Mortuary Bags Market Size Analysis

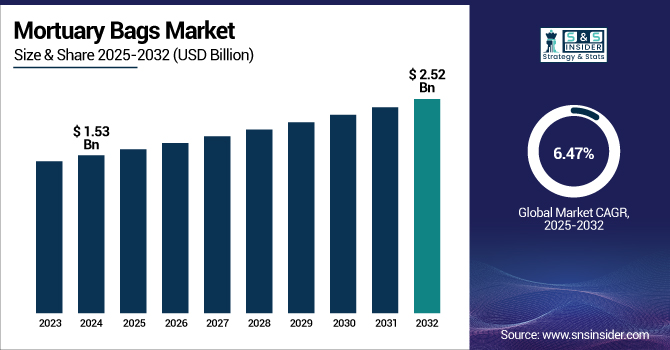

The Mortuary Bags Market size was valued at USD 1.53 billion in 2024 and is expected to reach USD 2.52 billion by 2032, growing at a CAGR of 6.47% over the forecast period of 2025-2032.

To Get more information on Mortuary Bags Market - Request Free Sample Report

Compounded global health and disaster issues have been responsible for the significant increase in demand in the mortuary bag market over recent years. The increased mortality rate of casualties from global road accidents is particularly alarming.

As of 2023, the WHO estimated 1.19 million deaths annually, with India alone recording approximately 168,000 road traffic fatalities in 2022, underscoring the urgent need for respectful and effective post-mortem management alternatives.

Moreover, the prevalence of non-communicable diseases (NCDs), which account for 74% of all world mortality, including around 17 million avoidable deaths annually, is severely taxing mortuary and healthcare services.

For instance, the WHO estimates for 2023 show that cardiovascular diseases accounted for over 18.6 million deaths globally, therefore stressing even more the need for efficient corpse management and containment mechanisms.

The COVID-19 epidemic severely disrupted the U.S. mortuary bags market when a nationwide corpse bag scarcity prompted government initiatives for higher stockpiling and supply chain security during 2020. Agencies like ASPR and FEMA responded by funding Disaster Mortuary Operational Response Teams (DMORT), therefore increasing the mass fatality handling capabilities. Moreover, growing R&D efforts help to estimate the demand for global mortuary bags. Mortuary bag companies like Mortuary Supplies USA and Premier HH have lately started designing biodegradable and antimicrobial bag materials in line with new laws and environmentally friendly tendencies. Following 2020, regulatory advice by the Inter-Agency Standing Committee (IASC) and WHO has concentrated on hygienic and safe corpse handling in disaster and humanitarian situations, therefore influencing global demand patterns.

For instance, A 2023 article in Forensic Science International detailed the creation of biodegradable body bags, resolving the environmental issues surrounding conventional vinyl-based products and impacting procurement policy within hospitals and humanitarian organizations.

Market Dynamics:

Mortuary Bags Market Drivers:

-

Rising Fatalities, Preparedness Investments, and Regulatory Push are Driving the Demand for the Mortuary Bags Market

Particularly during health emergencies and mass casualty incidents, global initiatives toward the improvement of fatality management systems are slowly pushing the mortuary bags market. One significant aspect is the increasing emphasis on infection control due as poorly handled dead bodies may contribute to the spread of diseases. Especially in instances of outbreaks such as Ebola or Nipah virus, double-sealed and leak-proof mortuary bags are stressed by the CDC in preventing the transmission of infectious pathogens. Indirectly funding mortuary bag purchases, the U.S. Biomedical Advanced Research and Development Authority (BARDA) put money into post-mortem restraint materials in 2021.

Hospitals are also investing in new materials to produce stronger anti-leak thermoplastic polyurethane (TPU) bags simultaneously. The Department of Defense (DoD) established a norm for technologically advanced civilian options in 2023 by featuring digital marking and smart seals in body bags for military victims. In addition, purchasing contracts with suppliers and scalable purchase agreements are disaster preparedness activities like NDMS and HHS's Public Health Emergency program. Combined with expanded hospital infection control budgets and R&D on green materials, these activities are driving long-term mortuary bag market growth in the private and public sectors.

Mortuary Bags Market Restraints:

-

Environmental Waste, Lack of International Standardization, and Ethical Issues Restrict Growth

One of the most significant problems is waste disposal. According to a 2022 AMA Journal of Ethics study, hospital waste, such as deceased funeral bags, contributes significantly to biohazard landfill overflow, particularly in mortality- or disaster-prone areas. Burning is the most widely used method of disposal, but it generates toxic dioxins that unsettle environmental health agencies. Furthermore, ethical concerns over below-standard treatment in war zones and disrespectful mass graves were raised during a 2023 UNHCR operational review, reinforcing calls for better standards and transparency.

Another constraint is the lack of coordinated global policies. While the WHO and ICRC offer minimum regulation, the majority of countries have no legally enforced standards on mortuary bag specifications, particularly for humanitarian supply shipments. More than 60% of the 15 underdeveloped nations the Humanitarian Logistics Council (2023) recently polled had no post-mortem supply management practices.

Moreover, the absence of African and Southeast Asian local manufacturing units has resulted in being reliant on world trade, aggravating cost inflation, and stalling crisis mitigation measures. All such regulatory and logistically loose areas, combined with environmental and ethics concerns, pose grave concerns to mortuary bag companies globally.

Mortuary Bags Market Segmentation Insights

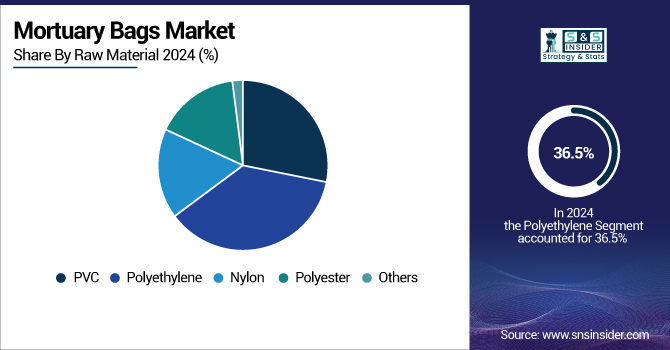

By Raw Material

In 2024, the polyethylene segment led the mortuary bags market share at about 36.5% revenue. The reason for polyethylene's leadership is that it is economical, lightweight in nature, and guarantees leak-proofing, which makes it most favorable for bulk use in emergencies and routine hospital procedures. It is most commonly applied in disposable mortuary bags and zippered body bags due to its resistance to chemicals and easy fabrication.

The PVC (polyvinyl chloride) segment is expected to be the most rapidly growing raw material segment in the body bags market. The increase in demand for PVC is due to its greater durability, fire resistance, and preference in military and disaster relief operations. Its increased use in human remains bags and post-mortem bags is being backed by innovation in biohazard containment features and antimicrobial coatings, driving overall mortuary bag growth.

By Size

Adult Bags dominated with a 48.2% global mortuary bags market share in 2024. Adult bags dominate the market due to they are mostly used in hospitals, morgues, and emergency response units, where adult deaths comprise the majority of body handling requirements. Usually, the manufacturers build these bags as zippered bags to allow for safe sealing and transport.

At the same time, the child/infant bags market is anticipated to witness the most rapid growth in response to increasing infant mortality rates in poorly resourced areas and increased spending on pediatric healthcare preparedness. The need for infant-sized cadaver bags and postmortem bags for infants is receiving more focus in humanitarian response plans and disaster areas, thus sustaining the growth of the mortuary bags market size.

By End Use

Morgues accounted for the highest use of mortuary bags in 2024, with a 44.2% market share. Continued high-volume body handling, especially in the event of pandemics, natural disasters, and in densely populated cities, lends to their dominance. Morgues need disposable bags and human remains pouches that can address long-term storage and contamination control requirements.

Hospitals are expected to be the cadaver bags market's fastest-growing end-use application. The recent global health emergencies, including the COVID-19 and Ebola outbreaks, have increased hospital-based mortality, increasing demand for on-site post-mortem products such as zippered bags. Such products are becoming increasingly integrated into hospitals' emergency preparedness inventories, driving mortuary bag development within healthcare facilities.

Mortuary Bags Market Regional Outlook

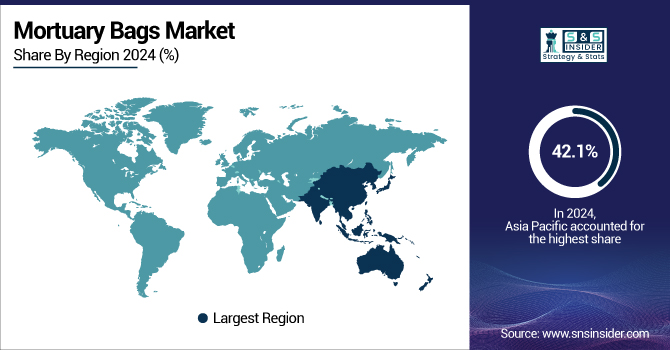

The Asia Pacific mortuary bags market led the global market with 42.1% share in 2024 and is anticipated to be the fastest-growing region during the forecast period. The growth is driven by increasing deaths due to road accidents, an increase in non-communicable diseases, and growing government expenditure on healthcare and emergency preparedness infrastructure. India, which had more than 168,000 road accident fatalities in 2022, is driving regional demand due to the high fatality rates and growing hospital networks. China, on the other hand, is enhancing epidemic response capacity, generating huge demand for cadaver bags and human remains pouches. Japan and South Korea are also playing a major role, due to their aging populations and rising NCD-related mortality.

Europe has the second-largest share of the mortuary bags market analysis due to strong public health infrastructures, an established funeral service industry, and growing government emphasis on disaster preparedness. Germany and the UK are the top players in the market due to the high death rates among elderly populations and formalized mortuary practices. For instance, Germany alone records over 980,000 deaths every year, creating a consistent demand for body bags market products. The UK has incorporated post-mortem logistics into its NHS emergency response initiatives, providing supply chain resilience for human remains pouch procurement. Poland and Italy are emerging markets as a result of increased hospital infrastructure development and public sector investment. Europe is also experiencing a boom in R&D for environmentally friendly disposable bags as a result of tighter EU regulations on plastic waste.

The North American mortuary bags market will witness steady growth led by its strong healthcare infrastructure, stringent regulatory environment, and well-established disaster management guidelines. The continent has widespread federal preparedness programs; for instance, the Disaster Mortuary Operational Response Teams (DMORT) within the U.S. Department of Health and Human Services react to mass deaths and stock up supplies. Because of excessive mortality rates from chronic conditions, nearly 90% of total fatalities, and rising incidents of public health emergencies, these pandemics and natural disasters, the U.S. mortuary bags market accounted for USD 0.45 billion in 2024 and is anticipated to grow to USD 0.80 billion by 2032, at a CAGR of 7.56% during the forecast period 2025–2032. Greater demand for mortuary bags, zippered body bags, and other post-mortem containment goods is a natural consequence of this. Also, leading makers of mortuary bags like Mopec and Classic Plastics Corporation have American operations, which aid in quick production, R&D improvement, and efficient distribution among hospitals, morgues, and emergency centers.

The LAMEA market is becoming an important contributor to the mortuary bags market, with Brazil and South Africa as key markets owing to their high disease burden and rising investments in healthcare infrastructure. Brazil, having a high incidence of road traffic accidents and a developing funeral service industry, depicts increasing adoption of disposable bags. Saudi Arabia and the United Arab Emirates are investing in emergency response systems across the Middle East as part of their national healthcare transformation plans. On the other hand, due to ongoing HIV/AIDS and tuberculosis deaths, South Africa is witnessing high demand for market products. As part of their outbreak response operations, the WHO and humanitarian partners are increasingly funding post-mortem management in Africa.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Mortuary Bags Market

Prominent players in the mortuary bags market include Flexmort, Isofroid, CEABIS (Vezzani Group), Mopec, Peerless Plastics, Classic Plastics Corporation, Auden Funeral Supplies Limited, SmartChoice Funeral Supplies, Eastman Chemical Company, and Evonik Industries AG.

Recent Trends:

-

In 2024, ASPR intensified its DMORT deployment strategies, increasing national body bag reserves and upgrading disaster response logistics, enhancing mortuary bags market share for responsive suppliers.

-

In 2023, MedTech Europe published a position paper advocating for increased stockpiling of critical medical devices, including body bags, within EU member states to ensure preparedness for future pandemics and climate-related disasters.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.53 Billion |

| Market Size by 2032 | USD 2.52 Billion |

| CAGR | CAGR of 6.47% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (PVC, Polyethylene, Nylon, Polyester, Others) • By Size (Adult Bags, Child/Infant Bags, Heavy Duty and Bariatric Bags) • By End Use (Hospital, Morgue, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Flexmort, Isofroid, CEABIS (Vezzani Group), Mopec, Peerless Plastics, Classic Plastics Corporation, Auden Funeral Supplies Limited, SmartChoice Funeral Supplies, Eastman Chemical Company, and Evonik Industries AG. |