Digital Mining Market Report Scope & Overview:

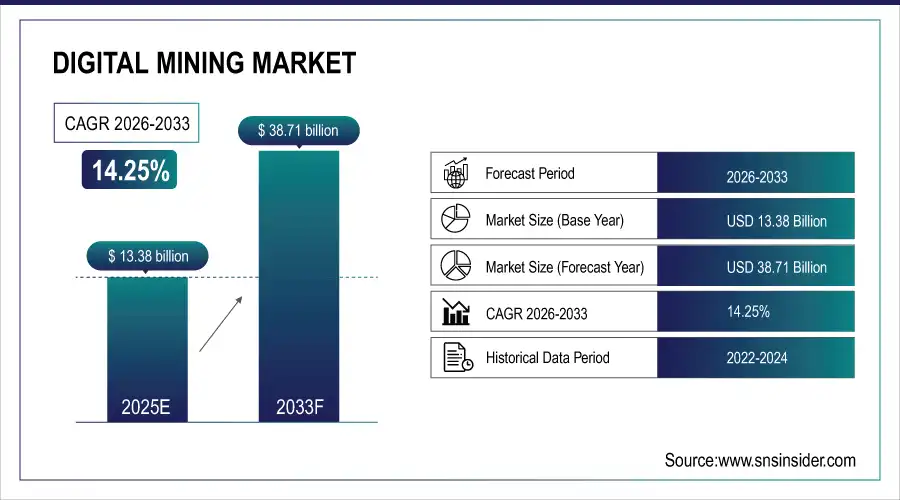

Digital Mining Market is valued at USD 13.38 billion in 2025E and is expected to reach USD 38.71 billion by 2033, growing at a CAGR of 14.25 % from 2026-2033.

The Digital Mining Market is growing due to increasing adoption of advanced technologies such as IoT, AI, cloud computing, and automation in mining operations. These technologies enhance operational efficiency, real-time monitoring, predictive maintenance, and resource optimization. Rising demand for minerals and metals, coupled with the need to reduce operational costs and improve safety standards, is driving digital mining solutions. Additionally, investments in smart mining initiatives and sustainable practices are further accelerating global market growth.

In 2025, global digital mining adoption rose by 26%, as 75% of mining firms leveraged cloud-based AI and automation to enhance real-time decision making reducing downtime by 28% and supporting ESG compliance through smarter energy and water management.

Digital Mining Market Size and Forecast

-

Market Size in 2025E: USD 13.38 Billion

-

Market Size by 2033: USD 38.71 Billion

-

CAGR: 14.25% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Digital Mining Market - Request Free Sample Report

Digital Mining Market Trends

-

Rising adoption of automation and robotics to improve mining efficiency, safety, and operational cost optimization

-

Increasing integration of IoT sensors for real-time monitoring of equipment, environment, and mineral extraction processes

-

Growing use of AI and machine learning to enhance predictive maintenance and optimize resource allocation

-

Expansion of data analytics and visualization platforms to enable informed decision-making and operational transparency

-

Cloud computing adoption accelerates collaboration, scalability, and storage of large-scale mining data across operations

U.S. Digital Mining Market is valued at USD 3.75 billion in 2025E and is expected to reach USD 10.57 billion by 2033, growing at a CAGR of 13.87% from 2026-2033.

Growth in the U.S. Digital Mining Market is driven by increasing adoption of IoT, AI, and automation technologies to improve operational efficiency, safety, and predictive maintenance. Rising demand for minerals and metals, coupled with investments in smart mining solutions, is further accelerating market expansion.

Digital Mining Market Growth Drivers:

-

Increasing adoption of automation, IoT, and AI technologies in mining operations is driving efficiency, safety, and real-time data analytics across the digital mining sector globally

Mining companies are increasingly implementing automation, Internet of Things (IoT) devices, and artificial intelligence (AI) to enhance operational efficiency and safety. Automation reduces human exposure to hazardous environments, while IoT-enabled sensors and equipment provide real-time data on machinery performance, ore quality, and environmental conditions. AI-based analytics help in predictive maintenance, process optimization, and resource allocation, reducing operational costs and downtime. These technologies also enable better decision-making and productivity. As mining companies seek to improve profitability, efficiency, and safety, the adoption of digital solutions continues to grow globally.

In 2024, 68% of global mining operations integrated automation, IoT, and AI, improving operational efficiency by 28%, reducing safety incidents by 35%, and enabling real-time analytics for predictive maintenance and resource optimization.

-

Growing demand for minerals and metals in industries such as automotive, electronics, and construction is boosting investment in advanced digital mining solutions to optimize production

The increasing global demand for essential minerals and metals, driven by automotive electrification, electronics manufacturing, and construction projects, is encouraging mining companies to invest in digital technologies. Digital mining solutions help optimize extraction processes, improve yield, and reduce operational inefficiencies. By integrating advanced monitoring, data analytics, and automated equipment, mining operations can achieve better production forecasting and cost control. Rising demand from multiple industries is therefore creating strong incentives for companies to adopt smart mining technologies, ensuring a consistent and high-quality supply of critical raw materials while enhancing operational performance.

In 2024, surging demand for critical minerals driven by EV, electronics, and infrastructure sectors spurred a 22% increase in digital mining investments, with companies deploying AI and automation to boost production efficiency by up to 30%.

Digital Mining Market Restraints:

-

High implementation costs and significant upfront investment for digital mining technologies limit adoption, especially among small and medium-sized mining companies in emerging regions

Implementing digital mining solutions, including automated machinery, AI analytics platforms, and IoT sensors, requires substantial capital investment. Small and medium-sized enterprises often struggle to afford the high upfront costs associated with installation, integration, and employee training. Additionally, ongoing maintenance and software updates add to operational expenses, making it challenging for smaller operators to justify digital investments. In emerging regions, limited access to financing and infrastructure further restricts adoption. As a result, despite the clear benefits of digital mining, high costs and financial barriers remain key obstacles for market expansion globally.

In 2024, 70% of small and medium-sized mining firms in emerging regions deferred digital transformation due to upfront costs exceeding USD2 million, with ROI uncertainty and limited financing further restricting adoption of advanced mining technologies.

-

Lack of skilled workforce, cybersecurity concerns, and integration challenges hinder seamless deployment of digital mining solutions, affecting operational efficiency and overall market growth

Digital mining requires highly skilled personnel capable of managing AI systems, IoT networks, and advanced analytics platforms. A shortage of trained professionals can slow implementation and reduce operational efficiency. Additionally, increasing reliance on digital technologies exposes mining operations to cybersecurity risks, including data breaches and system failures. Integration with legacy equipment and existing operational processes also presents technical challenges. These factors collectively hinder the smooth deployment of digital solutions, reduce productivity benefits, and limit adoption, particularly among smaller or less technologically advanced mining companies, impacting overall market growth.

In 2024, 65% of mining operators reported deployment delays due to a shortage of digital-skilled personnel, while 60% cited cybersecurity risks and legacy system integration issues as key barriers, reducing operational efficiency gains by up to 30%.

Digital Mining Market Opportunities:

-

Rising focus on sustainable and environmentally responsible mining practices offers opportunities for digital solutions that optimize energy usage, reduce emissions, and improve compliance

Environmental sustainability has become a major priority in the mining sector, prompting companies to adopt digital solutions that minimize environmental impact. Technologies such as energy-efficient automation, real-time emissions monitoring, and predictive resource management help reduce energy consumption, greenhouse gas emissions, and waste generation. Digital platforms also assist in complying with strict environmental regulations and reporting requirements. By integrating sustainable practices with operational efficiency, mining companies can improve public perception, reduce costs, and achieve long-term viability. This growing focus on responsible mining presents significant opportunities for providers of advanced digital solutions.

In 2024, 55% of mining companies deployed digital sustainability solutions, cutting energy consumption by 18% and lowering emissions by 22% while enhancing regulatory compliance through AI-driven resource optimization and real-time environmental monitoring.

-

Expansion of remote monitoring, predictive maintenance, and cloud-based analytics presents growth opportunities for companies to enhance safety, efficiency, and decision-making in mining operations

Remote monitoring systems, predictive maintenance solutions, and cloud-based data analytics are transforming mining operations worldwide. Remote monitoring enables operators to track equipment and production in real time, improving operational oversight and safety. Predictive maintenance reduces unplanned downtime, extends machinery life, and minimizes repair costs. Cloud-based analytics consolidates vast amounts of operational data for better forecasting, resource planning, and decision-making. These technologies allow mining companies to operate more efficiently, reduce operational risks, and improve profitability. Rising adoption of such digital solutions offers significant growth potential for market players globally.

In 2024, 60% of mining operators adopted remote monitoring and cloud-based analytics, reducing equipment downtime by 25% and improving safety incident response times by 30% through predictive maintenance and real-time data insights.

Digital Mining Market Segment Highlights

-

By Technology: Automation & Robotics led with 27.5% share, while AI & Machine Learning is the fastest-growing segment with CAGR of 17.8%.

-

By Application: Fleet & Equipment Management led with 24.8% share, while Predictive Maintenance is the fastest-growing segment with CAGR of 16.9%.

-

By Mining Type: Surface Mining led with 31.2% share, while Solution Mining is the fastest-growing segment with CAGR of 17.4%.

-

By End-User: Metals & Minerals Mining Companies led with 28.6% share, while Industrial & Construction Material Mining Companies is the fastest-growing segment with CAGR of 16.5%.

Digital Mining Market Segment Analysis

By Technology: Automation & Robotics led, while AI & Machine Learning is the fastest-growing segment

Automation & Robotics dominate the technology segment as they enhance operational efficiency, reduce human error, and improve safety in mining operations. Their adoption in drilling, excavation, and material handling optimizes processes, lowers operational costs, and ensures consistent productivity. Large-scale mining companies rely on automated machinery and robotics for repetitive and hazardous tasks. Advanced sensors, remote monitoring, and integration with control systems further reinforce the prominence of automation and robotics in the digital mining ecosystem.

AI & Machine Learning are the fastest-growing technology segment due to their ability to optimize operations through predictive analytics, anomaly detection, and intelligent decision-making. These tools help mining companies forecast equipment failures, enhance resource allocation, and improve production efficiency. Growing investment in smart mining solutions, cloud integration, and real-time data analytics drives adoption. AI-powered solutions also support energy efficiency, sustainability initiatives, and cost reduction, making it the fastest-growing technology in the digital mining market.

By Technology: Automation & Robotics led, while AI & Machine Learning is the fastest-growing segment

Fleet & Equipment Management leads the application segment as it enables mining companies to track, maintain, and optimize heavy machinery efficiently. Real-time monitoring, automated scheduling, and maintenance alerts reduce downtime and operational costs. Integration with IoT sensors and centralized software ensures efficient resource utilization, safety compliance, and operational continuity. Large-scale mining operations prioritize fleet management to improve productivity, streamline logistics, and maintain high equipment reliability, making it the most widely adopted application in digital mining.

Predictive Maintenance is the fastest-growing application as mining companies seek to prevent equipment failures, reduce unplanned downtime, and optimize operational efficiency. AI, IoT, and sensor-based analytics predict wear and performance issues, enabling timely interventions. The adoption of predictive maintenance improves asset lifespan, reduces repair costs, and enhances safety standards. Growing awareness of cost-saving benefits and increasing digitization of mining operations contribute to rapid growth in predictive maintenance applications globally.

By Mining Type: Surface Mining led, while Solution Mining is the fastest-growing segment.

Surface Mining dominates due to its large-scale operations, higher resource output, and extensive adoption of digital solutions. Automation, fleet management, and monitoring technologies are extensively applied in open-pit and quarry mining to improve productivity and safety. Companies in metals, minerals, and coal sectors prioritize surface mining operations for their scalability and cost efficiency. Integration of digital technologies enhances operational control, reduces manual labor, and provides real-time insights, maintaining surface mining as the dominant mining type segment.

Solution Mining is the fastest-growing mining type segment as companies increasingly adopt technology-driven methods for extracting soluble minerals efficiently. Digital tools, real-time monitoring, and automated control systems enable precise solution injection, recovery, and processing, minimizing waste and operational risks. The method supports sustainable practices, lower environmental impact, and high-yield extraction. Rising demand for minerals and adoption of advanced digital monitoring in solution mining are accelerating growth, making it the fastest-growing mining type in the market.

By End-User: Metals & Minerals Mining Companies led, while Industrial & Construction Material Mining Companies is the fastest-growing segment.

Metals & Minerals Mining Companies dominate due to their large-scale operations, extensive resource extraction, and early adoption of digital technologies. They rely on automation, AI, fleet management, and analytics to optimize production, reduce costs, and enhance safety. The sector’s high investment capacity and critical need for operational efficiency support widespread adoption of digital mining solutions. Advanced monitoring, predictive maintenance, and performance tracking reinforce their dominant position in the digital mining market.

Industrial & Construction Material Mining Companies are the fastest-growing end-user segment as they adopt digital mining solutions to optimize extraction, improve productivity, and reduce operational risks. The use of AI, IoT, and cloud-based monitoring tools enables efficient management of equipment, resource allocation, and energy consumption. Rising demand for construction materials, digital transformation initiatives, and focus on cost-effective operations drive rapid adoption of digital mining technologies, making this sector the fastest-growing end-user segment globally.

Digital Mining Market Regional Analysis

North America Digital Mining Market Insights:

North America dominated the Digital Mining Market with a 33.00% share in 2025 due to its advanced mining infrastructure, high adoption of digital technologies, and presence of leading mining companies investing in automation, IoT, and AI solutions. Strong regulatory support, focus on operational efficiency, and early technology adoption further reinforced regional leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Digital Mining Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 15.99% from 2026–2033, driven by rapid industrialization, increasing mining activities, and rising investments in digital mining solutions. Growing demand for minerals and metals, adoption of advanced analytics, and government initiatives supporting smart mining technologies are accelerating market growth across the region.

Europe Digital Mining Market Insights

Europe held a significant share in the Digital Mining Market in 2025, supported by established mining operations, advanced technological adoption, and strong regulatory frameworks promoting sustainable and efficient mining practices. Investments in automation, predictive maintenance, and energy-efficient digital solutions further strengthened Europe’s position in the global digital mining market.

Middle East & Africa and Latin America Digital Mining Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Digital Mining Market in 2025, driven by expanding mining activities, increasing demand for minerals, and gradual adoption of digital technologies. Investments in automation, IoT solutions, and smart mining infrastructure, along with government initiatives to modernize mining operations, supported the regions’ emerging presence in the market.

Digital Mining Market Competitive Landscape:

Caterpillar

Caterpillar is a global leader in heavy equipment and advanced mining solutions, offering digital mining technologies, autonomous haulage systems, and fleet management software. Its integrated solutions enhance operational efficiency, safety, and productivity across mining sites. Caterpillar combines IoT, data analytics, and automation to optimize equipment performance, reduce operational costs, and support sustainable mining practices. The company serves customers worldwide, providing robust, reliable, and innovative solutions for both surface and underground mining operations.

-

2024, Caterpillar launched autonomous haulage under its Cat MineStar Auto platform, enabling driverless operation of 794 AC electric drive haul trucks in mixed fleet environments .

Sandvik AB

Sandvik AB is a Swedish multinational specializing in mining and rock‑cutting equipment, including digital mining solutions. The company provides automation, monitoring, and data‑driven software to improve mine productivity, safety, and operational efficiency. Sandvik focuses on smart mining technologies, integrating sensors, IoT, and analytics into equipment to optimize fleet performance and resource management. Its solutions support both surface and underground operations globally, helping mining companies achieve precise, sustainable, and cost-effective production.

-

2025, Sandvik Developed its AutoMine autonomous system to support fully electric underground mining equipment, including the SANDVIK LH518B battery-electric loader and TH565B truck.

Komatsu Mining Corp.

Komatsu Mining Corporation is a leading provider of mining equipment and digital mining technologies, offering automation, fleet management, and real-time analytics solutions. Its smart mining systems enhance operational efficiency, equipment utilization, and safety at mining sites. Komatsu integrates IoT, AI, and sensor-based technologies to monitor and optimize machine performance, enabling cost savings and improved productivity. Serving mines worldwide, the company is recognized for innovative, reliable, and sustainable solutions for both underground and open-pit mining.

-

2023, Komatsu Mining launched SmartLift, an AI-powered autonomous hoisting system for deep mine shafts, designed to optimize cage movement, energy use, and personnel/material transport.

Digital Mining Market Key Players

Some of the Digital Mining Market Companies are:

-

Caterpillar

-

Sandvik AB

-

Komatsu Mining Corp.

-

Epiroc AB

-

Siemens AG

-

ABB Ltd.

-

Schneider Electric

-

Hitachi Construction Machinery Co., Ltd.

-

Hexagon AB

-

Rockwell Automation

-

Cisco Systems

-

FLSmidth & Co. A/S

-

Metso Outotec

-

ThyssenKrupp

-

Liebherr Group

-

Atlas Copco AB

-

Emerson Electric Co.

-

Honeywell International Inc.

-

Mitsubishi Electric Corporation

-

Yokogawa Electric Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 13.38 Billion |

| Market Size by 2033 | USD 38.71 Billion |

| CAGR | CAGR of 14.25% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Automation & Robotics, IoT & Sensors, AI & Machine Learning, Data Analytics & Visualization, Cloud Computing) • By Application (Mine Safety & Monitoring, Fleet & Equipment Management, Predictive Maintenance, Resource & Asset Management, Energy & Environmental Management) • By Mining Type (Surface Mining, Underground Mining, Placer Mining, Solution Mining) • By End-User (Metals & Minerals Mining Companies, Coal Mining Companies, Industrial & Construction Material Mining Companies, Oil & Gas Mining Companies, Government & Research Organizations) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Caterpillar, Sandvik AB, Komatsu Mining Corp., Epiroc AB, Siemens AG, ABB Ltd., Schneider Electric, Hitachi Construction Machinery Co., Ltd., Hexagon AB, Rockwell Automation, Cisco Systems, FLSmidth & Co. A/S, Metso Outotec, ThyssenKrupp, Liebherr Group, Atlas Copco AB, Emerson Electric Co., Honeywell International Inc., Mitsubishi Electric Corporation, Yokogawa Electric Corporation HORIBA Scientific, Jeol Ltd., Analytik Jena AG |