Weight Loss Devices Market Report Scope & Overview:

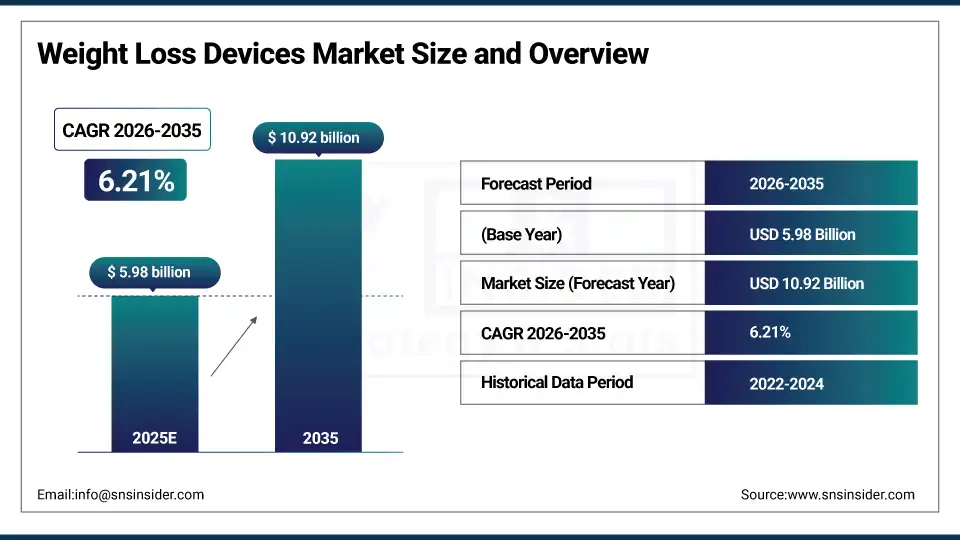

The Weight Loss Devices Market size is estimated at USD 5.98 billion in 2025 and is expected to reach USD 10.92 billion by 2035, growing at a CAGR of 6.21% over the forecast period of 2026-2035.

The global weight loss devices market trend is a growing demand for obesity management solutions such as fitness tracking wearables, non-invasive body contouring technologies, and bariatric surgical devices. The growth of the market is driven by increasing obesity prevalence, rising health consciousness among consumers, and technological advancements in connected fitness equipment. This trend is also driven by a growing adoption of home-based fitness solutions and the growing focus on preventive healthcare as consumers become more focused on maintaining healthy lifestyles and are more willing to invest in advanced weight management technologies, resulting in growth in the domestic and international market for wearable devices and non-invasive body contouring solutions.

For instance, in March 2024, growing awareness and improved smart fitness technology drove a 31% increase in wearable fitness device adoption for health-conscious consumers globally, boosting obesity management and remote health monitoring capabilities.

Weight Loss Devices Market Size and Forecast:

-

Market Size in 2025: USD 5.98 billion

-

Market Size by 2035: USD 10.92 billion

-

CAGR: 6.21% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On Weight Loss Devices Market - Request Free Sample Report

Weight Loss Devices Market Trends

-

Weight loss device solutions are being adopted because consumers demand convenient home fitness equipment, real-time health tracking capabilities, and non-surgical body contouring alternatives.

-

Customized weight management programs based on individual metabolic profiles, fitness levels, and personal health goals to improve weight loss outcomes.

-

The development of AI-powered fitness coaching, smart body composition analyzers, and connected exercise equipment to improve the user engagement and reduce barriers to sustainable weight management.

-

Advanced body contouring technologies, minimally invasive procedures, and wearable metabolism trackers are all available to ensure continuous weight monitoring and targeted fat reduction.

-

Increased demand for connected fitness platforms, mobile health integration and subscription-based wellness services to help personalized coaching and progress tracking.

-

Collaboration between fitness equipment manufacturers, wearable technology companies and healthcare providers to develop integrated weight management ecosystems and improve data interoperability.

-

FDA, CE marking authorities and medical device regulators promoting standards for device safety, clinical efficacy validation, and consumer protection requirements.

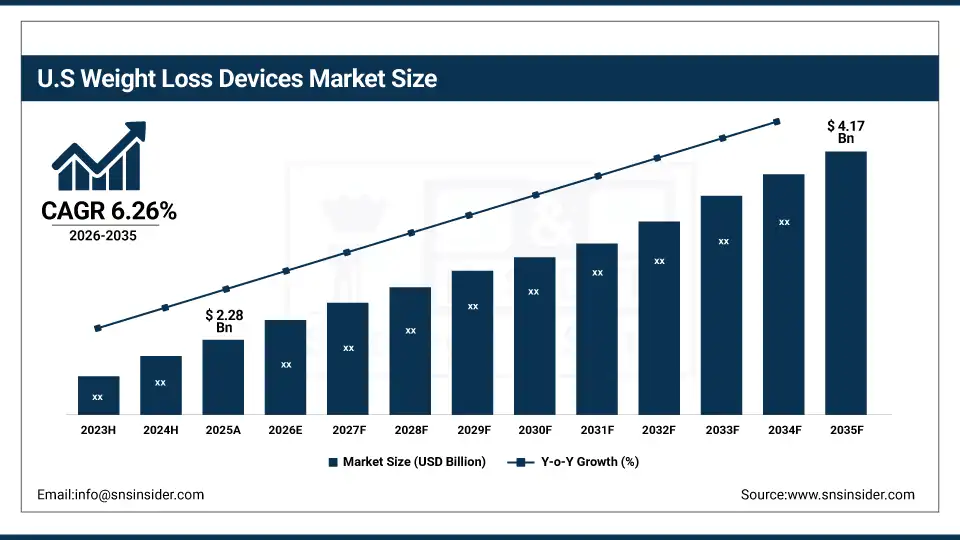

The U.S. Weight Loss Devices Market is estimated at USD 2.28 billion in 2025 and is expected to reach USD 4.17 billion by 2035, growing at a CAGR of 6.26% from 2026-2035. The United States represents the largest market for weight loss devices, primarily driven by the high obesity prevalence, strong consumer spending on health and wellness products, and well-developed fitness industry infrastructure. Government health initiatives, extensive insurance coverage for bariatric procedures and increased investment in preventive healthcare from consumers help to drive growth in the market. Also, the U.S. is the largest regional market in the world, due to the technological innovation leadership and swift adoption of connected fitness equipment and non-invasive body contouring solutions.

Weight Loss Devices Market Growth Drivers:

-

Rising Obesity Prevalence and Health Awareness is Driving the Weight Loss Devices Market Growth

Rising obesity prevalence and health awareness take the center stage as a growth driver for the weight loss devices market share, and are driven by the implementation of WHO obesity guidelines, national health campaigns for chronic disease prevention, and increasing consumer understanding of obesity-related health risks. These solutions for sustainable weight management and metabolic health improvement are driving the base of the market, the penetration of wearable technology & fitness equipment markets, and adding to the overall market share globally.

For instance, in June 2024, connected fitness devices and smart body composition analyzers accounted for ~58% of the total global consumer weight management technology spending, reflecting growing consumer preference and expanding market share.

Weight Loss Devices Market Restraints:

-

High Device Costs and Limited Reimbursement Coverage are Hampering the Weight Loss Devices Market Growth

High device costs & limited reimbursement coverage of weight loss devices also restrict the weight loss devices market growth, as a large number of consumers face financial barriers to accessing premium fitness equipment, surgical weight loss procedures, and advanced body contouring technologies. This might lead to market concentration in affluent demographics, limited adoption in price-sensitive markets, and reduced accessibility for lower-income populations. As a result, health equity concerns intensify, and market growth is stunted in regions where consumer purchasing power is limited and insurance reimbursement policies exclude weight management devices.

Weight Loss Devices Market Opportunities:

-

Technological Innovation and Smart Connected Devices Drive Future Growth Opportunities for the Weight Loss Devices Market

The opportunity in the technological innovation and smart connected devices in weight loss devices market is in the form of AI-powered personal training systems, virtual reality fitness experiences, and metabolic health monitoring platforms. These solutions provide for personalized workout recommendations, real-time biometric feedback, and gamified weight loss programs. Through enhanced user engagement, behavioral modification support, and data-driven progress tracking, particularly in areas with digital health infrastructure development, these technologies may improve adherence rates, accelerate weight loss outcomes, and expand the market.

For instance, in April 2024, the Consumer Technology Association reported that 71% of health-conscious consumers expressed interest in AI-integrated weight management devices, highlighting rising demand for intelligent fitness solutions and increasing market potential for connected health technologies.

Weight Loss Devices Market Segment Analysis

-

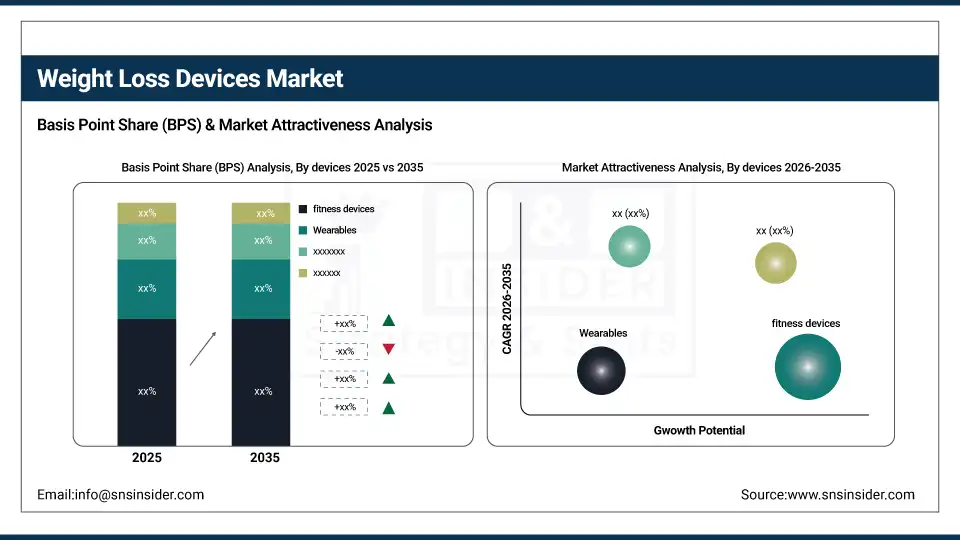

By devices, fitness devices held the largest share of around 42.18% in 2025E, and the wearables segment is expected to register the highest growth with a CAGR of 7.34%.

-

By indication, obesity management dominated the market with approximately 36.52% share in 2025E, while the fitness & performance enhancement is expected to register the highest growth with a CAGR of 6.89%.

-

By procedure, mechanical accounted for the leading share of nearly 48.73% in 2025E, and is expected to register the highest growth with a CAGR of 6.45%.

By Devices, Fitness Devices Lead the Market, While Wearables Registers Fastest Growth

The fitness devices segment accounted for the highest revenue share of approximately 42.18% in 2025, owing to widespread home gym adoption, diverse product portfolio including treadmills and elliptical trainers, and established consumer familiarity with traditional exercise equipment. Emerging trends, including increasing demand for compact home fitness solutions and integration of digital connectivity features. In comparison, the wearables segment is anticipated to achieve the highest CAGR of nearly 7.34% during the 2026–2035 period, driven by the rapid technological advancement in smart health monitoring, decreasing device costs, and growing consumer preference for continuous activity tracking. Drivers include rising adoption of smartwatches with health metrics, the popularity of fitness tracker ecosystems.

By Indication, the Obesity Management Segment dominates, while the Fitness & Performance Enhancement Segment Shows Rapid Growth

By 2025, the obesity management segment contributed the largest revenue share of 36.52% due to high clinical demand for weight reduction solutions, substantial healthcare expenditure on obesity treatment and growing medical device adoption for bariatric interventions. Growing emphasis on medically-supervised weight loss programs coupled with insurance coverage expansion, providers are increasingly recommending specialized obesity management devices. The fitness & performance enhancement segment is projected to grow at the highest CAGR of about 6.89% between 2026 and 2035 due to the growing participation in fitness activities and competitive sports performance optimization. Some of the reasons include better consumer awareness of athletic training technologies, increased investment in personal fitness improvement, and health enthusiasts' preference for advanced performance monitoring equipment.

By Procedure, Mechanical Lead, and Registers Fastest Growth

The mechanical segment accounted for the largest share of the weight loss devices market with about 48.73%, owing to proven effectiveness of traditional exercise equipment, lower technical complexity compared to electronic alternatives, and broad accessibility across various consumer segments. Reasons driving the mechanical segment include established exercise physiology principles and cost-effectiveness for budget-conscious consumers. In addition, it is slated to grow at the fastest rate with a CAGR of around 6.45% throughout the forecast period of 2026–2035, as consumers seek reliable physical training equipment, resistance training systems, and traditional cardiovascular exercise machines. Increased focus on functional fitness training and growing home gym installations contribute to their adoption, while improved durability and ergonomic design innovations drive continued investment.

Weight Loss Devices Market Regional Highlights:

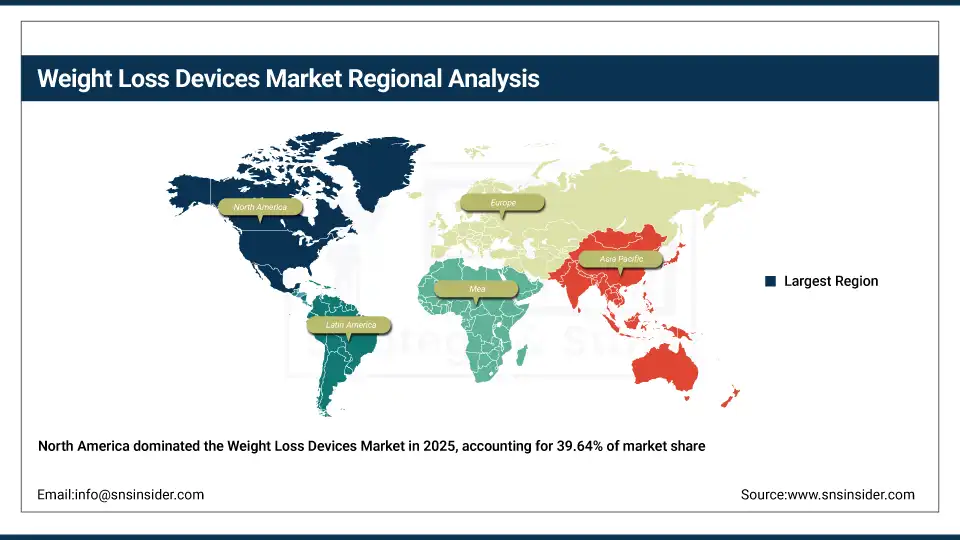

North America Weight Loss Devices Market Insights:

North America held the largest revenue share of over 39.64% in 2025 of the weight loss devices market due to an established fitness industry infrastructure, high consumer spending on health and wellness products, and increased awareness regarding the health consequences of obesity and sedentary lifestyles. Drivers include widespread gym membership penetration, an advanced medical device regulatory environment, growing adoption of connected fitness equipment and greater acceptance of cosmetic body contouring procedures stemming from reduced social stigma. At the same time, various insurance coverage improvements, corporate wellness program implementations and enormous investments in health technology innovation from both startups and established companies are anchoring weight loss device adoption in the market, and ensuring multibillion dollar revenues around the world.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Weight Loss Devices Market Insights:

Asia Pacific is the fastest-growing segment in the weight loss devices market with a CAGR of 7.89%, as the rising middle-class population with disposable income, increasing obesity rates in urban areas, and growing fitness center expansion in developing nations is growing. Factors including rapid urbanization, changing dietary patterns with increased Western food consumption, and growing adoption of health and wellness lifestyles are stimulating the market growth. E-commerce platform development and international fitness brand presence have been instrumental in improving product accessibility, especially in metropolitan and tier-two cities. Government health campaigns and workplace wellness programs also help in advancing fitness awareness and weight management initiatives. Increase in demand in Asia Pacific region owing to growing healthcare expenditure against historical spending levels and increasing affordability and accessibility of affordable fitness equipment and wearable health devices.

Europe Weight Loss Devices Market Insights:

The weight loss devices market in Europe is the second-dominating region after North America on account of an increase in the adoption of preventive healthcare approaches, robust medical device regulations including CE marking requirements, and increasing consumer emphasis on quality of life across healthcare systems. Rising implementation of national obesity prevention strategies, advanced aesthetic medicine practices, favorable government support for sports and fitness activities, and cross-border medical tourism for cosmetic procedures are also contributing to the sustained growth of the market in leading European countries.

Latin America (LATAM) and Middle East & Africa (MEA) Weight Loss Devices Market Insights:

In Latin America, and Middle East & Africa, the growing fitness culture adoption and increase in medical tourism for cosmetic procedures with expanding retail distribution networks support the weight loss devices market growth. The rising popularity of affordable home fitness equipment and international brand presence, along with social media fitness influencer impact, will aid health consciousness and weight management device accessibility. The increasing disposable income levels and improving consumer awareness in these regions are continuing to encourage market growth.

Weight Loss Devices Market Competitive Landscape:

Fitbit Inc. (est. 2007) is a leading wearable technology company that focuses on activity tracking devices and health monitoring solutions for comprehensive wellness management. It uses its extensive user data ecosystem and mobile application platform to produce cutting-edge fitness wearables with seamless health metric integration.

-

In February 2025, it expanded its smartwatch capabilities with advanced metabolic health tracking and AI-powered workout recommendations, aiming to improve weight management outcomes and user engagement across its global consumer base.

Peloton Interactive, Inc. (est. 2012) is a well-known connected fitness equipment manufacturer focused on interactive exercise bikes, treadmills, and digital fitness content subscriptions. It invests in immersive fitness experiences and community-driven workout platforms with the hopes of revolutionizing home exercise with engaging, instructor-led, and data-tracking connected fitness equipment.

-

In May 2024, launched an enhanced connected fitness platform featuring personalized training programs and real-time performance analytics across its equipment portfolio, enhancing user motivation, workout effectiveness, and subscriber retention globally.

Allergan Aesthetics (AbbVie Inc.) (est. 1948) is a leading medical aesthetics company in the fields of non-invasive body contouring technologies, facial aesthetics, and dermatological treatments. The company's weight loss device portfolio focuses on CoolSculpting cryolipolysis technology and innovative body shaping solutions, and features a strong commitment to clinical research and continuous innovation to complement the strong market presence in both aesthetic clinics and medical spas.

-

In September 2024, introduced advanced CoolSculpting applicators and treatment protocols for improved fat reduction efficacy, strengthening non-invasive body contouring capabilities and expanding adoption among cosmetic surgery centers worldwide.

Weight Loss Devices Market Key Players:

-

Fitbit Inc. (Google LLC)

-

Peloton Interactive, Inc.

-

Allergan Aesthetics (AbbVie Inc.)

-

Apple Inc.

-

Garmin Ltd.

-

Johnson Health Tech Co., Ltd.

-

Technogym S.p.A.

-

Life Fitness (Brunswick Corporation)

-

InBody Co., Ltd.

-

Ethicon Inc. (Johnson & Johnson)

-

Medtronic plc

-

ReShape Lifesciences Inc.

-

Apollo Endosurgery, Inc.

-

Cynosure LLC (Hologic, Inc.)

-

BTL Industries Ltd.

-

Cutera, Inc.

-

Zimmer Aesthetics (Zimmer MedizinSysteme GmbH)

-

Syneron Candela (Apax Partners)

-

Nautilus, Inc.

-

ICON Health & Fitness, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 5.98 Billion |

| Market Size by 2035 | USD 10.92 Billion |

| CAGR | CAGR of 6.21% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Devices (Fitness Devices, Wearables, Surgical Devices & Non-Invasive Body Contouring Devices) •By Indication (Body Contouring & Body Toning, Obesity & Weight Management, Chronic Disease Management, Fitness & Performance Enhancement, Others) •By Procedure (Mechanical, Electrical & Laser/Ultrasound) •By Distribution Channel (Retail Stores, Online Platforms (Direct Sales & Healthcare Providers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fitbit Inc. (Google LLC), Peloton Interactive, Inc., Allergan Aesthetics (AbbVie Inc.), Apple Inc., Garmin Ltd., Johnson Health Tech Co., Ltd., Technogym S.p.A., Life Fitness (Brunswick Corporation), InBody Co., Ltd., Ethicon Inc. (Johnson & Johnson), Medtronic plc, ReShape Lifesciences Inc., Apollo Endosurgery, Inc., Cynosure LLC (Hologic, Inc.), BTL Industries Ltd., Cutera, Inc., Zimmer Aesthetics (Zimmer MedizinSysteme GmbH), Syneron Candela (Apax Partners), Nautilus, Inc., ICON Health & Fitness, Inc. |