Design-To-Source Intelligence Market Report Scope & Overview:

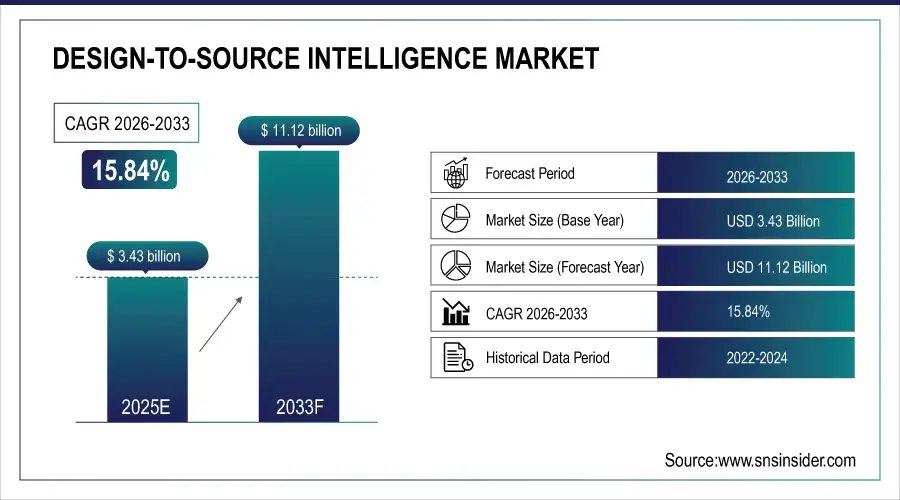

The Design-To-Source Intelligence Market size was valued at USD 3.43 Billion in 2025E and is projected to reach USD 11.12 Billion by 2033, growing at a CAGR of 15.84% during 2026–2033.

The Design-To-Source Intelligence Market is witnessing steady growth, driven by rising demand for cost-efficient product design, intelligent supplier discovery, and data-driven procurement decisions. Enterprises increasingly adopt design-linked sourcing platforms to improve supply chain visibility, reduce sourcing risks, and enhance product development efficiency across manufacturing-driven industries.

Design-To-Source Intelligence Market Size and Forecast:

-

Market Size in 2025E: USD 3.43 Billion

-

Market Size by 2033: USD 11.12 Billion

-

CAGR: 15.84% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Design-To-Source Intelligence Market - Request Free Sample Report

Key Design-To-Source Intelligence Market Trends

-

Increasing integration of AI and analytics into sourcing platforms is improving supplier selection accuracy and reducing procurement risks.

-

Growing adoption of cloud-based design-to-source solutions enables faster collaboration between design, engineering, and procurement teams.

-

Rising focus on supply chain resilience is driving demand for real-time supplier risk intelligence and benchmarking tools.

-

Expansion of digital procurement strategies across SMEs is accelerating market penetration.

-

Increased use of sustainability metrics in sourcing decisions supports ESG-driven supplier evaluation.

-

Integration with PLM, ERP, and CAD systems is enhancing design-to-cost and sourcing transparency.

U.S. Design-To-Source Intelligence Market Insights:

The U.S. Design-To-Source Intelligence Market size was USD 1.01 billion in 2025 and is expected to reach USD 2.89 billion by 2033, growing at a CAGR of 14.03% over the forecast period of 2026–2033. According to a study, rising product customization and shortened product lifecycles have increased sourcing complexity by nearly 30%, prompting manufacturers to adopt design-to-source intelligence platforms. This cause, higher supply chain volatility, effects faster supplier identification, improved cost transparency, and reduced procurement cycle times, strengthening operational efficiency across U.S. manufacturing and technology enterprises.

Design-To-Source Intelligence Market Drivers:

-

Growing Need for Design-Integrated Procurement and Cost Transparency Accelerates Enterprise Adoption Across Manufacturing Ecosystems

The growing need for design-integrated procurement has emerged as a primary driver of the Design-To-Source Intelligence Market. As product complexity increases and time-to-market shortens, organizations face rising cost pressures during early design phases. This cause, fragmented design and sourcing workflows, effects limited cost visibility and late-stage sourcing inefficiencies. Design-to-source intelligence platforms address this by connecting engineering designs directly with real-time supplier data, pricing benchmarks, and material availability. Manufacturers increasingly rely on these platforms to evaluate multiple sourcing scenarios, compare supplier capabilities, and ensure design feasibility at scale. Integration with PLM and ERP systems enhances cross-functional collaboration, enabling procurement teams to influence design decisions proactively. This cause, growing emphasis on cost optimization and supply chain agility, effects increased adoption of design-to-source intelligence solutions across electronics, automotive, and industrial manufacturing sectors.

In March 2025, a U.S.-based electronics manufacturer integrated design-to-source intelligence into its PCB design process, reducing sourcing-related design revisions by 27% and improving supplier cost accuracy during early-stage product development.

Design-To-Source Intelligence Market Restraints:

-

High Implementation Costs and Complex System Integration Challenges Limit Adoption Among Resource-Constrained Enterprises

High implementation costs and system integration complexity act as major restraints in the Design-To-Source Intelligence Market. Many organizations operate on legacy procurement, ERP, and design systems that lack interoperability. This cause, fragmented IT infrastructures, effects increased deployment time, higher upfront investment, and operational disruption during implementation. For small and mid-sized enterprises, licensing costs, customization requirements, and employee training further elevate adoption barriers. Additionally, integrating design intelligence platforms with CAD, PLM, and supplier databases demands specialized technical expertise, increasing dependency on external consultants. Resistance to change among procurement and engineering teams further compounds the challenge, slowing digital transformation initiatives. This cause, financial and operational constraints, effects uneven market penetration, especially among SMEs and enterprises in emerging economies, limiting the overall pace of market expansion.

In 2024, a mid-sized U.S. manufacturing firm postponed design-to-source platform deployment after pilot integration costs exceeded internal IT budgets, citing ERP compatibility issues and prolonged employee training timelines.

Design-To-Source Intelligence Market Opportunities:

-

AI-Driven Supplier Intelligence and Real-Time Risk Analytics Create New Growth Opportunities for Advanced Sourcing Platforms

AI-driven supplier intelligence presents a strong growth opportunity in the Design-To-Source Intelligence Market. As global supply chains become increasingly complex and vulnerable to disruptions, enterprises seek real-time visibility into supplier performance, risk exposure, and sourcing alternatives. This cause, rising geopolitical uncertainty and logistics volatility, effects increased reliance on AI-powered analytics to predict supplier risks and optimize sourcing decisions. Growing enterprise adoption of digital twins and predictive modeling further amplifies this opportunity. By embedding AI into early-stage design workflows, vendors can offer differentiated solutions that enhance resilience, speed, and cost efficiency. This cause, demand for intelligent automation, effects accelerated innovation and long-term revenue opportunities across global manufacturing ecosystems.

In June 2025, a design-to-source software provider launched an AI-based supplier risk module that enabled manufacturers to reduce sourcing disruptions by 18% through early-stage design adjustments.

Design-To-Source Intelligence Market Segmentation Analysis

By Deployment Mode, Cloud-Based Platforms Lead Market While On-Premises Solutions Register Fastest Growth

The cloud-based deployment segment dominates the Design-To-Source Intelligence Market with a 63% revenue share in 2025E due to its scalability, flexibility, and lower upfront infrastructure requirements. Because organizations increasingly operate distributed design and procurement teams, this cause, demand for centralized and real-time access, effects strong preference for cloud-based platforms. Cloud solutions enable seamless collaboration between engineering, sourcing, and supplier teams across geographies, improving design accuracy and sourcing efficiency.

On-Premises Segment Registers Fastest Growth at 17.31% CAGR, due to rising demand for data security, customization, and regulatory compliance. Because large enterprises handle sensitive design IP and supplier contracts, this cause, heightened security and compliance concerns, effects increased adoption of on-premises solutions. These platforms offer greater control over data governance, system customization, and internal workflows.

By Enterprise Size, SMEs Dominate Market While Large Enterprises Register Fastest Growth

Small & Medium Enterprises dominate the Design-To-Source Intelligence Market with a 70% revenue share in 2025E due to their increasing reliance on cost optimization and supplier transparency. Because SMEs operate with limited procurement resources, this cause, need for efficient sourcing decisions, effects rapid adoption of design-to-source platforms. These tools enable SMEs to access supplier benchmarking, cost visibility, and design feasibility insights without maintaining large sourcing teams. Cloud-based subscription pricing and user-friendly interfaces further lower entry barriers. SMEs leverage these platforms to reduce design revisions, shorten product development cycles, and negotiate better supplier contracts.

Large Enterprises Register Fastest Growth at 16.88% CAGR, due to increasing complexity of global supply chains and multi-site manufacturing operations. Because these organizations manage thousands of suppliers and complex product portfolios, this cause, need for advanced sourcing intelligence, effects growing adoption of enterprise-grade design-to-source platforms. Integration with ERP, PLM, and digital twin systems enables centralized decision-making and predictive cost modeling. Large enterprises increasingly deploy AI-driven analytics to mitigate supply risks and ensure compliance across regions. This cause, scale-driven complexity and risk exposure, effects accelerated growth of large enterprise adoption within the Design-To-Source Intelligence Market.

By Application, Supplier Discovery Leads Market While Procurement Optimization Registers Fastest Growth

Supplier discovery and benchmarking lead the market with a 35% revenue share in 2025E due to growing demand for diversified and resilient supplier networks. Because supply chain disruptions have exposed over-dependence on limited suppliers, this cause, risk mitigation priorities, effects increased adoption of supplier intelligence tools. Design-to-source platforms allow enterprises to compare supplier capabilities, pricing, certifications, and lead times early in the design phase. This enables informed design decisions that align with sourcing feasibility. Enhanced data visualization and real-time benchmarking improve negotiation outcomes and sourcing efficiency.

Procurement optimization is growing fastest due to rising pressure to control costs and improve sourcing efficiency. Because volatile raw material prices and logistics costs impact margins, this cause, cost control urgency, effects strong demand for predictive procurement tools. Design-to-source intelligence platforms support automated cost modeling, scenario analysis, and supplier performance tracking. Integration with AI-driven analytics enables proactive sourcing decisions. This cause, demand for intelligent procurement workflows, effects rapid growth of the procurement optimization segment.

By Industry Vertical, Electronics & Semiconductors Lead Market While Healthcare & Life Sciences Register Fastest Growth

Electronics & Semiconductors dominate the market with a 25% revenue share in 2025E due to high product complexity and rapid innovation cycles. Because component availability and pricing significantly affect design feasibility, this cause, need for early sourcing intelligence, effects widespread adoption of design-to-source platforms. These tools support BOM optimization, supplier qualification, and lifecycle risk management. This cause, fast-paced innovation demands, effects strong dominance of this vertical within the Design-To-Source Intelligence Market.

Healthcare & Life Sciences are growing fastest due to regulatory compliance requirements and increasing device complexity. Because product safety and supplier validation are critical, this cause, stringent compliance needs, effects growing reliance on design-to-source intelligence. Platforms help ensure supplier traceability, material compliance, and cost predictability. This cause, regulatory-driven digitalization, effects accelerated growth in this vertical.

Design-To-Source Intelligence Market Regional Insights

North America Dominates Design-To-Source Intelligence Market in 2025E

In 2025E, North America commands an estimated 42% share of the Design-To-Source Intelligence Market, driven by its advanced manufacturing ecosystem and early adoption of digital procurement and engineering platforms. The region benefits from strong integration of design, sourcing, and supply chain intelligence across automotive, aerospace, electronics, and industrial sectors. Growing focus on supply chain resilience, cost transparency, and early-stage sourcing decisions further accelerates adoption.

The United States dominates North America due to its mature product design ecosystem, large enterprise presence, and strong emphasis on digital transformation. U.S. manufacturers actively integrate design-to-source intelligence with CAD, PLM, and ERP systems to reduce procurement risks and accelerate time-to-market. Government-led reshoring initiatives and investments in domestic manufacturing further strengthen adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Is the Fastest-Growing Region in Design-To-Source Intelligence Market in 2025E

Asia Pacific is projected to grow at the fastest pace, with an estimated 18.28% CAGR in 2025E, fueled by rapid industrialization, expanding supplier networks, and rising manufacturing exports. Increasing complexity in sourcing across multi-country supplier ecosystems drives strong demand for design-integrated sourcing intelligence. Growing cloud adoption and digital manufacturing initiatives across emerging economies further support market expansion.

China dominates the Asia Pacific Design-To-Source Intelligence Market due to its vast manufacturing base and dense supplier ecosystems. Chinese enterprises increasingly deploy design-to-source platforms to manage BOM complexity, improve supplier benchmarking, and control material costs. Government-backed smart manufacturing programs and digital supply chain initiatives accelerate adoption. Alongside China, countries such as Japan and South Korea contribute through advanced electronics and automotive manufacturing, collectively driving regional growth.

Europe Design-To-Source Intelligence Market Insights, 2025

Europe held a significant share of the Design-To-Source Intelligence Market in 2025, driven by strict regulatory requirements, sustainability mandates, and advanced industrial manufacturing practices. Enterprises increasingly adopt design-to-source platforms to ensure supplier compliance, traceability, and cost efficiency during early design stages. Integration with Industry 4.0 frameworks supports sustained growth.

Germany leads Europe’s market due to its strong automotive and industrial manufacturing base. The country’s focus on digital engineering, sustainable sourcing, and regulatory compliance drives widespread adoption of design-to-source intelligence across enterprises.

Middle East & Africa and Latin America Design-To-Source Intelligence Market Insights, 2025

In 2025, the Middle East & Africa and Latin America regions experienced steady growth driven by industrial diversification and digital supply chain modernization. In Latin America, Brazil and Mexico lead adoption through expanding manufacturing exports and supplier digitalization initiatives. In the Middle East & Africa, the UAE dominates through smart manufacturing investments and digital procurement transformation aligned with national industrial strategies. Both regions are emerging markets, focusing on improving sourcing visibility and cost control through design-to-source intelligence platforms.

Competitive Landscape for the Design-To-Source Intelligence Market

Siemens

Siemens is a Germany-based global technology leader offering advanced digital manufacturing, product lifecycle management (PLM), and sourcing intelligence solutions through its industrial software portfolio. In the Design-To-Source Intelligence Market, Siemens plays a critical role by integrating design engineering, supplier data, and procurement intelligence within a unified digital thread. Its platforms enable manufacturers to link CAD and PLM environments with real-time supplier availability, cost structures, and compliance data. This integration helps enterprises reduce design-to-production timelines, optimize sourcing decisions early in the product lifecycle, and mitigate supply chain risks.

-

In February 2025, Siemens enhanced its digital manufacturing suite by introducing advanced supplier intelligence integration within its PLM platform, enabling real-time cost and sourcing validation during early-stage product design.

Luminovo

Luminovo is a Germany-based technology company specializing in design-to-source intelligence solutions tailored for electronics and hardware manufacturers. The company focuses on connecting engineering design data with sourcing, costing, and supplier intelligence to eliminate inefficiencies between design and procurement teams. Luminovo’s platform enables manufacturers to analyze bills of materials (BOMs), benchmark suppliers, and evaluate component availability directly from design files. Its role in the Design-To-Source Intelligence Market is vital, as it helps electronics manufacturers reduce sourcing errors, improve cost predictability, and shorten product development cycles.

-

In May 2025, Luminovo launched an AI-powered BOM analysis feature that improved component availability forecasting and reduced sourcing-related design changes for electronics manufacturers.

JAGGAER

JAGGAER is a U.S.-based provider of procurement and supplier management software, offering advanced sourcing intelligence solutions that integrate design data with procurement workflows. The company supports enterprises across manufacturing, higher education, and public sectors by enabling early-stage sourcing decisions aligned with product design requirements. In the Design-To-Source Intelligence Market, JAGGAER’s role centers on delivering supplier discovery, cost modeling, and compliance insights that connect engineering and procurement teams. Its platforms help organizations identify qualified suppliers, assess risk exposure, and optimize sourcing strategies before production begins.

-

In March 2025, JAGGAER expanded its supplier intelligence capabilities by introducing enhanced design-linked sourcing analytics, improving early cost estimation and supplier benchmarking accuracy.

Ivalua

Ivalua is a U.S.-based global leader in spend management and procurement software, providing comprehensive design-to-source intelligence capabilities for complex enterprises. The company enables organizations to integrate product design inputs with sourcing, supplier performance, and cost intelligence across the procurement lifecycle. Ivalua’s platforms allow enterprises to align engineering specifications with sourcing strategies, ensuring compliance, cost control, and supplier resilience. Its role in the Design-To-Source Intelligence Market is significant, as it supports large enterprises managing global supplier networks and complex regulatory environments.

-

In January 2025, Ivalua introduced enhanced supplier risk and compliance intelligence modules designed to integrate directly with early-stage product design workflows.

Design-To-Source Intelligence Market Key Players:

-

Siemens

-

Luminovo

-

JAGGAER

-

Ivalua

-

Source Intelligence

-

HCL Technologies

-

Zensar Technologies

-

EDITED

-

ITMAGINATION

-

Linagora

-

Tradegood

-

Sourceability

-

Descartes Systems Group

-

SAP

-

Oracle

-

Coupa

-

Kinaxis

-

Blue Yonder

-

o9 Solutions

-

Dassault Systèmes

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 3.43 Billion |

| Market Size by 2033 | US$ 11.12 Billion |

| CAGR | CAGR of 15.84% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Siemens, Luminovo, JAGGAER, Ivalua, Source Intelligence, HCL Technologies, Zensar Technologies, EDITED, ITMAGINATION, Linagora, Tradegood, Sourceability, Descartes Systems Group, SAP, Oracle, Coupa, Kinaxis, Blue Yonder, o9 Solutions, Dassault Systèmes. |