Dehumidifiers Market Report Scope & Overview:

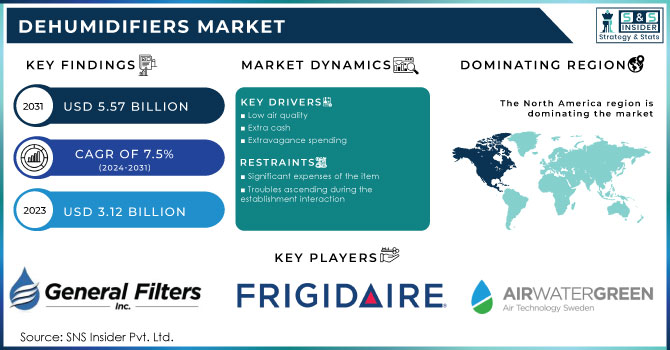

The Dehumidifier Market Size was estimated at USD 3.13 billion in 2023 and is expected to arrive at USD 5.37 billion by 2032 with a growing CAGR of 6.18% over the forecast period 2024-2032.

To get more information on Dehumidifiers Market - Request Free Sample Report

This report provides an in-depth analysis of dehumidifier market trends across regions, offering insights into production output, market penetration, and unit sales/revenue trends. It highlights technological advancements in dehumidifier systems, examining regional differences in innovation adoption. The export/import data sheds light on trade dynamics. Additionally, the report explores the growing demand for smart, energy-efficient dehumidifiers and the increasing preference for compact, portable models, offering a comprehensive view of market evolution beyond traditional metrics.

MARKET DYNAMICS

Drivers

-

Rising awareness of indoor air quality, driven by health concerns, is increasing demand for dehumidifiers to reduce moisture, mold, and allergens in indoor spaces.

Rising awareness of indoor air quality (IAQ) has significantly contributed to the growth of the dehumidifier market. With the increase in health awareness amongst consumers, there is evident need to build healthy surroundings. Moisture in the indoor environment creates the perfect condition for mold, mildew and dust mites to grow, which are well known indoor allergens that can cause respiratory problems, especially in asthmatics or people with allergies. By keeping optimal moisture content in the air, dehumidifiers reduce these health risks by controlling humidity levels. The rising knowledge of the hazards of bad IAQ and the growing consciousness regarding indoor air pollutants has further propelled the demand for dehumidifiers. Improved technology, including smart and energy-efficient models, has continued to drive the trend in recent years, attracting a more diverse range of buyers. Urbanization, especially in humid areas, is anticipated to further increase in the market growth and magnify the demand for dehumidifiers eventually leading to further economic growth.

Restraint

-

The high initial cost of advanced and energy-efficient dehumidifiers may limit their adoption, particularly in a price-sensitive market.

The high initial cost of dehumidifiers, particularly for advanced and energy-efficient models, presents a significant barrier to their widespread adoption, especially in price-sensitive markets. These models do provide for long-term savings due to their efficiency and performance, but the upfront investment can be a tough pill for consumers to swallow, especially in developing regions, or among budget conscious buyers. Because the high fee may not outweigh the would-be viewed benefits for many, particularly not full appreciating the longer-term benefits of just energy savings and probably quality of internal surroundings. To make this problem worse, competitors that are cheaper and don't have the same efficiency or state-of-the-art specifications are available. Consequently, it becomes difficult for manufacturers to make a case for consumers to buy into the higher-end models and dehumidifiers are not penetrating deep enough into the premium market. Hence performance-cost balance is important to expand the market in different economic brackets.

Opportunities

-

Dehumidifiers are crucial in industries like pharmaceuticals, food processing, and electronics to maintain optimal humidity levels, ensuring product quality, safety, and preventing damage.

In industrial applications, dehumidifiers are essential for maintaining optimal humidity levels to ensure product quality, safety, and operational efficiency. In the pharmaceutical industry, controlling humidity levels is also vital since fluctuating humidity may cause damage to medications that are sensitive to moisture or require precise manufacturing processes. Similarly, low humidity in food processing inhibits microbial growth, mold and spoilage, improving shelf life and safety. Excess moisture can cause damage to sensitive components in an electronics factory during manufacturing, leading to defects or failures. Dehumidifiers are employed to maintain exact environments that protect goods and devices from moisture-related problems. With industries giving utmost importance to quality control and strict compliance with regulations, need for industrial dehumidifiers is increasing, so much so that they have become an indispensable tool for several industries. Being able to control humidity improves products quality but also minimizes expensive production mistakes and environmental accidents.

Challenges

-

Energy consumption concerns, despite the availability of efficient models, may hinder the widespread adoption of dehumidifiers due to perceived high operating cost.

Energy consumption concerns remain a significant barrier to the widespread adoption of dehumidifiers, even though energy-efficient models are increasingly available. For many consumers, the operation costs of running dehumidifiers is a concern especially in the humid regions where these appliances are frequently in use. Especially dehumidifiers older models, use lots of electricity that can be high on your bill. Use of energy will always be a part of the essential features in our lives no matter how lucky we all are to have more energy-efficient options available, some consumers still do not spend time or invest in energy-efficient options based on the long-term cost of efficiency options or the kind of awareness they have about the energy-saving features provided by the solutions. Such an issue is more likely to arise in more price-indexed markets or among consumers who are being aware of the environment and trying to lessen the carbon footprint. Therefore, manufacturers must keep on their effort to educate the consumer on energy-efficient models and possible long-term savings while further innovating low-energy technologies to assure this issue will not inhibit broader market penetration.

SEGMENTATION ANALYSIS

By Technology

The Desiccant dehumidifiers segment dominated with the market share of over 56% in 2023, as these dehumidifiers are highly efficient and perform operation in various conditions including low temperature as well. Desiccant dehumidifiers, on the other hand, are not using cooling coils like the refrigerative ones to condense mosture but material like silica gel, or activated aluminia to absorb mosture from the air. They are thus perfect for places where one can experience drastic changes in temperature, such as warehouses, museums, and basements. They can also be used in both industrial and residential settings, which adds to their popularity. Furthermore, the surging requirements for energy-efficient and reliable moisture control solutions, particularly in lower ambient temperature climates, have propelled the desiccant dehumidifier market growth.

By Product

The Fixed segment dominated with a market share of over 62% in 2023, due to their reliable performance and long-term installation capabilities. Mainly used in residential and commercial hard usages, the units are efficient, effective, and continuous in both dehumidification and delivering high performance in long-operation periods. Fixed dehumidifiers are typically installed in basements, crawl spaces, and large commercial spaces where humidity control is essential for structural integrity, mold prevention, and enhanced indoor air quality. These can handle large-scale usage, have a strong design, and can work round the clock, so they can solve the humidity problems permanently. Moreover, they also can accommodate larger capacities, which further strengthens their place in the dehumidifier market by catering larger spaces.

By Application

The Industrial segment dominated with a market share of over 48% in 2023, driven by the essential role dehumidifiers play in various industrial applications. Industries such as manufacturing, pharmaceuticals, food processing, and warehousing require precise humidity control to ensure product quality, machinery longevity, and the overall safety of operations. Maintaining humidity levels in manufacturing plants is essential to preventing moisture damage to sensitive manufacturing equipment and materials. Dehumidifiers prevent goods from mold, rust, and spoilage in warehouses and other storage areas. However, the ever-increasing demand for moisture control in critical environments, such as data centers and cold storage, is also expected to further propel the industrial dehumidifier market. On account of growing emphasis on efficiency along with quality, it is highly likely that the industrial segment continues to dominate the market.

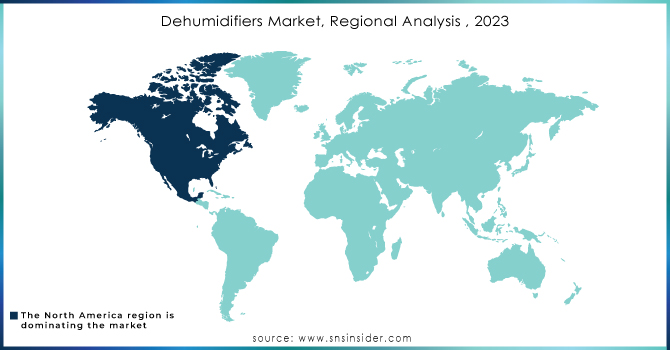

KEY REGIONAL ANALYSIS

North America region dominated with a market share of over 42% in 2023, Due to the diverse climate of the region, this also includes high humidity levels prevalent in locations such as the southeastern U.S., making dehumidifiers an essential appliance for healthier indoor air and better comfort. Furthermore, growing focus on healthy indoor environment is boosting the adoption rate across residential and commercial sector. This has propelled the market growth moreover, consumers are now learning more about the health advantage such as preventing allergens, mycotoxins and henceforth various respiratory ailments. It is also known for its well-developed infrastructure and technological development, which supports the production as well as distribution of high-quality dehumidifiers. Combined, those factors also go a long way in making North America a market leader.

The Asia-Pacific region is witnessing the fastest growth in the Dehumidifier Market due to several key factors. Increasing urbanization and industrialization in countries such as China, India, and Japan is further generating demand for dehumidifiers among residential as well as commercial segments. Growing construction activities, primarily in the metropolitan cities of these countries, is further creating demand for effective indoor air quality as well as climate control solutions. In addition, the growing level of standards of living is making consumers more conscious about health and comfort, resulting in the increasing demand for dehumidification solutions. Humidity also continues to raise the demand for dehumidifiers in the region, which has a naturally humid climate, as the humidity level affects human health and the health of the infrastructure.

Need any customization research on Dehumidifiers Market - Enquiry Now

Some of the major key players in the Dehumidifier Market

-

Airwatergreen AB (Residential and commercial dehumidifiers)

-

De’Longhi Appliances S.r.l. (Dehumidifiers for home and office)

-

Frigidaire (Portable dehumidifiers for residential use)

-

General Filters, Inc (Dehumidifiers and air filtration systems)

-

Resideo Technologies, Inc. (Whole-home dehumidifiers and air quality products)

-

GE Appliances (Dehumidifiers for home use)

-

LG Electronics (Portable and home dehumidifiers)

-

SEIBU GIKEN DST (Industrial dehumidifiers for large-scale applications)

-

Munters (Dehumidifiers for industrial and commercial purposes)

-

Therma-Stor (Dehumidifiers for basements, crawl spaces, and larger spaces)

-

Kerone Engineering Solutions LTD. (Industrial dehumidifiers and drying solutions)

-

Drycool System (Dehumidifiers for industrial and commercial use)

-

Sunpentown Inc.(Compact dehumidifiers for home use)

-

Whirlpool (Portable and in-wall dehumidifiers for homes)

-

ADVANCE INTERNATIONAL (Dehumidifiers for commercial and industrial applications)

-

Origin Corporate Services Pvt. Ltd. (Dehumidifiers and HVAC solutions)

-

Honeywell International Inc. (Home and portable dehumidifiers for various environments)

-

AB Electrolux (Dehumidifiers for residential and commercial markets)

-

Sharp Corporation (Dehumidifiers for residential and commercial applications)

-

Trotec GmbH (Dehumidifiers for industrial and home use)

Suppliers for (high-efficiency, reliable, and energy-saving dehumidifiers with smart technology integration for home and commercial use) on the Dehumidifier Market

-

Honeywell International Inc.

-

Frigidaire

-

Whirlpool Corporation

-

De'Longhi S.p.A.

-

Mitsubishi Electric Corporation

-

Sharp Corporation

-

TROTEC GmbH

-

Ebac Industrial Products Ltd.

-

Keystone

-

GE Appliances

RECENT DEVELOPMENT

In April 2023: Honeywell completed the acquisition of Compressor Controls Corporation from INDICOR, LLC, a company owned by funds affiliated with private equity firm Clayton, Dubilier & Rice, LLC, and Roper Technologies, Inc., for USD 670 million.

In April 2023: Frigidaire, a US-based brand owned by Electrolux, partnered with local Indian brand Ossify to enter the Indian market. This collaboration introduces Frigidaire’s range of home appliances, such as air conditioners, washing machines, refrigerators, and freezers, leveraging over 100 years of innovation and expertise.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.13 Billion |

| Market Size by 2032 | USD 5.37 Billion |

| CAGR | CAGR of 6.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Refrigerative Dehumidifier, Desiccant Dehumidifier, Electronic/Heat Pump Dehumidifier) • By Product (Portable, Fixed) • By Application (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Airwatergreen AB, De’Longhi Appliances S.r.l., Frigidaire, General Filters, Inc., Resideo Technologies, Inc., GE Appliances, LG Electronics, SEIBU GIKEN DST, Munters, Therma-Stor, Kerone Engineering Solutions Ltd., Drycool System, Sunpentown Inc., Whirlpool, ADVANCE INTERNATIONAL, Origin Corporate Services Pvt. Ltd., Honeywell International Inc., AB Electrolux, Sharp Corporation, Trotec GmbH. |