Digestive Health Supplements Market Report Scope & Overview:

Get more information on Digestive Health Supplements Market - Request Free Sample Report

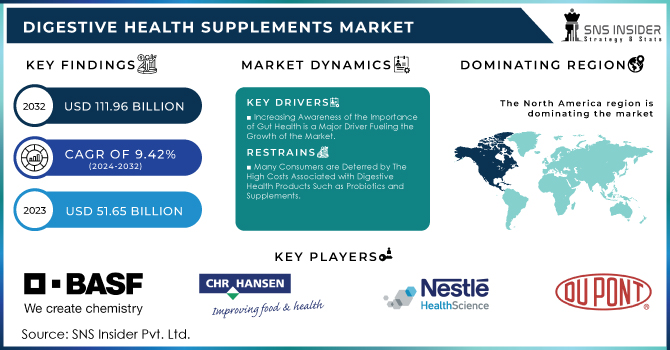

The Digestive Health Supplements Market Size was valued at USD 51.65 Billion in 2023, and is expected to reach USD 111.96 Billion by 2032, and grow at a CAGR of 9.42%.

The increasing prevalence of digestive disorders worldwide has led to a growing demand for products aimed at improving digestive health. According to the World Health Organization (WHO), an estimated 20-30% of the global population suffers from digestive disorders, making it a significant area of concern for healthcare providers and governments. As a result, there has been a rise in government-led initiatives to raise public awareness about these diseases and to fund research for better treatments and prevention methods.

In the United States alone, 60 to 70 million people are affected by digestive diseases annually, ranging from common conditions like acid reflux and irritable bowel syndrome (IBS) to more severe illnesses such as Crohn's disease and ulcerative colitis. To promote overall health and disease prevention, government agencies have emphasized the importance of gut health. This topic has been extensively researched globally, with various U.S. national agencies, including the NIH and the Centers for Disease Control (CDC), funding multiple research projects focused on understanding gut health and its impact on immune function, metabolic health, and mental well-being through the "gut-brain axis."

In Europe, the European Commission allocated a budget of up to euro 9 million for research under Horizon Europe in 2023 to study gut microbiota and their role in maintaining physiological balance. This reflects a growing awareness of the influence of our gut microbiome on functions such as digestion and immune regulation. The funds are aimed at developing new interventions and preventive approaches to promote a healthy gut and reduce the burden of treatment for gastrointestinal diseases. Governments across Europe, North America, and Asia are also organizing educational programs to emphasize the importance of a balanced diet that includes probiotics, prebiotics, and fiber for maintaining gut health.

MARKET DYNAMICS:

Key Drivers:

-

The Growing Prevalence of Digestive Disorders such as irritable bowel syndrome (IBS), Crohn’s disease, and Gastroesophageal Reflux Disease (GERD) is Pushing the Demand for Digestive Health Supplements.

-

Increasing Awareness of the Importance of Gut Health is a Major Driver Fueling the Growth of the Market.

Restraints:

-

Strict Government Regulations Concerning the Labeling and Health Claims of Digestive Health Products Pose a Significant Barrier to Market Growth.

-

Many Consumers are Deterred by The High Costs Associated with Digestive Health Products Such as Probiotics and Supplements.

Opportunity:

-

The Rising Consumer Preference for Plant-Based Diets Opens Up Significant Opportunities for Companies in the Digestive Health Supplements Market.

-

Emerging Economies in Asia-Pacific, Latin America, And Africa Present Substantial Growth Opportunities Due to Increasing Urbanization, Rising Disposable Incomes, and Heightened Awareness of Digestive Health.

KEY MARKET SEGMENTATION:

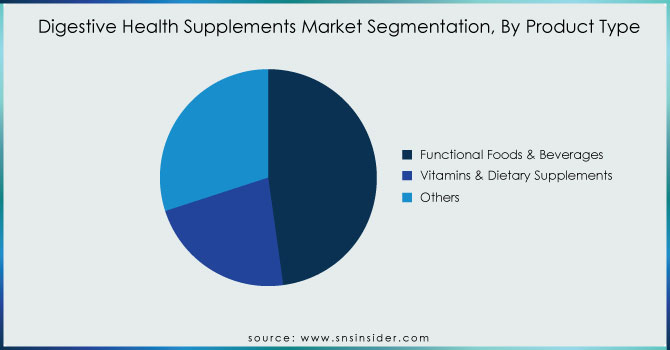

By Product Type

Functional Foods & Beverages led the digestive health supplements market and held a 47.5% share in 2023. The dominance of this segment is attributed to the increasing awareness among consumers about the importance of diet in maintaining gut health and government programs promoting healthier eating habits. Currently, demand for probiotics and prebiotics containing functional foods accounts for over 12% of the market, as per a report published by the FAO. The consumption of fortified beverages and functional dairy products containing probiotics has also seen a positive impact, as reported by the United States Department of Agriculture (USDA). The European Food Safety Authority (EFSA) noted a 15% growth in the movement of functional foods with claims on digestive health-related ingredients across Europe in 2023. Other contributing factors to the dominance of this segment include the increasing demand for convenient and ready-to-eat healthy foods that support digestion.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Distribution Channel

In 2023, supermarkets and hypermarkets led the market. These retail operations are dominant due to their convenience for consumers. The sales of health-related products, including digestive health supplements, in supermarkets and hypermarkets are expected to rise by as much as 10% in 2023, according to U.S. Census Bureau statistics. The trend of in-store health sections dedicated to wellness products has further increased their sales. This information is based on the Retail Strategy for Europe 2022–25 report published by The European Commission, which shows a shift towards including digestive health services and an expanded selection of vitamins, dietary supplements, and functional beverages in stores. Consumers prefer to buy digestive health solutions from supermarkets/hypermarkets as it is a convenient one-stop shopping destination for groceries and health products.

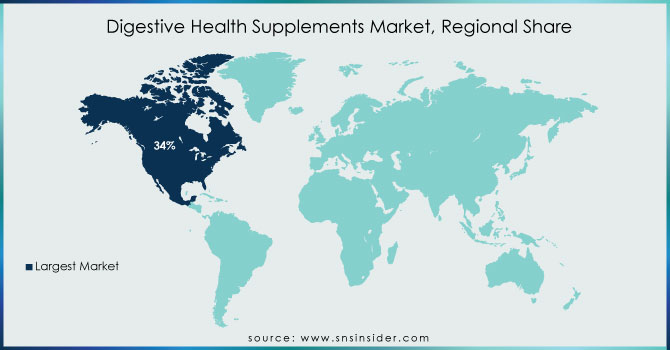

REGIONAL ANALYSIS:

North America led the global digestive health supplements market in 2023, with 34% of the share. The upward trends of digestive health across the globe indicate a growing market, propelled by consumer demand for solutions such as probiotics, prebiotics, and dietary supplements. According to the Centers for Disease Control and Prevention, more than 74 million Americans dealt with digestive issues in 2023, highlighting the consumer demand for solutions. The U.S. Department of Health & Human Services initiated programs to promote awareness regarding digestive health, ultimately boosting market growth. Demand for functional foods and dietary supplements is also surging in the U.S. & Canada due to growing consumer interest in preventive healthcare alongside an aging population. A report by the UK Government's Department of Health and Government in 2023 found that sales of digestive health products increased by up to 8% over the previous year, particularly for functional food & beverages, and supplements, making North America a leading region in this market.

KEY PLAYERS:

The key market players are BASF SE, Chr. Hansen Holding A/S, Nestle SA, International Flavors & Fragrances Inc., DuPont de Nemours, Inc., Bayer AG, Danone, Arla Foods amba, Sanofi, Cargill, Inc., and other players.

RECENT DEVELOPMENTS

-

In August 2023, Herbalife introduced a range of new vegan supplements in response to increasing consumer demand. These products are certified USDA Organic, verified non-GMO, certified kosher, and certified plant-based/vegan by FoodChain ID.

-

Megalabs Inc. subsidiary, Glutapak R, launched its probiotic glutamine supplement for intestinal healing & gut health in August 2022.

-

In February 2022, Organic India released portable daily pack supplements consisting of whole herb formulas designed for immunity, mood shifts, stress, digestion, and brain health.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

US$ 51.65 Billion |

|

Market Size by 2032 |

US$ 111.96 Billion |

|

CAGR |

CAGR of 9.42% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Ingredient Type (Probiotics, Prebiotics, Digestive Enzymes/Food Enzymes, and Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

BASF SE, Chr. Hansen Holding A/S, Nestle SA, International Flavors & Fragrances Inc., DuPont de Nemours, Inc., Bayer AG, Danone, Arla Foods amba, Sanofi, Cargill, Inc., and other players |

|

Key Drivers |

•The Growing Prevalence of Digestive Disorders such as irritable bowel syndrome (IBS), Crohn’s disease, and Gastroesophageal Reflux Disease (GERD) is Pushing the Demand for Digestive Health Supplements. |

|

RESTRAINTS |

•Strict Government Regulations Concerning the Labeling and Health Claims of Digestive Health Supplements Pose a Significant Barrier to Market Growth. |