IoT Device Management Market Size & Trends:

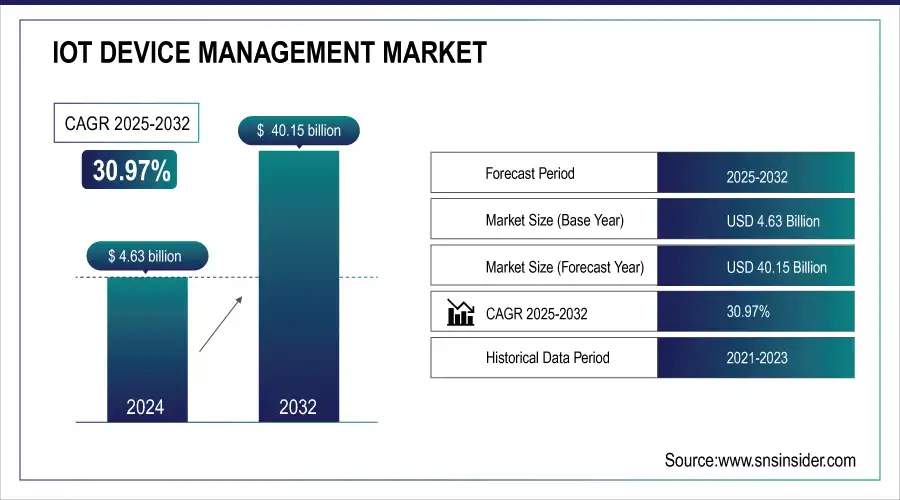

The IoT Device Management Market Size was valued at USD 4.63 Billion in 2024 and is expected to reach USD 40.15 Billion by 2032 and grow at a CAGR of 30.97% over the forecast period 2025-2032.

The IoT Device Management Market has had great developments during 2024 and 2025, supported by technological advancements and positive government policies in major economies such as the USA, China, and Europe. The United States launched the US Cyber Trust Mark in 2023, similar to the Energy Star rating, marking a crucial step towards increasing cybersecurity for smart home devices. This will allow the consumer to see which products offer strong security practices, such as software updates and secure data handling, thus making it easier to build trust in IoT technologies across the board.

To get more information on IoT Device Management Market - Request Free Sample Report

In China, the IoT landscape is characterized by rapid growth. The IoT device management market is expected grow significantly till 2030. The reason is that the country has an intense manufacturing sector and the government is actively seeking to incorporate IoT solution integrations into various industries, hence streamlining operations and thereby increasing efficiency. Europe also shows robust support for the development of IoT by investing greatly in research and development to ensure improved technological support. The establishment of complete regulatory frameworks in this region helps with seamless integration and safety in the operation of IoT devices, leading to a sustainable and secure IoT environment.

The main technological drivers for the IoT device management market in 2023 and 2024 have been innovations in safety solutions. Safety solutions have become essential for the protection of networks and data, thereby making it more reliable and efficient for IoT deployments. Looking forward, the IoT device management market has a huge prospect for growth and will continue to grow with new opportunities emerging due to the increase in the use of IoT devices in different industries. The application of IoT solutions in healthcare, manufacturing, and transportation industries will lead to high demand for device management solutions, which are efficient, secure, and scalable.

Market Size and Forecast:

-

Market Size in 2024 USD 4.63 Billion

-

Market Size by 2032 USD 40.15 Billion

-

CAGR of 30.97% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Key IoT Device Management Market Trends:

-

Rising adoption of IoT devices across healthcare, manufacturing, and transportation to enhance efficiency and enable real-time monitoring.

-

Growing importance of device management solutions for provisioning, configuration, monitoring, and security of connected devices.

-

Increased focus on predictive maintenance, automation, and quality monitoring in industrial IoT applications.

-

Government-led initiatives such as the U.S. Cyber Trust Mark promoting secure IoT deployments.

-

Standardization and regulatory compliance in Europe boosting consumer trust and accelerating IoT adoption.

IoT Device Management Market Growth Drivers:

-

The proliferation of IoT devices across industries necessitates strong device management solutions.

IoT devices have been widely adopted across different sectors. For instance, the healthcare, manufacturing, and transportation industries are adopting IoT devices to make their operations more efficient, monitor critical systems, and obtain real-time data. For example, IoT devices have the following applications: In health, patient monitoring, asset tracking, and medical stock management are enabled. For example, IoT can facilitate predictive maintenance, automation, and quality monitoring in the manufacture of any goods.

Fleet management, optimization, and tracking become the prime reasons for adopting IoT in transport industries. Increasing device connectivity brings on increased complexities with managing all of these; the solution that enables device provisioning, configuration, monitoring, and security becomes vital. Effective device management ensures that IoT deployments remain secure, scalable, and efficient, thereby driving the demand for comprehensive IoT device management platforms.

IoT Device Management Market Restraints:

-

Lack of standardized protocols hinders seamless IoT device integration.

It means that the integration and interoperability of devices in the IoT environment are highly impeded by a lack of globally accepted standards and protocols. In this regard, fragmentation leads to compatibility issues and increased complexity when managing devices; it also threatens security. Devices operating on proprietary communication protocols are not able to communicate effectively with other systems; this leads to data silos and inefficient operations.

Besides this, the absence of standardization complicates the development of common security measures as different protocols require different security approaches, making some devices more susceptible to cyber-attacks. This lack of consistency is not only challenging the scalability of IoT deployments but also increasing the cost and effort needed to manage diverse device ecosystems. They would therefore seek more industry-wide action toward developing the necessary standardized protocols to ensure greater interoperability and security with an easy device-management regime in an IoT landscape.

IoT Device Management Market Segment Analysis:

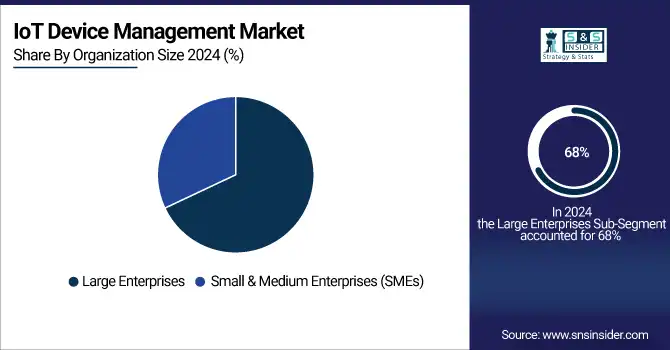

By Organization Size

Large enterprises held the highest market share in 2024, at 68%, due to their large-scale adoption of IoT solutions for improving operational efficiency, monitoring assets, and enhancing customer experience. These organizations have the requisite financial and technical capabilities to roll out full IoT ecosystems, with advanced device management solutions that support seamless connectivity and security. Sectors like manufacturing, transportation, and retail also have been strong drivers of large enterprise adoption, as they have increasingly relied on IoT-driven innovation.

In contrast, the SME segment is expected to register significant growth, projected to grow at the fastest CAGR of 31.64% during the forecast period from 2025 to 2032. The scale-up of SMEs without massive infrastructure investment through the use of cloud-based IoT device management solutions is encouraging their adoption. The growing affordability of IoT technologies and government policies aimed at attaining digital transformation are also factors driving the growth of IoT adoption for SMEs.

By End-Use Industry

In 2024, the manufacturing segment had the largest market share, which was approximately 37.42%. This sector is one of the key users of IoT technology due to enhanced operational efficiency, real-time asset tracking, and predictive maintenance. IoT-enabled solutions help manufacturers track production processes, visibility in the supply chain, and effective downtimes, making them inevitable in modern industrial operations.

On the other hand, the healthcare segment is expected to grow at the fastest CAGR of 32.51% in the forecast period from 2025 to 2032. The increased adoption of IoT devices through remote patient monitoring, diagnostics, and management of hospital assets catalyzes this explosive growth rate. The demand for secure and reliable device management platforms has increased dramatically due to the data privacy regulation and the seamless integration of the devices across health care networks.

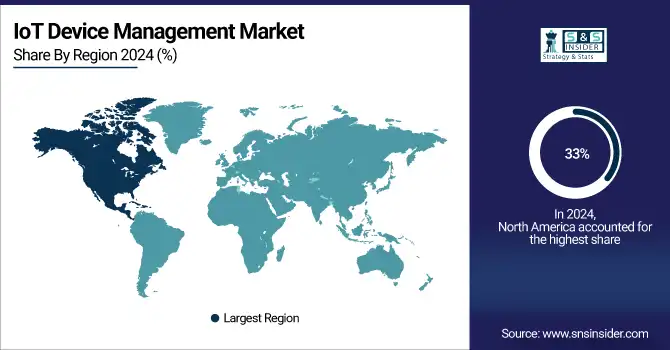

IoT Device Management Market Regional Analysis:

North America IoT Device Management Market Insights

The North America region dominated the same in 2024, by capturing 33% of the total market share. The region's leadership is attributed to advance technological infrastructure, high IoT adoption rates in sectors like healthcare and manufacturing, and supportive government initiatives for secure IoT deployments. The presence of key market players also fuels regional growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific IoT Device Management Market Insights

The Asia Pacific region is expected to have the fastest CAGR of 31.42% during the forecast period of 2025 to 2032. Such rapid growth in this region will be due to the increased usage of IoT technologies in countries like China, India, and Japan, where various industries are digitizing at an incredible pace. The initiatives undertaken by the government regarding smart city projects and development of IoT ecosystems add strength to the market in this region and become a key growth hub for IoT device management solutions.

Europe IoT Device Management Market Insights

Europe’s IoT device management market is expanding due to strong regulatory frameworks, such as GDPR and IoT security standards, driving secure deployments. The region emphasizes interoperability, data protection, and standardization, fueling adoption across smart cities, manufacturing, and healthcare. Investments in Industry 4.0 and sustainability further strengthen IoT growth.

Latin America (LATAM) and Middle East & Africa (MEA) IoT Device Management Market Insights

LATAM and MEA markets are gaining momentum, driven by smart city projects, digital transformation initiatives, and rapid mobile connectivity adoption. Governments and enterprises increasingly leverage IoT for utilities, agriculture, and transport optimization. However, infrastructure gaps and cybersecurity concerns remain challenges, creating opportunities for scalable, secure device management solutions.

IoT Device Management Market Key Players:

Some of the IoT Device Management Market Companies are

-

Google (Nest, Brillo)

-

Amazon Web Services (AWS) (AWS IoT Core, AWS IoT Device Management)

-

Microsoft (Azure IoT Hub, Azure IoT Central)

-

IBM (IBM Watson IoT Platform, IBM Maximo)

-

Cisco Systems (Cisco IoT Control Center, Cisco Kinetic)

-

PTC (ThingWorx, Vuforia)

-

Oracle (Oracle IoT Cloud, Oracle Autonomous Database)

-

SAP (SAP Leonardo IoT, SAP Cloud Platform)

-

Siemens (MindSphere, Siemens Industrial Edge)

-

GE Digital (Predix, Proficy)

-

Intel (Intel IoT Platform, Intel Edge Insights)

-

Qualcomm (Qualcomm IoT Services Suite, Qualcomm Snapdragon)

-

Arm Holdings (Arm Pelion IoT Platform, Arm Cortex-M)

-

Bosch (Bosch IoT Suite, Bosch IoT Edge)

-

Samsung Electronics (Samsung ARTIK, Samsung SmartThings)

-

Huawei (Huawei OceanConnect IoT, Huawei Cloud)

-

Verizon (Verizon ThingSpace, Verizon Smart Communities)

-

AT&T (AT&T IoT Solutions, AT&T Control Center)

-

Vodafone (Vodafone IoT, Vodafone Business IoT)

-

Telit (Telit IoT Platform, Telit DeviceWISE)

-

Belden Inc.

Competitive Landscape for IoT Device Management Market:

Belden Inc. is a leading provider of networking and connectivity solutions, actively supporting the IoT device management market with secure and reliable infrastructure. The company delivers industrial-grade networking, cybersecurity, and automation platforms that enable seamless IoT connectivity, device monitoring, and data management, helping industries optimize operations and ensure secure, scalable deployments.

September 2024: Belden Inc. is a global leading supplier of network infrastructure and digitization solutions. The company has announced that it has integrated the functionality of its CloudRail software with AWS IoT SiteWise. CloudRail was acquired by Belden in 2023. The company enables cloud-based device management that allows users to roll out, manage and update edge devices globally.

Vodafone is a global telecommunications leader with a strong presence in the IoT device management market. Through its Vodafone IoT platform and connectivity solutions, the company enables secure device provisioning, monitoring, and management across industries. Vodafone supports large-scale IoT deployments with reliable connectivity, analytics, and compliance, driving digital transformation worldwide.

January 2023: Vodafone opted for TCS as its partner for superior customer experience in matters such as customer life cycle management, order management, IoT product lifecycle management, billing, device, and customer support. Through TCS HOBS —a cloud-based, pre-integrated IoT subscription management platform built on a catalog-driven architecture — Vodafone Idea could rapidly launch, manage, and monetize IoT services.

| Report Attributes | Details |

| Market Size in 2024 | USD 4.63 Billion |

| Market Size by 2032 | USD 40.15 Billion |

| CAGR | CAGR of 30.97% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Solution (Data Management, Real-Time Streaming Analytics, Remote Monitoring, Security Solutions, Network Bandwidth Management) • By Service (Professional Services, Managed Services) • By Deployment (Public Cloud, Private Cloud, Hybrid Cloud) • By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)) • By End-Use Industry (Retail, Transportation & Logistics, Manufacturing, Healthcare, Utilities, Other End-Use Industries) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Google, Amazon Web Services (AWS), Microsoft, IBM, Cisco Systems, PTC, Oracle, SAP, Siemens, GE Digital, Intel, Qualcomm, Arm Holdings, Bosch, Samsung Electronics, Huawei, Verizon, AT&T, Vodafone, Telit |