Digital Lending Platform Market Report Scope & Overview:

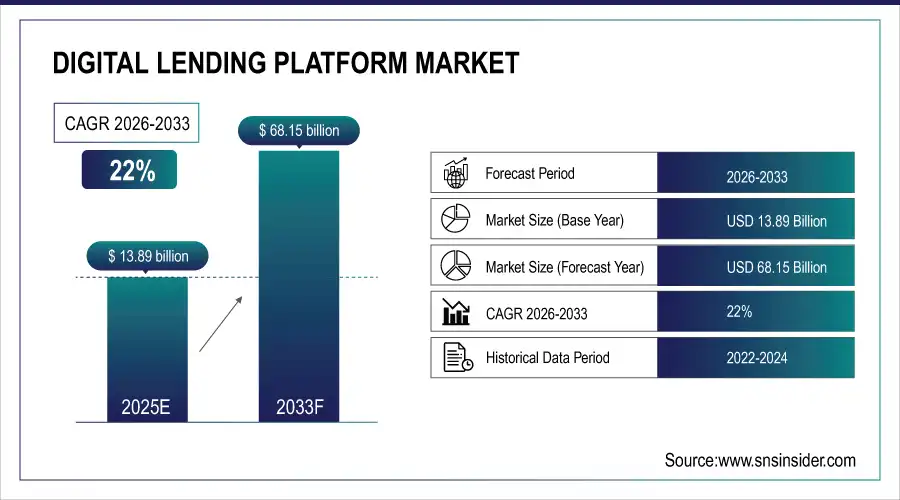

The Digital Lending Platform Market was valued at USD 13.89 billion in 2025E and is expected to reach USD 68.15 billion by 2033, growing at a CAGR of 22% from 2026-2033.

The Digital Lending Platform Market is growing due to increasing adoption of digital banking solutions, rising demand for faster and more convenient loan processing, and automation of credit assessment. Enhanced customer experience, improved risk management, and reduced operational costs are driving financial institutions to adopt these platforms. Additionally, the expansion of online lending, fintech innovations, and growing smartphone penetration contribute to the market’s robust growth trajectory.

Digital Lending Platform Market Size and Forecast

-

Market Size in 2025E: USD 13.89 Billion

-

Market Size by 2033: USD 68.15 Billion

-

CAGR: 22% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Digital Lending Platform Market - Request Sample Report

Digital Lending Platform Market Trends

-

Rising demand for faster, seamless, and paperless lending processes is driving the digital lending platform market.

-

Growing adoption of AI, machine learning, and analytics is enhancing credit risk assessment and decision-making.

-

Expansion of fintech solutions and online lending services is boosting market growth across BFSI and SME sectors.

-

Increasing focus on customer experience, automated workflows, and real-time loan processing is shaping adoption trends.

-

Integration with mobile banking, payment gateways, and digital KYC/AML solutions is improving accessibility and compliance.

-

Rising smartphone penetration and internet adoption are fueling digital lending platform usage.

-

Collaborations between banks, fintech startups, and technology providers are accelerating innovation and global deployment.

Digital Lending Platform Market Growth Drivers:

-

Rising demand for faster loan processing and automation of credit evaluation driving digital lending adoption globally

The increasing need for quick and seamless loan processing is encouraging financial institutions to adopt digital lending platforms. Automation of credit assessment reduces human intervention, accelerates approvals, and enhances efficiency. Customers increasingly prefer digital channels for loan applications, making traditional manual processes less attractive. Financial institutions are leveraging AI and machine learning to improve decision-making and risk evaluation. Enhanced operational efficiency and reduced turnaround time are key benefits that drive market expansion. The integration of mobile apps and online portals further boosts adoption across retail and corporate lending segments worldwide.

Digital Lending Platform Market Restraints:

-

Regulatory complexities and inconsistent guidelines across regions limiting digital lending market expansion

Varying regulatory frameworks and compliance requirements across countries hinder the growth of digital lending platforms. Financial institutions must adhere to multiple standards for consumer protection, interest rates, and digital transactions, making implementation complex and costly. Inconsistent licensing, reporting obligations, and approval processes create barriers for cross-border expansion. Regulatory uncertainty affects investor confidence and slows platform development. Institutions may delay or limit adoption to mitigate compliance risks. These regulatory challenges make it difficult to scale operations globally, reducing market penetration and slowing the overall growth of digital lending platforms in emerging and mature markets.

Digital Lending Platform Market Opportunities:

-

Integration of AI, machine learning, and analytics in lending platforms creating growth avenues

Incorporating AI, machine learning, and advanced analytics enhances decision-making, risk management, and customer experience in digital lending platforms. Predictive algorithms streamline credit evaluation, detect fraud, and improve loan approval accuracy. Personalized product recommendations increase borrower engagement and satisfaction. Analytics help institutions optimize lending strategies, pricing, and portfolio management. Fintech partnerships enable seamless integration of innovative tools, reducing costs and improving scalability. As demand for smarter, data-driven lending solutions grows, leveraging AI and analytics opens new revenue streams and strengthens market competitiveness, driving long-term growth opportunities for digital lending platforms globally.

Digital Lending Platform Market Segment Analysis

By Solution, Loan Origination dominated the Digital Lending Platform Market

Loan Origination held the largest market share around 46% in 2023. It is mainly because loan origination is the first and the most important step of the lending process where a borrower applies for loans and lenders determine whether they qualify for a loan. Moreover, digital lending has greatly eased this process as it automates processes to a good extent, minimizes human intervention, and provides an enhanced experience. A digital loan origination platform helps in faster application, approval, and disbursement for loans, and eliminates quite a few hassles created for borrowers and lenders.

By Service, Support and Maintenance dominated the Digital Lending Platform Market

Support and Maintenance held the largest market share around 38% in 2023. Because digital lending platforms need to evolve sustainably to keep functioning smoothly, safely, and seamlessly within changing regulations. With the heavy dependency on sophisticated technology like AI, machine learning, and cloud computing integrated into these platforms, constant updates, bug fixes, and system upgrades become crucial to ensure performance, security, and scalability. In addition, an evolving digital lending environment means keeping the financial institution financial institution platform current with the latest features, and regulatory needs.

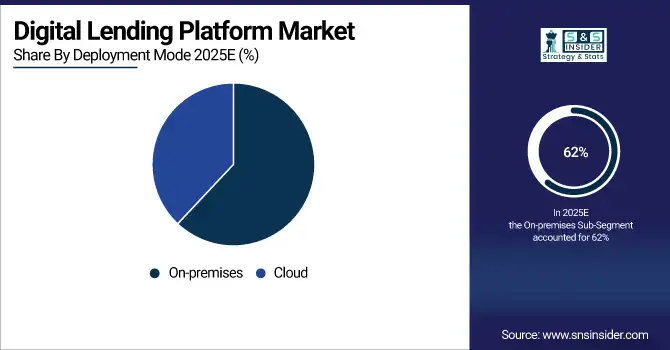

By Deployment, On-Premises dominated the Digital Lending Platform Market

On-Premises held the largest market share around 62% in 2023. It is mainly due to the ability to control the digital lending process at each stage, both securing and streamlining the processes and system into the overall organization by establishing a compliant environment. On-premises has a natural appeal for financial institutions (particularly socialized camps with a GFC-like background), if only because it provides them with a greater level of control over their data and infrastructure. This is especially true for lenders who process sensitive customer data that is subject to strict data privacy laws.

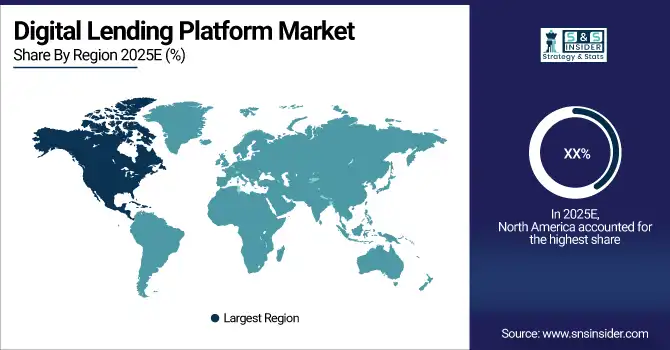

Regional Analysis:

North America Digital Lending Platform Market Insights

North America’s Digital Lending Platform Market is expanding rapidly due to widespread adoption of fintech solutions, growing demand for faster loan approvals, and advanced digital banking infrastructure. Rising smartphone penetration, cloud-based platforms, and AI-driven credit assessment tools enhance customer experience and operational efficiency. Favorable regulatory support and increasing investment in digital transformation by banks further accelerate market growth, making North America a key hub for innovative lending solutions.

Need any customization research on Digital Lending Platform Market - Enquiry Now

Asia Pacific Digital Lending Platform Market Insights

The Asia Pacific region held the largest revenue share around 46%. Government actions to develop digital infrastructure for promoting the region's adoption of Digital Lending solutions. Because of rapid economic development, globalization, digitization, and the rising ubiquity of smartphones, APAC is likely to be the fastest-growing market. Furthermore, Asia Pacific is undergoing a remarkable digital transformation, including rising internet penetration rates, smartphone prevalence, and population familiarity with technology, all of which facilitate the adoption of digital financial services.

Europe Digital Lending Platform Market Insights

Europe’s Digital Lending Platform Market is witnessing steady growth driven by increasing digital banking adoption and fintech innovations. Regulatory frameworks like PSD2 promote secure and seamless online transactions, boosting platform usage. Rising demand for faster loan processing, AI-based credit assessments, and enhanced customer experience encourages adoption. Additionally, growing investments in cloud-based solutions, mobile banking, and financial inclusion initiatives are accelerating the expansion of digital lending platforms across European markets.

Middle East & Africa and Latin America Digital Lending Platform Market Insights

The Middle East & Africa and Latin America Digital Lending Platform Markets are growing due to increasing smartphone penetration, rising internet access, and growing fintech adoption. Demand for faster, convenient loan processing and digital financial inclusion drives platform usage. Governments promoting cashless transactions and supportive regulations encourage growth. Additionally, AI-based credit scoring, mobile-first solutions, and expanding underbanked populations create significant opportunities for digital lending platforms across these regions.

Digital Lending Platform Market Competitive Landscape:

Upstart Network, Inc.

Upstart Network, Inc. is a fintech innovator leveraging artificial intelligence to transform consumer lending. Its AI-driven platform assesses credit risk beyond traditional FICO scores, enabling faster, more inclusive, and data-driven loan approvals. Upstart integrates proprietary machine-learning models with scalable cloud infrastructure to support banks, credit unions, and alternative lenders. The company emphasizes predictive accuracy, automation, and regulatory compliance, positioning itself as a leading provider of AI-based credit-scoring and loan-origination solutions.

-

2025: Announced a USD 1.5 billion forward-flow agreement with Castlelake, L.P., securing funding for future AI-originated consumer loans and strengthening financial stability across economic cycles.

Finastra

Finastra is a global financial-software provider delivering cloud-native solutions for retail, commercial, and corporate banking. Its offerings span digital lending, core banking, payments, and treasury management, enabling banks to accelerate digital transformation, improve operational efficiency, and enhance customer experiences. Finastra emphasizes AI, low-code platforms, and automation to streamline workflows, reduce manual effort, and improve compliance. The company serves financial institutions worldwide, supporting scalable and agile lending and banking operations.

-

2025: Expanded its global lending cloud via partnership with NTT DATA, providing managed digital-lending services across Middle East, Africa, Asia Pacific, and Latin America to improve deployment speed and automation.

-

2024: Launched Loan IQ Simplified Servicing for bilateral and SME loan portfolios, optimizing loan-servicing workflows, consolidating portfolio management, and reducing manual overhead.

-

2024: Partnered with Newgen Software to integrate AI-powered loan origination and document automation with Finastra’s banking systems, enabling faster, compliant onboarding and loan generation for lenders globally.

Key Players:

-

Clariant AG

-

The Dow Chemical Company

-

Solvay

-

Bayer AG

-

Huntsman International LLC

-

Helena Agri-Enterprises LLC

-

Ashland, Inc.

-

Land O’Lakes, Inc.

-

FMC Corp.

-

Croda International Plc

-

BASF SE

-

Finastra

-

Temenos AG

-

Oracle Corporation

-

Fiserv, Inc.

-

Kony, Inc. (Now part of Temenos)

-

LendingClub Corporation

-

Prosper Marketplace, Inc.

-

Upstart Network, Inc.

-

Zopa

|

Report Attributes |

Details |

|

Market Size in 2025E |

US$ 13.89 Bn |

|

Market Size by 2033 |

US$ 68.15 Bn |

|

CAGR |

CAGR of 22% From 2026 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2033 |

|

Historical Data |

2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• by Solution (Business Process Management, Lending Analytics, Loan Management, Loan Origination, Risk & Compliance Management, Others) |

|

Regional Analysis/Coverage |

North America (USA, Canada, Mexico), Europe |

|

Company Profiles |

Black knight, Inc., Ellie Mae, Inc., Finastra, FIS, Fiserv, Inc., Intellect design arena ltd, Nucleus software exports ltd, Tavant, Temenos, Wipro limited |