Wrapping Machine Market Report Scope & Overview:

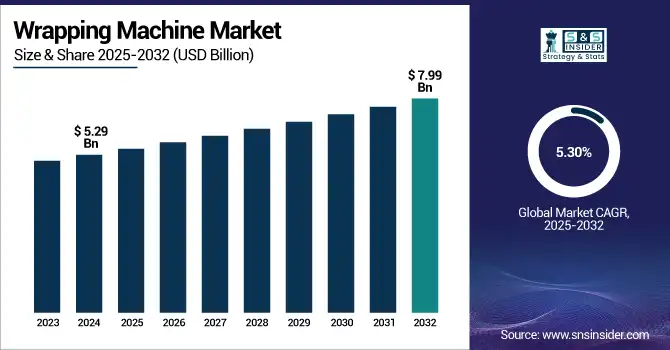

The Wrapping Machine Market size was valued at USD 5.29 billion in 2024 and is expected to reach USD 7.99 billion by 2032, growing at a CAGR of 5.30% over the forecast period of 2025-2032.

To Get more information on Wrapping Machine Market - Request Free Sample Report

The global wrapping machine market is growing at a high rate due to the growing demand for automation in packaging applications from different end-use industries such as food & beverage, pharmaceuticals, logistics, e-commerce, and so on. So, wrapping machines are used for protecting the product, decreasing the wastage of production materials, and adding efficiency to the packaging process. Stretch wrapping equipment accounts for a substantial portion of these, as it securely stabilizes pallet loads for transport. The adoption of smart and energy-efficient machines supporting high retrieval speeds with industry 4.0 technologies drives the wrapping machine industry. Some of the trends include the expanding use of recyclable & biodegradable films, compact & mobile wrapping units, and the integration of IoT and AI that offer real-time monitoring and predictive maintenance.

There is also a shift in the market for sustainable packaging owing to environmental regulations and demand from consumers. The Asia-Pacific region dominates the volume market due to its strong manufacturing base, while North America and Europe are targeted towards technologically advanced and automated solutions. The wrapping machine market growth is driven sustainably by such kind of continuous innovations, automation expansion of end-use industries. As global trade, logistics, and volumes become more significant than ever, Demand for wrapping machines will continue to drive the integrity of product & efficiency of operation.

Wrapping Machine Market Dynamics

Drivers

-

Automation and efficiency are driving forces in the market, enabling high-speed, precise, and scalable packaging solutions across industries.

Automation and efficiency play an important role in shaping the wrapping machine market due to growing industries with the aim of cost-effective operations. Wrapping machines automate the wrapping process, making it faster and improving consistency and accuracy, thereby reducing reliance on human labor and operational errors. These machines allow for continuous and high-volume packaging processes to help manufacturers keep up with demand and push out consistent quality. Automated solutions optimize throughput and minimize downtime by integrating components like programmable logic controllers (PLCs), servo motors, and real-time monitoring solutions. Such a transition is extremely beneficial in industries such as food, pharma, and e-commerce, where packaging speed as well as hygiene are of utmost importance. With increasing labor costs and the need for operations to be scalable, automation is becoming vital for every industry to remain competitive and keep their operations running efficiently in the long run.

In May 2025, The Financial Times article “March of the Cobots” reports a surge in collaborative robots (cobots), which are compact, safe, and ideal for small and medium enterprises. Cobots made up 11% of industrial robot installations in 2023, generating $3 billion in sales with over 30% annual growth. They handle tasks like packing, welding, and inspection alongside humans, reducing exposure to dangerous or repetitive work. Key players include Universal Robots, ABB, Fanuc, and Kuka.

Restraint

-

High upfront costs limit SME adoption of advanced wrapping machine technologies.

The high initial investment for wrapping machines is a major restraint, especially for small and medium enterprises (SMEs), which is one of the major factors hindering the growth of the wrapping machine market. Modern wrapping machines, particularly fully automatic or robotic, require significant initial investment costs, including the cost of the machine itself, installation, and integration within already existing production lines. They typically require special infrastructure and trained personnel, further adding to the initial cost. The outlay on such investments is prohibitive and often retards the plans of many SMEs working with limited budgets, for modernizing their operations. Additionally, constant upgrading or modifying equipment so that it can better accommodate changing packaging specifications and materials only compounds the cost burden. Because of this, and while more efficient and ultimately cost-saving in the long term, the steep up-front cost discourages many smaller operators from seeking advanced wrapping technologies.

Wrapping Machine Market Segmentation Analysis

By Type

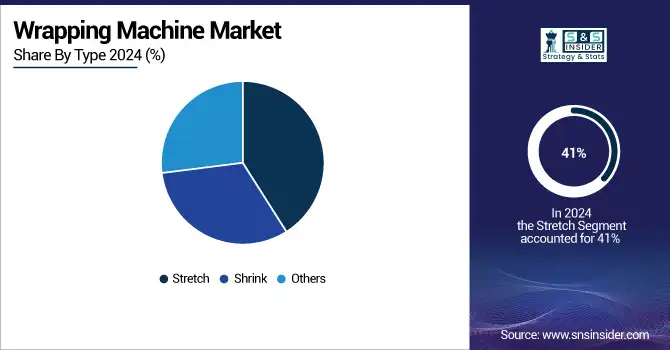

Stretch segment dominated the market and accounted for 41% of the Wrapping Machine market share. Because of the ability to utilize pallet loads, lower damage to products, and better warehouse operations, these machines are common within the industry. High demand for logistics, food & beverage, and consumer goods sectors has propelled their dominance. Moreover, stretching wrapping provides cost benefits by reducing film use and increasing load stability, which are important for manufacturers oriented towards operational efficiency and consistency of packaging.

Shrink wrapping machines are the fastest growing segment, driven by rising demand for tamper-proof, secure, and visually appealing packaging. They are increasingly popular due to their flexibility to bundle a variety of products, especially food, beverages, and pharmaceuticals. This is further fueling their growth due to greater adoption in the retail and e-commerce space, where product visibility and protection are essential. Technological improvements like energy-efficient shrink tunnels and sustainable film materials are also growing their market share.

By Mode of Operation

Semi-automatic wrapping machines held the largest market share at 50% in 2024, mainly due to their economy, simplicity of operation, and versatility, which work best for small-to-medium enterprises. Designed for medium-volume end-user industries, these machines are the right choice for those who are not ready to shift to fully automatic machines, but want everything to be as ballpark as possible. The lower cost of both the initial investment as well as maintenance (compared with fully automatic systems) means solid penetration in emerging markets and small to medium enterprises looking to increase packaging throughput without significant capex commitment.

Automatic wrapping machines are witnessing the fastest growth owing to the continuous trends of automation in the manufacturing and packaging industries. They increase the production efficiency, eliminate the need for human labor, and reduce the scope of human error; hence, they are the most suitable form of production. Automatic systems are gaining preference in high-throughput industries requiring uniformity in packaging. Additionally, with IoT and smart factory integration, these machines are becoming increasingly smart and functional, which is driving their adoption in multiple sectors, including food, pharmaceuticals, and logistics.

By Application

The food segment led the wrapping machine market in 2024 with a 32% share, due to increasing demand for packaged and processed food worldwide. Wrapping machines are so important as they ensure hygiene in the product, the long life of the product, uncompleted compliance with health standards. Rising demand for ready-to-eat meals, frozen foods, and snacks, especially in urban areas, is expected to drive the growth of the food packaging equipment over the forecast period.

The pharmaceutical segment is the fastest-growing application segment, owing to various factors such as increasing packaging regulation, rising global/ever-expanding healthcare demand, as well as an ever-growing e-pharmacy channel. Some of the major functions of a wrapping machine include tamper-evidence, contamination protection, and regulatory norms compliance in drug packaging. In light of the growing demand for safe, secure and traceable packages of medicines, which has only been intensified by the post-COVID world, pharmaceutical players are swiftly implementing high-tech wrapping systems to ensure product integrity and transparency of the supply chain.

Wrapping Machine Market Regional Outlook

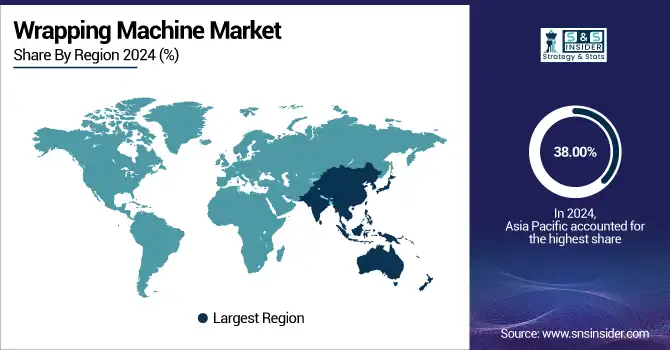

Asia-Pacific held the dominant position in the global wrapping machine market, accounting for 38.00% of the total share in 2024. Demand for the region's bastion is fueled by the swift growth of manufacturing sectors, particularly in China, India, and Southeast Asia. The boom in packaged food, consumer goods, and pharmaceutical consumption is driving demand for automated packaging. Additionally, local manufacturers, favorable cost, and growing investments in industrial automation are expected to fuel the steady market growth. Asia-Pacific continues to be a premier market as a result of government efforts to upgrade its food processing and industrial sectors.

China is both the dominant and fastest-growing country in the Asia-Pacific wrapping machine market. The dominance of the market is driven by vast manufacturing base, high consumption of packaged goods and strong local machine makers. It is driven by rapid industrial automation, support from the government, and surging exports. In addition, the rising demand from food, pharma, and e-commerce sectors increases the requirement for superior wrapping solutions.

Latin America is emerging as the fastest-growing region in the wrapping machine market. Countries like Brazil, Mexico, and Argentina are witnessing increased demand for modern packaging technologies due to expanding food and beverage, pharmaceutical, and e-commerce industries. Rising consumer awareness of product safety and shelf life, coupled with economic development and growing industrialization, is pushing regional manufacturers to adopt advanced wrapping machinery. Additionally, foreign investments and trade liberalization are enabling access to high-tech packaging equipment, driving rapid growth in this region compared to others.

North America holds a significant share of the wrapping machine market due to its advanced industrial infrastructure and early adoption of automation technologies. In the US and Canada, the dynamic impetus of producers in food processing, personal care, and logistics is also very crucial. The demand for automatic and stretch wrapping equipment is primarily driven by the need to maintain high standards for packaging quality, improve operational efficiency, and minimize labor costs. In addition, constant product innovation from major market players, along with a mature e-commerce ecosystem, helps keep demand afloat, allowing North America to remain relevant as an important market despite lower growth rates compared to faster-growing regions.

The U.S. wrapping machine market is expected to grow from USD 0.63 billion in 2024 to USD 0.96 billion by 2032, registering a CAGR of 5.32%. Driven by rising automation and the thriving food, pharma, and e-commerce sectors with a mature industrial base supporting it. North America is the prominent region of packaged and transparent films, with the U.S. sales emerging as the largest market, propelling by continuous technological innovation and packaging solutions with an emphasis on efficiency.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Wrapping Machine Companies are Lantech, Matco International, Syntegon Technology GmbH, Orion Packaging Systems LLC, I.M.A. Industria Macchine Automatiche S.p.A., Phoenix Wrappers, Robopac, Coesia S.p.A, Durapak, ProMach Inc.

Recent Development

-

In November 2024, Lantech upgraded its automatic stretch wrapper lineup with next-gen Metered Film Delivery for improved film control and fewer breaks. Key features like Power Roller Stretch Plus, Pallet Grip, and Load Seeking Clamp 4.0 were standardized across models. Additionally, optional LINC IoT connectivity was introduced to enable real-time monitoring and analytics.

-

In October 2023, Matco Tools, a renowned supplier of high-quality tools, introduced its latest diagnostic scan tool, the Maximus Plus. Specifically designed for automotive technicians, the Maximus Plus offers comprehensive coverage, OE-level capabilities, and the convenience of Android technology in a single, powerful device.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.29 Billion |

| Market Size by 2032 | USD 7.99 Billion |

| CAGR | CAGR of 5.30% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Stretch, Shrink, Others) • By Mode of Operation (Automatic, Semi-Automatic) • By Application (Food, Beverages, Chemicals, Personal Care, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Lantech, Matco International, Syntegon Technology GmbH, Orion Packaging Systems LLC, I.M.A. Industria Macchine Automatiche S.p.A., Phoenix Wrappers, Robopac, Coesia S.p.A, Durapak, ProMach Inc. |