Human Resource (HR) Technology Market Report Scope and Overview:

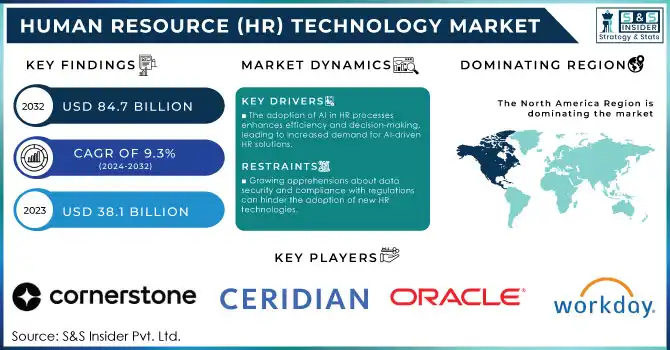

The Human Resource (HR) Technology Market Size was valued at USD 41.64 billion in 2024 and is expected to reach USD 84.82 billion by 2032, growing at a CAGR of 9.3% over the forecast period of 2025-2032.

The Human Resource Technology Market is experiencing significant expansion, propelled by advancements in digital tools that optimize human resource technology. Government statistics reveal a rapid increase in HR technology adoption across industries. For instance, the U.S. Bureau of Labor Statistics highlights that over 70% of businesses in OECD nations adopted HR software in 2023, a substantial jump from just 54% in 2019. This growth correlates with global digital transformation efforts, especially in small and medium enterprises (SMEs), which often face resource constraints in managing HR processes. In the U.S., the National Institute of Standards and Technology (NIST) supports SMEs through initiatives that provide access to cloud-based solutions, enhancing operational efficiency.

Get more informtion on Human Resource (HR) Technology Market - Request Sample Report

Human Resource (HR) Technology Market Size and Forecast:

-

Market Size in 2024: USD 41.64 Billion

-

Market Size by 2032: USD 84.82 Billion

-

CAGR: 9.3% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Human Resource (HR) Technology Market Highlights:

-

The rise of remote and hybrid work models drives demand for advanced HR technologies for collaboration, engagement, and performance management.

-

AI integration is transforming HR processes into data-driven, predictive systems, improving hiring, retention, and workforce planning.

-

AI-powered tools and chatbots handle routine tasks, allowing HR personnel to focus on strategic initiatives and employee development.

-

Predictive analytics and AI-enabled platforms customize training, anticipate turnover, and enhance engagement and upskilling.

-

Automation and AI reduce compliance risks, streamline policy updates, and promote a more inclusive and equitable workplace.

-

High initial costs, data privacy concerns, regulatory compliance, and employee reluctance can limit adoption and increase operational challenges.

In Europe, the Digital Europe Program allocates substantial funding to help businesses modernize their HR frameworks. This investment supports compliance, automation, and talent management innovations. Similarly, Asia-Pacific nations are advancing their workforce digitization policies, such as India’s "Digital India" program, which focuses on creating smart HR ecosystems for public and private enterprises. These strategies align with global trends emphasizing productivity improvements, data-driven decision-making, and employee engagement. The HR technology market thus continues to grow as companies adapt to remote and hybrid work settings, focusing on automated processes to reduce costs and enhance workforce satisfaction.

Human Resource (HR) Technology Market Drivers:

-

The rise of remote and hybrid work models necessitates advanced HR technologies for virtual collaboration, employee engagement, and performance management.

HR technology is being revolutionized with the incorporation of artificial intelligence to turn traditional HR processes into applicable, data-driven, efficient, leading, predictive systems. AI in HR helps improve talent hiring, employee engagement, and Human Resource Technology. Recent studies highlight that nearly 80% of HR professionals believe AI will have a significant impact on workplace practices in the coming years. AI-based tools like chatbots have started addressing 70% of employee queries, leaving much of the strategic tasks for HR personnel. LinkedIn Talent Insights and IBM Watson Talent are examples of AI-powered recruitment platforms that utilize machine learning algorithms to find the right candidate from millions of candidate profiles based on vibrant skills and cultural fits. Furthermore, predictive analytics tools enable organizations to anticipate employee turnover, helping them proactively address retention challenges.

Businesses are also applying AI to customize employee training and development. AI-enabled platforms like Degreed are being used to suggest customized training programs to employees, leading to more engagement and upskilling. Moreover, AI minimizes compliance-assured risk by automating policy changes and ensuring compliance with regional labor laws. While the adoption of AI in HR technology is surging, the benefits go beyond efficiency. AI combats modern workplace challenges by creating a more inclusive and equitable workplace through the reduction of all hiring biases and smarter decision-making. Such transitions reflect how AI can revolutionize HR systems ready for the future.

Human Resource (HR) Technology Market Restraints:

-

High initial investment and maintenance expenses may deter small and medium-sized enterprises from adopting advanced HR technology solutions.

With the expanding reliance on HR technology, worries regarding data privacy and security have been heightened. HR systems handle sensitive information about employees, such as personal information, financial data, and performance information. This poses a great fear to organizations in terms of data breaches, unauthorized access, or cyberattacks. In addition, strict regulations such as GDPR, CCPA, and other local data protection laws make implementing HR technologies more complicated.

This will also raise the operational expense of adoption and delay timelines as organizations will have to ensure their HR technology vendors are following high-degree security protocols and data encryption measures. Additionally, employees may express reluctance to engage with systems they perceive as intrusive, which can hinder the effective use of these platforms. Addressing these concerns requires organizations to adopt transparent policies, invest in cybersecurity measures, and educate employees about the safeguards in place, which can pose challenges in time-sensitive HR operations.

Human Resource (HR) Technology Market Segment Analysis:

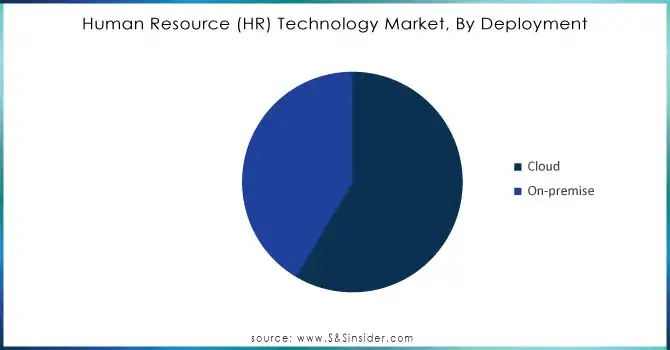

By Deployment

Cloud-based HR technology solutions commanded the highest revenue share, at 62%, in 2024. This dominance arises from the scale, flexibility, and cost-effectiveness provided by these platforms. Cloud solutions, in particular, allow businesses to quickly change to meet changing workforce timelines, especially now with remote and hybrid models compared to on-premise systems. All around the world, governments are encouraging cloud adoption, as a national mandate, to construct a robust digital infrastructure. For instance, Germany’s "Cloud for Europe" provides data sovereignty with emerging cloud innovation. The "MeitY Cloud Vision 2025" also includes cloud services for businesses on the priority list of the Indian Ministry of Electronics and Information Technology.

Moreover, according to a 2024 report, almost 60 percent of HR leaders have said that they see cloud platforms as vital to effective Human Resource Technology in the future. This trend was further accelerated by the pandemic, as organizations had to find real-time solutions to on-time payroll, employee tracking, and compliance. Cloud solutions, especially valuable for SMEs, provide cost cost-saving, subscription-driven model that eliminates CAPEX issues. With these platforms, the increased threat of sensitive employee data being compromised by a cyber email is mitigated across HR systems as well. The continued evolution of cloud-based HR tools reflects their market leadership as the chosen deployment model.

Need any customization research/ data on Human Resource (HR) Technology Market - Enquiry Now

By Type

In 2024, the talent management segment dominated the market with the largest share 20%, due to an international focus on retaining employees and upgrading their skills. With the increase in turnover rate and skill shortages, governments and corporations are also becoming more concerned about talent management these days. According to the U.S. Department of Labor, 25% of employees cited limited career development opportunities as their reason for leaving jobs in 2022. Thus, organizations have been driven to utilize talent management solutions by incorporating next-generation AI and analytics capabilities to help them with predictive workforce planning and personalized career paths.

The European Union is actively supporting this area through the Horizon Europe program to fund projects that focus on innovative solutions to improve talent mobility and skill-building across member states. For example, in the Asia-Pacific region, countries such as Singapore have expanded their skill development programs, as well as their integration with government systems, into HR platforms for a comprehensive workforce ecosystem. Sustained talent management solutions assist organizations in evaluating employees, recognizing the skills required, and facilitating constant training sessions. These solutions align with global workforce trends emphasizing adaptability and employee-centric policies, making the segment critical for HR technology providers.

By Industry

In 2024, the IT and telecommunications industry was the largest HR technology adopter with a 23% market share. The sector also comes with its challenges like transitioning technology, skill shortage as well as distribution of the workforce globally. Such requests push organizations to opt for advanced HR systems that help streamline various operations such as recruitment, compliance management, and upskilling. As per the 2023 survey, 45% of global IT organizations adopted AI-powered HR Solutions in a bid to streamline their hiring management processes and enhance talent engagement.

Governments play a pivotal role in this adoption. In Singapore, for instance, its Infocomm Media Development Authority rolled out initiatives seeking to have IT companies adopt HR tech and transform their workforce. Likewise, Australia has its Digital Workforce Initiative where tech companies are provided tools and financial mechanisms for addressing workforce diversity, as well as overcoming skill shortages. These industries have solid digital infrastructure, making HR platforms easier to deploy as well as making the data available for real-time analysis and decision-making. As IT and telecom firms strive to maintain a competitive edge, their reliance on cutting-edge HR technology continues to grow.

Human Resource (HR) Technology Market Regional Analysis:

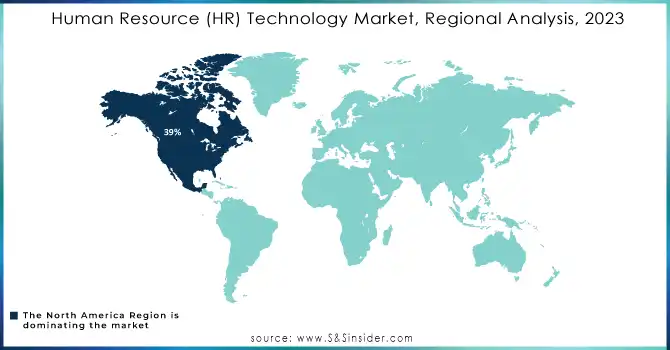

North America Human Resource (HR) Technology Market Trends:

North America emerged as the dominating region in the HR Technology Market with 39% in revenue share in 2024, owing to increased digital adoption and sizable investments in HR innovation. U.S. based companies are taking the lead, with assistance from government programs such as the Workforce Innovation and Opportunity Act (WIOA), which continues to fund innovative tech-based human resources solutions. Europe also plays a critical role, with countries like Germany and the U.K. highly focused on compliance-oriented HR tools to navigate a myriad of stringent labor laws.

Asia-Pacific Human Resource (HR) Technology Market Trends:

Asia Pacific is expected to be the fastest-growing region at a CAGR of 12.5%, due to government policies like China's Digital Silk Road and India's workforce digitization. A young and tech-savvy workforce, along with rising IT infrastructure investments make the Asia-Pacific market beneficial too. HR technologies are receiving active government funding to make the employees more productive and help the small and medium enterprises (SME) sector. For example, Japan’s “Society 5.0” initiative incorporates digital HR platforms for ideal workforce planning. These regional dynamics indicate that Asia-Pacific will soon emerge as a key player in the HR technology landscape.

Europe Human Resource (HR) Technology Market Trends:

Europe holds a significant share in the HR technology market, with countries like Germany, the U.K., and France emphasizing compliance-oriented HR tools to navigate stringent labor laws. Organizations increasingly invest in cloud-based platforms for payroll, talent management, and workforce analytics, while digital transformation initiatives across the EU drive adoption of AI and automation in HR processes.

Latin America Human Resource (HR) Technology Market Trends:

Latin America is witnessing steady growth in HR technology adoption, driven by the increasing need for workforce efficiency and digital transformation in both private and public sectors. Countries such as Brazil and Mexico are investing in cloud-based HR solutions to streamline payroll, talent management, and compliance processes. The rise of multinational corporations and a growing startup ecosystem are also contributing to higher demand for integrated HR platforms.

Middle East & Africa Human Resource (HR) Technology Market Trends:

The Middle East & Africa (MEA) region is gradually adopting HR technologies, with the UAE, Saudi Arabia, and South Africa leading the charge. Government initiatives supporting workforce modernization and smart city projects are boosting HR automation, particularly in talent management, employee engagement, and payroll systems. Organizations are increasingly leveraging cloud-based HR solutions to enhance productivity, ensure compliance with local labor laws, and attract global talent.

Human Resource (HR) Technology Market Competitive Landscape:

ADP (Automatic Data Processing, Inc.), established in 1949, is a global leader in human capital management solutions, offering cloud-based payroll, HR, talent, time, tax, and benefits administration services. Serving businesses of all sizes, ADP leverages AI, analytics, and automation to enhance workforce efficiency, compliance, and employee engagement across over 140 countries.

-

In August 2023: ADP acquired Honu HR, Inc. (Sora), a workflow automation and data integration platform, to streamline HR processes. The acquisition combines Sora's user-friendly platform with ADP's HCM solutions to support employees, HR professionals, and business owners.

Workday, Inc., established in 2005, is a leading provider of enterprise cloud applications for finance and human resources. Its solutions include HR, payroll, talent management, workforce planning, and analytics. Workday leverages AI and machine learning to help organizations improve decision-making, streamline operations, and enhance employee engagement globally.

-

In February 2023: Workday launched AI-enhanced talent marketplaces, aiding organizations in optimizing workforce flexibility. These developments align with U.S. government initiatives supporting AI in HR technologies.

Oracle Corporation, established in 1977, is a global leader in enterprise software and cloud solutions, including human capital management (HCM) platforms. Its Oracle Fusion Cloud HCM suite offers payroll, workforce management, talent, and analytics tools. Oracle leverages AI, automation, and data-driven insights to optimize HR operations and enhance workforce productivity worldwide.

-

In June 2023: Oracle launched new generative AI features in Oracle Fusion Cloud HCM to enhance HR operations, boost productivity, improve employee and candidate experiences, and align HR strategies with business goals.

Human Resource (HR) Technology Market Key Players:

Service Providers / Manufacturers

-

SAP SE (Germany)

-

Oracle Corporation (USA)

-

Automatic Data Processing (ADP), Inc. (USA)

-

Workday Inc. (USA)

-

Ceridian HCM Holding Inc. (USA)

-

Cornerstone OnDemand, Inc. (USA)

-

UKG Inc. (USA)

-

Infor, Inc. (USA)

-

IBM Corporation (USA)

-

Cegid Group (France)

-

HiBob (UK)

-

The Access Group (UK)

-

SumTotal Systems, Inc. (USA)

-

ServiceNow, Inc. (USA)

-

Rippling (USA)

-

Gusto, Inc. (USA)

-

15Five (USA)

-

BambooHR LLC (USA)

-

Darwinbox (India)

-

Personio (Germany)

Users of HR Technology Solutions

-

Amazon

-

Microsoft

-

Accenture

-

Walmart

-

Google (Alphabet Inc.)

-

Infosys

-

Cognizant Technology Solutions

-

Deloitte

-

Tata Consultancy Services (TCS)

-

Pfizer

| Report Attributes | Details |

| Market Size in 2024 | USD 41.64 Billion |

| Market Size by 2032 | USD 84.82 Billion |

| CAGR | CAGR of 9.3% from 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Talent Management, Human Resource Technology, Recruitment, Payroll Management, Performance Management, Others) • By Enterprise Type (Small and Medium Sized Enterprises, Large Enterprises) • By Deployment (Cloud, On-premise) • By Industry (BFSI, IT and Telecommunication, Government, Manufacturing, Retail, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | SAP SE, Oracle Corporation, Automatic Data Processing (ADP), Inc., Workday, Inc., Ceridian HCM Holding Inc., Cornerstone OnDemand, Inc., UKG Inc., Infor, Inc., IBM Corporation, Cegid Group, HiBob, The Access Group, SumTotal Systems, Inc., ServiceNow, Inc., Rippling, Gusto, Inc., 15Five, BambooHR LLC, Darwinbox, Personio |