The dialysis equipment market size was valued at USD 98.57 billion in 2024 and is expected to reach USD 191.24 billion by 2032, growing at a CAGR of 8.65% over the forecast period of 2025-2032.

The dialysis device market is transforming significantly on account of the high incidence rate of end-stage renal disease (ESRD), coupled with the increasing geriatric population and incidence rate of kidney failure associated with diabetes and hypertension. More than 37 million U.S. adults have chronic kidney disease (CKD), and over 800,000 are living with ESRD, over 70% of whom are on dialysis, according to the CDC. Development of home-based hemodialysis machines, including economic NxStage machines and wearable artificial kidneys, is transforming the dynamics of the dialysis equipment market.

The U.S. dialysis device market is moving toward home dialysis, facilitated by reimbursement policies from CMS and Medicare coverage expansion. Contributing to the growth of the dialysis apparatus market are additional R&D investments, something that is shown in the 2024 USRDS report and indications of increased uptake of home dialysis technologies. There is also increased demand through technology integration dialysis machine market with devices for monitoring patients remotely and for AI-based diagnostics. Emphatically, in countries such as India, dialysis access is being increased on the PPP model, which makes an immense impact on the global dialysis equipment market trends.

According to the 2024 USRDS Annual Data Report, home dialysis use in the U.S. increased 6.4% due largely to policy changes and the pandemic-inspired push for home health care (homedialysis.org).

The dominance of companies, such as Fresenius Medical Care and Baxter International, also plays a significant role in the dialysis equipment market share, as most of these companies invest in novel systems. Government regulatory bodies, including the FDA and the NHS, are instrumental in driving approval of home and portable dialysis systems. There is a growing trend toward newer HD machines with more user-friendly features, particularly in the hemodialysis and peritoneal dialysis industry, according to the AJKD journal. Supply chain enhancement, onboarding of digital health, and a rise in public-private investments in dialysis infrastructure also drive the growth of the kidney dialysis equipment market. Simultaneously, there is an increase in the dialysis devices market size due to government funding at the global level and a higher occurrence of CKD, particularly among city dwellers who lead a sedentary lifestyle.

Fresenius achieved a breakthrough in transportable hemodialysis devices and remote monitoring novelties, thereby attesting its resolve to adopt novel technologies, and emerged as a prime player in the dialysis equipment market analysis (AJKD, 2024).

Market Dynamics:

Drivers:

Rising Disease Prevalence, Increasing Investments, And Technological Innovation Fueling the Growth of the Dialysis Equipment Market

Increasing incidences of chronic kidney disease (CKD) and end-stage renal disease (ESRD) are boosting the dialysis equipment market growth. The CDC estimates that 15% of the U.S. adult population is affected by CKD and that 130,000 new cases of ESRD are diagnosed annually. Additionally, the increasing population of aging and diabetes patients is further raising the demand for innovative dialysis techniques. The rise in R&D spending by dialysis device manufacturers, such as Asahi Kasei Corporation and Nipro Corporation, is driving innovation.

For instance, Asahi Kasei recently increased the number of its dialysis R&D centers to work on faster hemodialysis membranes. In addition, the payment models, such as ESRD Treatment Choices (ETC) of CMS, are leading towards acceptance of home-based treatments, thereby influencing the U.S. dialysis equipment market. Regulatory approval is a factor, too, and FDA approval of the Tablo Hemodialysis System (Outset Medical) for home use shows a growing trend towards innovative approval.

Furthermore, in the global dialysis consumables supply chain, manufacturers are scaling up to increase their distribution capacity and maintain a ready supply of machines and equipment. Another driver driving the growth of the global dialysis equipment market is the WHO's global action plan on NCDs, which urges governments to build kidney care infrastructure. All of these drivers cumulatively lead to growing demand and maintaining dialysis equipment market trends.

Restraints:

High Treatment and Equipment Costs, Limited Infrastructure, and Patient Access Barriers Hinder the Dialysis Equipment Market Growth

The average dialysis treatment expense for a patient in the U.S. is more than USD 90,000 per year, or so high and remains out of reach for most patients, as reported by the National Kidney Foundation. Dialysis is not available in many low- and middle-income countries due to limited trained staff and facilities, and the kidney dialysis equipment market is feeling the rippling effects.

Furthermore, the high percentage of device recalls owing to mechanical issues and product safety concerns leads to reluctance among healthcare providers. In 2022, for instance, a recall by Baxter on alarms that were not setting properly on some machines raised reliability concerns. Further, cumbersome regulatory channels delay the introduction of advanced dialysis devices, specifically portable and AI-based machines. The FDA’s 510(k) process for Class II devices is cumbersome and slows time-to-market.

Global events, such as the current COVID-19 pandemic, have revealed equipment and component supply chain downfalls that can impact patient care. In addition, the R&D process takes time and money, as investments take time to mature into ROI, dissuading smaller dialysis equipment providers from entering the market.

Segmentation Analysis:

By Type

The dialysis equipment market was led by the hemodialysis equipment segment in 2024, which captured 78% of the overall market share. This supremacy is driven by its widespread application in the management of acute and chronic kidney failure, especially when immediate and controlled intervention is necessary, as in clinical care. Strong market presence, established reimbursement structures, and availability of highly developed hemodialysis machines are some of the factors responsible for its strong position. Besides, hemodialysis is one of the common front-line treatments for ESRD patients, particularly in well-developed health care countries.

Peritoneal dialysis equipment is growing at the highest CAGR due to the availability of home-based treatment and fewer dietary restrictions for the patients. Rising awareness, development in catheter technologies, and backing from initiatives, such as the U.S. CMS ESRD treatment choices model, are responsible for this whole paradigm shift. Moreover, peritoneal dialysis is also associated with lower infection rates and cost effectiveness, giving it greater attractiveness in developed and developing health care systems.

By End User

Dialysis centers and hospitals were the highest in terms of the value of the dialysis equipment market, representing more than 70% of the overall demand, in 2024. The credit for this supremacy lies largely in the presence of well-trained nephrologists, sophisticated dialysis infrastructure, and the ability to handle huge patient numbers. These centers also provide 24hours-365days monitoring and emergency services, both of which are necessary for patients with advanced renal disease. Also, the majority of initial dialysis treatments start in a hospital, and then you are referred to a long-term care facility.

Home healthcare is the fastest growing segment owing to increasing patients’ preference for home treatment, continuous technological advancements, such as compact and wearable dialysis machines, supporting cost reduction to the public health system at the policy level. Initiatives such as the “Advancing American Kidney Health” program in the U.S. have encouraged the adoption of home dialysis. Better telehealth/remote monitoring. Faster, more patients and providers are taking treatment outside the clinical setting into their own hands.

Regional Analysis:

Asia Pacific dominated the market in 2024 on account of the increasing number of CKD patients, healthcare infrastructure development, and urbanization. China is the largest contributor, with 130 million people suffering from CKD, which will bring substantial demand for both hemodialysis and peritoneal dialysis products. Similarly, government initiatives as “Healthy China 2030” of China are enhancing accessibility and funding of renal care. Another booming market is India, with the Pradhan Mantri National Dialysis Program and private investments in dialysis centres fueling growth.

Europe is anticipated to be the fastest-growing region contributing to the dialysis equipment market share, owing to universal healthcare systems, a rising geriatric population, and rising penetration of peritoneal dialysis. Germany is the region’s largest market, with a significant prevalence of diabetes-related kidney failure and the presence of numerous outpatient dialysis centers. Germany performs more than 100,000 dialysis sessions yearly (Eurostat). The U.K. and France are progressing swiftly with home dialysis offerings and have companies benefiting from NHS and government self-care programs. Italy and Spain are building their dialysis resources through regional government initiatives and collaborations with medical device companies. Eastern European nations, such as Poland and Turkey, are gaining greater market momentum in response to healthcare modernization and growing ESRD incidence. Integrating AI and IoT in dialysis monitoring across Europe is also driving further market expansion.

The global dialysis equipment market for North America was the second most prominent owing to the increasing incidence of CKD, developed healthcare infrastructure, and favorable reimbursement policies. The U.S. dialysis equipment market size was valued at USD 15.64 billion in 2024 and is expected to reach USD 25.54 billion by 2032, growing at a CAGR of 6.37% over the forecast period of 2025-2032. The U.S. dominated the region owing to the presence of more than 800,000 ESRD patients and nearly 500,000 on dialysis in the 2024 USRDS report. The U.S. government’s efforts, in programs such as the “Advancing American Kidney Health” policy and Medicare’s backing of home dialysis, have brought about far wider access and use. The renal market in Canada is heading for sustained growth, after years of slow growth, supported by greater interest in the development of renal care and home-based therapies. Mexico, with less infrastructure availability, is now investing in public–private partnerships to expand access to dialysis in these same underserved areas. North America’s supremacy is backed by the constant focus of leading players, including dialysis equipment companies, on R&D, and the increasing acceptance of home hemodialysis.

The leading players operating in the market are Fresenius Medical Care, Baxter International Inc., B. Braun Melsungen AG, Nipro Corporation, Nikkiso Co., Ltd., Asahi Kasei Corporation, JMS Co., Ltd., Toray Medical Co., Ltd., Medtronic plc, and Rockwell Medical Inc.

In May 2025, the Delhi government installed 300 dialysis machines across 16 government hospitals under the Pradhan Mantri National Dialysis Programme (PMNDP) and the Public-Private Partnership (PPP) Dialysis Project, aiming to provide free and subsidized kidney care to underprivileged patients.

In March 2025, the Nigerian government approved an 80% subsidy on kidney dialysis, reducing the cost per session from ₦50,000 to ₦12,000, to alleviate the burden on the estimated 230,000 patients sharing 354 dialysis machines nationwide.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 98.57 Billion |

| Market Size by 2032 | USD 191.24 Billion |

| CAGR | CAGR of 8.65% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hemodialysis Equipment (Hemodialysis Machines, Hemodialysis Consumables, Peritoneal Dialysis Equipment (Peritoneal Dialysis Equipment Type), Peritoneal Dialysis Product (Cyclers, Fluids, Other Accessories)) • By End User (Dialysis Centers and Hospitals, Home Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Fresenius Medical Care, Baxter International Inc., B. Braun Melsungen AG, Nipro Corporation, Nikkiso Co., Ltd., Asahi Kasei Corporation, JMS Co., Ltd., Toray Medical Co., Ltd., Medtronic plc, and Rockwell Medical Inc. |

Ans: The Dialysis Equipment market is anticipated to grow at a CAGR of 8.65% from 2025 to 2032.

Ans: The market is expected to reach USD 191.24 billion by 2032, increasing from USD 98.57 billion in 2024.

Ans: Increasing incidences of chronic kidney disease (CKD) and end-stage renal disease (ESRD) are boosting the growth of the dialysis equipment industry.

Ans: The high treatment and equipment costs, limited infrastructure, and patient access barriers hinder the dialysis equipment market growth.

Ans: Asia Pacific dominated the Dialysis Equipment market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Chronic Kidney Disease (CKD) and End-Stage Renal Disease (ESRD) Prevalence (2024)

5.2 Dialysis Modality Trends, by Region (2024)

5.3 Healthcare Spending on Dialysis Care, by Region and Payer Type (2024)

5.4 Number of Dialysis Centers and Capacity, by Region (2024)

5.5 Technological Adoption and Innovation Trends (2024)

6. Competitive Landscape

6.1 List of Major Companies By Region

6.2 Market Share Analysis By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion Plans and New Product Launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Dialysis Equipment Market Segmentation By Type

7.1 Chapter Overview

7.2 Hemodialysis Equipment

7.2.1 Hemodialysis Equipment Market Trend Analysis (2021-2032)

7.2.2 Hemodialysis Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Hemodialysis Machines

7.2.3.1 Hemodialysis Machines Market Trend Analysis (2021-2032)

7.2.3.2 Hemodialysis Machines Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.3 n-Center Hemodialysis Machines

7.2.3.3.1 n-Center Hemodialysis Machines Market Trend Analysis (2021-2032)

7.2.3.3.2 n-Center Hemodialysis Machines Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.4 Home-Based Hemodialysis Machines

7.2.3.4.1 Home-Based Hemodialysis Machines Market Trend Analysis (2021-2032)

7.2.3.4.2 Home-Based Hemodialysis Machines Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Hemodialysis Consumables

7.2.4.1 Hemodialysis Consumables Market Trend Analysis (2021-2032)

7.2.4.2 Hemodialysis Consumables Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4.3 Dialyzers

7.2.4.3.1 Dialyzers Market Trend Analysis (2021-2032)

7.2.4.3.2 Dialyzers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4.4 Dialysate

7.2.4.4.1 Dialysate Market Trend Analysis (2021-2032)

7.2.4.4.2 Dialysate Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4.5 Access Products

7.2.4.5.1 Access Products Market Trend Analysis (2021-2032)

7.2.4.5.2 Access Products Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4.6 Others

7.2.4.6.1 Others Market Trend Analysis (2021-2032)

7.2.4.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Peritoneal Dialysis Equipment

7.3.1 Peritoneal Dialysis Equipment Market Trends Analysis (2021-2032)

7.3.2 Peritoneal Dialysis Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Peritoneal Dialysis Equipment Type

7.3.3.1 Peritoneal Dialysis Equipment Type Market Trends Analysis (2021-2032)

7.3.3.2 Peritoneal Dialysis Equipment Type Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3.3 Continuous Ambulatory Peritoneal Dialysis (CAPD)

7.3.3.3.1 Continuous Ambulatory Peritoneal Dialysis (CAPD) Market Trends Analysis (2021-2032)

7.3.3.3.2 Continuous Ambulatory Peritoneal Dialysis (CAPD) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3.4 Automated Peritoneal Dialysis (APD)

7.3.3.4.1 Automated Peritoneal Dialysis (APD) Market Trends Analysis (2021-2032)

7.3.3.4.2 Automated Peritoneal Dialysis (APD) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Peritoneal Dialysis Product

7.3.4.1 Peritoneal Dialysis Product Market Trends Analysis (2021-2032)

7.3.4.2 Peritoneal Dialysis Product Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4.3 Cyclers

7.3.4.3.1 Cyclers Market Trends Analysis (2021-2032)

7.3.4.3.2 Cyclers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4.4 Fluids

7.3.4.4.1 Fluids Market Trends Analysis (2021-2032)

7.3.4.4.2 Fluids Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4.5 Other Accessories

7.3.4.5.1 Other Accessories Market Trends Analysis (2021-2032)

7.3.4.5.2 Other Accessories Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Dialysis Equipment Market Segmentation By End User

8.1 Chapter Overview

8.2 Dialysis Centers and Hospitals

8.2.1 Dialysis Centers and Hospitals Market Trends Analysis (2021-2032)

8.2.2 Dialysis Centers and Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Home Healthcare

8.3.1 Home Healthcare Market Trends Analysis (2021-2032)

8.3.2 Home Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Dialysis Equipment Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.2.3 North America Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.2.4 North America Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.2.5.2 USA Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.2.6.2 Canada Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.2.7.2 Mexico Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.3 Europe

9.3.1 Trends Analysis

9.3.2 Europe Dialysis Equipment Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.3.3 Europe Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.4 Europe Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.3.5 Germany

9.3.5.1 Germany Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.5.2 Germany Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.3.6 France

9.3.6.1 France Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.6.2 France Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.3.7 UK

9.3.7.1 UK Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.7.2 UK Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.3.8 Italy

9.3.8.1 Italy Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.8.2 Italy Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.3.9 Spain

9.3.9.1 Spain Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.9.2 Spain Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.3.10 Poland

9.3.10.1 Poland Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.10.2 Poland Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.3.11 Turkey

9.3.11.1 Turkey Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.11.2 Turkey Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.3.12 Rest of Europe

9.3.12.1 Rest of Europe Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.3.12.2 Rest of Europe Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Dialysis Equipment Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.4.3 Asia Pacific Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.4 Asia Pacific Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.5.2 China Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.5.2 India Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.5.2 Japan Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.6.2 South Korea Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.4.7 Singapore

9.4.7.1 Singapore Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.7.2 Singapore Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

8.4.8 Australia

8.4.8.1 Australia Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

8.4.8.2 Australia Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.4.9 Rest of Asia Pacific

9.4.9.1 Rest of Asia Pacific Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.4.9.2 Rest of Asia Pacific Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.5 Middle East & Africa

9.5.1 Trends Analysis

9.5.2 Middle East & Africa Dialysis Equipment Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.5.3 Middle East & Africa Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.4 Middle East & Africa Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.5.5 UAE

9.5.5.1 UAE Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.5.2 UAE Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.5.6 Saudi Arabia

9.5.6.1 Saudi Arabia Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.6.2 Saudi Arabia Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.5.7 Qatar

9.5.7.1 Qatar Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.7.2 Qatar Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.5.8 South Africa

9.5.8.1 South Africa Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.8.2 South Africa Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.5.9 Middle East & Africa

9.5.9.1 Middle East & Africa Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.5.9.2 Middle East & Africa Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Dialysis Equipment Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.6.3 Latin America Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.6.4 Latin America Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.6.5.2 Brazil Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.6.6.2 Argentina Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

9.6.7 Rest of Latin America

9.6.7.1 Rest of Latin America Dialysis Equipment Market Estimates and Forecasts, By Type (2021-2032) (USD Billion)

9.6.7.2 Rest of Latin America Dialysis Equipment Market Estimates and Forecasts, By End User (2021-2032) (USD Billion)

10. Company Profiles

10.1 Fresenius Medical Care

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 Baxter International Inc.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product/ Services Offered

10.2.4 SWOT Analysis

10.3 B. Braun Melsungen AG

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product/ Services Offered

10.3.4 SWOT Analysis

10.4 Nipro Corporation

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product/ Services Offered

10.4.4 SWOT Analysis

10.5 Nikkiso Co., Ltd.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product/ Services Offered

10.5.4 SWOT Analysis

10.6 Asahi Kasei Corporation

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product/ Services Offered

10.6.4 SWOT Analysis

10.7 JMS Co., Ltd.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product/ Services Offered

10.7.4 SWOT Analysis

10.8 Toray Medical Co., Ltd.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product/ Services Offered

10.8.4 SWOT Analysis

10.9 Medtronic plc

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product/ Services Offered

10.9.4 SWOT Analysis

10.10 Rockwell Medical Inc.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

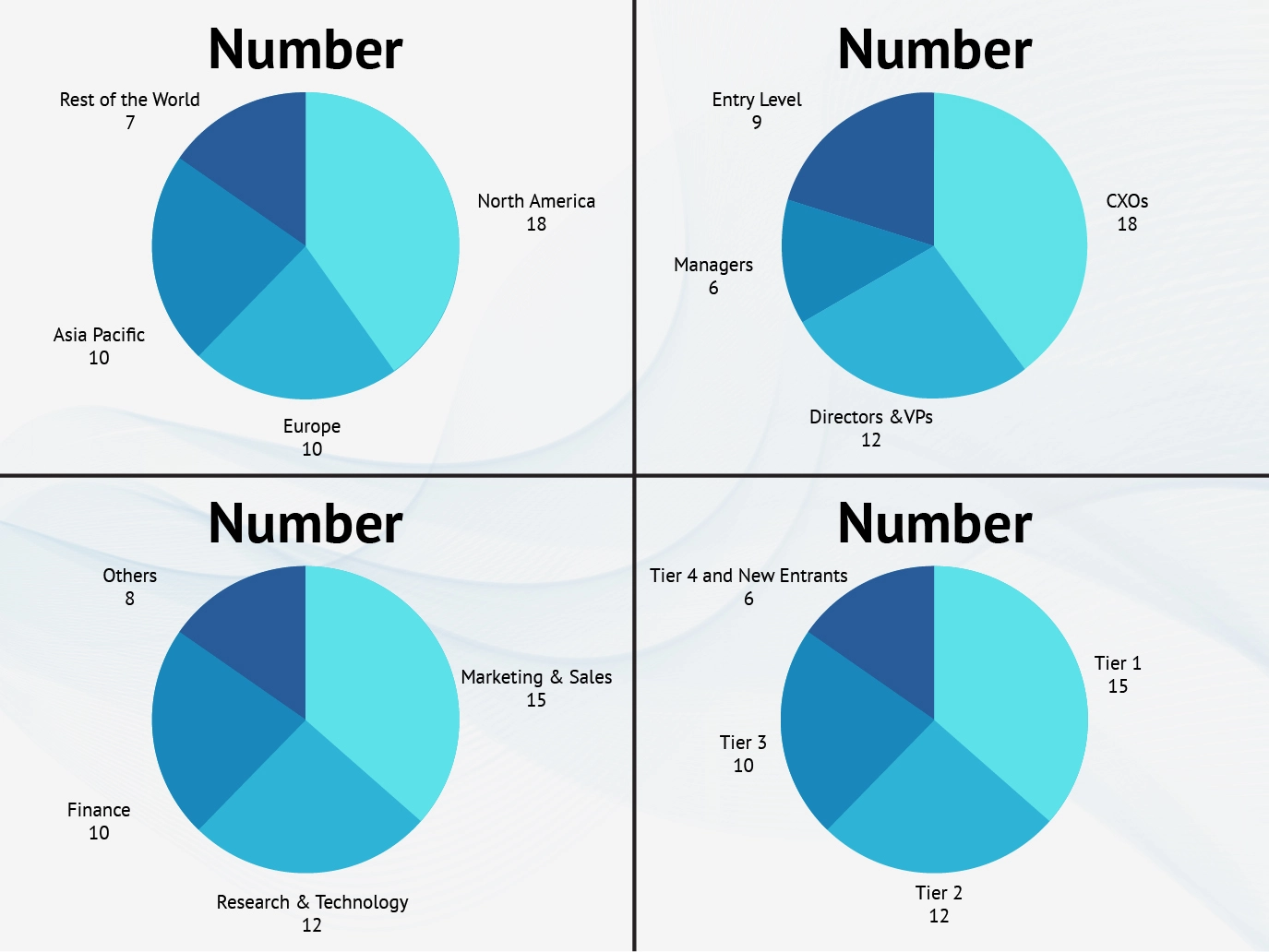

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Type

Hemodialysis Equipment

Hemodialysis Machines

n-Center Hemodialysis Machines

Home-Based Hemodialysis Machines

Hemodialysis Consumables

Dialyzers

Dialysate

Access Products

Others

Peritoneal Dialysis Equipment

Peritoneal Dialysis Equipment Type

Continuous Ambulatory Peritoneal Dialysis (CAPD)

Automated Peritoneal Dialysis (APD)

Peritoneal Dialysis Product

Cyclers

Fluids

Other Accessories

By End User

Dialysis Centers and Hospitals

Home Healthcare

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Poland

Turkey

Rest of Europe

Asia Pacific

China

India

Japan

South Korea

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

UAE

Saudi Arabia

Qatar

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g., Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players