cyclosporine is limited by being association with severe side effects, including nephrotoxicity and hypertension. Renal failure caused by chronic use may necessitate dose reduction or stopping treatment due to these safety concerns. physicians are unlikely to prescribe it, especially for patients with pre-existing renal or cardiac complications, thereby limiting its broader use and cyclosporine market growth potential, although it is an efficacious therapy.

For instance, in March 2024, the FDA warned of increased renal toxicity risk in elderly cyclosporine users, prompting cautious use and reduced prescriptions, especially when combined with nephrotoxic drugs.

Segmentation Analysis:

By Indication

Transplant Rejection Prophylaxis is the dominant segment in the global cyclosporine market, with a 45.94% market share in 2024, as it is essential for inhibiting organ rejection for kidney, liver, and heart transplantation. The growing trend of Organ transplant across the globe and the proven immunosuppressive effect of cyclosporine creates a significant demand for the drug. This treatment segment alone accounts for a major share of the total cyclosporine market and strengthens the further dominance of the segment in hospitals and clinics.

The dry eye segment is emerging as the fastest growing with a CAGR of 16.10% in the global cyclosporine market, driven by prolonged screen time, ageing populations, and greater recognition of OSDs. As a result, the demand to get either over-the-counter or prescription topical formulas, including cyclosporine eye drops, on the market so that patients can receive long-lasting comfort and relief is increasing. Advancing ophthalmic drug delivery to further drive the cyclosporine market growth within the dry eye disease treatment sector.

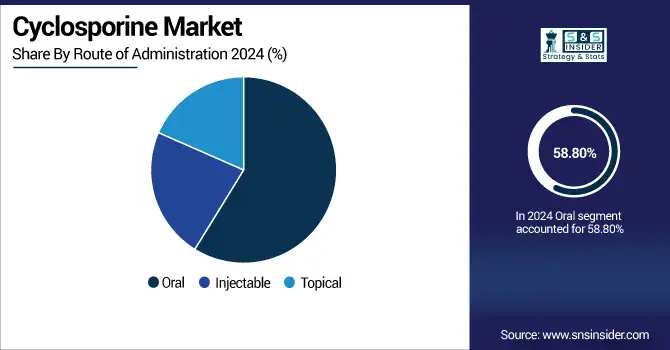

By Route of Administration

In 2024, the Oral dominated the cyclosporine industry with a 58.80% market share, owing to the most commonly prescribed pathway for chronic immunosuppression in transplant and autoimmune patients. Its simple administration, reliable absorption patterns, and general clinical availability have made it the standard of choice. This robust clinical use makes a major contribution here to the cyclosporine market share.

The Topical segment is the fastest-growing segment of the cyclosporine market analysis, which is being fueled by rising incidents of dry eye disease and regional inflammatory skin disorders. Advancements in ophthalmic dosage forms and patient demand for non-invasive therapy are the reasons behind this. Increasing awareness and over-the-counter availability are also driving cyclosporine market growth, specifically in ophthalmology and dermatology.

By End-Users

Hospitals Care held a dominant cyclosporine market share of 52.40% of the cyclosporine industry in 2024 driven by the major processing centers of transplantation and acute care. With the injectable and initial oral doses, they must be given in a hospital, and they have to be closely monitored. The importance of hospitals in after-transplant care means that they make a substantial contribution to the total cyclosporine market, justified by consultant input and drug regulation measures.

Homecare is emerging as the fastest-growing segment in the cyclosporine industry with the highest CAGR of 15.54%, propelled by the growing demand for easy and sustained treatment of chronic diseases, including dry eye and autoimmune disorders. Patients prefer home-administered and self-applied topical or oral cyclosporin treatment. This trend toward outpatient settings is boosting the demand for the cyclosporine market growth, on the back of comfort, low cost, and home-friendly treatment.

By Distribution Channel

Hospital Pharmacy is the largest segment for the cyclosporine industry, owing to the first point of distribution for transplant-related medication, including life-saving immunosuppressants, including cyclosporine. Hospitals also prescribe and monitor post-transplant treatment with pre-determined dosages. This centrally controlled use provides for consistent access and adherence, such that hospital pharmacies contribute substantially to the overall cyclosporine market share, primarily for acute and inpatient care.

The Online Pharmacy segment is witnessing the highest growth in the cyclosporine market, fuelled by growing digital health adoption, the attractiveness of home delivery, and the broadening of e-commerce access to prescription medicine. Patients who are controlling for a chronic condition, including dry eye, would rather purchase topical or oral cyclosporine online. This transition to digital channels is promoting the development of the cyclosporine market through increased availability, affordability, and patient adherence.

Regional Analysis:

In 2024, the North American region holds the largest market share of the cyclosporine Industry and dominates the market with a 38.60% market share, owing to its established health care infrastructure, large volume of transplants performed, and strict regulation from the FDA. Branded drugs are made available to the general population, health insurance is available, and therapeutic drug monitoring is promoted to ensure the reliability of treatments and patient compliance. The fact that some of the global pharmaceutical giants have an office here and ongoing clinical trials also contributes to the region’s competitiveness. All these factors together lead to North America having the highest cyclosporine market share, driven by the demand for transplant and autoimmune purposes.

Europe is the second major shareholder in the global cyclosporine market, supported by strong implementation programs of organ, advanced, and large-scale public health care systems, and high application of immunosuppressive therapy. EMEA regulatory assistance, coupled with the presence of branded and new generic forms of cyclosporine, and increasing prevalence of autoimmune diseases, will also drive demand. Moreover, innovative therapeutic monitoring and reimbursement policies fueled the cyclosporine market growth.

Asia Pacific emerges as the fastest-growing region with the highest CAGR of 15.42%, owing to more organs being lost, more organs being transplanted, and more people being able to access health care. Countries, including India and China, in investing in transplant infrastructure and public health programs, thus driving the market for immunosuppressive drugs, including cyclosporine. Adding to this, the increasing recognition of autoimmune diseases and dry eye disease, and the enhancement of diagnostic technologies are further driving demand for sustained treatments. The existence of cheaper common cyclosporine sources further facilitates access to treatment for a wider range of the population. These elements are collectively driving quick cyclosporine market growth in the Asia-Pacific region, and it is expected to be a main goal for development.

The Middle East & Africa have the least share of the cyclosporine market due to poor health facilities, a smaller number of transplant centers, and their focus on only transplant surgeries, also for limited knowledge of autoimmune and transplant-related diseases. Cost barriers, cost-effectiveness issues, and burdensome bureaucratic regulations are additional obstacles to cyclosporine therapy. Furthermore, embryonic supply chains create delays in drug availability. These integrated challenges lower treatment rates and market penetration, and continue to contribute to less rapid growth than more developed parts of the globe.

Cyclosporine market share is relatively low in Latin America due to growing organ transplant programs, along with an increase in the number of patients with autoimmune disease. Brazil and Mexico are the major regional drivers in the countries. Expansion is led by greater healthcare access and generic market penetration. There are challenges, however, including low reimbursement, uneven infrastructure, and irregularities in the supply chain. However, the region is witnessing the consistent growth prospects of the cyclosporine market on account of health reforms and better drug availability.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Cyclosporine Companies, including Novartis AG, AbbVie Inc., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Mylan, Apotex Inc., Zydus Lifesciences Ltd., Amneal Pharmaceuticals, Inc., Intas Pharmaceuticals Ltd., Sandoz, and other players.

Recent Developments:

-

In March 2024, Novartis announced continued investment in Neoral lifecycle management, with new post-marketing studies in Europe focusing on improving dosing strategies in liver transplant patients.

-

In February 2024, Viatris scaled production of generic cyclosporine modified capsules at its manufacturing unit in Hungary to meet rising EU transplant demand.

-

In April 2024, Amneal began U.S. distribution of its FDA-approved generic Restasis, positioning it in both retail and mail-order pharmacy channels.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD3.15 billion |

| Market Size by 2032 | USD 9.44 billion |

| CAGR | CAGR of 14.76% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Indication (Transplant Rejection Prophylaxis, Rheumatoid Arthritis, Psoriasis, Autoimmune Myasthenia Gravis, Dry Eye, Others) • By Route of Administration (Oral, Injectable, Topical) • By End-Users (Hospitals, Homecare, Speciality Centres, Others) •By Distribution Channel(Hospital Pharmacy, Online Pharmacy, Retail Pharmacy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Novartis AG, AbbVie Inc., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Mylan, Apotex Inc., Zydus Lifesciences Ltd., Amneal Pharmaceuticals, Inc., Intas Pharmaceuticals Ltd., Sandoz, and other players. |