Location Intelligence Market Report Scope & Overview:

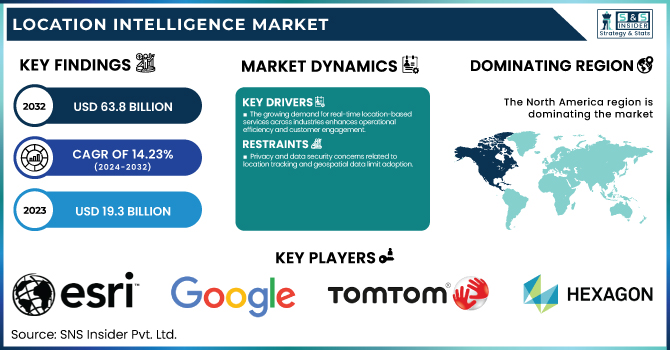

The Location Intelligence Market was valued at USD 19.3 billion in 2023 and is expected to reach USD 63.8 billion by 2032, growing at a CAGR of 14.23% from 2024-2032.

To Get more information on Location Intelligence Market - Request Free Sample Report

This report covers key trends in the Location Intelligence Market, including the growing adoption of location-based services across industries like retail, logistics, and smart cities. It highlights regional growth in geospatial data usage, with North America and Asia-Pacific leading due to smart city investments. The report also examines the market penetration of location intelligence platforms by organization size, showing rising adoption by SMEs and large enterprises. Additionally, it tracks the increasing use of real-time location analytics in fleet tracking, consumer behavior analysis, and emergency response while exploring emerging trends like AI-driven insights and IoT-based geospatial solutions.

The U.S. The Location Intelligence Market was valued at USD 5.0 billion in 2023 and is expected to reach USD 16.3 billion by 2032, growing at a CAGR of 14.09% from 2024-2032, due to increasing adoption in smart city projects, rising demand for real-time analytics in logistics and retail, and advancements in geospatial technologies. Government investments in infrastructure and expanding use cases in sectors like healthcare, defense, and transportation further drive growth. Future forecasts point to continued expansion fueled by AI integration, IoT connectivity, and cloud-based location intelligence solutions.

Location Intelligence Market Dynamics

Driver

-

The growing demand for real-time location-based services across industries enhances operational efficiency and customer engagement.

Location-based services are increasingly being adopted across various industries, including retail, transportation, logistics, and government, which is a major driver for the growth of the location intelligence market. Companies are using location intelligence to improve customer experience, boost operational productivity, and streamline supply chain logistics. Demand is also powered by the increasing penetration of smartphones, IoT devices, and GPS-enabled solutions. In addition to that, the growing utilization of geospatial data in applications such as asset tracking, workforce management, and emergency response has contributed to the growth of the market. The combination of real-time analytics for predictive insights and recent advancements in AI continues to broaden the applications available for location intelligence.

Restraint

-

Privacy and data security concerns related to location tracking and geospatial data limit adoption.

As location intelligence has a rising number of users, they remain prone to privacy and data security concerns. This collection, storage, and processing of sensitive user location data pose ethical and regulatory challenges to your service, particularly in areas with robust data protection law where GDPR in the EU is the most prominent example. Risks to user privacy from misuse of geospatial data, potential breaches, and concerns about location tracking technologies. Companies are struggling to balance data monetization and privacy. In addition, growing consumer awareness of data security rights combined with increased scrutiny from regulatory boards can pose difficulties to data collection, which may delay data adoption in specific applications.

Opportunity

-

Increased integration of AI and IoT in location intelligence opens avenues for advanced analytics and smart applications.

The usage of AI and IoT technologies is giving rise to ample opportunities in the location intelligence market. Leveraging AI-Powered Location Intelligence — In addition to capturing, analyzing, and processing location data, AI can also be used with location intelligence solutions to derive new insight through advanced geospatial analysis, such as real-time anomaly detection, predictive maintenance, and route optimization. The Internet of Things and its connected devices are driving a new era of location data collection and management that will transform industries, improve consumer experiences, and enhance public services. Other significant factors, such as the growing use of AI-based geofencing tools and the automation of data visualization, are expected to drive market adoption further. The potential opportunity here is strengthened by the increased need for hyper-personalized services in areas such as retail, where location intelligence improves customer targeting and engagement.

Challenge

-

Integration and interoperability issues with legacy systems and multi-vendor environments hinder seamless implementation.

Integration and Interoperability Challenges continue to be a major roadblock in the location intelligence market. However, many organizations are unable to implement location intelligence tools in their existing IT infrastructure, resulting in data silos and inefficiencies. The data may come from disparate sources, stored in different formats, leading to a lack of standardized protocols preventing seamless data exchange between different systems. The complexity is compounded in multi-vendor environments, and interoperability becomes a key requirement. Moreover, legacy systems in industries like government and transportation may not work with a modern geospatial analytics platform. Overcoming these integration hurdles by open APIs, data harmonization, and cloud-based platforms is necessary for all location intelligence solutions to realize their full potential.

Location Intelligence Market Segmentation Analysis

By Component

The software segment dominated the market and accounted for a 62% revenue market share in 2023. The integration of such location intelligence software with AI and machine learning technologies is also anticipated to augment the segment growth. With advanced techniques, software may evaluate data a lot more accurately, notice trends, predict trends, and supply compelling solutions. Retail stores, for instance, may use predictive analytics to identify the best locations for their stores, whereas logistics/logistics organizations would use analytics for path optimization.

The service segment is projected to witness the fastest CAGR during the forecast period owing to the increasing complexity of location intelligence technologies often requiring industry-specific expertise to properly implement, maintain, and scale. The demand is shifting toward service providers for assisted integration of location intelligence systems into the structured infrastructure to derive seamless collection and analysis of data. These services generally include training of in-house teams, and tailoring of dashboards, analytics, and reporting tools.

Location Type

In 2023, the outdoor segment dominated the market and held the largest revenue share due to the growing use of GPS-enabled devices as well as the growing usage of real-time data in outdoor applications. As GPS technology is incorporated into nearly all smartphones and the number of IoT-connected devices is soaring in industries such as agriculture, logistics, and construction, the number of outdoor data points available to organizations has significantly increased. Outdoor applications such as fleet route optimization and improved resource management are utilizing these data points to help businesses better gain location-based insights and even enhance public safety initiatives.

The indoor segment is expected to register the fastest CAGR over the forecast period. Increasing demand for positioning technologies in indoor environment and advancement in location-based services are some of the other factors boosting segmental growth. Structural complexities associated with indoor spaces, including shopping malls, airports, hospitals, and large corporate campuses, make traditional GPS-based solutions ineffective.

By Deployment

The on-premise segment dominated the market with a revenue share of over 56% in 2023. Indeed, many industries — particularly those involving finance, healthcare, and government — often need on-premise solutions in order to better protect sensitive data. These sectors are often highly regulated with strong guidelines surrounding data protection. On-premise deployments provide organizations with direct control of their infrastructure and data storage, enabling them to remain compliant with industry regulations.

The cloud segment is anticipated to grow at a significant CAGR during the forecast timeframe, owing to the need for operational efficiency coupled with cost reductions that drive demand. in transportation and logistics. Cloud-based location intelligence like route optimization, fleet management, and asset tracking are taking a greater place in the organization. Cloud deployment gives logistics companies real-time access to supply chains, allowing them to reduce fuel costs, streamline delivery times, and control inventory.

By Application

The sales and marketing optimization segment dominated the market and accounted for a significant revenue share in 2023. As consumers increasingly browse and buy using their mobile phones, businesses can harness mobile location to understand and meet customer journeys and needs and engage with customers in real time. Mobile apps are one of the entities that also collect geolocation data, allowing companies to have detailed knowledge of consumer behaviour and preferences.

The remote monitoring segment is anticipated to exhibit significant CAGR from 2024 to 2032. Telematics solutions are being used by the transportation and logistics industries to track vehicles in real time. These systems utilize GPS and location data to follow vehicle movements, improve routes and supervise driver conduct. This not only helps with operational efficiency but also meets the needs of safety and regulatory compliance.

By Vertical

The transportation and logistics segment dominated the market and accounted for a significant revenue share in 2023, owing to the increasing need to manage the supply chain efficiently. Emergence of New Market Trends The world with expanding trades and customers demanding faster delivery times demands all organizations to rethink their logistics operations for better deliveries. With location intelligence, you can track what's happening with your transportation routes, inventory, and shipments in real-time, which helps companies make decisions on the fly, which improves efficiency and ultimately cuts costs.

The retail and consumer goods segment is also anticipated to witness a significant CAGR over the assessment period, with growing omnichannel retailing where consumers seek a seamless shopping experience across platforms, online, mobile, and in-store.

Regional Analysis

In 2023, North America dominated the market and accounted for 34% of revenue share, attributed to increasing integration of the Internet of Things (IoT) and edge computing. IoT devices are collecting location data from an array of data sources in real time, and businesses are investing in these devices to improve operational effectiveness and intelligence. Edge Computing — Where data can be processed where it is generated, which serves quicker responses based on location insights by saving on latency.

Asia Pacific is the fastest-growing region, with the fastest CAGR from 2024 to 2032. The Asia Pacific retail market is becoming omnichannel as customers can blend shopping experiences between online and offline channels. Retailers are leveraging location data analytics to understand customer behavior, improve inventory management, delivery processes, and targeted marketing campaigns, ultimately improving customer engagement and satisfaction.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

The major key players along with their products are

-

Esri – ArcGIS

-

Google LLC – Google Maps Platform

-

Apple Inc. – Apple Maps

-

HERE Technologies – HERE Location Services

-

TomTom N.V. – TomTom Maps APIs

-

Mapbox – Mapbox Studio

-

Hexagon AB – Luciad Portfolio

-

Pitney Bowes Inc. – Spectrum Spatial

-

TIBCO Software Inc. – TIBCO GeoAnalytics

-

Oracle Corporation – Oracle Spatial and Graph

-

Microsoft Corporation – Azure Maps

-

SAP SE – SAP HANA Spatial Services

-

CartoDB, Inc. (Carto) – Carto Platform

-

Foursquare Labs, Inc. – Foursquare Places

-

Trimble Inc. – Trimble GPS Solutions

Recent Developments

-

April 2024 – Delhivery: Delhivery introduced "LocateOne," a location intelligence solution aimed at enhancing address data accuracy, improving rooftop precision, and reducing fraud, thereby bolstering logistics efficiency.

-

October 2024 – Google: Google integrated its AI chatbot, Gemini, into mapping applications like Google Maps, Google Earth, and Waze, enabling more tailored and context-aware responses to user queries, enhancing the overall user experience.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 19.3 Billion |

| Market Size by 2032 | US$ 63.8 Billion |

| CAGR | CAGR of 14.23 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Service) • By Location Type (Indoor, Outdoor) • By Deployment (On-premise, Cloud) • By Application (Workforce Management, Asset Management, Facility Management, Risk Management, Remote Monitoring, Sales and Marketing Optimization, Customer Management, Others) • By Vertical (Retail and Consumer Goods, Government and Defence, Manufacturing and Industrial, Transportation and Logistics, BFSI, IT & Telecom, Utilities & Energy, Media & Entertainment) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Esri, Google LLC, Apple Inc., HERE Technologies, TomTom N.V., Mapbox, Hexagon AB, Pitney Bowes Inc., TIBCO Software Inc., Oracle Corporation, Microsoft Corporation, SAP SE, CartoDB, Inc. (Carto), Foursquare Labs, Inc., Trimble Inc. |