Plasma Therapy Market Size & Overview:

Get more information on Plasma Therapy Market - Request Sample Report

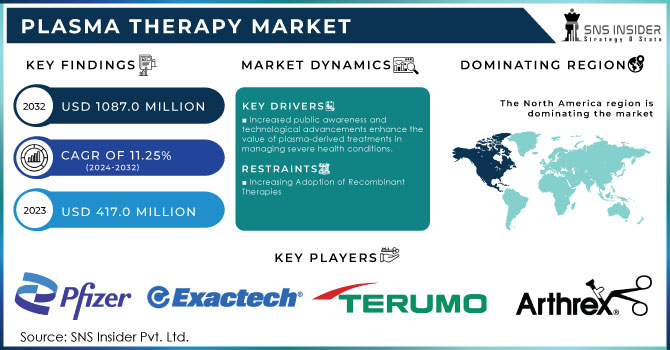

The Plasma Therapy Market Size was valued at USD 417.0 million in 2023 and is expected to reach USD 1087.0 million by 2032 and grow at a CAGR of 11.25% over the forecast period 2024-2032.

Growth in the global plasma therapy market is accelerating rapidly due to the increasing incidents of life-threatening diseases, like different types of neurological disorders-chronic inflammatory demyelinating polyneuropathy (CIDP), idiopathic thrombocytopenic purpura (ITP), and multifocal motor neuropathy (MMN). The increasing incidents of contagious diseases like hepatitis A and B, tetanus, and rabies will also act as a healthy influence that is believed to change the inclination of the market in the coming years. The geriatric population also has more diminished immune systems and they are more susceptible to infectious diseases, thus adding up the demand for plasma therapy, hence supporting the overall growth in the market. CIDP, which accounts for 0.7 to 10.3 cases per 100,000, involving 1–2 new cases every year, fuels the demand for plasma-based treatments in the Plasma Therapy Market. Plasma therapy also has an indispensable role in the treatment of ITP, where the immune system mistakenly attacks the platelets. Simultaneously, with a prevalence of 1.33 cases per 100,000, Multifocal Motor Neuropathy patients also gain considerably from plasma therapy, thereby fueling the market.

The two major growth drivers for the market are the increasing incidence of orthopedic disorders and androgenic alopecia, diseases that plasma therapy can treat with protein substitution. The development in techniques related to plasma fractionation has allowed the manufacture of multiple plasma-derived therapies and thus life-altering drugs to be administered to patients with chronic and debilitating diseases such as hemophilia and congenital immunodeficiencies. Plasma products have established an indispensable role in the management and prevention of bleeding disorders and autoimmune diseases. Plasma products are major contributors to medical treatment and prophylaxis.

Advances in technology have emerged as a driver in the market. New separator technologies, to give an example, have acquired significant importance in meeting the resultant demand for plasma-derived therapies, just like in the case of the Rika Plasma Donation System. In 2021, for instance, GEA provided separator technology to Biopharma S.A. in Ukraine used for plasma fractionation processes. Other collaborations among pharmaceutical firms in the development of medicines, including in response to public health issues such as that presented by COVID-19, have also increased in the market.

Table 1: Regulatory Landscape for Plasma Therapy in Key Regions

|

Region |

Regulatory Body |

Key Regulations and Guidelines |

|---|---|---|

|

North America (USA) |

FDA |

Approval for PRP treatments in specific uses |

|

Europe (EU) |

EMA |

CE marking requirements for plasma devices |

|

Asia Pacific (Japan, China) |

PMDA, NMPA |

Strict guidelines for blood-derived products |

|

Middle East & Africa |

Ministry of Health (Various) |

Limited regulations, emerging market |

|

Latin America |

ANVISA |

Increasing focus on plasma therapy standards |

Plasma Therapy Market Dynamics

Drivers

-

Increased public awareness and technological advancements enhance the value of plasma-derived treatments in managing severe health conditions.

The surge in COVID-19 cases worldwide has significantly affected the plasma therapy market because the plasma of recovered patients has become more highly valued as a potential treatment for the virus. These are targeting only SARS-CoV-2, and with the positive responses after transfusing such plasma into infected patients, interest in plasma therapy has mounted with its promise in managing an increasingly high level of cases.

An added factor contributing to the demand for plasma therapy is public awareness of diseases and appropriate treatments available. Benefits of plasma-derived therapies towards patients, as informed by healthcare providers, continue increasing their utilization in clinical settings.

Pharmaceutical and biopharmaceutical companies are rapidly expanding collaborations and partnerships driving this market demand. For instance, in November 2022, Australia-based biotechnology company CSL agreed to license Translational Sciences, Inc. with the development of an anti-α2-antiplasmin monoclonal antibody TS23. This candidate aims to be the first to break thrombi responsible for grave conditions such as pulmonary embolism, which is the cause of severe issues like acute ischemic stroke, and its future evaluation in the U.S. within the NAIL-IT Phase II study, assessing the safety in patients with intermediate-risk pulmonary embolism.

The development of new technologies in plasma therapy also assists growth in the market. In March 2021, Grifols, S.A. announced that DG Reader Net, a semi-automated analyzer has been installed to increase pre-transfusion blood type compatibility testing in North America. Such new developments much do towards streamlining the process in plasma therapy and improving patient outcomes, which fuel further growth in the sector.

Restraints

-

Increasing Adoption of Recombinant Therapies

-

Safety Concerns Associated with Plasma Products

Plasma Therapy Market - Key Segmentation

by Type

In 2023, pure PRP captured almost 40.0% revenue share in the plasma therapy market. Its success is due to it being an effective and handy treatment for almost all medical applications such as orthopedics, dermatology, and dental procedures. Pure PRP contains high concentrations of platelets proven for healing and diminishing the recovery time. The clinical outcomes of Pure PRP have led to the fact that healthcare providers as well as patients prefer it. Besides, new advancements in extracting techniques continue improving the quality and efficacy of Pure PRP, enhancing its position in the marketplace.

The fastest growing one is Leucocyte-Rich PRP, which is expected to grow at a CAGR of 12.0% because of enhanced healing properties as well as added leukocytes that contribute to tissue regeneration. This segment is primarily driven by the demand for more effective treatments, especially in orthopedic and sports medicine applications.

by Source

In 2023, the source category of autologous dominated the market for plasma therapy with a share of around 65.0% in terms of revenue. The high demand for autologous plasma therapies is due to their high safety profile as they are sourced from the patient's blood itself, thus providing a major advantage in terms of safety since there is no risk of disease transmission associated with autologous sources. Autologous therapies also trigger fewer allergic reactions and better overall acceptance among patients, thus making them an ideal choice for most practitioners.

Allogenic sources are the fastest growing area in this category with an estimated growth rate of 10.0%. Due to the demand for easily accessible treatment methods, especially in emergency conditions where direct access to the patient's blood may not be granted, allogenic products are increasingly needed. Coupled with the research and development accompanied by technological advancement, allogenic therapy is secured as a safe and efficient therapeutic option.

by Application

The Orthopedics application segment dominated the plasma therapy market in 2023, accounting for approximately 45.0% of the total revenue. Orthopedics is perceived to be major over the rest due to the increased incidence of sport-related injuries and higher demand for minimally invasive treatments. Plasma therapy is most known for the acceleration of the healing process of joint and soft tissue injuries, making it more in demand by orthopedic practices.

The fastest-growing application is in dermatology, with a projected CAGR of 15.0%. This is due to the high demand for hair restoration and skin rejuvenation treatments through PRP, among others. Such demand is attributed to increased consumer awareness of aesthetic procedures. Innovative applications in dermatology increasingly augment plasma therapy's reach, accounting for higher consumption.

by End User

In 2023, Hospitals & Clinics became the largest end users in the plasma therapy market, accounting for approximately 70.0% of the revenue. Hospitals and clinics are preferred because they have established infrastructure and skilled professionals besides ready access to advanced technologies for plasma therapies. Even more, hospitals are likely the patient's first stop for treatment of conditions such as injuries that often happen among people associated with sports and even orthopedic surgeries that can be treated with plasma therapy.

The research institutions are the most rapidly growing segment, with growth prospects at around 13.0%. Rising research and development activities related to plasma therapy are increasingly driving demand from research institutions. Clinical studies and trials related to plasma-derived treatments, which have the potential to help discover new applications for these treatments, increase the growth due to the validation of researchers of the efficacy and safety of the same in different medical fields.

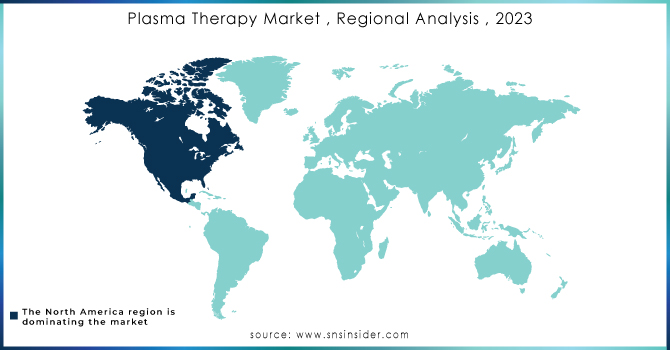

Plasma Therapy Market Regional Analysis

The market share of North America was the highest in 2023 at 47.8% due to the considerable awareness prevailing in the region and a very robust healthcare infrastructure. The regional market was dominated by North America with the highest market share during 2020 primarily because it houses the leading manufacturers of platelet-rich plasma (PRP) therapy products and has the proactive involvement of research and academic institutions conducting advanced R&D. The high public awareness about the advantages of PRP therapies, the continued good support from the authorities as well as government initiatives to promote plasma therapy in different medical applications are also contributing to growth. Well-established healthcare structures in North America, coupled with the availability of highly skilled professionals, contribute significantly towards market growth.

The Asia-Pacific plasma therapy market is rapidly growing with a surge in government activity in the promotion of plasma therapy as an available treatment. The high population density in the region, coupled with the increasing prevalence of chronic diseases, is a major factor propelling the expansion of this market. Improved healthcare facilities and the active involvement of the government in improving public health form substantial opportunities for growth in this industry. The COVID-19 pandemic has also increased the level of awareness about plasma therapy, which has also become an identified possible treatment for the virus. India would emerge as a leader in the adoption of this therapy. Apart from that, major market players in the region are making significant investments in plasma therapy, driving the growth of the plasma therapy market in Asia-Pacific and defining its prospects in healthcare development.

Need any customization research on Plasma Therapy Market - Enquiry Now

Key Players Offering Plasma Therapy

-

MTF Biologics

-

Regen Lab SA

-

Arthrex, Inc.

-

Terumo Corporation

-

Exactech, Inc.

-

Cambryn Biologics LLC

-

Global Stem Cells Group, Inc.

-

Celling Biosciences, Inc.

Key Players Offering Drugs Related to Plasma Therapy

-

Johnson & Johnson (DePuy Synthes)

-

Pfizer Inc.

-

Teva Pharmaceutical Industries Ltd.

-

Octapharma

-

Grifols S.A.

-

CSL Ltd.

-

Grifols International S.A.

-

Kedrion S.p.A.

-

LFB S.A.

-

Bio Products Laboratory Ltd.

-

China Biologic Products, Inc.

Recent Developments

In Oct 2024, Capillot Hair broadened its hair restoration services in Dallas by incorporating Follicular Unit Extraction (FUE) transplants and Platelet-Rich Plasma (PRP) therapy.

In Sept 2024, Cold atmospheric plasma therapy emerged as an innovative treatment for infections associated with Berlin Heart EXCOR pediatric cannulas. This novel approach is gaining attention for its potential to effectively address these challenging infections in young patients.

In May 2023, Dr. John Kahen, the founder of Beverly Hills Med Spa, was awarded a U.S. patent for Smart PRP therapy. This innovative treatment is primarily utilized for hair restoration and also serves various purposes, including skin rejuvenation, addressing skin scarring, and pigmentation issues, and improving skin texture.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 417.0 Million |

| Market Size by 2032 | USD 1087.0 Million |

| CAGR | CAGR of 11.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Pure PRP, Leucocyte-rich PRP, Pure Platelet-rich Fibrin (PRF), Leukocyte-rich Fibrin (L-PRF)) • By Source (Autologous, Allogenic) • By Application (Orthopedics, Dermatology, Dental, Cardiac Muscle Injury, Nerve Injury, Others) • By End User (Hospitals & Clinics, Research Institutions) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | MTF Biologics, Regen Lab SA, Arthrex, Inc., Terumo Corporation, Zimmer Biomet, Exactech, Inc., Cambryn Biologics LLC, Global Stem Cells Group, Inc., Juventix Regenerative Medical LLC, Celling Biosciences, Inc. |

| Key Drivers | • Increased public awareness and technological advancements enhance the value of plasma-derived treatments in managing severe health conditions. |

| Restraints | • Increasing Adoption of Recombinant Therapies • Safety Concerns Associated with Plasma Products |