Anti-Fungal Treatment Market Report Scope & Overview:

Get More Information on Anti-Fungal Treatment Market - Request Sample Report

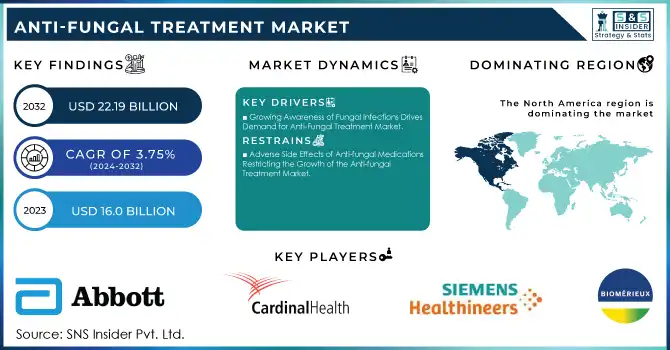

Anti-Fungal Treatment Market was valued at USD 16.83 billion in 2023 and is expected to reach USD 23.70 billion by 2032, growing at a CAGR of 3.88% from 2024-2032.

The Anti-Fungal Treatment Market has experienced steady growth in recent years, driven by the increasing prevalence of fungal infections worldwide. This growth is largely due to the rise in chronic conditions such as diabetes, cancer, and HIV/AIDS, which weaken the immune system and make individuals more susceptible to fungal diseases. In 2023, the American Cancer Society estimated that there would be approximately 1.96 million new cancer cases and 609,820 cancer-related deaths in the United States. Additionally, 39.9 million people globally were living with HIV, and 1.3 million new HIV infections occurred, as reported by Global HIV & AIDS. As a result, the demand for antifungal treatments has escalated, especially with the growing awareness about these infections. In addition, improved healthcare infrastructure and better diagnostics have helped in detecting fungal infections earlier, further propelling the market's expansion.

This increased demand for anti-fungal treatments is also being driven by the growing concern over antibiotic resistance, which is pushing the healthcare community to explore alternative solutions like antifungals. The emergence of drug-resistant fungal strains has made it imperative to develop new, more effective therapies. As a result, the adoption of advanced antifungal drugs, especially those with fewer side effects, has grown, benefiting both developed and emerging markets. Additionally, the expansion of antifungal product availability in retail settings, due to the rise of over-the-counter medications and self-medication, has led to a wider market reach.

The opportunities in the anti-fungal treatment market are substantial, fueled by ongoing research into novel therapies targeting resistant fungal strains. The focus on biotechnology and the development of more targeted antifungal agents presents significant potential for improved treatment outcomes. Furthermore, as healthcare access continues to improve in developing regions, there is an untapped market ready for growth. In addition, the shift toward personalized medicine and combination therapies offers the prospect of more effective and tailored treatments, positioning the anti-fungal treatment market for continued expansion in the years ahead.

Anti-Fungal Treatment Market Dynamics

DRIVERS

-

Growing Awareness of Fungal Infections Drives Demand for Anti-Fungal Treatment Market

The growing recognition of fungal infections, including their symptoms and risks, has led to a rise in people seeking treatment. With better education and information available through public health campaigns, more individuals are becoming aware of the potential complications of untreated fungal infections such as athlete's foot, ringworm, and candidiasis. This is particularly important for at-risk populations, including the elderly, those with diabetes, and individuals with weakened immune systems. As these groups become more informed, they are more likely to seek medical attention and request antifungal treatments. Additionally, increased awareness helps reduce the stigma around these infections, encouraging more individuals to pursue effective therapies. The heightened focus on fungal health is, therefore, contributing to a growing demand for antifungal medications and treatment options.

-

Rising Use of Immunosuppressive Drugs Expands Demand for Anti-Fungal Treatment Market

The increasing use of immunosuppressive drugs to treat autoimmune diseases, manage organ transplants, and support cancer therapies significantly heightens the risk of fungal infections. Immunosuppressive drugs weaken the body's immune system, making patients more susceptible to fungal pathogens. As more individuals undergo treatments that compromise their immune function, the prevalence of fungal infections rises, creating a greater need for effective antifungal therapies. Patients receiving organ transplants, chemotherapy, or long-term treatment for autoimmune disorders are especially vulnerable to infections like candidiasis, aspergillosis, and cryptococcosis. This growing risk among immunocompromised individuals drives the demand for anti-fungal drugs, as healthcare providers seek to prevent and treat infections in this high-risk population. The trend is expected to continue as the use of immunosuppressive therapies expands.

RESTRAINTS

-

Adverse Side Effects of Anti-fungal Medications Restricting the Growth of the Anti-fungal Treatment Market

Some antifungal medications, especially systemic treatments, are associated with significant side effects that can discourage their widespread use. Common adverse reactions include liver toxicity, gastrointestinal disturbances, and potential drug interactions, particularly in patients taking multiple medications for other conditions. These side effects can lead to treatment discontinuation, reduced patient compliance, and the need for additional monitoring, which may deter healthcare providers from prescribing certain antifungal therapies. The safety concerns surrounding these drugs limit their adoption, especially for long-term use or in vulnerable populations like the elderly or those with pre-existing liver conditions. As a result, the adverse side effects of antifungal medications represent a significant barrier to market growth, influencing both patient choice and healthcare provider recommendations.

-

Preference for Alternative and Complementary Therapies Limits Growth in the Anti-Fungal Treatment Market

The growing adoption of alternative and complementary therapies, such as herbal remedies and homeopathic treatments, is restraining the expansion of the pharmaceutical anti-fungal treatment market. In regions where these non-traditional therapies are preferred, patients often choose them over conventional antifungal medications, believing they offer safer or more natural options. While some alternative treatments may possess antifungal properties, they lack the rigorous clinical validation that pharmaceutical treatments undergo. This trend, especially in regions with a strong cultural preference for alternative medicine, presents a significant challenge to the growth and widespread adoption of the anti-fungal treatment market.

Anti-Fungal Treatment Market Segment Analysis

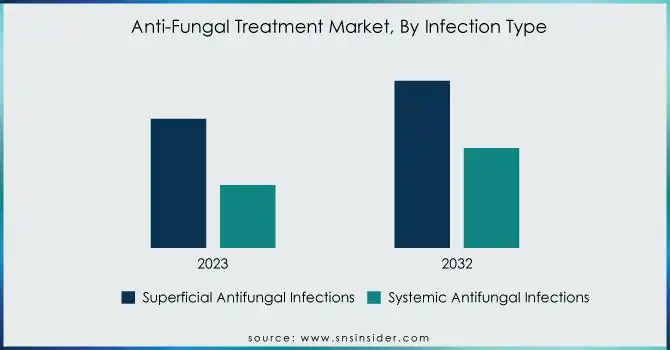

BY INFECTION TYPE

The Superficial Antifungal Infections segment dominated the anti-fungal treatment market with the highest revenue share of around 67% in 2023. This is primarily due to the high prevalence of common superficial infections, such as athlete’s foot and ringworm, which are easily treatable with over-the-counter antifungal medications. The low cost and widespread availability of treatments have also contributed to the segment's dominance.

The Systemic Antifungal Infections segment is expected to grow at the fastest CAGR of 5.33% from 2024 to 2032. This growth is driven by the increasing number of immunocompromised patients, particularly those undergoing chemotherapy or organ transplants. As awareness of systemic fungal infections rises, the demand for advanced, prescription-based treatments will continue to propel this segment's rapid expansion.

BY END USER

The Dermatology Clinics segment dominated the anti-fungal treatment market with about 50% of the revenue share in 2023. This is due to the high incidence of common fungal skin conditions like athlete’s foot and ringworm, which are primarily treated in dermatology clinics. These specialized clinics offer effective and targeted treatments, making them the go-to option for patients with superficial fungal infections.

The Hospitals & Clinics segment is expected to grow at the fastest CAGR of 5.15% from 2024 to 2032. This growth is driven by the rising number of immunocompromised patients and the increasing complexity of systemic fungal infections. Hospitals and clinics provide advanced diagnostic tools and specialized treatments, making them the preferred choice for managing more severe and invasive fungal infections.

BY DOSAGE FORM

The Oral Drugs segment dominated the anti-fungal treatment market with the highest revenue share of about 55% in 2023. This dominance is driven by the widespread use of oral antifungal medications, which are highly effective in treating both superficial and systemic infections. Oral drugs offer convenience and proven efficacy, making them the preferred choice for patients and healthcare providers in managing a wide range of fungal conditions.

The Ointments segment is expected to grow at the fastest CAGR of 4.92% from 2024 to 2032. This growth is attributed to the increasing preference for topical treatments, especially for mild and localized fungal infections. Ointments offer a non-invasive, easy-to-apply option with fewer systemic side effects, making them particularly appealing for patients with conditions like athlete’s foot, ringworm, and fungal skin infections.

BY DRUG CLASS

The Azoles segment dominated the anti-fungal treatment market with the highest revenue share of about 50% in 2023. This dominance is due to the broad spectrum of activity and effectiveness of azoles in treating a wide range of fungal infections, including dermatophytes, yeasts, and systemic infections. Their well-established safety profile, ease of use, and availability in both oral and topical formulations have made them the go-to choice for healthcare providers worldwide.

The Allylamines segment is expected to grow at the fastest CAGR of 6.64% from 2024 to 2032. This growth is driven by the increasing demand for effective treatments for dermatophyte infections, such as athlete's foot and ringworm. Allylamines, known for their potent antifungal action and fewer side effects compared to other classes, are gaining preference among both patients and healthcare professionals, positioning this segment for rapid expansion in the coming years.

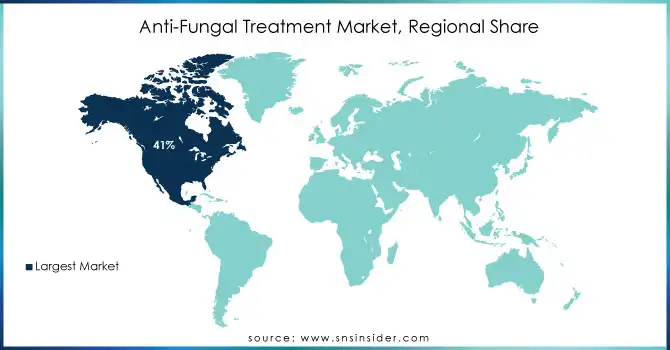

Anti-Fungal Treatment Market Regional Outlook

North America dominated the anti-fungal treatment market with the highest revenue share of approximately 41% in 2023. This dominance is driven by the region's advanced healthcare infrastructure, high awareness of fungal infections, and strong presence of leading pharmaceutical companies. The availability of a wide range of antifungal treatments, along with significant research and development investments, has contributed to North America's leading position in the market.

On the other hand, Asia Pacific is expected to grow at the fastest CAGR of 6.02% from 2024 to 2032. This rapid growth can be attributed to the region's expanding healthcare access, rising fungal infection awareness, and increasing prevalence of conditions like diabetes, which make populations more susceptible to fungal infections. Additionally, the growing middle-class population and improving healthcare systems in emerging markets like India and China are fueling the demand for antifungal treatments in the region.

Need any customization research on Anti-Fungal Treatment Market - Enquiry Now

LATEST NEWS -

-

In 2023, Sandoz announced the acquisition of global rights for Mycamine (micafungin sodium) from Astellas. This acquisition strengthens Sandoz’s hospital portfolio and anti-infectives offerings, supporting their global efforts to combat antimicrobial resistance (AMR) with targeted therapies.

-

On March 30, 2023, GSK and SCYNEXIS announced an exclusive agreement to commercialize Brexafemme (ibrexafungerp), a first-in-class antifungal for vulvovaginal candidiasis (VVC) and recurrent VVC.

KEY PLAYERS

-

Abbott - (Abbott Fungistat, Cresemba)

-

bioMérieux SA - (VITEK 2, BioFire FilmArray)

-

Cardinal Health - (Nystatin, Lamisil)

-

F. Hoffmann-La Roche Ltd - (Diflucan, MycoGuard)

-

BD - (BD BBL CHROMagar, BD Phoenix System)

-

Hologic - (Panther Fusion, Aptima)

-

Siemens Medical Solutions - (Atellica Solution, Immulite)

-

Quest Diagnostics - (T2Candida Panel, PCR Fungal Tests)

-

Koninklijke Philips N.V. - (Philips Luminous, Philips Imaging Solutions)

-

Pfizer - (Diflucan, Nizoral)

-

Johnson & Johnson - (Lotrimin, Lamisil)

-

Bayer AG - (Canesten, Daktarin)

-

Novartis AG - (Exelderm, Lotrimin)

-

Merck KGaA - (Cancidas, Vormulon)

-

Gilead Sciences - (AmBisome, Vistide)

-

Cipla - (Fluconazole, Ketoconazole)

-

Sanofi S.A. - (Diflucan, Fluconazole)

-

GlaxoSmithKline - (Lamprene, Betadine)

-

Mylan N.V. - (Fluconazole, Ketoconazole)

-

Teva Pharmaceutical Industries - (Fluconazole, Ketoconazole)

-

Sun Pharmaceutical Industries - (Terbinafine, Fluconazole)

-

Apotex - (Fluconazole, Nystatin)

-

Amneal Pharmaceuticals - (Nystatin, Ketoconazole)

-

Zydus Cadila - (Miconazole, Fluconazole)

-

Aurobindo Pharma - (Clotrimazole, Fluconazole)

-

Sandoz (Mycamine, Fungizone)

-

GSK (Brexafemme, Tinactin)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.83 Billion |

| Market Size by 2032 | USD 23.70 Billion |

| CAGR | CAGR of 3.88% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Drug Class (Azoles, Polyenes, Allylamines, Echinocandins) • By End User (Hospitals & Clinics, Dermatology Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, bioMérieux SA, Cardinal Health, F. Hoffmann-La Roche Ltd, BD, General Electric, Hologic, Siemens Medical Solutions, Quest Diagnostics, Koninklijke Philips N.V., Pfizer, Johnson & Johnson, Bayer AG, Novartis AG, Merck KGaA, Gilead Sciences, Cipla, Sanofi S.A., GlaxoSmithKline, Mylan N.V., Teva Pharmaceutical Industries, Sun Pharmaceutical Industries, Apotex, Amneal Pharmaceuticals, Zydus Cadila, Aurobindo Pharma. |

| Key Drivers | • Growing Awareness of Fungal Infections Drives Demand for Antifungal Treatments • Rising Use of Immunosuppressive Drugs Expands Demand for Antifungal Treatments |

| Restraints |

• Adverse Side Effects of Antifungal Medications Restricting the Growth of the Antifungal Treatment Market • Growing Popularity of Alternative and Complementary Treatments Challenges Pharmaceutical Antifungal Demand |