Unnatural Amino Acids Market Report Scope & Overview:

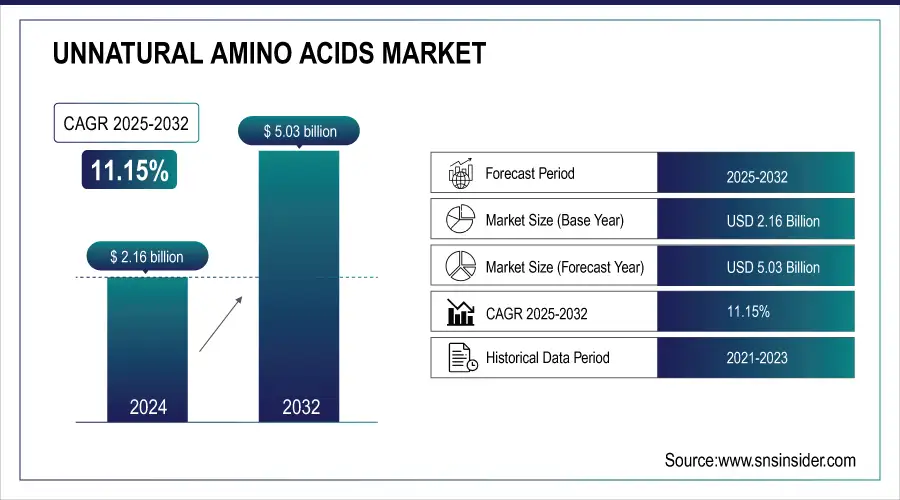

The Unnatural Amino Acids Market size was valued at USD 2.16 billion in 2024 and is expected to reach USD 5.03 billion by 2032, growing at a CAGR of 11.15% over 2025-2032.

The global unnatural amino acids market is witnessing strong momentum, driven by their expanding role in drug discovery, biologics development, and protein engineering. These amino acids are critical in enhancing drug stability, bioavailability, and specificity, making them indispensable in next-generation therapeutics. The unnatural amino acids market is experiencing heightened demand due to increased R&D spending by key unnatural amino acids companies such as Ajinomoto Co., BASF SE, and Senn Chemicals. For instance, Ajinomoto has significantly invested in proprietary biosynthesis platforms to produce enantiomerically pure D- and beta-amino acids.

To Get more information on Unnatural Amino Acids Market - Request Free Sample Report

Additionally, the U.S. unnatural amino acids market is benefiting from FDA-backed initiatives promoting peptide and protein drug innovation. According to PhRMA, U.S. biopharmaceutical R&D investment surpassed USD 100 billion in 2023, directly boosting the need for synthetic amino acids. Furthermore, regulatory frameworks are increasingly supporting custom amino acid incorporation into therapeutic development, aiding the unnatural amino acids market growth. The rise in biologics, protein-based drugs, and increasing outsourcing to CROs are additional growth factors. Companies are also ramping up production capacities in Asia-Pacific to meet growing global demand, highlighting the robust unnatural amino acids market analysis.

In July 2024, AnaSpec Inc. launched a new line of Fmoc-protected unnatural amino acids to streamline solid-phase peptide synthesis (SPPS) workflows, addressing the growing needs in oncology drug development.

In May 2024, Ajinomoto Co., Inc., collaborated with a leading mRNA therapeutics developer to integrate unnatural amino acids into lipid nanoparticle formulations, showcasing the evolution of unnatural amino acids market trends toward mRNA and gene therapy platforms.

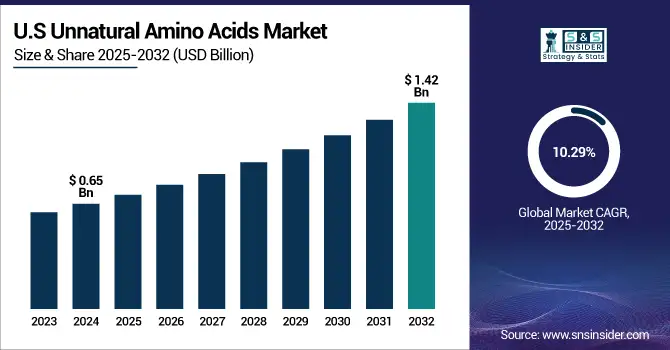

The U.S. unnatural amino acids market size was valued at USD 0.65 billion in 2024 and is expected to reach USD 1.42 billion by 2032, growing at a CAGR of 10.29% over 2025-2032. The U.S. dominated the regional market, supported by over USD 100 billion in annual biopharma R&D investment and a robust pipeline of biologics and peptide-based therapeutics.

Market Dynamics:

Drivers:

-

Growing Applications in Targeted Drug Delivery, Antibody-Drug Conjugates (ADCs), and Biosynthetic Peptide Development Fuel Market Growth

As of 2024, over 70% of biologics under development incorporate synthetic or modified amino acids, signaling a sharp rise in demand. Biopharmaceutical firms such as Merck and Novartis are investing heavily in advanced protein engineering platforms. For instance, Merck allocated over USD 2.5 billion in 2023 toward R&D for biologics incorporating unnatural amino acids. Rising interest in precision therapeutics has also fueled collaborative research, with institutions like MIT and Stanford integrating synthetic amino acids into protein modeling studies.

The global unnatural amino acids market is further supported by advancements in enzymatic and microbial synthesis, reducing production costs and improving scalability. Regulatory frameworks, including the EMA and FDA’s guidance on non-standard amino acid use in peptide-based drugs, have become more accommodating, accelerating development timelines. Additionally, companies like GenScript and Bachem are expanding their custom amino acid portfolios, responding to increased orders from CDMOs and biotech startups. These factors collectively ensure strong unnatural amino acids market growth through the next decade.

Restraints:

-

Unnatural Amino Acids Market Faces Notable Restraints Stemming from Complex Synthesis Processes, Regulatory Hurdles, And High Development Costs

The production of stereochemically pure and functionally specific unnatural amino acids often requires multistep chemical synthesis or engineered microbial strains, both of which are resource-intensive. For example, small-scale peptide synthesis using unnatural amino acids can cost 3–5 times more than standard amino acids. Moreover, there are still limited standardized pathways for regulatory approval, especially when incorporating non-canonical amino acids into human therapeutics. This uncertainty often leads to extended validation phases, slowing clinical adoption.

Additionally, supply chain instability, especially in raw materials like protected amino acid reagents, continues to be a bottleneck, particularly in post-pandemic settings. Companies in the U.S. unnatural amino acids market face compliance challenges when aligning production practices with the FDA’s evolving safety standards for synthetic peptide components. Intellectual property (IP) complexity around novel amino acid synthesis also poses risks for new entrants. These issues collectively restrain the unnatural amino acids market analysis, especially for early-stage biotech firms with limited capital.

Segmentation Analysis:

By Type

In 2024, D-amino acids & derivatives dominated the market, accounting for over 28% of the total unnatural amino acids market share. This dominance is driven by their critical use in the development of peptide-based drugs, antimicrobial agents, and their role in enhancing pharmacokinetic properties. Modified/Functionalized Amino Acids emerged as the fastest-growing segment due to their increasing use in customized protein synthesis and biologics engineering, particularly in targeted cancer therapies and synthetic biology.

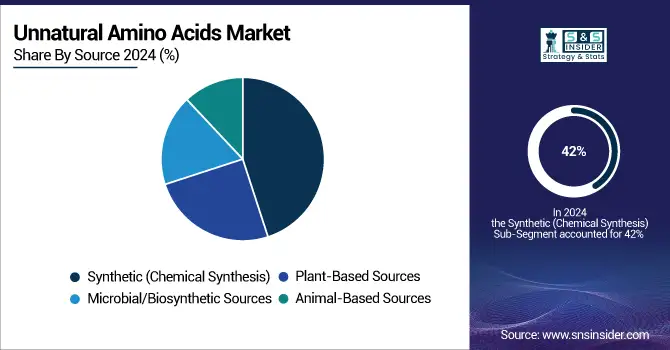

By Source

In terms of source, Synthetic (Chemical Synthesis) led the global unnatural amino acids market in 2024 with 42% market share. This is attributed to the precise control over structure, high purity, and scalability in production. However, microbial/biosynthetic sources are the fastest-growing segment, gaining traction due to sustainability concerns and the emergence of cost-effective, enzyme-driven production technologies that reduce dependency on chemical synthesis.

By Application

Pharmaceuticals & drug development held the largest share in 2024, contributing to over 35% of the unnatural amino acids market share. Their demand is significantly fueled by the increasing pipeline of peptide and protein drugs using non-natural amino acids for enhanced stability and bioactivity. Cosmetics & Personal Care is the fastest-growing application segment, driven by the growing adoption of bioactive amino acid derivatives in anti-aging and skin-regenerating formulations.

By End-User

Pharmaceutical & Biotechnology Companies dominated the unnatural amino acids market in 2024, holding a market share exceeding 48%. Their dominance is linked to continuous investments in drug discovery and development of protein-based therapeutics incorporating unnatural amino acids. On the other hand, Contract Research Organizations (CROs) are the fastest-growing end-user segment, supported by the increasing trend of outsourcing custom amino acid synthesis and peptide formulation to reduce in-house R&D burden and accelerate time-to-market.

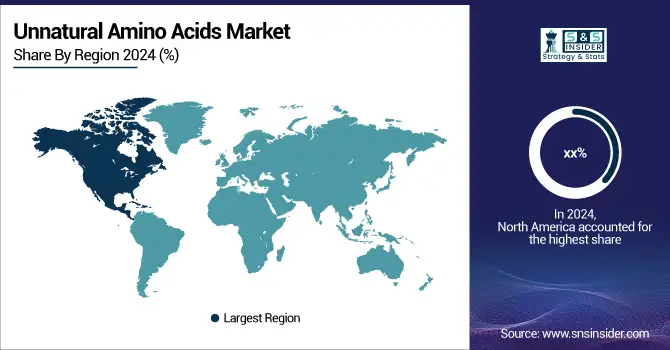

Regional Analysis:

North America led the global unnatural amino acids market in 2024, primarily due to its strong pharmaceutical and biotechnology infrastructure, advanced R&D facilities, and high adoption of synthetic biology.

Get Customized Report as per Your Business Requirement - Enquiry Now

The presence of key unnatural amino acids companies like Abbott, AbbVie, and AnaSpec further enhances market leadership. The fastest-growing segment in the region is Canada, driven by government-backed life sciences investments, with over CAD 2 billion allocated for biotech research in 2023. The U.S. remains a center for regulatory innovation, with the FDA facilitating accelerated approvals for novel peptides containing non-canonical amino acids.

Asia Pacific is the fastest-growing region in the global unnatural amino acids market, driven by rising contract manufacturing activities, growing biopharma R&D outsourcing, and expanding food and cosmetics industries. China is the dominant country, contributing over 35% of regional demand due to its vast chemical manufacturing base and the presence of major players like Shanghai Hanhong and Donboo Amino Acid. The country has heavily invested in biosynthesis technologies and peptide research. India is the second fastest-growing, supported by the government's push for biopharma innovation and increased exports of custom amino acid products. Japan also plays a crucial role due to its deep involvement in protein engineering and pharmaceutical innovation, with companies like Ajinomoto leading in functional amino acid development.

Key Players:

Leading unnatural amino acids companies in the market include Abbott, AbbVie, Ajinomoto Co., Inc., Aminologics Co., AnaSpec Inc., AstraZeneca, BASF SE, Bayer AG, CU Chemie Uetikon GmbH, Enzo Life Sciences Inc., GlaxoSmithKline Plc, Miat S.P.A., Yoneyama Yakuhin Kogyo Co., Ltd., Nagase & Co., Ltd., Nippon Rika Co., Ltd., Senn Chemicals AG, Fufeng Group, Donboo Amino Acid Co., Ltd., Wuxi Jinghai Amino Acid Co., Ltd., and Taizhou Tianhong Biochemistry Technology Co., Ltd.

Recent Developments:

In May 2024, BASF SE announced the expansion of its synthetic amino acid production capabilities in Ludwigshafen, Germany, specifically focusing on beta- and D-amino acids for pharmaceutical applications. The expansion aims to meet rising demand from CDMOs and biologics manufacturers in Europe and North America.

In July 2024, Suzhou Highfine Biotech Co., Ltd. launched a new line of high-purity unnatural amino acids tailored for peptide therapeutics and enzyme modification. The company also entered strategic supply agreements with two European peptide drug developers to support ongoing clinical trials.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.16 billion |

| Market Size by 2032 | USD 5.03 billion |

| CAGR | CAGR of 11.15% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [D-Amino Acids & Derivatives, DL-Amino Acids & Derivatives, Rare L-Amino Acids, Beta-Amino Acids & Derivatives, Cyclic Amino Acids, Gamma-Amino Butyric Acid (GABA), Gamma-Amino-Beta-Hydroxybutyric Acid (GABOB), Synthetic Amino Acids, Modified/Functionalized Amino Acids] • By Application [Pharmaceuticals & Drug Development, Therapeutic Applications, Food & Nutraceuticals, Cosmetics & Personal Care, Biological Research & Enzyme Engineering, Others (veterinary medicine, specialty chemicals, and material science applications)] • By Source [Synthetic (Chemical Synthesis), Plant-Based Sources, Animal-Based Sources, Microbial/Biosynthetic Sources] • By End-User [Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, Food & Beverage Industry, Cosmetics & Personal Care Manufacturers, Contract Research Organizations (CROs), Others (veterinary drug developers and chemical manufacturers)] |

| Regional Analysis/Coverage | North America (U.S., Canada), Europe (Germany, France, UK, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, AbbVie, Ajinomoto Co., Inc., Aminologics Co., AnaSpec Inc., AstraZeneca, BASF SE, Bayer AG, CU Chemie Uetikon GmbH, Enzo Life Sciences Inc., GlaxoSmithKline Plc, Miat S.P.A., Yoneyama Yakuhin Kogyo Co., Ltd., Nagase & Co., Ltd., Nippon Rika Co., Ltd., Senn Chemicals AG, Fufeng Group, Donboo Amino Acid Co., Ltd., Wuxi Jinghai Amino Acid Co., Ltd., and Taizhou Tianhong Biochemistry Technology Co., Ltd. |