Device as a Service Market Size & Trends:

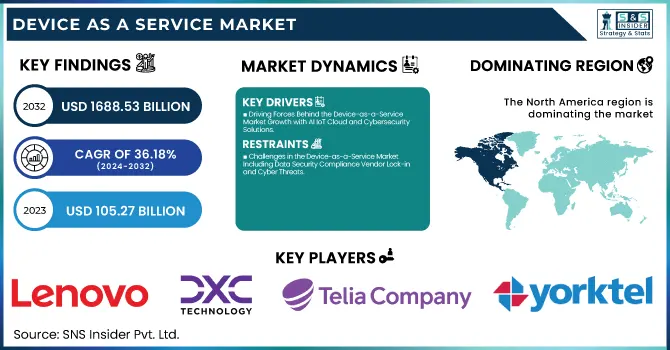

The Device as a Service Market Size was valued at USD 105.27 billion in 2023 and is expected to reach USD 1688.53 billion by 2032, growing at a CAGR of 36.18% over the forecast period 2024-2032. The expanding Device-as-a-Service (DaaS) market, supported by increasing adoption from enterprises looking for affordable, scalable IT solutions DaaS is helping businesses to outsource the entire device procurement, maintenance, and upgrade to the vendor relieving IT of the hassle and helping in operational efficiency. Advanced remote monitoring and predictive maintenance reduce downtime and improve performance with automated updates.

To Get more information on Device as a Service Market - Request Free Sample Report

AI-powered analytics, cloud-based management, and security features are all built into the device to enable maximum utilization of the devices. DaaS helps enhance workforce productivity as well by providing employees with updated hardware and software, optimizing collaboration between teams, and improving mobility in hybrid and remote work environments. This change reflects the trends of digital transformation across sectors.

Device-as-a-Service (DAAS) Market Dynamics

Key Drivers:

-

Driving Forces Behind the Device-as-a-Service Market Growth with AI IoT Cloud and Cybersecurity Solutions

Growing requirements for economically managing IT infrastructure, rising adoption of subscription-based models, and increasing demand for remote work solutions are the major factors boosting the growth of the Device-as-a-Service (DaaS) market. For this reason, organizations have been moving towards DaaS to lower their CapEx, allowing for a predictable expenditure versus an OpEx that requires the organization to maintain the cost of both staffing and IT services relatively long after implementation. Moreover, the adoption of AI, IoT, and cloud computing also plays a significant role in driving the demand for DaaS by helping organizations boost productivity and optimize the device lifecycle management process. Rising cybersecurity threats have also led to enterprises opting for managed services and DaaS providers offer them endpoint security, timely updates, and proactive monitoring as well.

Restrain:

-

Challenges in the Device-as-a-Service Market Including Data Security Compliance Vendor Lock-in and Cyber Threats

The DaaS market never has a smooth ride, due to multiple challenges like data security and compliance concerns, etc. The growing dependencies of organizations on third-party providers being used to manage devices and IT infrastructure leads to data privacy breaches, unauthorized access, and cyber threats act as the key restraining factor for the growth of the market. The nature of certain DaaS solutions may limit their widespread use in sectors that require strict data protection regulations, such as healthcare, finance, or government. Fifthly, businesses may also be cautious about adopting a DaaS model entirely because of the possibility of vendor lock-in, which means dependent on a single provider and restricts their flexibility and control over their IT resources.

Opportunity:

-

Growth Opportunities in Device-as-a-Service Market Driven by 5G Hybrid Work Sustainable IT and SMEs Demand

The market also has enormous growth opportunities due to the growing adoption of 5G, expanding hybrid work models, and increasing need for sustainable IT solutions. Increasing adoption of sustainable IT asset management products by the vendors under the DaaS model, owing to the shifting trend of environmentally friendly and energy-efficient devices. In addition, the increasing preference of small and medium business enterprises (SMEs) for device procurement and upgradation options is opening new revenue opportunities. In addition, the growing IT infrastructure in developing countries also creates potential markets for DaaS providers.

Challenges:

-

Overcoming Flexibility Compatibility Supply Chain and Integration Challenges in the Device-as-a-Service Market

The second biggest challenge is the lack of flexibility and compatibility with existing IT environments. For enterprises with complex IT environments and legacy systems, it can be difficult to get DaaS offerings to integrate without causing operational problems down the road. In addition to these, higher levels of software compatibility, device standardization, and cross-platform interoperability can challenge adoption continually. Additionally, supply chain and hardware availability challenges can create friction as companies utilizing DaaS must receive and deploy the device immediately for business continuity. Eliminating these barriers calls for service providers to provide solutions that are secure, highly flexible, and highly scalable, with support specific to the industry.

DAAS (Device as a Service) Market Segment Analysis

By Offering

The service segment led the Device-as-a-Service (DaaS) market in 2023, capturing a 38.9%market share. The rise in demand for managed services, such as IT support, device management, security management, and software upgrades, was the impetus for this dominance. With the penchant among enterprises towards the adoption of service-based solutions to streamline operations, productivity increase, and IT asset management complexity reduction.

The hardware segment is projected to experience the highest CAGR from 2024 to 2032, owing to the increasing penetration of sophisticated computing devices, mobile phones, and IoT-based devices using DaaS. With 5G spreading and AI taking its toll on tech offerings as it pushes its surrounding device upgrade, the demand for more hardware infusion into the DaaS ecosystem is only going to get stronger.

By Device

The desktop segment held the largest market share in the Device-as-a-Service (DaaS) market segment, with a market share of 38.8% The preference was largely due to the steep demand for desktops in enterprise settings, especially in environments seeking high-performance computing such as IT, finance, and healthcare. In the DaaS model, businesses prefer desktops as these are durable, cost-effective can handle heavy workloads in an office environment.

The smartphone and peripheral segment is projected to witness the fastest CAGR from 2024 to 2032, due to the growing mobile-first work environment and remote collaboration tools. There has been an ever-increasing demand for smart devices such as smartphones, tablets, monitors, and other accessories with models based on subscriptions owing to the need for more flexible, scalable, and cost-effective IT solutions by organizations that are catering to a large workforce.

By Enterprise Size

In 2023, the Device-as-a-Service (DaaS) market was held by large enterprises 58.2% market share. The growing need for scalability of IT infrastructure, affordable end-device management, and better security options propelled this dominance. DaaS was increasingly adopted by large organizations as it helped streamline operations, minimize IT exhaustion, and improve workforce efficiency consolidated by the ongoing trend of remote and hybrid work environments.

The SME segment is poised to grow at the highest CAGR between 2024 and 2032 because of the growing demand for agile and cost-effective IT solutions. Application of DaaS technologies is being adopted not only by big enterprises but rather by SMEs where they start enlarging the usage on access to best computer equipment thereby reducing implementation along with Managed IT Services to give proper match to bigger enterprises.

By End Use

The IT & Telecom sector accounted for the biggest share of the Device-as-a-Service (DaaS) market share at 24.7% in 2023 and is anticipated to witness the fastest CAGR during the forecast period, 2024–2032. The growth can be attributed to the sector's highly reliant on advanced IT infrastructure, the increasing adoption of remote work models, and the growing need for seamless device management solutions across the network. DaaS is a solution that is appealing to the IT & Telecom industry as it continuously requires upgrades of hardware and software to run and function efficiently, which is why DaaS can help relieve the IT of the business and allows the business to be a lot more flexible. With 5G technologies, cloud, and AI based automation finding its way and scaling, it is creating the need for quickly scalable, and economical device procurement models. As telecom operators and IT service providers keep on upgrading their tech stacks, the adoption cycle for DaaS will work because it guarantees the best device lifecycle management and a boost in workforce productivity.

Device-as-a-Service Market Regional Landscape

The Device-as-a-Service (DaaS) market in North America accounted for the largest size share of 28.8% in 2023, due to the presence of several technology incumbents and the early adoption of cloud-based solutions combined with an increase in demand for managed IT services. The existing IT infrastructure in the region and the established trends of remote and hybrid work culture have accelerated the adoption of DaaS by enterprises. The North American DaaS market is largely dominated by companies including HP Inc., Dell Technologies, and Lenovo that provide businesses with flexible hardware coupled with service offerings. For instance, HP offers its DaaS program for enterprises, providing customized device solutions, predictive analytics, and security, enabling organizations to streamline and optimize IT asset management.

Asia Pacific is likely to register the fastest CAGR from 2024-2032, driven by swiftly advancing digitization, rising SME adoption, and exploding 5G networks across the region. Demand for affordable IT solutions in countries such as China, India, and Japan is propelling the DaaS market forthrightly. With the rising need for scalable IT infrastructure, firms like Lenovo and Fujitsu are broadening their DaaS suppliers within the area. For example, Lenovo's TruScale DaaS provides businesses in the Asia Pacific the ability to consume state-of-the-art technology with optimal pay-per-use flexibility and minimum cost overheads to streamline day-to-day operations and enhance IT management further.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Device-as-a-Service Market are:

-

Hemmersbach (Device as a Service, Global Field Service)

-

Lenovo (ThinkPad Laptops, ThinkCentre Desktops)

-

HP (EliteBook Laptops, ProDesk Desktops)

-

DXC Technology (Device as a Service, IT Outsourcing)

-

Telia Company (Device-as-a-Service, Cloud Services)

-

Atea Global Services (Device as a Service, IT Infrastructure)

-

Yorktel (Device as a Service, Video Conferencing Solutions)

-

Ergo (Device as a Service, Cloud Solutions)

-

Dell Technologies (Latitude Laptops, OptiPlex Desktops)

-

Microsoft (Surface Devices, Microsoft 365)

-

Apple (MacBook Pro, iPad Pro)

-

Cisco Systems (Webex Devices, Meraki Networking)

-

Amazon Web Services (AWS) (WorkSpaces, EC2 Instances)

-

Fujitsu (LIFEBOOK Laptops, ESPRIMO Desktops)

-

Acer Inc. (TravelMate Laptops, Veriton Desktops)

Recent Trends

-

In April 2024, Dell Technologies expanded its data protection offerings with next-gen PowerProtect Data Domain appliances and AI-integrated APEX Backup Services, aiming to combat rising cyber threats with faster backups, improved efficiency, and enhanced security.

-

In March 2025, Cisco introduced Agile Services Networking and an Open Telecom AI Platform, enhancing service provider growth with AI-driven automation, improved network performance, and cost efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 105.27 Billion |

| Market Size by 2032 | USD 1688.53 Billion |

| CAGR | CAGR of 36.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Service) • By Device (Desktop, Laptop, Notebook and Tablet, Smartphone and Peripheral) • By Enterprise Size (Small & Medium Enterprise, Large Enterprise) • By End Use (Banking, Financial Services and Insurance (BFSI), Educational Institutions, Healthcare and Life Sciences, IT & Telecom, Public Sector and Government Offices, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hemmersbach, Lenovo, HP, DXC Technology, Telia Company, Atea Global Services, Yorktel, Ergo, Dell Technologies, Microsoft, Apple, Cisco Systems, Amazon Web Services (AWS), Fujitsu, Acer Inc. |