Dewatering Equipment Market Report Scope & Overview:

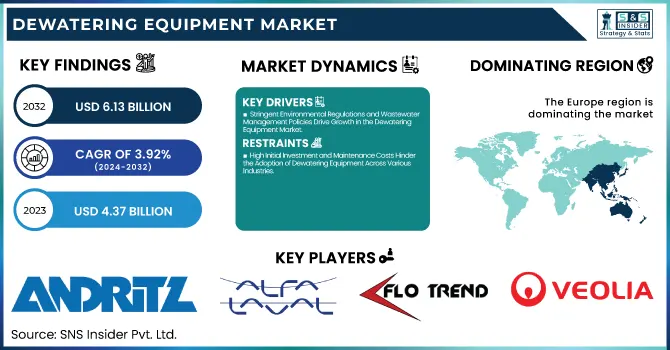

The Dewatering Equipment Market Size was valued at USD 4.37 Billion in 2023 and is expected to reach USD 6.13 Billion by 2032 and grow at a CAGR of 3.92% over the forecast period 2024-2032.

To Get more information on Dewatering Equipment Market - Request Free Sample Report

The Dewatering Equipment Market is witnessing tremendous growth owing to increased industrialization, environmental regulations, and growing wastewater treatment demands. Municipal wastewater, food processing, pharmaceuticals, and mining are some of the major industries responsible for market growth. Advances in technology for centrifuges, belt presses, and filter presses are improving efficiency and sustainability in operation. Sludge management and water conservation concerns also drive demand. With increasing investments and innovations, the dewatering equipment market is set to witness high growth, creating profitable opportunities for manufacturers and service providers worldwide.

The U.S. dewatering equipment market was valued at USD 0.43 billion in 2023 and is projected to reach USD 0.53 billion by 2032, growing at a CAGR of 2.29% from 2024 to 2032. The U.S. dewatering equipment market is driven by stringent environmental regulations, increasing wastewater treatment needs, and growing industrial activities. Municipalities and industries such as food processing, pharmaceuticals, and mining are investing in advanced dewatering technologies like centrifuges, belt presses, and filter presses to improve efficiency and compliance with EPA standards. The rising focus on sustainable water management and sludge disposal is further fueling market demand.

Dewatering Equipment Market Dynamics

Key Drivers:

-

Stringent Environmental Regulations and Wastewater Management Policies Drive Growth in the Dewatering Equipment Market

The growing regulatory enforcement of environmental laws by agencies like the EPA (Environmental Protection Agency) is one of the major drivers for the U.S. dewatering equipment market. The industries are subject to stringent wastewater disposal regulations, resulting in increased use of effective dewatering technologies like centrifuges, belt presses, and filter presses. The increasing focus on sustainable water treatment and sludge treatment in applications such as municipal wastewater treatment, food processing, and pharmaceuticals is also stimulating demand further. With industries looking for cost-saving and environmentally friendly dewatering solutions, innovation in technology and automation in the management of sludge is also driving market growth further.

Restraints

-

High Initial Investment and Maintenance Costs Hinder the Adoption of Dewatering Equipment Across Various Industries

Despite increasing demand, the huge initial capital outlay for dewatering equipment becomes a major bottleneck, especially for small and medium-sized industries. The expense of sophisticated centrifuges, vacuum filters, and belt presses is astronomical, and the companies find it hard to switch to new systems. Also, maintenance costs and the requirement of skilled operators escalate the cost of ownership. These budgetary restrictions restrict mass adoption, particularly in the developing world. Companies tend to look for low-cost substitutes, like outsourcing wastewater treatment services, which can affect the overall growth of the dewatering equipment market.

Opportunities

-

Rising Adoption of Smart and Automated Dewatering Technologies Creates Growth Opportunities in the U.S. Market

The convergence of IoT, AI, and automation in dewatering gear has a large growth potential. Smart monitoring systems and predictive maintenance solutions enhance efficiency, decrease operation downtime, and increase sludge processing precision. Such innovations allow industries to make energy consumption optimal and cut down on manual intervention, making dewatering operations cost-efficient. Increased attention from the U.S. government towards upgrading wastewater treatment facilities is also prompting industries to spend on next-gen dewatering solutions. With industries focusing on sustainability and resource optimization, the implementation of automated dewatering technologies is likely to gain momentum, creating new opportunities for manufacturers and service providers in the industry.

Challenges

-

Fluctuating Raw Material Prices and Supply Chain Disruptions Impact Dewatering Equipment Manufacturing and Market Stability

The fluctuating raw material prices of stainless steel, aluminum, and polymers utilized in the production of dewatering equipment are a challenge to market expansion. Disruptions in supply chains due to international trade barriers, transportation congestion, and geopolitical tensions also affect production costs and delivery timelines. Manufacturers struggle to maintain competitive prices while maintaining product quality and availability. Also, the reliance on imported parts heightens exposure to exchange rate fluctuations and tariff adjustments. To counteract these, businesses are concentrating on localizing supply chains and creating substitute materials to bring stability to dewatering equipment manufacturing and supply.

Dewatering Equipment Market Segment Analysis

By Type

The sludge segment led the Dewatering Equipment Market in 2023 on account of growing wastewater treatment demands in industrial and municipal industries. Increasing sludge disposal regulations have driven demand for effective dewatering technologies. Alfa Laval and Andritz Group are some of the players that have introduced advanced filter presses and centrifuges for effective sludge management. Alfa Laval, for example, recently launched a next-generation decanter centrifuge with enhanced energy efficiency for wastewater treatment facilities. Likewise, Huber Technology broadened its sludge dewatering options to maximize water recovery. Increasing demand for green sludge treatment continues to push innovations and investment in dewatering equipment globally.

The application segment is anticipated to have the highest CAGR during the forecast period, driven by growing industrial and municipal wastewater treatment projects. The use of advanced dewatering solutions is growing across industries like mining, food processing, and pharmaceuticals. Players like Evoqua Water Technologies have introduced high-efficiency filter presses and belt presses, serving industrial applications.

Further, Veolia Water Technologies launched modular dewatering systems for personalized wastewater treatment needs. The requirement for automation and IoT-enabled equipment in wastewater treatment is also driving market growth, with industries looking to save on sludge disposal and enhance water reuse efficiency.

By Technology

The centrifuges segment led the dewatering equipment market in 2023 owing to its efficiency in sludge separation, lower cost of operations, and lesser manual intervention. Centrifuge systems are well-established in municipal wastewater treatment, industrial processing, and oil & gas sectors for their excellent dewatering capability. Alfa Laval, Andritz, and GEA Group have led the technological curve by introducing high-speed, energy-efficient centrifuge models with better automation.

For example, Alfa Laval launched the ALDEC G3 VecFlow, a machine meant to cut power consumption by as much as 30%. Increasing needs for advanced dewatering technologies in wastewater treatment plants continue to support this segment's revenue leadership.

The belt presses segment is projected to register the highest CAGR over the forecast period with growing applications in industrial and municipal wastewater treatment. Belt presses are favored for lower energy use, being cost-effective, and continuous operation as compared to centrifuges. Major players like Huber Technology, Evoqua Water Technologies, and Komline-Sanderson have been introducing advanced models with improved automation and minimized water usage. Evoqua's Envirex Belt Press, which is the latest offering, provides increased throughput with enhanced sludge conditioning. Growing focus on energy-efficient and sustainable dewatering technologies and expanding investments in wastewater treatment infrastructure are fueling quick growth in this market.

Dewatering Equipment Market Regional Outlook

Europe led the dewatering equipment market in 2023 with 52.46% of total revenue, fueled by stringent environmental regulations, sophisticated wastewater treatment infrastructure, and high industrial uptake. The European Union's Urban Wastewater Treatment Directive has enforced rigorous sludge management and water conservation practices, boosting demand for high-efficiency dewatering solutions. Top players like Veolia Water Technologies, Huber SE, and Andritz Group are heavily investing in innovation. Andritz entered the market with its new decanter centrifuge series featuring more energy efficiency and higher sludge handling capacity, and Huber SE entered with new belt filter presses equipped with automatic control systems.

The Asia Pacific dewatering equipment market is expected to register the highest CAGR of 6.67% in the forecast period owing to rapid urbanization, growing industrialization, and expanding investments in wastewater treatment plants. China, India, and Japan are enforcing stricter policies for wastewater management, fueling demand for high-end dewatering technologies. Other companies such as Evoqua Water Technologies, Alfa Laval, and Mitsubishi Kakoki Kaisha are increasing their footprint in the region. Alfa Laval has introduced high-performance decanter centrifuges engineered to meet the specific needs of Asian municipal and industrial applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ANDRITZ - (Decanter Centrifuges, Belt Filter Presses)

-

ALFA LAVAL - (ALDEC G3 Decanter Centrifuge, Solid Bowl Decanter Centrifuge)

-

Flo Trend - (Rotary Drum Vacuum Filters, Belt Filter Presses)

-

Veolia - (Actiflo® Clarification System, Centrifuge dewatering equipment)

-

Fournier Industries - (Fournier Rotary Press, Fournier Vacuum Disc Filters)

-

Griffin Dewatering Corporation - (Hydraulic Dewatering Equipment, Portable Dewatering Pumps)

-

ThyssenKrupp - (Dewatering Screens, Belt Filter Presses)

-

NLMK - (Sludge Dewatering Systems, Vacuum Filters)

-

Aqseptence Group - (Belt Filter Presses, Vacuum Filters)

-

Hitachi Zosen Corporation - (Horizontal Belt Filter Press, Decanter Centrifuges)

-

KONTEK - (Belt Filter Press, Horizontal Vacuum Belt Filters)

-

ENCON Evaporators - (Evaporator Dewatering System, Rotary Evaporators)

Recent Trends

-

October 2023 - ALFA LAVAL Launched advanced sludge dewatering technologies with reduced energy consumption, including an advanced range of centrifugal dewatering systems.

-

December 2023 - ANDRITZ launched its Andritz Separation AD-LEAP decanter centrifuge, focusing on automation and improving dewatering performance for various industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.37 Billion |

| Market Size by 2032 | US$ 6.13 Billion |

| CAGR | CAGR of 3.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type - (Sludge, Application, Industrial, Municipal) • By Technology - (Centrifuges, Belt Presses, Filter Presses, Vacuum Filters, Drying Beds, Sludge Lagoons) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ANDRITZ, ALFA LAVAL, Flo Trend, Veolia, Fournier Industries, Griffin Dewatering Corporation, ThyssenKrupp, NLMK, Aqseptence Group, Hitachi Zosen Corporation, KONTEK, ENCON Evaporators. |