AI in Medical Billing Market Analysis & Overview:

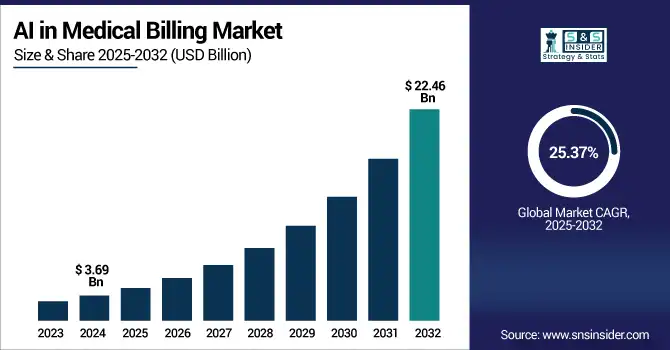

The AI in the Medical Billing Market size was valued at USD 3.69 billion in 2024 and is expected to reach USD 22.46 billion by 2032, expanding at a CAGR of 25.37% over the forecast period of 2025-2032.

To Get more information on AI in Medical Billing Market - Request Free Sample Report

The AI in Medical Billing Market is highly competitive as all healthcare providers are implementing the latest technology for their efficient operations and to mitigate errors in billing. AI automates processes such as processing of claims, coding, eligibility verification, and payment posting, resulting in improved productivity and reduced revenue leakage. Cloud deployment dominates the market, as it is scalable, allows remote access, and can be integrated with EHR systems. These are solutions to which both big hospitals and small practices with limited budgets can all get behind. Surge in telehealth and the need for data-backed decisions are among other factors to fuel the uptake of cloud. As demands increase for regulation, the role of AI to better comply and ease administration lays the ground for further market expansion.

According to research, more than 70% of small to mid-sized practices used cloud-based AI billing whereby healthcare facilities are enabled to reduce their administrative costs by 30% and automate 60% of complicated billing codes.

The U.S AI in the Medical Billing Market size reached USD 1.29 billion in 2024 and is expected to reach USD 7.41 billion in 2032 at a CAGR of 24.46% from 2025 to 2032.

Robust healthcare infrastructure, rapid adoption of AI-based technologies, and stringent regulatory requirements to perform correct billing practices are some of the factors that dominate the market in the U.S. quarter. As the pressure to lower administrative costs, avoid billing errors, and operate more efficiently grows, providers have flocked to AI-powered solutions. Deployment on the cloud is becoming popular due to its scalability and ease of integration with EHRs.

Additionally, increasing telehealth adoption and an emphasis on revenue cycle optimization are expected to drive the continued growth of artificial intelligence in medical billing in the U.S.

AI in the Medical Billing Market Dynamics

Drivers:

-

Increasing Adoption of AI-Powered Automation Tools Enhances Efficiency and Accuracy in Healthcare Revenue Cycle Management.

Incorporating AI-Powered Automation Tools for a report in healthcare revenue cycle management helps bring unparalleled levels of operational efficiency and accuracy. Automation helps healthcare providers reduce manual errors, accelerate reimbursement processes, and improve productivity by automating tasks like claim processing, coding, and billing. Examples of recent advancements include AI systems that can not only assess payer trends but also recommend optimum billing methods to ensure prompt payment and minimize claim denials. These advancements enable better administrative workflows, cost savings, and patient satisfaction. With the rapid increase in the need for optimal functioning of healthcare operations, the demand for AI-based automation tools is predicted to surge even further.

Restraints:

-

Rising Concerns Over Data Security and Patient Privacy Pose Challenges to AI Integration in Healthcare Billing Systems

While the efficiency gain from utilizing AI in healthcare billing systems is worthy of praise, it brings with it a lot of concerns related to data security and patient privacy. AI systems rely on patient information, which is quite sensitive, hence the target of many cyberattacks and data breaches. However, patient data protection compliance with regard to HIPAA and other regulations becomes a must. The risks associated with AI adoption are considerable, and healthcare providers must strive for exemplary standards of security and data integrity if these risks are to be mitigated. Such challenges require constant monitoring and enhancement of the cybersecurity infrastructure to protect patient data.

Opportunities:

-

Emerging AI Technologies Offer Opportunities to Enhance Revenue Optimization and Reduce Claim Denials in Healthcare Billing.

advancements in AI technologies provide opportunities to improve revenue optimization and reduce claim denials for healthcare billing. AI systems can analyze payer behaviors, determine which billing methods may work best, and ensure that claims are compliant with the correct requirements. With its ability to minimize errors like undercoding and ensure accurate claims, AI helps in maximizing reimbursements. Dynamic billing adjustments and real-time feedback mechanisms help enable more efficient revenue cycle management. As providers seek to enhance financial performance, demand for robust AI-driven billing optimization solutions is rising, shifting from reactive to proactive billing strategies.

Challenges:

-

High Implementation Costs and Integration Complexities Hinder the Adoption of AI Solutions in Healthcare Billing Processes.

AI solutions for healthcare billing processes are not used due to the high implementation costs and difficulty in integration. You build AI systems at scale by investing heavily in infrastructure, software, and people. It is also difficult to incorporate AI into current workflows, requiring drastic adjustments to traditional workflows. Healthcare providers may experience complications when it comes to training staff and managing the integration of AI tools into existing systems and workflows. Although it can save a lot of time and effort in making the bills and being accurate, these barriers can be a major reason that organizations do not come to terms with the AI technologies.

AI in the Medical Billing Market Segmentation Analysis

By Deployment Mode

In 2024 cloud-based segment will account for the maximum revenue share of 66.08% due to the growing demand for scalable, affordable, and accessible solutions. Additionally, telehealth services are on the rise, and cloud deployment allows for integration with EHRs while also supporting remote access. The top billing platforms, such as Athenahealth and Kareo, have created cloud-based platforms, embedded with AI, to improve coding accuracy and reduce claim denials. Increased demand due to the changing AI in medical billing market trends around real-time data access, improved collaboration, and regulatory compliance.

The on-premises segment is expected to grow at the fastest CAGR of 26.08% during the forecast period, as many large healthcare institutions prefer on-premises software due to rising demand for data control and better security. This model provides you with direct infrastructure control, which is crucial to address stringent regulations when handling patient data. Existing on-premise AI tools are being enhanced by companies, including AdvancedMD and eClinicalWorks, to assist in claims processing and billing analytics. Demand for bespoke solutions and cyber dangers exacerbate the growth. The on-premise AI deployments are increasingly becoming a part of the AI in healthcare ecosystem as demand for data sensitivity, in addition to infrastructure autonomy, grows.

By Application

The revenue cycle management segment led the market with a 49.37% share in 2024, due to the increasing importance of financial stability in healthcare. Key RCM tasks like patient registration, eligibility verification, claim coding, and denial management are enhanced through the use of AI. Both Change Healthcare and R1 RCM have introduced solutions that use AI to automate billing workflows and enhance collections. Adoption has been driven by the greater emphasis on lowering manual interventions and speeding up payment cycles.

The fraud detection segment is projected to grow at the highest growth rate of 30.85% as there are stricter regulations and a growing number of fraudulent claims. They can identify patterns and anomalies that signal billing fraud, upcoding, or duplicate claims, using AI algorithms. Optum and SAS are examples of companies that have implemented AI-based fraud analytics platforms that improve billing transparency and risk management. With healthcare organizations trying to shield their financial assets and bolster compliance, the investment in fraud detection capabilities is ramping up. As the need for fraud prevention to protect payer and provider interests increases, this segment is likely to witness significant AI in medical billing market growth.

By End-User

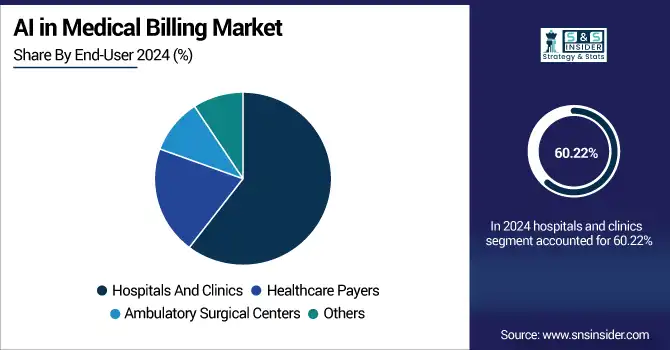

In 2024, hospitals and clinics held the largest AI in medical billing market share, at 60.22%, owing to high patient volumes and substantial administrative burden. And, it is AI that makes it possible for these institutions to automate the tasks, which take a lot of time in processing and complexity when it comes to billing, and makes a difference in terms of accuracy and other. Epic Systems and Cerner have added features for clinical and financial workflows in the hospital environment through integrated automated billing tools via AI. Hospitals will continue to maintain their position as the biggest contributor to the AI in medical billing industry as they increasingly use AI to manage claim submissions, denial tracking compliance.

Healthcare payers are expected to record the fastest growth rate of 26.84% over the forecast period, which is attributed to the rising trend of insurers striving to invest in AI for effective claims adjudication and fraud prevention. It also enables payers to detect billing errors, verify claim legitimacy, and streamline reimbursement systems aided by intelligent automation. Humana, UnitedHealth Group, and others are starting to use artificial intelligence to improve their operations and save money, as well. Driven by the shift to value-based care and predictive analytics, healthcare payers are increasingly influencing AI-driven medical billing innovations to enhance financial outcomes and improve patient satisfaction.

According to research, healthcare providers report a 50% reduction in billing cycle time after integrating AI for eligibility verification and payment posting.

AI in the Medical Billing Market Regional Outlook

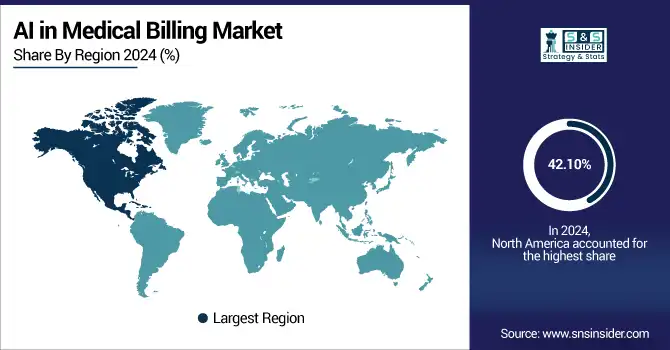

North America accounts for the largest revenue share of 42.10%, attributed to healthy healthcare infrastructure, early integration of AI technologies, and established stringent regulations. Greater investments in healthcare IT and the increased demand for revenue cycle management efficiency through automation and AI-focused solutions benefit the region.

This region is led by the U.S. with strong healthcare spending, high AI penetration, and an amateur digital health market facilitating the automation and optimization of medical billing.

Europe's AI in Medical Billing Market expansion is driven by growing digitization in the healthcare sector, government policies in favor of AI adoption, and the imperative to decrease administrative expenses. The region is also helped by growing telehealth services and stringent data privacy laws that compel secure AI billing systems.

Germany is the leading country in Europe, aided by a robust healthcare infrastructure, heavy investments in IT infrastructure, and aggressive adoption of AI technologies in medical billing and revenue management.

The Asia Pacific market is growing at a CAGR of 27.30% with growing healthcare infrastructure, rising expenditure on healthcare, and rising demand for streamlined billing solutions. The shifting adoption of cloud technologies and initiatives by governments to go digital in the healthcare sector is the driver.

China leads this market, driven by its high population base, mounting investments in healthcare, and the fast-paced adoption of AI and cloud-based billing systems in hospitals and clinics.

Development in the Middle East, Africa, and Latin America is powered by modernization in healthcare, growing digital adoption, and government support, with the UAE and Brazil in the lead due to sophisticated infrastructure and growing AI-based medical billing deployments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the AI in Medical Billing Market are Waystar, NextGen Healthcare, Inc., McKesson Corporation, Epic Systems Corporation, Athenahealth, Inc., eClinicalWorks LLC, GE Healthcare, Optum, Inc., RapidClaims.Ai, Nym Health, and others.

Key Developments

-

In April 2024, McKesson's Ontada collaborated with Microsoft to utilize Azure AI and OpenAI capabilities, processing more than 150 million oncology documents to improve clinical data extraction and insights.

-

In May 2025, Optum introduced Optum Integrity One, an artificial intelligence-enabled revenue cycle platform intended to eliminate administrative inefficiencies and improve clinical documentation and coding accuracy. A recent pilot program showed a 20% boost in coding productivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.69 Billion |

| Market Size by 2032 | USD 22.46 Billion |

| CAGR | CAGR of 25.37% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Deployment Mode (Cloud-Based, On-Premise) •By Application (Automated Billing and Documentation, Revenue Cycle Management, Claims Processing, Denial Management, Fraud Detection, Others) •By End-User (Hospitals and Clinics, Healthcare Payers, Ambulatory Surgical Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Waystar, NextGen Healthcare, Inc., McKesson Corporation, Epic Systems Corporation, Athenahealth, Inc., eClinicalWorks LLC, GE Healthcare, Optum, Inc., RapidClaims.Ai, Nym Health |