Contact Center Software Market Size & Overview:

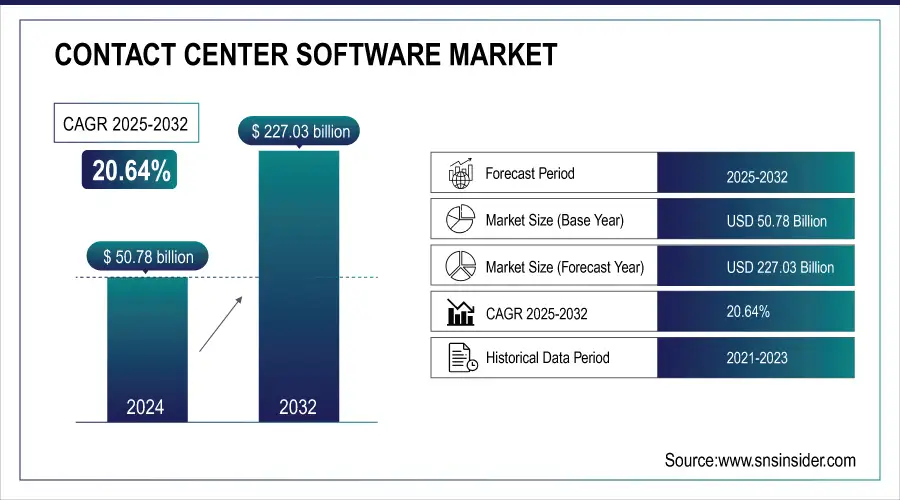

The Contact Center Software Market was valued at USD 50.78 billion in 2024 and is expected to reach USD 227.03 billion by 2032, growing at a CAGR of 20.64% from 2025-2032.

The contact center software market is growing as businesses prioritize customer experience and digital transformation. Cloud-based and AI-driven solutions enable flexible handling of voice, chat, and social media, while providing real-time insights. Companies are adopting omnichannel strategies with AI chatbots, self-service portals, and predictive analytics to enhance efficiency and reduce costs. Sectors like retail, healthcare, and finance increasingly embrace these tools for secure, scalable, and personalized customer engagement.

Contact Center Software Market Size and Forecast

-

Market Size in 2024: USD 50.78 Billion

-

Market Size by 2032: USD 227.03 Billion

-

CAGR: 20.64% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2020–2024

Get More Information on Contact Center Software Market - Request Sample Report

Contact Center Software Market Highlights:

-

Growing demand for omnichannel communication (voice, chat, email, social media) is driving adoption to ensure seamless customer experiences and loyalty.

-

AI and automation tools such as chatbots and virtual assistants are transforming customer service, improving efficiency and agent productivity.

-

61% of businesses track customer satisfaction, while 81% of executives are investing in AI to enhance customer engagement and service delivery.

-

Data security and privacy risks remain a major restraint, with 3,205 U.S. data compromise incidents in 2023 affecting 353 million individuals.

-

High implementation and maintenance costs limit adoption, particularly for SMEs struggling with licenses, hardware, training, and support expenses.

Looking to the future, the contact center software market is poised for transformative opportunities, as advancements in technologies like machine learning and natural language processing unlock new capabilities. These innovations are being supercharged by the adoption of 5G networks, which promise faster and more reliable communication, further empowering customer interaction platforms. In 2023, the adoption of 5G connections accelerated, reaching 1.76 billion globally by adding 700 million according to The Voice of 5G & LTE for the Americas. Moreover, as businesses prioritize sustainability and stricter data privacy measures, the market is evolving to offer solutions that align with these goals.

Contact Center Software Market Growth:

- Growing Need for Omnichannel Communication Solutions Drives Contact Center Software Market Growth

The increasing demand for seamless and efficient customer experiences pushes businesses to adopt omnichannel communication solutions. By integrating voice, chat, email, and social media channels, companies can engage with customers across multiple touchpoints, ensuring a consistent and smooth interaction. This integration enhances customer satisfaction and fosters loyalty, as businesses can respond faster and more personally across various platforms. According to Zippia, 61% of businesses track customer satisfaction, 52% monitor online review sites, and 24% have formal customer advocacy programs. As customer expectations for quick, personalized service continue to rise, organizations are turning to contact center software to enable real-time, multi-channel communication. This trend is expected to accelerate as customer experience becomes a more central focus for companies aiming to maintain a competitive edge.

-

AI and Automation Transform Customer Service in the Contact Center Software Market

The growing reliance on AI-powered tools like chatbots and virtual assistants is revolutionizing customer service in the contact center software market. These technologies enable businesses to efficiently handle a higher volume of customer inquiries, providing instant responses and personalized interactions. According to Deloitte, 81% of contact center executives are investing in AI for agent-enabling technologies, improving agent experience and operational efficiency, with up to a 120-point NPS improvement. As customer service demands increase, AI tools help businesses maintain high-quality service while improving efficiency and resource allocation. This shift towards AI and automation is rapidly gaining traction, as companies aim to streamline operations, enhance the customer experience, and stay competitive in an increasingly digital marketplace.

Contact Center Software Market Restraints:

- Data Security and Privacy Risks Pose a Major Restraint on the Contact Center Software Market

Concerns surrounding data security and privacy are significant restraints for the contact center software market, especially as businesses face increasing cybersecurity threats. In 2023, there were 3,205 data compromise incidents in the U.S., affecting over 353 million individuals, according to Statista. Many organizations, particularly in regulated industries such as finance and healthcare, hesitate to adopt cloud-based solutions due to fears of data breaches and non-compliance with stringent privacy regulations. The risk of sensitive customer information being exposed or misused heightens the reluctance to fully embrace cloud technologies.

-

High Implementation and Maintenance Costs Limit Adoption of Contact Center Software

The high initial setup costs and ongoing maintenance expenses present a significant restraint for the contact center software market, particularly for small and medium-sized enterprises. Many of these businesses may find it challenging to justify the substantial investment required to implement and maintain sophisticated software solutions. The financial burden of purchasing licenses, hardware, and training staff can be prohibitive, especially when coupled with the need for continuous updates and technical support. For SMEs with limited budgets, the long-term cost implications may deter them from adopting advanced contact center systems, leading them to stick with traditional or less sophisticated solutions that are more affordable, despite their limitations.

Contact Center Software Market Segmentation Analysis:

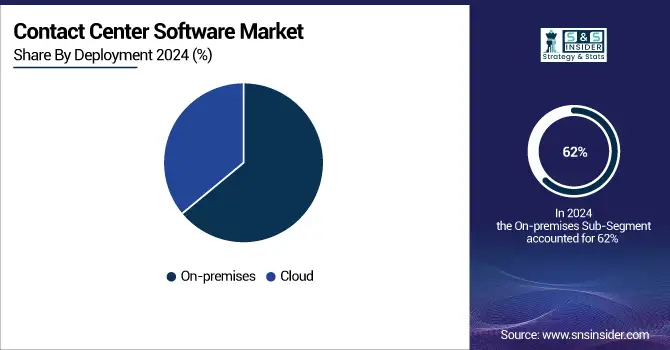

By Deployment, On-Premises Leads Contact Center Software Market, While Cloud Segment Set for Rapid Growth

In 2024, the On-premises segment dominated the contact center software market with the highest revenue share of approximately 62%. This dominance is driven by organizations' preference for greater control over their infrastructure, security, and data management. On-premises solutions are particularly favored by large enterprises with complex IT requirements and strict compliance needs, where customization and data security are critical priorities.

Conversely, the Cloud segment is expected to grow at the fastest CAGR of 20.64% from 2025 to 2032, fueled by the increasing demand for scalability, flexibility, and cost efficiency. Cloud-based solutions offer businesses the ability to quickly adapt to changing market conditions while reducing IT maintenance costs. As companies seek more agile and remote-friendly solutions, the Cloud segment is poised to benefit from these evolving business needs.

By Appication, Solution Segment Dominates Contact Center Software Market While Service Segment Poised for Rapid Growth

In 2024, the Solution segment led the contact center software market with the highest revenue share of around 70%. This is due to the increasing demand for integrated, multi-channel platforms that improve customer engagement and operational efficiency. Solutions offering AI, automation, and advanced analytics are particularly appealing, as they streamline workflows and enhance customer experience, driving significant market investments.

The Service segment is projected to grow at the fastest CAGR of 22.41% from 2025 to 2032, as businesses require continuous support to optimize their contact center software. With rising software adoption, there’s an increasing need for installation, maintenance, and training services. This demand for expert assistance to ensure effective software deployment and performance is fueling the rapid growth of the Service segment.

By Enterprise Size, Large Enterprises Lead Contact Center Software Market While SMEs Drive Fastest Growth

In 2024, the Large Enterprise segment dominated the contact center software market with the highest revenue share of about 60%. This is due to their substantial investment capabilities, complex customer service needs, and requirement for customized, scalable solutions. Large enterprises benefit from advanced features such as AI integration, analytics, and multi-channel support, which improve efficiency and customer experience across vast operations.

The Small & Medium Enterprise segment is expected to grow at the fastest CAGR of 22.11% from 2025 to 2032. SMEs are increasingly adopting cloud-based contact center solutions for their cost-efficiency, scalability, and ease of implementation. As businesses in this segment prioritize customer service improvements while managing operational costs, they are rapidly embracing solutions that provide flexibility and lower upfront investments, driving the segment's growth.

By End Use, IT & Telecom Lead Contact Center Software Market While Consumer Goods & Retail Segment Shows Fastest Growth

In 2024, the IT & Telecom segment dominated the contact center software market with the highest revenue share of about 25%. This dominance is driven by the industry's constant need for efficient customer support solutions, as businesses in this sector handle large volumes of customer inquiries across multiple channels. Additionally, the adoption of advanced technologies like AI, automation, and data analytics is vital for telecom and IT companies to maintain competitive customer service standards.

The Consumer Goods & Retail segment is expected to grow at the fastest CAGR of 25.74% from 2025 to 2032. As consumer expectations for personalized, real-time service continue to rise, companies in this sector are turning to contact center software to enhance customer engagement and streamline operations. The increasing shift toward e-commerce and omnichannel communication is driving retailers to invest in scalable, agile solutions, fueling rapid growth in this segment.

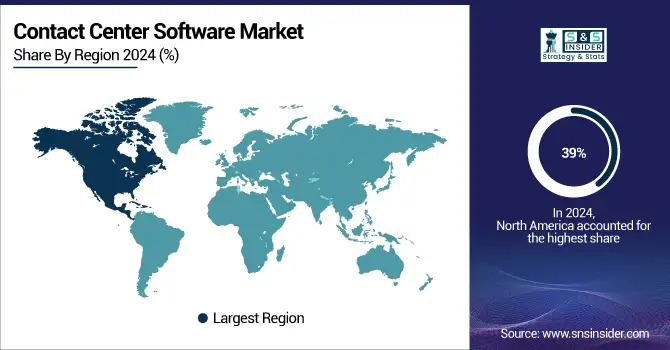

Contact Center Software Market Regional Analysis:

North America Leads Contact Center Software Market with 39% Revenue Share in 2024

In 2024, North America dominated the contact center software market with the highest revenue share of about 39%. This dominance is attributed to the region's advanced technological infrastructure, high adoption rates of cloud-based solutions, and the presence of large enterprises across key industries like IT, telecom, and retail. Additionally, businesses in North America prioritize customer experience, driving significant investments in innovative contact center technologies such as AI and automation.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Asia Pacific Contact Center Software Market Poised for Fastest Growth at 23.07% CAGR

Asia Pacific is expected to grow at the fastest CAGR of 23.07% from 2025 to 2032. This rapid growth is fueled by the region's expanding digital transformation, increasing adoption of cloud services, and a growing demand for customer support solutions across emerging markets. As businesses in Asia Pacific continue to modernize their operations and improve customer engagement, the contact center software market is poised to see significant expansion.

Contact Center Software Market Recent Development:

Microsoft:

Microsoft is a global technology leader specializing in software, cloud computing, and hardware solutions. Its flagship products include Windows, Office 365, and the Azure cloud platform. Microsoft provides contact center solutions through its Dynamics 365 Customer Service platform, integrating AI, automation, and omnichannel support to enhance customer engagement. These tools help businesses streamline workflows, gain real-time insights, and deliver personalized experiences, improving operational efficiency and customer satisfaction.

-

On June 4, 2024, Microsoft unveiled Dynamics 365 Contact Center, a Copilot-first cloud solution designed to enhance customer engagement using generative AI across voice, digital channels, and self-service.

Amazon:

Amazon is a multinational e-commerce and cloud computing company, known for its marketplace, Amazon Web Services (AWS), and logistics network. AWS offers cloud-based contact center solutions like Amazon Connect, enabling scalable, AI-driven customer service. The platform supports multi-channel communication, automated workflows, and analytics, helping organizations provide seamless, cost-efficient, and personalized customer experiences while optimizing support operations.

-

On December 1, 2024, Amazon announced the integration of generative AI into Amazon Connect, enhancing customer experiences with features like proactive outreach, AI-powered self-service, and real-time agent performance evaluations

Contact Center Software Market Key Players:

-

8x8, Inc. (8x8 Contact Center, 8x8 Voice for Microsoft Teams)

-

ALE International (Alcatel Lucent Enterprise) (Rainbow, OmniTouch Contact Center)

-

Altivon (Altivon Cloud Services, Altivon Customer Interaction Solutions)

-

Amazon Web Services, Inc. (Amazon Connect, AWS Lambda)

-

Ameyo (Ameyo Fusion CX, Ameyo Omni)

-

Amtelco (Intelligent Series, miSecureMessages)

-

Aspect Software (Aspect Unified IP, Aspect Via)

-

Avaya Inc. (Avaya Aura Contact Center, Avaya OneCloud CCaaS)

-

Avoxi (Avoxi Genius, Avoxi Virtual Contact Center)

-

Cisco Systems, Inc. (Cisco Webex Contact Center, Cisco Unified Contact Center Enterprise)

-

Enghouse Interactive Inc. (Enghouse Cloud Contact Center, Enghouse Interactive Quality Management Suite)

-

Exotel Techcom Pvt. Ltd. (Exotel Voice Platform, Exotel Smart IVR)

-

Five9, Inc. (Five9 Intelligent Cloud Contact Center, Five9 Workforce Optimization)

-

Genesys (Genesys Cloud CX, Genesys Engage)

-

Microsoft Corporation (Microsoft Dynamics 365 Customer Service, Microsoft Azure Communication Services)

-

NEC Corporation (NEC UNIVERGE SV9500, NEC Contact Center Suite)

-

SAP SE (SAP Service Cloud, SAP CRM Contact Center)

-

Spok, Inc. (Spok Mobile, Spok Care Connect)

-

Talkdesk, Inc. (Talkdesk CX Cloud, Talkdesk AI Trainer)

-

Twilio Inc. (Twilio Flex, Twilio Programmable Voice)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 |

USD 50.78 billion |

| Market Size by 2032 |

USD 227.03 billion |

| CAGR | CAGR 20.64 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution and services) • By Deployment (Cloud and On-premise) • By Enterprise Size (Large Enterprise and Small & Medium Enterprise) • By End Use (BFSI, Consumer Goods & Retail, Government, Healthcare, IT & Telecom, Travel & Hospitality, Others |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | 8x8, Inc., ALE International, Altivon, Amazon Web Services, Inc., Ameyo, Amtelco, Aspect Software, Avaya Inc., Avoxi, Cisco Systems, Inc., Enghouse Interactive Inc., Exotel Techcom Pvt. Ltd., Five9, Inc., Genesys, Microsoft Corporation, NEC Corporation, SAP SE, Spok, Inc., Talkdesk, Inc., Twilio Inc., UiPath, Unify Inc., VCC Live, Mitel Networks Corporation, Bright Pattern, Inc. |