Industrial Laundry Machine Market Scope & Overview:

To get more information on Industrial Laundry Machine Market - Request Free Sample Report

The Industrial Laundry Machine Market Size was estimated at USD 5.98 billion in 2023 and is expected to arrive at USD 8.93 billion by 2032 with a growing CAGR of 4.55% over the forecast period 2024-2032. The Industrial Laundry Machine Market report provides insights into manufacturing output trends across key regions, along with utilization rates and operational efficiency metrics. It examines downtime patterns and maintenance benchmarks, shedding light on industry reliability. The report also explores technological adoption, highlighting automation and IoT integration in laundry operations. Additionally, export/import trends offer a global trade perspective. A key addition is the sustainability shift, covering eco-friendly innovations like water-efficient systems and energy-optimized machines, aligning with rising environmental regulations and cost-saving strategies.

The U.S. industrial laundry machine market is poised for steady growth, with its market size increasing from USD 0.44 billion in 2023 to USD 0.82 billion by 2032, reflecting a CAGR of 7.25%. This growth is driven by rising demand from commercial laundries, healthcare facilities, and hospitality sectors. Technological advancements in energy-efficient and automated laundry solutions further contribute to market expansion.

Market Dynamics

Drivers

-

The growing hospitality and healthcare sectors are driving demand for high-capacity, energy-efficient industrial laundry machines with advanced automation and sustainability features.

The industrial laundry machine market is witnessing significant growth, driven by the expanding hospitality sector, including hotels, resorts, and hospitals. The demand for commercial laundry solutions with high capacity is increasing with the growing global travel and expanding healthcare facilities. When it comes to hotels and/or resorts, they need high-performance machines to process millions of different linens, towels, uniforms, and so on daily while still achieving high turnaround times and hygiene compliance. Likewise, hospitals and other healthcare facilities depend on industrial laundry machines to sanitize bed sheets, gowns, and other fabric items to achieve strict sanitation standards. This trend in the market has also led to the further development of automation and energy-efficient machines that utilize IoT and artificial intelligence to help optimize operations and minimize water and energy consumption. Moreover, sustainability issues propel the uptake of eco-friendly cleaning options. This steady upscaling in this machinery is fueled by the unprecedented increase in urbanization alongside the rise of tourism and hospitality industries both across cities and in rural areas of countries. In conclusion, the industrial laundry machine market is expected to grow at a steady rate with manufacturers investing in advanced, cost-efficient, and eco-friendly industrial laundry machines in light of the rising demand for laundry services.

Restraint

-

The high initial investment and ongoing maintenance costs of industrial laundry machines pose a financial challenge for SMEs, often leading them to opt for outsourced services.

Industrial laundry machines require a significant upfront investment, making them a costly endeavor for businesses, especially small and medium-sized enterprises (SMEs). These machines, being automated, energy efficient, and IoT-based monitoring systems, require a heavy initial capex. Moreover, the expense does not end with the purchase; fueling the vehicle and servicing, repairing, and replacing parts also cost a ton of money. Constant maintenance is needed to maintain performance and durability, which entails costly human resources and extra costs. These costs can be prohibitive for many SMEs with limited budgets, resulting in the tendency to outsource laundry services instead of owning machines. Moreover, long-term financial repercussions include costs associated with operations, such as electric consumption and water use. Apart from that, larger capital investment is necessary to a certain level to comply with safety and environmental regulations, which makes it significantly more difficult for smaller businesses to invest in industrial laundry machines unless they have planned their finances carefully or access external funding, both of which take time.

Opportunities

-

The high initial investment and ongoing maintenance costs of industrial laundry machines pose a financial challenge, especially for SMEs with limited budgets.

Industrial laundry machines require a significant initial investment, making them a substantial financial commitment, especially for small and medium-sized enterprises (SMEs). These machines are higher-capacity than the average washing machine and include advanced features like automation, energy efficiency, and water-saving technology, which help drive up their costs. Maintenance costs, such as repairs, replacement parts, and service, must also be considered. Maintenance is required for smooth operation, to avoid breakdowns and improve the lifespan of the equipment. Nonetheless, for SMEs with budget constraints, such recurring expenditure often poses a burden. This necessitates the hiring of trained technicians and other specialized maintenance services, adding to operational costs. Most businesses prefer outsourcing laundry services rather than spending a lot on buying equipment. The high initial and maintenance costs are widely seen as a constraint to widespread adoption, especially in cost-sensitive markets, although industrial laundry machines may provide long-term savings and efficiency.

Challenges

-

Supply chain disruptions in the industrial laundry machine market stem from raw material shortages, global trade uncertainties, and logistical delays, impacting production and delivery timelines.

Supply chain disruptions in the industrial laundry machine market arise due to dependence on multiple raw material and component suppliers. Manufacturers depend on metals, electronic components, and other parts from around the world, exposing them to economic turbulence or military conflict, trade restrictions, and transportation delays. Shortages of critical materials, like stainless steel and microchips, can trigger production slowdowns and higher costs. Moreover, unexpected events such as pandemics, natural disasters, or labor strikes can exacerbate supply chain constraints, leading to delays in delivery and affecting customer commitments. Surging freight costs and congested ports are another headache, as they make it harder for manufacturers to keep production steady. To address these risks, companies are diversifying their supplier base, implementing nearshoring strategies, and improving inventory management systems. Yet, persistent distortions over international trade and logistics remain a major hurdle facing manufacturers, delaying the availability of industrial laundry machines to enter the market.

Segmentation Analysis

By Type

The Industrial Washer segment dominated with a market share of over 38% in 2023, due to its widespread demand across various industries, including commercial laundries, healthcare, and hospitality. These devices are of paramount importance for efficiently managing large volumes of laundry, to provide cleanliness, hygiene, and operational convenience. Industrial washers are especially vital at hospitals and hotels to uphold high sanitation standards and address daily laundering requirements. These machines are in high demand because they can handle bulk loads, cut back on labor, and improve productivity. Moreover, the growing demand for sustainable, energy-efficient, and water-saving solutions among businesses is encouraging the adoption of smart building technologies, as they provide cost-effective means to save on resources. As there is a growing need for large-scale laundry operations, the industrial washer segment continues to stay at the fore of the industrial washing equipment market.

By Application

The hospitality segment dominated with a market share of over 42% in 2023, driven by the continuous demand for large-scale laundry services in hotels, resorts, and commercial laundries catering to the tourism industry. Hotels and resorts must wash linens, towels, tablecloths, and staff uniforms regularly to keep hygiene and service quality. The dramatic increase in the amount of travelling and the percentage of hotels worldwide filling up, means the demand for efficient, high-capacity laundry machines is higher than ever. Moreover, commercial laundries that cater to several hospitality establishments depend on high-efficiency washing, drying, and folding equipment to accelerate bulk loads. This means that solutions provided by industrial laundry machine manufacturers are energy-efficient, high-performance, and designed to cater to the hospitality sector’s needs, all while ensuring continuous progress in this space.

Key Regional Analysis

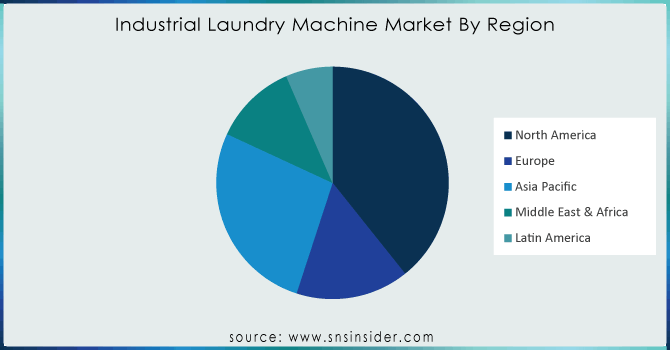

Asia-Pacific region dominated with a market share of over 38% in 2023, due to its well-established textile and hospitality industries, which generate a high demand for large-scale laundry operations. Major textile hubs such as China, India, and Bangladesh are in the region and require industrial laundry machines to process bulk fabric texture. Also, modern urbanization combined with increasing disposable income levels is resulting in the growing adoption of commercial laundry services in hotels, hospitals, and residential complexes. The increasing awareness of hygiene standards and cleanliness in industries such as healthcare and hospitality drives the market to grow. Japan and South Korea. For instance, the use of automated and energy-efficient washing machines is becoming popular, making operations more efficient.

North America is emerging as the fastest-growing region in the Industrial Laundry Machine Market, driven by several key factors. Laundry automation, smart technologies, easier maintenance, and lower operational costs are enabling rapid growth in the region. The market is experiencing significant growth due to the growing adoption of automated and energy-efficient laundry systems across the commercial sector, such as laundromats, hotels, and hospitals. Furthermore, the increasing need for maximizing hygiene and efficiency in the healthcare market, by strict cleanliness standards, is providing uplifting growth impetus. The continued recovery and growth of the hospitality industry, especially in the U.S. and Canada, is spurring demand for advanced laundry equipment, too. In addition, the presence of major players and investment in North America are innovating things that are growing the market.

Need any customization research on Industrial Laundry Machine Market - Enquiry Now

Key players in the Industrial Laundry Machine Market

-

MAG Laundry Equipment (Commercial Washers, Dryers, Ironers)

-

Laundrylux Inc. (Commercial Washers, Dryers, Payment Systems)

-

Herbert Kannegiesser GmbH (Washer Extractors, Ironers, Folders)

-

Vega Systems Group (Tunnel Washers, Drying Tumblers, Ironing Lines)

-

Lavatec Laundry Technology GmbH (Washer Extractors, Tunnel Washers, Dryers)

-

Girbau Group (Industrial Washers, Dryers, Flatwork Ironers)

-

Jensen Group (Feeding & Folding Machines, Tunnel Washers, Ironers)

-

Ferrotec Holding Corporation (Industrial Cleaning Systems, Drying Systems)

-

Domus (High-Speed Washers, Barrier Washers, Dryers)

-

Pellerin Milnor Corporation (Washer Extractors, Continuous Batch Washers, Dryers)

-

Alliance Laundry Systems (Commercial Washers, Dryers, Ironers)

-

Electrolux Professional (Barrier Washers, Dryers, Ironing Equipment)

-

Dexter Laundry, Inc. (Washer-Extractors, Tumbler Dryers, Coin Laundry Equipment)

-

BÖWE Textile Cleaning GmbH (Professional Cleaning Machines, Dry Cleaners)

-

Danube International (Barrier Washers, Professional Ironers, Dryers)

-

Yamamoto Manufacturing Co., Ltd. (Industrial Washers, Extractors, Drying Machines)

-

Unipress Corporation (Shirt Finishers, Pant Presses, Dry Cleaning Equipment)

-

Sea-Lion Machinery Co., Ltd. (Industrial Washing Equipment, Continuous Batch Washers)

-

R.W. Martin Company (Industrial Laundry Equipment, Ironers, Folders)

-

Lapauw International (Tunnel Washers, Dryers, Ironers, Finishing Equipment)

Suppliers for (range of laundry and dry-cleaning equipment for garment industries and hotels) Industrial Laundry Machine Market

-

BTC Laundry Equipment Co. Pvt. Ltd.

-

S.R. Sons Garments Equipment

-

Bharati Laundry Washing Machines

-

Jiangsu Chuandao Washing Machinery Technology Co., Ltd.

-

Shanghai Weishi Machinery Co., Ltd.

-

Shanghai Hangxing Machinery (Group) Co., Ltd.

-

Shandong Xiaoya Holding Group Co., Ltd.

-

Xiebao Washing Machinery (Shanghai) Co., Ltd.

-

Jiangsu Sea-Lion Machinery Co., Ltd.

-

Electrolux Professional AB

Recent Development

In March 2025: R.W. Martin announced its exclusive partnership as the U.S. distributor for TOLON, providing their cutting-edge washer-extractors, dryers, and finishing equipment. This collaboration supports R.W. Martin's commitment to improving efficiency and reliability for its customers.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.62 Billion |

| Market Size by 2032 | USD 4.76 Billion |

| CAGR | CAGR of 6.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Industrial Washer, Industrial Dryer, Industrial Cleaner, Industrial Extractor, Others [Garment Finishing, Ironing]) • By Application (Hospitality, Healthcare, Food & Beverages, Automotive, Others [Marine]) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | MAG Laundry Equipment, Laundrylux Inc., Herbert Kannegiesser GmbH, Vega Systems Group, Lavatec Laundry Technology GmbH, Girbau Group, Jensen Group, Ferrotec Holding Corporation, Domus, Pellerin Milnor Corporation, Alliance Laundry Systems, Electrolux Professional, Dexter Laundry, Inc., BÖWE Textile Cleaning GmbH, Danube International, Yamamoto Manufacturing Co., Ltd., Unipress Corporation, Sea-Lion Machinery Co., Ltd., R.W. Martin Company, and Lapauw International. |