Dyspnea Treatment Market Report Scope & Overview:

Get more information on Dyspnea Treatment Market - Request Free Sample Report

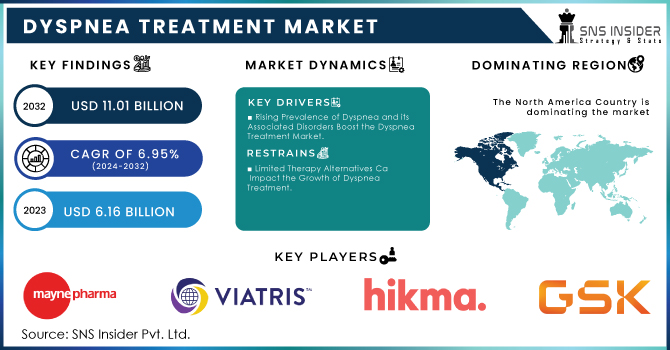

The Dyspnea Treatment Market Size was valued at USD 6.16 Billion in 2023, and is expected to reach USD 11.01 Billion by 2032, and grow at a CAGR of 6.95% over the forecast period 2024-2032.

The high burden of cardiopulmonary diseases, increase in population-based overweight, and lifestyle changes are responsible for having dyspnea. The February 2022 article in the European Respiratory Journal titled "Prevalence and severity of different dimensions of breathlessness among the population: A systematic review, meta-analysis " notes that for decades dyspnea has been a clinical symptom suffered by patients with cardiorespiratory disease (cardiopulmonary), as well as prevalent within community-based populations. 10-25% of middle-aged to older adults become short of breath performing normal activities. Hence, the rise in the prevalence of dyspnea is expected to increase its management and treatment due to avoidable disciplines that would drive overall market growth.

Furthermore, with COPD and asthma being leading causes of dyspnea the market growth is further encouraged by an increasing prevalence of these conditions in several markets over our forecast period. The World Health Organization (WHO) 2021 fact sheet: Asthma in adults and children estimates that asthma is a very common non-communicable disease. Huge incidence of Asthma causing dyspnea1 treatment to uplift demand Dyspnea is a common symptom in many respiratory diseases, and the severity can vary considerably. In 2020 globally around some262 million people had asthma and these end users are likely to seek effective medication arsenals expected as one of the prominent factors high the valued growth market during the projected timeframe.

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising Prevalence of Dyspnea and its Associated Disorders Boost the Dyspnea Treatment Market.

-

Increasing Levels of Air Pollution and Exposure to Various Toxins are Responsible for the Increasing Demand for Dyspnea Treatment.

RESTRAINTS:

-

Higher Costs of Dyspnea Treatment Hinder the Dyspnea Treatment Market.

-

Limited Therapy Alternatives Can Impact the Growth of Dyspnea Treatment.

OPPORTUNITY:

-

Government Initiatives are Expected to Drive the Growth of the Dyspnea Treatment Market.

-

Technological Advancements Provide Opportunities for Dyspnea Treatment Market Expansion.

KEY MARKET SEGMENTATION:

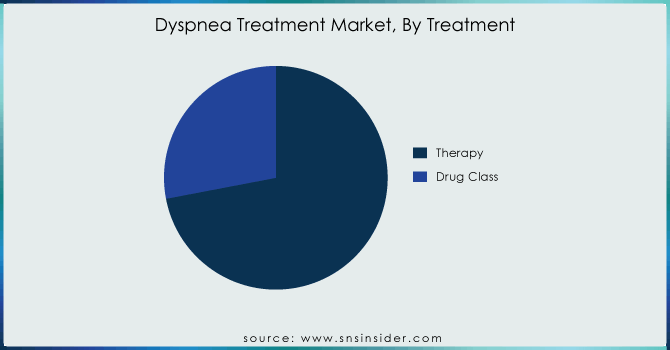

By Treatment

In 2023, therapy held the largest market share of approximately 72%. Supplemental oxygen therapy dominated the therapy segment. Patients with chronic lung diseases, such as dyspnea and COPD (Chronic Obstructive Pulmonary Disease) have been commonly prescribed the use of oxygen therapy due to improvement in quality of life and greater survival rates among hypoxemic individuals. In the United States, 1.5 million patients per year would receive oxygen therapy as documented in a study titled "Long-term supplemental oxygen therapy" by Rick Carter published in March of 2022 As a result, the market is expected to expand in the coming years driven by increased use of oxygen therapies for respiratory diseases including dyspnea.

Supplemental oxygen was the most efficacious component of treatment for dyspnea (according to a study titled "Provision of Supplemental Oxygen" published in the New England Journal of Medicine in July 2021. For many lung diseases, oxygen therapy changes sleep quality, mood, and mental acuity for the better - it improves endurance with basic activities of daily living that so easily disappear in the face of breathlessness. At the same time, oxygen therapy to prevent heart failure in patients with severe lung diseases. Oxygen therapy also offers various other benefits due to which the oxygen Concentrators market is expected to grow during the forecast period. Therefore, based on the above factors the segment is expected to experience robust growth during the forecast period.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End User

Hospitals lead the dyspnea treatment market with a 45% share in 2023 on the back of availability as well-experienced healthcare providers enabling treat dyspnea encompassing severe and critical cases. For instance, in 2022 American Hospital Association (AHA) stats stated that there are now more than 6,000 hospitals in the U.S., and that will lead to around a combined total of four trillion outpatient visits per year. Hospitals are furnished with modern diagnostic facilities, an ICU, and a team of health experts from varied areas for unique emergent conditions like severe acute dyspnea outcomes such as status asthmaticus or exacerbations in COPD.

Emergency departments in hospitals play a crucial role here for they offer immediate care to individuals who have suddenly developed severe breathlessness and this is one of the most important factors in preventing complications as well as improving outcomes. This segment growth is primarily attributed to advanced medical infrastructure, availability of skilled professionals for critical healthcare, and managing severe cases that need immediate as well as comprehensive care.

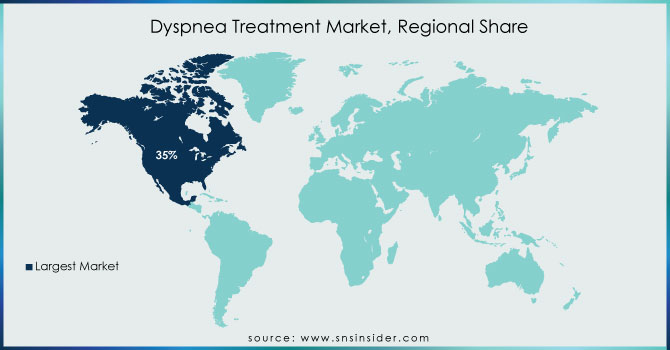

REGIONAL ANALYSIS:

The North American region held a major market share of 35% in 2023 because of the presence of the key giants, the emerging number of product approvals, and the established healthcare system with a high prevalence rate related to obesity or cardiopulmonary diseases. The Pulmonary Therapy research, "Respiratory Symptoms among US Adults: A Cross-Sectional Health Survey Study," found that one in six American adults experiences the most common respiratory symptom-an irritating and bothersome cough-annually along with a productive cough (what is often called congestion) and shortness of breath at 17% per person-years. Asthma, chronic obstructive pulmonary disease (COPD), and coronary heart disease were common causes of dyspnea on exertion among subjects reporting this symptom; however, morbid obesity was the most frequently associated comorbidity. The rising geriatric population has increased the cases and prevalence of these diseases which are anticipated to drive market growth. According to the Office of Disease Prevention and Health Promotion (ODPHP) in 2020, more than 25 million Americans have asthma; COPD affects about 14.8 million US adults.

Furthermore, the expanding air population base along with hazardous pollutants are key factors that will enhance market growth. United States in America, around 67 million tons of pollution were discharged into the air in 2021 (US Environmental Protection Agency June 2002). These emissions lead to the formation of ozone and particles, acid deposition, and visibility impairment. This can then lead to various respiratory diseases, such as dyspnoea. The increase in the number of clinical trials is predicted to contribute toward improved treatments, fueling market expansion. According to the Clinitrials. According to the gov updates February 2022, Study Record Detail, which is namely "Dexamethasone in Controlling Dyspnea in Patients with Cancer" by the National Cancer Institute (NCI) regarding dexamethasone is effective for controlling dyspnea in patients affected by cancer. Among cancer patients, dexamethasone increases lung function decreases dyspnea (breathlessness), and enhances quality of life. That being said, it is likely that this will launch shortly and help expand the market of choice.

KEY PLAYERS:

The key market players include Mayne Pharma Group Limited, Viatris Inc. (Mylan N.V.), Hikma Pharmaceuticals plc, GlaxoSmithKline plc, Akron Incorporated, Bausch Health Companies Inc., Amneal Pharmaceuticals LLC, Lannett Company, Inc., Lupin Limited, Teva Pharmaceutical Industries Ltd. & other players.

RECENT DEVELOPMENTS

-

OMRON Healthcare announced the expansion of its Oxygen therapy category at OMRON headquarters following the launch worldwide with a press conference in July 2022, by launching an advanced portable oxygen concentrator. It is intended to help offer the extra support that many COPD and respiratory patients require in their homecare needs, concerning therapy and lifestyle.

-

Max Ventilator, the multifunctional non-invasive ventilator equipped with inbuilt oxygen therapy and humidifier was launched in May 2022.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 6.16 Billion |

|

Market Size by 2032 |

US$ 11.01 Billion |

|

CAGR |

CAGR of 6.95% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Treatment Type (Therapy (Supplemental Oxygen Therapy, Relaxation Therapy), Drugs (Antianxiety Drugs, Antibiotics, Anticholinergic Agents, Corticosteroids, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Mayne Pharma Group Limited, Viatris Inc. (Mylan N.V.), Hikma Pharmaceuticals plc, GlaxoSmithKline plc, Akron Incorporated, Bausch Health Companies Inc., Amneal Pharmaceuticals LLC, Lannett Company, Inc., Lupin Limited, Teva Pharmaceutical Industries Ltd. & other players |

|

Key Drivers |

•Rising Prevalence of Dyspnea and its Associated Disorders Boost the Dyspnea Treatment Market. |

|

RESTRAINTS |

•Higher Costs of Dyspnea Treatment Hinder the Dyspnea Treatment Market. |