Digital MRO Market Size & Overview:

Get more information on Digital MRO Market - Request Free Sample Report

Digital MRO Market size was valued at USD 1.0 billion in 2023 and is expected to grow to USD 2.9 billion by 2032 and grow at a CAGR of 12.6 % over the forecast period of 2024-2032.

The digital maintenance, repair, and overhaul market has been expanding rapidly in recent years, propelled by the growth in the adoption of digital systems in the aviation sector, and the various government policies aimed at enhancing efficiency. The U.S. Department of Transportation revealed that at the end of 2023, 78% of airlines were using digital tools for maintenance management, indicating a significant increase from the previous years. Similarly, in mid-2023, the European Aviation Safety Agency announced that it had delivered a new regulatory framework for the use of AI and machine learning in predictive maintenance, which would also allow a more widespread use of digital MRO technologies. Also, according to China's Civil Aviation Administration (CAAC), annual MRO digitization investment by 19% towards MRO digitization, with plans to fully automate 40% of their major airline maintenance processes by 2025. These government measures and the demand to achieve higher operational efficiency of aircraft drive the market. The policies encourage increased operational efficiency, cost decline, and increased safety standards in the aviation industry.

Traditional on-premises field services had been expensive and inefficient because most of the maintenance was being managed using outdated, inappropriate paper, which resulted in customer dissatisfaction as well as lagging revenue growth. At present, SaaS-based systems demand is high because the cloud platform provides customizable services and, therefore, has opened new market opportunities for cloud-based aviation MRO software developers. The pay-as-you-use model allows the tier 2 and tier 3 MRO providers to save costs, while at the same time being provided vast data storage, real-time updates, flexibility, and systematic scheduling. Additionally, the cloud-based maintenance systems effectively capture and support the management of timely maintenance data, which allows for instant communication and easy access to inventories, and also ensures that the systems remain compliant with airworthiness regulations, thus pushing the market growth.

Digital MRO Market Dynamics

Drivers

-

Advanced analytics, AI, and ML technologies are increasingly being integrated into MRO operations to enhance predictive maintenance, automate routine tasks, and improve overall efficiency.

-

The growing emphasis on maintaining high standards of aircraft safety and performance drives the adoption of digital solutions for real-time monitoring, reducing downtimes, and improving fleet availability.

-

The proliferation of IoT-enabled devices within aircraft maintenance allows for continuous data collection and analysis, facilitating proactive and condition-based maintenance.

The aviation industry is rapidly introducing artificial intelligence and machine learning into maintenance, repair, and overhaul operations to implement predictive maintenance and improve operational efficiency. Since such technologies enable airlines and MRO service providers to switch to predictive and condition-based maintenance from reactive and time-based, aircraft downtime is minimized, safety is enhanced, and maintenance costs are optimized since no unnecessary maintenance is conducted. For instance, Delta Air Lines has already implemented AI-powered predictive maintenance solutions that analyze sensor data from aircraft components to detect possible issues that may arise. Since AI is capable of predicting the remaining useful life of parts such as engines or landing gears, the accuracy of maintenance is greatly improved.

In 2023, Airbus expanded its Skywise platform, which is an AI-driven tool for aviation data analytics, in multiple MRO operations. The system draws information from over 10,000 aircraft and is capable of providing real-time insights that facilitate the maintenance of aircraft. Implementing AI technologies will result in as low as 30% of unscheduled maintenance events according to industry sources. Moreover, the optimization of routine maintenance and inventory management releases technicians from having to conduct such tasks or other light-technical issues allowing them to concentrate on more complicated maintenance operations. Also, AI promotes workforce efficiency as machine learning solutions adjust to the degradation patterns of different parts. The AI system uses image recognition to facilitate the assessment process, being capable of evaluating the photos of different components and determining whether minute cracks or signs of material wear that are barely visible in the photos are present. In such a way, the trend in MRO that is being rapidly developed promises higher fleet reliability and operational availability.

Restraints

-

The significant upfront investment required for deploying digital MRO solutions, including infrastructure upgrades and software costs, can be a major barrier for small and medium-sized MRO providers.

-

The increasing digitization of MRO operations also heightens the risk of cyberattacks, making companies wary of adopting fully digital solutions without robust security measures.

-

Integrating data from various legacy systems with new digital tools remains a challenge, slowing the seamless transition to fully digitized MRO processes.

One of the main restraints in the digital MRO market is the concern about cybersecurity. As MRO operations become more digitalized, they become heavily reliant on data exchange between various systems, as well as the aircraft’s sensors and the maintenance platform. While convenient and efficient, it creates a new medium that could be targeted by cybercriminals who see any digital systems that allow access to aircraft data as a worthwhile target. Aircraft maintenance data, including a wide variety of aircraft operational parameters and real-time diagnostics, could be potentially vulnerable if the system is not protected by adequate security measures. It is also possible that by breaking into the MRO systems, hackers could potentially disrupt operations, mislead the maintenance crew by manipulating the data, or even cause direct harm by accessing some of the aircraft’s critical systems. Due to these concerns, many MRO providers resist the adoption of fully digital solutions. At the moment, there is also no comprehensive framework for cybersecurity established by the regulatory bodies, which adds to the uncertainty. Thus, companies hesitate to adopt the new technology because they cannot ensure the safety of their data.

Digital MRO Market Segment analysis

By Application

In 2023, the predictive maintenance segment dominated the market and was the major contributor to the digital MRO market revenue of 27%. The primary reason for the dominance of the segment is a rapid expansion of data-driven analytics used to monitor the health of aircraft. Governments across the globe have directed their timely efforts toward adopting predictive maintenance strategies to enhance aircraft safety and performance. In 2023, the Federal Aviation Administration explicitly stated that commercial airline-based companies in the U.S. had to include predictive maintenance tools as a part of the maintenance strategy before 2024. The push towards enhancing the level of predictive maintenance is in line with the long-term efforts directed at reducing operation costs. The overarching focus on actual and anticipated efficiency has provided an additional source of motivation behind the prominence of this segment. Predictive maintenance allows forecasting potential component failures before they happen which reduces both the costs and risks associated with unscheduled checks.

By End User

The majority of the market share in 2023 was held by the airline segment, which contributed 43% to the overall market. The large share is based on the increasing investment of the airlines in digital tools that enable improved maintenance processes. A report from the International Air Transport Association covered that global airline invested over $1.4 billion in digital tools to execute MRO more efficiently. The measures are taken by the severe requirements set by aviation authorities worldwide, such as the European Union Aviation Safety Agency, which demands airlines install a digital system to analyze aircraft's real-time performance. However, these measures are also beneficial for airlines where no regulation yet exists, as the elimination of laborious manual checks is conducive to reducing costs associated with maintenance, replacing, and repairing elements of aircraft. With measures in place, airlines are guaranteed to ensure higher fleet uptime, efficiency, safety, and savings opportunities that are secured in a long perspective. It makes the airline sector the greatest contributor to the digital MRO market.

By Technology

The predictive analysis segment held the largest share of the market in terms of technology in 2023, at about 26% of total revenue. This technology utilizes big data and machine learning to predict potential issues that may need maintenance. Predictive analytics is widely used and supported by governments as a way to increase the reliability and safety of aviation. The U.S. Department of Defence invested in this technology for its aviation in 2023, with a focus on increasing the MRO efficiency of military aircraft. Predictive analysis provides a maintenance schedule based on the data of previous maintenance needs, so that service providers spend less time on operational delays and airlines and maintenance facilities spend less money on maintenance needs.

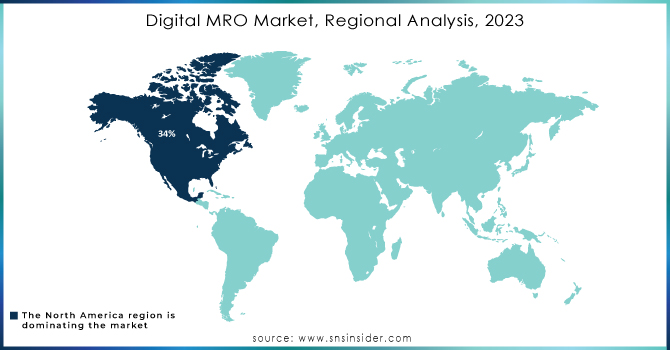

Regional Insights

The digital MRO market was led by North America in 2023, which held around 34% of the market due to the large presence of leading aviation companies in this region and government incentives, promoting digitization in various industries. The United States Department of Transportation and the Federal Aviation Administration have been the main promoters of using digital devices to ensure efficiency in the aviation sector. The Next Generation or NextGen program aims at modernizing the aviation system and in doing so, it has been actively involved in promoting the use of digital maintenance.

It is expected that the Asia-Pacific market will grow at the fastest CAGR from 2024 to 2032. In 2023 the Asia-Pacific market accounted significant share of the market with China and India being on the top position in adopting digital MRO. The China Civil Aviation Authority has a plan to digitize aviation maintenance and India’s Make in India campaign has resulted in many MRO that focus on digital activities. The rise in the number of people traveling by air and the increase in government and private investment in emerging countries was also instrumental in making the Asia-Pacific market be highest at the Compound Annual Growth Rate from 2024 to 2032.

Do you have any specific queries on Digital MRO Market - Ask for Customization

Recent Developments

-

In February 2023, the U.S. Air Force announced a new contract for the digital MRO solutions implementation. The contract has been designed to optimize the maintenance, repair works, and overhaul services processes for military aircraft. The new approach will be adopting innovative digital technologies and tools, such as predictive analytics and real-time data monitoring.

-

In March 2023, a new contract was signed by Lufthansa Technik and Emirates for the maintenance, repair works, and overhaul services to the whole Airbus A380 aircraft fleet in Emirates. The supplier’s main landing gear’s overhauls and base maintenance’s flexible extra capacity, such as the C-checks, will be delivered by Lufthansa Technik. Emirates has never been outsourcing the abovementioned aviation services from its in-house team before this contract’s conclusion.

-

In March 2023, Honeywell International Inc. and Lufthansa Technik have expanded their cooperation in aviation analytics. Honeywell Connected Maintenance has been fully integrated by the latter company in the former’s AVIATAR, thus the availability of the Predictive Health Analytics’ package that includes over 100 predictors for majority of Airbus and Boeing aircrafts.

Key Players

Key Service Providers/Manufacturers:

-

IBM Corporation (IBM Maximo, Watson IoT)

-

Boeing (Boeing AnalytX, Boeing Optimized Maintenance)

-

GE Aviation (Predix, FlightPulse)

-

Honeywell Aerospace (Honeywell Forge, GoDirect Maintenance Service)

-

Lufthansa Technik (AVIATAR, Mobile Engine Services)

-

Ramco Systems (Ramco Aviation Suite, MRO Aviation Software)

-

IFS AB (IFS Applications, IFS Maintenix)

-

SAP SE (SAP Predictive Maintenance and Service, SAP Asset Intelligence Network)

-

Siemens AG (Siemens Digital Twin, MindSphere)

-

Swiss Aviation Software (AMOS, AMOSmobile)

Key Users of Digital MRO Services/Products:

-

Air France-KLM

-

United Airlines

-

Singapore Airlines

-

British Airways

-

Emirates Airlines

-

Qatar Airways

-

Lufthansa

-

American Airlines

-

Etihad Airways

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.0 Billion |

| Market Size by 2032 | US$ 2.9 Billion |

| CAGR | CAGR of 12.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (AR/VR, 3D Printing, Robotics, Blockchain, Internet of Things (IoT), Artificial Intelligence & Big Data Analytics, Digital Twin & Simulation, Cloud Computing) • By End User (MROs, Airlines, OEMs) • By Application (Inspection, Predictive Maintenance, Performance Monitoring, Parts Replacement, Inventory Management, Training, Mobility) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Boeing, GE Aviation, Honeywell Aerospace, Lufthansa Technik, Ramco Systems, IFS AB, SAP SE, Siemens AG, Swiss Aviation Software |

| Key Drivers | • Advanced analytics, AI, and ML technologies are increasingly being integrated into MRO operations to enhance predictive maintenance, automate routine tasks, and improve overall efficiency. • The growing emphasis on maintaining high standards of aircraft safety and performance drives the adoption of digital solutions for real-time monitoring, reducing downtimes, and improving fleet availability. • The proliferation of IoT-enabled devices within aircraft maintenance allows for continuous data collection and analysis, facilitating proactive and condition-based maintenance. |

| Market Restraints | • The significant upfront investment required for deploying digital MRO solutions, including infrastructure upgrades and software costs, can be a major barrier for small and medium-sized MRO providers. • The increasing digitization of MRO operations also heightens the risk of cyberattacks, making companies wary of adopting fully digital solutions without robust security measures. • Integrating data from various legacy systems with new digital tools remains a challenge, slowing the seamless transition to fully digitized MRO processes. |