Acne Treatment Market Report Scope & Overview:

Get more information on Acne Treatment Market - Request Free Sample Report

The Acne Treatment Market was valued at USD 10.54 billion in 2023 and is expected to reach USD 16.65 billion by 2032, growing at a CAGR of 5.25% from 2024-2032.

The acne treatment market is in considerable growth as it is mainly driven by increasing demand, awareness, and ongoing innovation into different treatment modalities. The anti-acne market in the United States saw significant growth in 2023, with Hero Cosmetics spearheading the event by taking home about $214 million in sales. Neutrogena and Panoxyl also listed sales which proved them to be quite in demand.

Acne is a common problem for people of all ages, which contributes to the strong performance of the skincare market. Acne treatments are among the best-selling products, with Over-the-counter products generating about $536 million in sales and selling over 50 million units. This ongoing increase in sales reflects a growing need for effective acne solutions, making these products highly sought after. As more people seek treatments, brands are likely to keep innovating and expanding their offerings to meet a variety of skincare needs

One of the common skin problems is acne, which is common among the teenage population and the young adult group. According to numerous studies, approximately 85% of individuals aged 12 to 24 have at one point experienced acne. However, adult acne increases with age and is highest among women aged 30 to 40 years. Such is the high demand for the treatment of acne that markets for products used to treat acne have been high, and this indicates the need for good products and therapies.

South Korea's Beauty Tech market is estimated to be about $0.53 billion in 2024, and it will have a compound annual growth rate of 5.23% for the period 2024-2032. Breakthrough technologies, increased consumer consciousness about the fast-changing beauty trends, and personalization in skincare solutions are driving the expansion of this market which further boosts the growth of the acne treatment market.

The face of beauty technology is changing completely because AI is offering innovative solutions that are best suited to the individual needs of one's skin. Personalized product recommendations and tailored treatment plans further increase the experience and efficiency that users can get out of treating acne. This kind of trend for customization, generally speaking, matches the rising consumer demand for particular solutions. Therefore, AI gives opportunities and room for innovation and market growth in the beauty industry.

Acne Treatment Market Dynamics

DRIVERS

-

The Rise of Personalized Acne Treatments

Americans spend more than $3 billion annually on over-the-counter acne treatments, which is a remarkable level of interest in effective skincare products. While many consumers can be addressed with these over-the-counter, broadly available products, the growth opportunity is accelerating as providers are moving towards tailored medicine. This would be the very reason that treatment can be tailored to meet an individual's very specific skin type and needs, both for effectiveness and to make the patient a little happier with how things are done. With the increasing demand for customized solutions, innovators are pushing manufacturers to create niche products targeted at solving key issues. In this way, this trend will further expand the acne treatment market to cater more effectively to the diverse needs of consumers. Overall, a balance between OTC options and personalized therapies will provide an all-rounded landscape for acne care.

-

Innovative Laser and Light Treatments for Acne Solutions

Advanced laser and light technologies are likely to open new avenues of significant growth opportunities in the acne treatment market. These technologies are also known to effectively target almost all forms of acne, thereby bringing forth the increased demand for personalized skincare solutions. With every step towards evolution, not only do these technologies provide avenues for new options but also contribute to the dynamic manner in which the market continues to grow. This change will allow for the inclusion of various new therapies and make treatments for acne more effective and more tailored to the patient. Brighter futures indeed, as the industry looks forward to embracing these breakthroughs.

-

Essential AI Tools Revolutionizing the Acne Treatment Industry

Artificial Intelligence in the Beauty and Cosmetics market in the global market was valued at $3.54 billion in 2023 and is expected to grow up to $19.47million by 2032, growing at a compound annual growth rate of 20.84% from 2024 to 2032. This field of acne treatment has exhibited immense scope for innovative technology and AI-based solutions for acne detection. These devices use smartphone cameras to take pictures of the skin and report results, providing recommendations for a tailored, patient-centered course of treatment with timely delivery of care. These technologies will likely revolutionize the approach towards acne and the direction of innovation in the industry.

RESTRAINTS

-

High Costs associated with the treatment of acne

This is one of the major barriers the industry faces about the high costs of treatments for acne. Oral isotretinoin, for instance, may incur average medical costs reaching $380 and pharmacy costs reaching $2,439. It deters most patients from seeking effective therapies for their acne disease. In the United States alone, the direct cost for the treatment of acne exceeds $1 billion annually, with about $100 million on over-the-counter medications. Such a financial squeeze on patients also restricts access to much-needed treatments and affects compliance; hence, alternatives with a lower price tag are called for.

-

Challenges of Side Effects in the Adoption of Acne Therapies

One major barrier to the industry regarding the incidence of side effects from acne treatment is that antibiotics, in particular, tetracycline and macrolides, may often trigger nausea, vomiting, and diarrhea among other side effects for an enormous number of patients treated with antibiotics. In addition, the FDA has posted warnings on some non-prescription products that could eventually lead to serious allergic reactions. Barriers to adequate therapies would only serve to reduce the possible future growth of the market for acne treatment.

Acne Treatment Market Segmentation Overview

BY AGE GROUP

The 18 to 44 years age group held the highest percentage share approximately 48.65% for the year 2023. Several reasons are cited for this occurrence in young adulthood, encompassing changes in hormonal influences and personal lifestyle factors that trigger many to seek remedies beyond over-the-counter choices, leading to the quest for professional care for such a medical condition.

The 10 to 17 years age group, on the other hand, is expected to grow the most rapidly at a CAGR of 5.71% in 2024-2032 primarily due to increased awareness relating to skin health and access to dermatological services. More importantly, social media has played a significant role in this group, making young people seek dermatologists to counsel them on acne problems so that they fall in line with society's defined beauty criteria. Besides, the increasing cases of acne among the youth, triggered by factors such as dietary habits and stress, send children to earlier treatment, further catapulting growth in this segment through healthy settings in schools and communities.

BY DRUG TYPE

The acne treatment market in 2023 was dominated by the over-the-counter segment, which accounted for roughly 63.11% of revenue, mainly because products containing active ingredients that well perform against mild forms of this common dermatological condition are easily accessible and affordable. The product is also very attractive because it can be purchased non-prescription.

|

Product Name |

Benefits |

|

Benzoyl Peroxide |

Kills acne-causing bacteria, reduces inflammation, and helps clear clogged pores. |

|

Salicylic Acid |

Exfoliates the skin, unclogs pores, and reduces acne lesions. |

|

Tea Tree Oil |

Natural antibacterial properties help to reduce inflammation and redness. |

|

Niacinamide |

Reduces inflammation, minimizes redness, and improves skin barrier function. |

|

Sulfur |

Absorbs excess oil and has antibacterial properties, reducing acne flare-ups. |

|

Adapalene |

A topical retinoid that promotes cell turnover and prevents clogged pores. |

The prescription segment is forecasted to grow at an aggressive rate of around 5.46% during the forecast period, 2024-2032. This is due to the result of some recently approved drugs along with innovative therapeutics equipment. As the demand for more effective treatment from increasing numbers of patients with acne, the prescription market will expand as it would lead to improving health outcomes and new avenues for development.

BY ROUTE ADMINISTRATION

The highest share in terms of treating acne falls under topical drugs, covering around 59.46% of the total revenues due to the ease of access and management of multiple forms of acne. Retinoids and antibiotics are the common ingredients of these products for which a large number of patients want to avail themselves.

On the other hand, the oral drug segment is supposed to increase at a compound annual growth rate of approximately 5.76% from 2024 to 2032. This will be triggered by increased diagnosis rates and better awareness about the use of oral drugs in more severe cases. Since healthcare professionals realize untapped potential within specific populations, there is a high degree of innovation within advanced oral treatments that continues to push more adoption and demand for these products.

BY ACNE TYPE

According to the report Moderate to Severe acne treatment market captured about 53.08% of all revenues in 2023 primarily because severe acne has a greater impact on life and is usually significantly costlier to treat. Their spending levels on care will be higher because of the seriousness of this disease. Given the emotional and psychological consequences of having acne and then the issue is with the objective therapy needed to treat it, demand is growing.". That is why, in this regard, it creates much potential for market growth because the innovative solutions enhance health and well-being at the skin level.

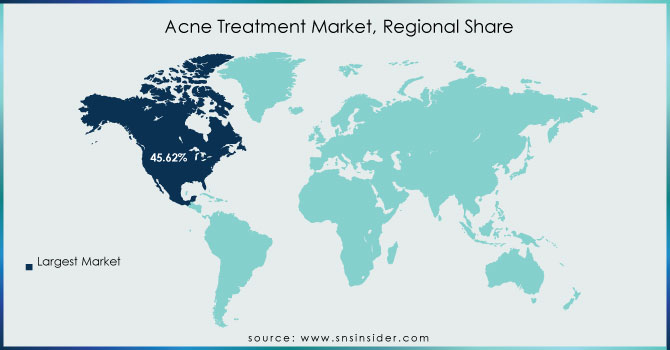

Acne Treatment Market Regional Analysis

North America emerged as the market leader in 2023, with a revenue share of around 45.62%. It is primarily because of high consumer preference for personal grooming and skincare, and this has a diversified population seeking to cure acne treatments. A significant development in this regard was seen in October 2023 when the U.S. Food and Drug Administration approved IDP-126, now branded as Cabtreo, developed by Bausch Health. With the uniqueness of this product being the first and only fixed-dose, triple-combination topical therapy approved for use in acne management, this makes a difference in clinical practice. The innovative formulation of the new treatment addresses all factors that would lead to breakouts of acne; thus, the patient has a new option to treat this condition effectively and be enriched in offerings in the market.

The Asia Pacific is likely to be a growth leader, with a projected CAGR of nearly 6.02% in the period from 2024 to 2032, due primarily to increased awareness about skincare, an increase in disposable income, and an ever-growing cosmetics industry, especially across countries like China. That has been giving enormous opportunities to companies innovating and adapting their products in response to changing consumer needs in this emerging market.

Get Customized Report as per your Business Requirement - Request For Customized Report

LATEST NEWS-

In May 2024, The Ordinary launched its new product called Saccharomyces Ferment 30% Milky Toner. It is an innovation, applied via yeast fermentation technology with an easy peel-off. This goes in line with the brand's mission of achieving effective skincare solutions.

KEY PLAYERS

-

Differin (Acne-Clearing Body Scrub, Differin Gel)

-

Neutrogena (Neutrogena Oil-Free Acne Wash Facial Cleanser, Neutrogena Oil-Free Acne Wash)

-

Clearasil (Clearasil Ultra Rapid Action Treatment, Clearasil Stay Clear Biactol Daily Gel)

-

CeraVe (CeraVe Resurfacing Retinol Serum, CeraVe Acne Control Gel)

-

PanOxyl (PanOxyl Acne Creamy Wash, PanOxyl Overnight Spot Patches)

-

Hero Cosmetics (Pimple Correct, Micropoint for Blemishes)

-

StarFace (Blackstar, acne patch stickers)

-

La Rochey Poshay (Effaclar Duo Acne Spot Treatment, Effaclar Salicylic Acid Acne Treatment Serum)

-

ABBVIE (SkinMedica Pro-Infusion Serums, DiamondGlow)

-

Botanix Pharmaceuticals (BTX1503, BTX1702)

-

Bausch Health Companies Inc. (Clindamycin Phosphate Gel, AcneFree Oil-Free Acne Cleanser)

-

GlaxoSmithKline Plc. (Benzac AC (Benzoyl Peroxide), PanOxyl (Benzoyl Peroxide))

-

Bayer AG (Bepanthen Ointment, Clearasil)

-

Johnson & Johnson Services, Inc. (Neutrogena Oil-Free Acne Wash, Clean & Clear Persa-Gel 10)

-

Pfizer Inc. (Accutane (Isotretinoin), Retin-A (Tretinoin))

-

Teva Pharmaceutical Industries Ltd. (Clindamycin/Tretinoin Gel, Isotretinoin Capsules)

-

Amgen Inc. (Otezla (Apremilast), Enbrel (Etanercept))

-

Mylan N.V. (Clindamycin Topical Gel, Isotretinoin Capsules)

-

Eucerin (Eucerin DermoPurifyer Oil Control Cleansing Gel, Eucerin DermoPurifyer Acne & Makeup Removal Gel)

-

Procter & Gamble (Olay Total Effects Cleanser, SK-II Facial Treatment Essence)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.54 Billion |

| Market Size by 2032 | USD 16.65 Billion |

| CAGR | CAGR of 5.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Drug Type(Over the Counter (OTC), Prescription ) • By Product(Therapeutic Treatment, Devices) • By Acne Type(Moderate, Mild, Moderate to Severe) • By Route of Administration(Oral, Topical, Injectable) • By Age Group(10 to 17 Years, 18 to 44 Years, 45 to 64 Years, 65 Years & Above) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Differin, Neutrogena, Clearasil, CeraVe, PanOxyl, Hero Cosmetics, StarFace, La Roche-Posay, ABBVIE, Botanix Pharmaceuticals, Bausch Health Companies Inc., GlaxoSmithKline Plc., Bayer AG, Johnson & Johnson Services, Inc., Pfizer Inc., Teva Pharmaceutical Industries Ltd., Amgen Inc., Mylan N.V., Eucerin, Procter & Gamble. |

| Key Drivers |

• Personalized acne treatments are growing, driven by tailored skincare solutions for specific needs. • Advanced laser and light therapies are revolutionizing acne treatment, offering more effective, customized solutions. • AI-driven solutions are transforming acne treatment, enabling personalized care through advanced smartphone technology |

| RESTRAINTS |

• High treatment costs, particularly for oral isotretinoin, remain a significant barrier to accessing effective acne therapies. • Side effects from acne treatments, especially antibiotics, present a challenge to patient adoption and market growth. |