Data Center As A Service Market Report Scope & Overview:

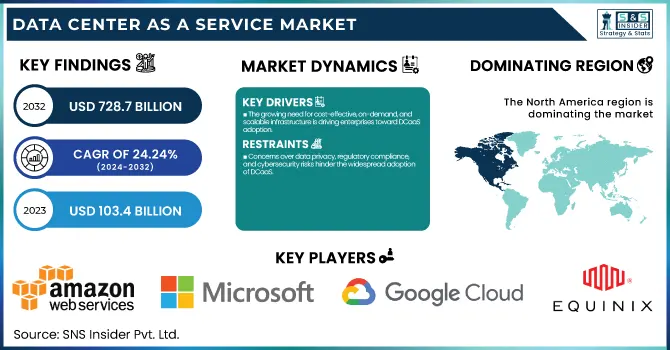

The Data Center As A Service Market was valued at USD 103.4 Billion in 2023 and is expected to reach USD 728.7 Billion by 2032, growing at a CAGR of 24.24% from 2024-2032.

To Get more information on Data Center As A Service Market - Request Free Sample Report

This report consists of insights into the Data Center as a Service Market, covering key trends and developments. The adoption rates of DCaaS solutions by industry highlight the increasing demand across sectors like BFSI, healthcare, and IT, driven by scalability and cost efficiency. Data center capacity expansion by region showcases significant investments in North America and Asia-Pacific to meet growing cloud and enterprise demands. DCaaS cost savings and efficiency improvements emphasize reduced capital expenditure and optimized resource utilization. Lastly, enterprise workload migration to DCaaS reflects the shift from traditional on-premise infrastructure to cloud-based solutions, enhancing agility and business continuity.

Data Center As A Service Market Dynamics

Driver

-

The growing need for cost-effective, on-demand, and scalable infrastructure is driving enterprises toward DCaaS adoption.

Gain insights on the high demand for on-demand and scalable data center infrastructure which has been one of the important drivers of the Data Center as a Service Market. Organizations are migrating away from traditional on-premise data centers to cloud-based DCaaS solutions, enabling greater operational flexibility, reduced Capital Expenditure, and better disaster recovery capabilities. DCaaS is seeing rapid adoption due to factors such as the digital transformation surge, the adoption of applications based on AI, and the continued growth of cloud workloads. Further, small and medium enterprises are also adopting DCaaS as the model provides enterprise-grade IT infrastructure without large capital investment, thus promoting market expansion. Thanks to its essence of rapid scaling resources based on business requirements, DCaaS is the future for modern enterprises.

Restraint

-

Concerns over data privacy, regulatory compliance, and cybersecurity risks hinder the widespread adoption of DCaaS.

Although it provides benefits, security, and compliance continue to be the primary reason DCaaS is in such an early stage of adoption. Corporates dealing with sensitive data like BFSI, healthcare, and government are concerned about data breaches unauthorized access, and compliances. Security frameworks to ensure data sovereignty as well as meeting industry standards for compliance such as the General Data Protection Regulation and Health Insurance Portability and Accountability Act have all become paramount, along with the threats posed by hacking and cybercrime. The dependence on third-party data center providers is also a concern in the way of data privacy and control. Those considerations hinder organizations from completely switching to DCaaS so hybrid models have emerged, keeping important workloads on-premise while using the cloud mainland.

Opportunity

-

The rise of edge computing and AI-powered optimization is creating new growth opportunities for DCaaS providers.

The DCaaS market has a massive opportunity in the expansion of edge data centers and the integrations of AI-driven infrastructure. As industries such as IoT, 5G, and AVs drive the need for low-latency computing, edge DCaaS solutions also facilitate the faster processing of data closer to end-users. Companies have improved overall efficiency with AI-driven infrastructure which increases resource optimization, predictive maintenance, and automated scaling. Furthermore, hyperscale cloud providers and colocation service providers are also targeting edge computing to support high-performance workloads. The combination of industry-specific Artificial Intelligence with DCaaS solutions is likely to innovation and faster adoption for the market in different domains.

Challenge

-

Migrating legacy systems to DCaaS presents challenges in compatibility, downtime risks, and integration with existing IT infrastructure.

Moving to a DCaaS model has its challenges in terms of the complexity of migration and integration with current IT systems. Those enterprises with aging infrastructure often find it impossible to migrate workloads into cloud-based data centers smoothly without disrupting operations. They must overcome the compatibility issues, network latency, and downtime threats that typically accompany migration by designing comprehensive migration tactics. Moreover, hybrid or multi-cloud adoption and integration with DCaaS also require considerable know-how in the area of orchestration, protection, and compliance management. Since a significant amount of organizations require customized solutions and support services to facilitate a successful move, DCaaS vendor selection and underlying technical know-how are some of the most critical aspects to ensure the successful adoption of DCaaS.

Data Center As A Service Market Segmentation Analysis

By Infrastructure

In 2023, the servers segment dominated the market and held the largest revenue share of 58%. However, at the same time, new, transforming solutions based on cutting-edge digital technologies like artificial intelligence, the Internet of things, and machine learning are being adopted at a feverish pace across academic institutions, defense agencies, and government agencies, everyone driving demand for advanced, hyper-converged IT infrastructure including high-performance computing servers to run computer-intensive, software-defined solutions and processing huge amounts of data.

Natural gas storage is expected to register the fastest CAGR during the forecast period. At the same time, worldwide growth in the volumes of computing data is fueling the need to embed storage systems that guarantee rapid data access, which, too, adds to the market for MAMR technology. Thus, many nations are moving to construct virtual data storage to decrease their dependence on foreign institutions and to increase the certainty of data security.

By Enterprise Size

In 2023, the large enterprises segment dominated the market and accounted for 59% of revenue share. Government regulatory favor due to the growing need to establish data centers and huge investments by the giant company to host private data centers are likely to provide a major opportunity for the segment's growth in the data ceneter-as-a-service market.

The SME segment is anticipated to register the fastest CAGR during the forecast period. Segment growth is driven by the increasing adoption of digital tools and cloud-based applications among SMEs. With the increasing adoption of Software-as-a-Service platforms, e-commerce solutions, and customer relationship management systems by businesses, the data processing and storage requirements are on the rise.

By Vertical

In 2023, the retail segment dominated the market and accounted for a significant revenue share. With a variety of data processing and latency requirements, the IT & telecommunications industry is being rapidly transformed according to what the latest technologies, including IoT, 5G, virtual reality, and augmented reality, can do. Telcos, in particular, are meeting their infrastructure requirements by building private cloud data centers for core as well as non-core networking operations on their own.

This is a major factor propelling segment growth due to the innovative digitalization of healthcare operations and the demand for risk & security management solutions to outspread solid IT infrastructure. As the volume of electronic health records, imaging data, and other patient information grows, healthcare providers and organizations from hospitals, clinics, and research institutions are quickly adopting DCaaS solutions.

Regional Landscape

In 2024, North America dominated the market and accounted for 37% of revenue share. The North American DCaaS market is growing due to the increasing demand for edge computing. As the number of Internet of Things devices increases dramatically and real-time data processing becomes essential in many scenarios, edge computing is emerging as an integral IT strategy investment. More and more, the providers of data center-as-a-service are building edge capabilities into their platforms so that businesses can minimize latency by processing data closer to the source.

The Asia Pacific data center as-a-service market is anticipated to register the fastest CAGR over the forecast period. Based on the large amount of data produced by huge telecom networks, a large customer base for electronic commerce, and many solution providers with high flows of traffic through servers, the demand for data center development and infrastructure is increasing in Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Amazon Web Services (AWS) – AWS Outposts

-

Microsoft – Azure Stack

-

Google Cloud – Google Anthos

-

IBM – IBM Cloud Satellite

-

Equinix – Equinix Metal

-

Digital Realty – PlatformDIGITAL

-

Alibaba Cloud – Alibaba Cloud Elastic Compute Service

-

Oracle – Oracle Cloud@Customer

-

Hewlett Packard Enterprise (HPE) – HPE GreenLake

-

Dell Technologies – Dell APEX Data Storage Services

-

VMware – VMware Cloud on AWS

-

Cyxtera – Cyxtera Digital Exchange

-

Tencent Cloud – Tencent Cloud TStack

-

Fujitsu – Fujitsu Hybrid IT

-

NTT Communications – NTT Global Data Centers

Recent Developments

-

January 2024: Flexential launched Flexential Fabric, a next-generation system integrated with FlexAnywhere, designed to provide advanced, software-defined interconnection services.

-

March 2024: YTL Power announced the formation of YTL AI Cloud, collaborating with NVIDIA to build Malaysia's fastest supercomputers using NVIDIA AI chips, marking a significant investment in AI infrastructure.

-

May 2024: CoreWeave raised $1.1 billion in funding led by Coatue Management, valuing the company at $19 billion, to expand its cloud-based GPU infrastructure for AI developers.

-

October 2024: CoreWeave secured a $650 million credit facility from top Wall Street banks, including Goldman Sachs, JPMorgan Chase, and Morgan Stanley, to further its AI cloud-computing expansion.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 103.4 Billion |

| Market Size by 2032 | US$ 728.7 Billion |

| CAGR | CAGR of 24.24 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Infrastructure (Servers, Storage, Networking) • By Enterprise Size (Large Enterprises, SMEs) • By Verticals (Retail, BFSI, IT & Telecom, Healthcare, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services (AWS), Microsoft, Google Cloud, IBM, Equinix, Digital Realty, Alibaba Cloud, Oracle, Hewlett Packard Enterprise (HPE), Dell Technologies, VMware, Cyxtera, Tencent Cloud, Fujitsu, NTT Communications |