Electronic Lab Notebook Market Report Scope & Overview:

The Electronic Lab Notebook Market is valued at USD 0.67 billion in 2025 and is expected to reach USD 1.30 billion by 2035, growing at a CAGR of 7.00 % from 2026-2035.

The Electronic Lab Notebook (ELN) Market is growing due to increasing demand for digital solutions that streamline research documentation, enhance data accuracy, and ensure regulatory compliance. ELNs improve collaboration, data sharing, and reproducibility across pharmaceutical, biotechnology, and academic research laboratories. Rising adoption of cloud-based platforms, integration with laboratory instruments, and the need for secure, centralized data management are driving market expansion. Additionally, growing emphasis on reducing paper-based processes, accelerating research workflows, and meeting stringent FDA and ISO guidelines is further supporting steady growth in the ELN market globally.

88% of global research labs adopted ELNs driven by cloud integration, regulatory demands, and the shift from paper to enhance data accuracy, collaboration, and compliance.

Electronic Lab Notebook Market Size and Forecast

-

Market Size in 2025: USD 0.67 Billion

-

Market Size by 2035: USD 1.30 Billion

-

CAGR: 7.00 % from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on Electronic Lab Notebook Market - Request Free Sample Report

Electronic Lab Notebook Market Trends

-

Rising adoption of digital lab notebooks to improve data management accuracy and streamline research workflows

-

Increasing integration with LIMS ELN and other laboratory software for seamless data sharing and collaboration

-

Growing demand for cloud-based ELN solutions enabling secure remote access and real-time experiment tracking

-

Expansion of AI and analytics features for enhanced insights data visualization and predictive research outcomes

-

Rising focus on regulatory compliance and audit-ready documentation in pharmaceutical and biotechnology laboratories

U.S. Electronic Lab Notebook Market is valued at USD 0.22 billion in 2025 and is expected to reach USD 0.41 billion by 2035, growing at a CAGR of 6.81 % from 2026-2035.

The U.S. Electronic Lab Notebook (ELN) Market is growing due to increasing demand for digital solutions that improve data accuracy, collaboration, and regulatory compliance in research labs. Adoption of cloud-based platforms, integration with laboratory instruments, and the need to streamline workflows while reducing paper-based processes are driving steady market growth across pharmaceutical, biotech, and academic sectors.

Electronic Lab Notebook Market Growth Drivers:

-

Growing adoption of digital transformation in laboratories and increasing demand for efficient data management are driving ELN implementation across academic, pharmaceutical, and industrial research environments

Laboratories across pharmaceutical, biotechnology, academic, and industrial sectors are increasingly adopting digital tools to enhance productivity and streamline data management. Electronic Lab Notebooks (ELNs) provide structured, searchable, and centralized storage of experimental data, replacing traditional paper notebooks. The need to improve collaboration, reduce manual errors, and accelerate research timelines is driving adoption. Additionally, ELNs facilitate integration with laboratory information management systems (LIMS), laboratory instruments, and cloud platforms, enabling seamless workflows. The global push for operational efficiency, digital transformation, and real-time data access is significantly fueling ELN market growth.

86% of academic, pharma, and industrial labs implemented ELNs to support digital transformation and meet rising demand for efficient, structured data management.

-

Rising focus on regulatory compliance, data integrity, and research reproducibility is accelerating demand for secure and audit-ready electronic lab notebook solutions globally

Strict regulations in pharmaceutical, clinical, and chemical research require accurate documentation, traceability, and audit trails. ELNs ensure data integrity and compliance with regulatory frameworks such as FDA 21 CFR Part 11, GLP, and GMP standards. Researchers benefit from standardized protocols, automated record-keeping, and reproducibility of experimental results. These capabilities reduce the risk of non-compliance penalties and enhance trust in research outcomes. The growing emphasis on reproducible science and transparent data management is driving laboratories to adopt secure, audit-ready ELNs, further expanding the global market across both academic and commercial research environments.

84% of global research labs adopted secure, audit-ready ELNs to comply with tightening regulations and ensure data integrity and reproducibility.

Electronic Lab Notebook Market Restraints:

-

High implementation costs, integration challenges with legacy laboratory systems, and user resistance to digital workflows limit ELN adoption, particularly among small research organizations

Implementing ELNs requires significant investment in software licenses, IT infrastructure, training, and support services. Small laboratories and academic institutions with limited budgets often find adoption cost-prohibitive. Additionally, integrating ELNs with existing LIMS, instruments, and data systems can be technically complex, requiring specialized expertise. Resistance from researchers accustomed to traditional paper-based workflows further slows adoption. Concerns about learning curves, usability, and workflow disruption contribute to reluctance in deployment. These financial, technical, and cultural barriers hinder market penetration, particularly among small or resource-constrained organizations, limiting the overall growth potential of the ELN market.

77% of small research labs avoided ELNs due to high costs, legacy system incompatibility, and staff resistance to digital workflows.

-

Data security concerns, privacy risks, and fear of intellectual property loss restrain ELN deployment in highly sensitive research and proprietary development environments

Research data stored in ELNs, especially in pharmaceutical and biotech sectors, is highly confidential. Concerns over cyberattacks, unauthorized access, or accidental data leaks make organizations cautious about digital adoption. Intellectual property protection is critical, and companies fear that cloud-based ELNs may compromise sensitive formulations or proprietary protocols. These security and privacy concerns, coupled with regulatory scrutiny, create hesitancy in implementation. Without robust encryption, secure access controls, and compliance with data protection regulations, organizations may delay or avoid ELN adoption, restricting widespread market growth despite strong functional benefits.

79% of pharma and defense R&D labs delayed ELN adoption due to data security and intellectual property risks.

Electronic Lab Notebook Market Opportunities:

-

Advancements in cloud computing, AI, and laboratory automation create opportunities to enhance ELN functionality, collaboration, and real-time data analytics capabilities

Emerging technologies such as cloud platforms, artificial intelligence, machine learning, and IoT-enabled lab instruments are revolutionizing ELNs. Cloud-based ELNs provide remote accessibility, scalability, and lower infrastructure costs, while AI-driven analytics help researchers derive insights faster. Integration with automated laboratory equipment reduces manual data entry and errors. Real-time collaboration tools within ELNs enhance teamwork across geographically dispersed research teams. These innovations allow vendors to offer feature-rich solutions that improve efficiency, accuracy, and decision-making in laboratories, creating significant growth potential for the ELN market across industries and academic institutions.

85% of Electronic Lab Notebook (ELN) platforms leveraged advancements in cloud computing, AI, and laboratory automation enabling enhanced functionality, seamless cross-team collaboration, and real-time data analytics to accelerate scientific discovery and innovation.

-

Increasing R&D investments in pharmaceuticals, biotechnology, and life sciences offer strong growth opportunities for ELN vendors across emerging and developed markets

Rising global investments in R&D, particularly in drug discovery, diagnostics, and personalized medicine, are driving demand for advanced laboratory tools. ELNs help researchers manage complex experimental data, ensure regulatory compliance, and accelerate innovation. Developed markets, including North America and Europe, are witnessing extensive ELN adoption due to advanced infrastructure, while emerging markets show growing interest as pharmaceutical and biotech sectors expand. Increased funding for clinical trials, scientific research, and laboratory modernization creates a strong opportunity for ELN providers to capture new clients, expand geographic reach, and strengthen market presence globally.

83% of Electronic Lab Notebook (ELN) vendors reported accelerated growth fueled by surging R&D investments in pharmaceuticals, biotechnology, and life sciences expanding their footprint across both emerging and developed markets seeking digital lab transformation.

Electronic Lab Notebook Market Segment Highlights

-

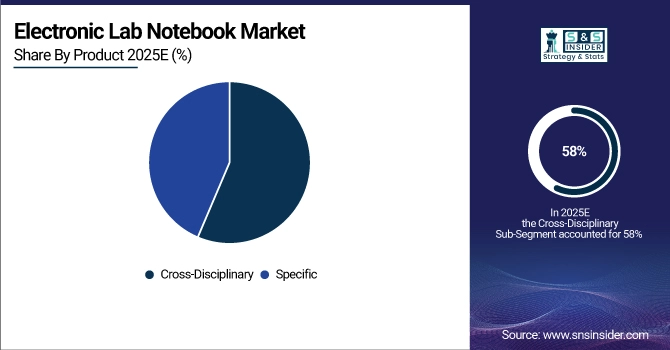

By Product: Cross-disciplinary ELNs led with 58% share, while Specific ELNs are the fastest-growing segment.

-

By Solution: Lab Informatics Solutions led with 55% share, while Quality Management Solutions are the fastest-growing segment.

-

By Delivery Mode: Web-hosted / Cloud-based ELNs led with 62% share and are also the fastest-growing segment.

-

By License: Proprietary ELNs led with 66% share, while Open-license ELNs are growing steadily.

-

By End Use: Life Sciences led with 43% share, while CROs are the fastest-growing segment.

Electronic Lab Notebook Market Segment Analysis

By Product: Cross-disciplinary ELNs led, while Specific ELNs are the fastest-growing segment.

Cross-disciplinary electronic lab notebooks dominate the market due to their flexibility across multiple scientific workflows, including chemistry, biology, materials science, and clinical research. These platforms enable standardized documentation, collaboration across departments, and seamless integration with laboratory instruments and informatics systems. Enterprises and research institutions prefer cross-disciplinary ELNs to avoid data silos and support multidisciplinary R&D initiatives. Their ability to scale across global research teams, support regulatory compliance, and adapt to evolving experimental needs makes them the preferred choice, driving sustained adoption and revenue leadership in the ELN market.

Specific or domain-focused ELNs are experiencing rapid growth as laboratories demand tailored functionality for specialized workflows. These solutions offer customized templates, analytics, and compliance features designed for niche applications such as genomics, formulation chemistry, or clinical research. Increasing complexity of experiments and stricter regulatory requirements encourage adoption of specialized tools that improve accuracy and efficiency. Smaller research teams and specialized labs particularly favor these ELNs for their precision and ease of use. Growing investment in targeted R&D fields continues to accelerate demand for specific electronic lab notebooks.

By Solution: Lab Informatics Solutions led, while Quality Management Solutions are the fastest-growing segment.

Lab informatics solutions lead the ELN market as they form the backbone of digital laboratory operations. These platforms centralize experimental data, enable version control, support collaboration, and integrate with LIMS, SDMS, and analytical instruments. Their role in improving data integrity, reproducibility, and operational efficiency makes them indispensable for regulated industries such as pharmaceuticals and biotechnology. Organizations increasingly rely on lab informatics to streamline workflows, reduce manual errors, and accelerate innovation cycles. This broad utility across research environments sustains their dominant position within the ELN ecosystem.

Quality management solutions are the fastest-growing ELN segment, driven by increasing regulatory scrutiny and the need for audit-ready documentation. These solutions support compliance with standards such as FDA 21 CFR Part 11, GMP, and ISO guidelines by enabling traceability, electronic signatures, and controlled documentation. Adoption is rising in pharmaceutical manufacturing, CROs, and regulated testing laboratories. As organizations prioritize data integrity and risk mitigation, quality-focused ELN capabilities are becoming essential, accelerating growth and expanding their role beyond traditional R&D environments.

By Delivery Mode: Web-hosted / Cloud-based ELNs led and are also the fastest-growing segment.

Cloud-based ELNs dominate and grow fastest due to their scalability, remote accessibility, and lower infrastructure requirements. These platforms enable real-time collaboration across distributed research teams and simplify system upgrades and maintenance. Cloud deployment supports rapid implementation and cost efficiency, making it attractive to both large enterprises and smaller laboratories. Enhanced cybersecurity frameworks and compliance certifications have further strengthened confidence in cloud solutions. As digital transformation and remote research models expand, cloud-based ELNs continue to gain preference over on-premise alternatives.

By License: Proprietary ELNs led, while Open-license ELNs are gaining adoption.

Proprietary ELNs lead the market due to their robust feature sets, enterprise-grade security, and dedicated vendor support. These solutions offer advanced integrations, customization options, and validated compliance frameworks critical for regulated industries. Large pharmaceutical companies and CROs favor proprietary platforms for reliability, long-term support, and continuous innovation. While licensing costs are higher, organizations view proprietary ELNs as strategic investments that enhance productivity and regulatory readiness, reinforcing their dominant share in the global ELN market.

Open-license ELNs are the fastest-growing segment as academic institutions, startups, and smaller labs increasingly adopt cost-effective, flexible solutions. These platforms offer customization, transparency, and collaborative capabilities without the licensing costs of proprietary systems. Growing demand for open-source ELNs is driven by the need for accessible research tools, integration with other lab informatics, and support for multidisciplinary research environments. The rise of digital and remote research workflows further accelerates adoption. Open ELNs are expanding rapidly, particularly in universities, government labs, and emerging markets, making them a high-growth segment in the market.

By End Use: Life Sciences led, while CROs are the fastest-growing segment.

The life sciences sector dominates ELN adoption due to extensive R&D activity in pharmaceuticals, biotechnology, and clinical research. ELNs support experimental documentation, data integrity, collaboration, and regulatory compliance throughout the drug discovery and development lifecycle. Increasing investment in biologics, personalized medicine, and translational research further drives demand. Life science organizations rely heavily on ELNs to accelerate innovation, reduce development timelines, and ensure compliance, making them the largest end-use contributor to market revenue.

Contract research organizations represent the fastest-growing end-use segment as outsourcing of R&D activities continues to rise. CROs adopt ELNs to standardize workflows, improve data transparency, and meet diverse client and regulatory requirements. Cloud-based collaboration and secure data sharing are particularly valuable for CROs managing multi-client projects. As pharmaceutical and biotech companies increasingly rely on external partners, ELN adoption among CROs accelerates, positioning them as a key growth driver in the market.

Electronic Lab Notebook Market Regional Analysis

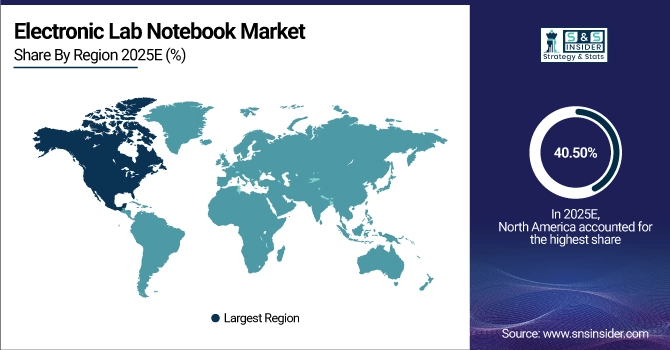

North America Electronic Lab Notebook Market Insights:

North America dominated the Electronic Lab Notebook Market with a 40.50% share in 2025 due to strong adoption of digital laboratory workflows, high R&D spending across pharmaceutical and biotechnology sectors, and the presence of leading ELN providers. Strict regulatory compliance requirements and early adoption of cloud-based lab informatics further supported regional market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Electronic Lab Notebook Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 8.28% from 2026–2035, driven by expanding pharmaceutical manufacturing, rising clinical research activities, and increasing digitalization of laboratories. Growing investments in life sciences R&D, supportive government initiatives, and rising adoption of cloud-based research tools accelerate ELN market growth across the region.

Europe Electronic Lab Notebook Market Insights

Europe held a significant position in the Electronic Lab Notebook Market in 2025, supported by strong pharmaceutical and life sciences research activities, widespread adoption of digital lab documentation, and strict regulatory requirements for data integrity and compliance. Increasing focus on research efficiency and collaboration across academic and industrial laboratories further strengthened regional demand.

Middle East & Africa and Latin America Electronic Lab Notebook Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Electronic Lab Notebook Market in 2025, driven by gradual digital transformation of research laboratories, expanding pharmaceutical manufacturing, and increasing clinical trial activities. Growing investments in healthcare R&D, improving research infrastructure, and rising awareness of compliant digital data management supported market expansion across these regions.

Electronic Lab Notebook Market Competitive Landscape:

Revvity, Inc.

Revvity, Inc. is a leading provider of digital research solutions, specializing in electronic lab notebooks, scientific software, and workflow management tools. The company focuses on enhancing laboratory productivity, data integrity, and collaboration for life sciences and chemical research. Revvity’s ELN solutions provide secure data storage, compliance with regulatory standards, and seamless integration with laboratory instruments and enterprise systems. With a global client base, Revvity supports researchers in streamlining experiments, improving reproducibility, and accelerating scientific discovery.

-

April 2024, Revvity (spun off from PerkinElmer in 2023) launched Revvity Signals ELN, a next-generation cloud-based electronic lab notebook integrated with its Signals Analytics Platform.

Dassault Systèmes SE

Dassault Systèmes SE, headquartered in France, is a global software company offering 3D design, modeling, and lifecycle management solutions, including advanced ELN platforms. Its electronic lab notebooks enable researchers to document, manage, and analyze experimental data efficiently while ensuring compliance with industry standards. Dassault Systèmes emphasizes collaborative research, data security, and workflow optimization. The platform is widely adopted in life sciences, pharmaceutical, and biotechnology industries to accelerate research and innovation while reducing errors and duplication in laboratories.

-

October 2023, Dassault Systèmes enhanced its BIOVIA Notebook as part of the 3DEXPERIENCE Lab suite, introducing a “Digital Twin of the Experiment” that links ELN entries to molecular structures, protocols, and instrument data.

Benchling, Inc.

Benchling, Inc. is a prominent life sciences software company focused on cloud-based ELN solutions for biotechnology, pharmaceutical, and academic research laboratories. Its platform allows researchers to design experiments, manage data, and collaborate across teams in real-time. Benchling ELN integrates with laboratory instruments, inventory systems, and analytics tools, ensuring streamlined workflows, reproducibility, and regulatory compliance. With an emphasis on innovation and user experience, Benchling supports faster scientific discovery, better data management, and enhanced collaboration for global research organizations.

-

January 2025, Benchling launched generative AI capabilities within its R&D Cloud, enabling scientists to design, document, and analyze experiments in a unified ELN environment.

Electronic Lab Notebook Market Key Players

Some of the Electronic Lab Notebook Market Companies are:

-

Revvity, Inc.

-

Benchling, Inc.

-

Waters Corporation

-

ID Business Solutions (IDBS) Ltd.

-

STARLIMS Corporation

-

LabVantage Solutions, Inc.

-

LabLynx, Inc.

-

Agilent Technologies, Inc.

-

LabWare, Inc.

-

Eppendorf SE

-

Lab-Ally LLC

-

Labforward GmbH

-

Labii Inc.

-

Abbott Laboratories

-

Arxspan, LLC (Bruker)

-

Carl Zeiss AG

-

Codon Software Pvt Ltd

-

SciNote LLC

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 0.67 Billion |

| Market Size by 2035 | USD 1.30 Billion |

| CAGR | CAGR of 7.00% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product: Cross-disciplinary, Specific • By Solution: Lab Informatics Solutions, Quality Management Solutions • By Delivery Mode: On-Premise, Web-hosted/ Cloud-based • By License: Proprietary, Open • By End Use: Life Sciences, CROs, Chemical Industry, F&B and Agriculture, Environmental Testing Labs, Petrochemical Refineries & Oil and Gas Industry, Other Industries |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Thermo Fisher Scientific Inc., Abbott Informatics, Dassault Systèmes SE, Benchling, Inc., LabWare, Inc., Agilent Technologies, Inc., PerkinElmer, Inc., LabArchives, LLC, ID Business Solutions (IDBS) Ltd., Arxspan (Bruker Corporation), Eppendorf AG, Waters Corporation, Mestrelab Research S.L., LabVantage Solutions Inc., SciNote LLC, RURO, Inc., BioData Ltd. (Labguru), AgileBio (LabCollector), KineMatik, Inc., Lab-Ally, LLC |