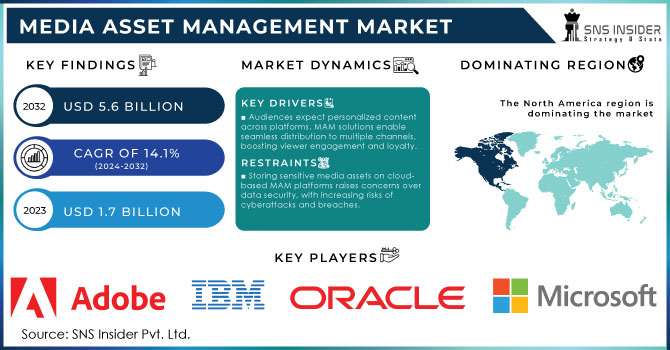

Media Asset Management Market Size & Overview:

Get more information on Media Asset Management Market - Request Sample Report

Media Asset Management Market size was valued at USD 1.7 billion in 2023 and is expected to grow to USD 5.6 billion by 2032 and grow at a CAGR of 14.1% over the forecast period of 2024-2032.

The media asset management market is witnessing rapid growth due to the increasing digitalization in all industries, led by the government’s efforts to promote innovation and technology. According to the latest statistics provided by the International Telecommunication Union and supported by national institutions, governments have invested $5.8 billion in media technology equipment as part of their ongoing digitalization efforts. The rise of content creators has fostered the development and use of over-the-top channels that require sophisticated MAM systems. The increase in demand has been influenced by the size of the media and entertainment industry in the United States, with the Department of Commerce estimating its worth at $660 billion. The European Union, spearheaded by the European Union’s Digital Decade, aims to ensure that its citizens have access to digital tools and services. As part of the media industry, the film and audiovisual sectors are set to benefit from the ruling, which will drive demand for MAM systems, among other digital tools.

The use of digital media has increased worldwide, assisted by government investments in high-speed internet and 5G connectivity. The consumption of digital media continues to rise, with South Korea, China, and India leveraging the available capacity in the cloud as well as the deployment of digital content distribution. Meanwhile, the increase in the use of smartphones is attributable to customers’ reliance on digital media for information, entertainment, and other purposes. There has been a rise in the demand for solutions that optimize content management across multiple channels.

| Category | Details |

|---|---|

| Key Function | Media Asset Management systems help organize, store, and retrieve digital media files, reducing content search time by 30-40%. |

| Cloud-based MAM Solutions | 55% of new MAM implementations are cloud-based, offering scalability and remote access, especially for OTT platforms. |

| Benefits | Reduces time to market for media content by 25% through efficient content management and streamlined workflows. |

| Integration with AI | AI-powered MAM solutions improve content tagging accuracy by 50-60%, leading to faster media retrieval and metadata management. |

| Content Storage Efficiency | MAM systems reduce storage space requirements by 30-35% through efficient file compression and archiving. |

| Demand in Broadcasting | Over 70% of broadcasters have adopted MAM to manage vast libraries of digital content, improving workflow efficiency. |

Media Asset Management Market Dynamics

Drivers

-

Cloud-based MAM systems offer flexibility, scalability, and cost-efficiency, allowing media companies to store, manage, and distribute assets without hefty infrastructure costs. This trend is accelerating cloud adoption for media management.

-

Audiences expect personalized content experiences across various platforms. MAM solutions enable seamless content distribution to multiple channels and devices, enhancing viewer engagement and loyalty.

-

With the rise of digital platforms, OTT services, and social media, there is a growing demand for efficient management of media assets. Content creators and broadcasters require robust MAM systems to handle large volumes of video, audio, and image files.

Increased adoption of cloud-based solutions is one of the primary drivers in the media asset management market. The rise of such solutions has revolutionized the way media assets are stored, handled, and transferred. Cloud-based MAM systems show a unique level of flexibility and scalability in comparison to traditional on-premise platforms since they allow media companies to adjust to the dynamic loads without large-scale infrastructure investments. A report indicates that by 2024, more than 70% of media companies will have applied either cloud storage or cloud-based media processing.

This trend is being driven by the need for media companies to handle ever-growing volumes of content. For instance, streaming services such as Netflix, Amazon Prime, and Disney produce thousands of hours of new content every year. Handling such a large-scale media library requires an effective and efficient management of large-scale media libraries. Cloud-based MAM allows such companies to store and retrieve large amounts of collected data and to deliver media across the globe. Due to the utilization of high-speed networks, the shear latency becomes insignificant. For example, during the last coverage of the Olympics in 2020, BBC adopted the cloud-based MAM allowing all teams to access the same content in real-time across multiple locations. This was a breakthrough since it allowed all engineers, directors, producers, and reporters to work remotely and collaborate on the same content. The expansion of 5G networks drives the shift in cloud-based MAM because it ensures high-quality and fast data transfer. As a result, buffering becomes less evident, and content is delivered more effectively and efficiently.

Restraints:

-

The upfront cost of implementing MAM systems, especially for on-premise solutions, can be a barrier for smaller media companies, limiting widespread adoption.

-

Storing sensitive media assets on cloud-based MAM platforms raises concerns over data security, with increasing risks of cyberattacks and breaches.

One of the major limitations in the media asset management market is security and privacy concerns. In particular, as media organizations pursue the adoption of larger-scale cloud-based solutions, the threat of data breaches and depriving access to assets, intellectual and confidential production content, and clients’ data, is becoming more severe. Therefore, providing a secure solution and using encryption, access control, data-gravity guards, and audits are required for proper MAM. However, this process is rather expensive and complex, as the prior implementation of such measures requires substantial resource allocation before using the solutions on the corresponding cloud hosts. In addition, the adoption of MAM may become even more complicated due to new rules and regulations, such as GDPR, about the use of program solutions and customer data. As a result, concerns over security vulnerabilities and compliance with legal standards can hinder the broader adoption of cloud-based MAM systems.

Media Asset Management Market Segment analysis

By End-User

Media & Entertainment was the leading segment in this global media asset management market and accounted for a 29% share in 2023. The reasons were mainly the sheer volume of digital content that gets created every day and the need to store, retrieve, and disseminate it effectively. According to a recent report by the U.S. The Bureau of Labor Statistics projects that employment in the media and entertainment sector will rise 7% from 2023 to 2032, faster than for all occupations. This increase in demand is likely to lead to new demand for MAM systems as companies operating within this sector are likely to look towards managing their resources and distributing their assets more efficiently.

Moreover, this segment is witnessing growth with global demand for localization of content and government efforts to promote the creation and dissemination of digital content. The U.K. Department for Digital, Culture, Media, and Sport reported a 15% year-on-year increase in demand for media and entertainment technology in 2023, while India’s Ministry of Information and Broadcasting is promoting indigenous content creation under the "Digital India" initiative. With these government-sponsored initiatives, the industry will continually need scalable MAM systems to support its fast growth in content delivery and continue dominating the market.

By Organization Size

Large enterprises held 76% market share in 2023 because managing high volumes of digital assets efficiently is their demand. There is a demand for media asset management among large organizations, especially in broadcasting, OTT services, and advertising. According to the U.S. Department of Commerce, media companies with annual revenues greater than $1 billion have reported a 12% growth in digital content creation during the last year, attributing their aggressive spending to sophisticated media asset management systems.

Huge organizations will have an investment in customized and high-performance MAM systems, capable of processing vast amounts of data-the data that an individual organization can handle will be large enough for easy streamlining of their work, automation of processes, and protection of data. For example, according to the report of the European Commission in 2023, large enterprises remain a leading performer in the AI-driven MAM systems across organizations as they help optimize their media distribution strategy on multiple channels and further enforce their dominance in the market. Thus, large enterprises' commanding market share is mainly driven by the ability to afford and deploy advanced technologies at scale.

By Deployment

In 2023, the cloud deployment segment accounted for the highest market share, holding around 72%. The increasing adoption of cloud computing technologies across industries is a primary driver for this shift towards MAM solutions. Moreover, cloud solutions offer better scalability, flexibility, and cost-effectiveness. U.S. data revealed that. Federal Communications Commission, cloud computing investments grew 25% in 2023, mainly attributed to the demand for more infrastructure for cloud to support media storage and streaming services.

The cloud-first policies started by the European Union within the EU Cloud Strategy have also made companies begin to shift from the on-premises model of MAM systems to the cloud model. In this context, these solutions for the cloud enable media companies to manage vast amounts of digital assets remotely while offering better collaboration and security capabilities. This tendency is likely to grow as more and more organizations realize the importance of cloud-based deployments in running complex media ecosystems efficiently.

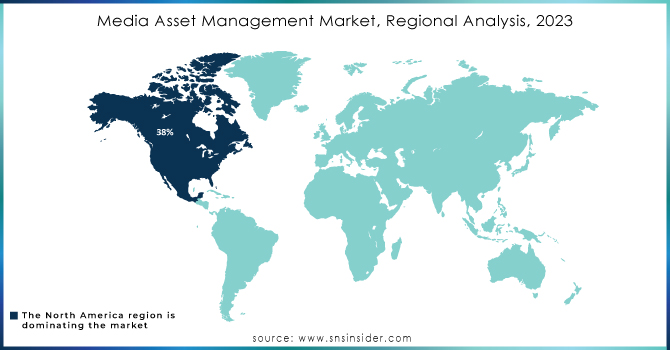

Regional Analysis

In 2023, North America dominated the media asset management market and accounted for about 38% of revenue shares. This dominance of regions is due to the United States, as the country is characterized by a developed digital ecosystem, large investments in media infrastructure, and industry participants. According to the U.S. Department of Commerce, investments in digital media technology continue to grow in North America in 2022, more than $12 billion was invested in MAM. Many key players are in the United States Adobe Systems, Avid Technology, Inc., and Qualcomm Inc./APIC. In the United States, there is the most developed network infrastructure, and high-speed internet, and there is also a wide use of OTT platforms, which has a positive effect on the development of media digital management.

The Asia-Pacific region shows the highest growth rate from 2024 to 2032. According to Asia-Pacific Telecommunity, investments in digital transformation activities in emerging markets: India, China, and Southeast Asia rigid speed. The governments of these countries are focusing heavily on 5G rollouts and cloud computing infrastructure to keep up with the demand for digital content. For example, according to the Ministry of Industry and Information Technology of China, in 2023 the country’s digital economy grew by 18%, which has a positive effect on the growing interest in the MAM system. Improving digital infrastructure and the government’s support through national digital localized infrastructure are the key factors that contribute to the growth of traffic in this region.

Need any customization research/data on Media Asset Management Market - Enquiry Now

Recent News and Developments

-

The U.S. Department of Commerce reported in January 2024 that it had invested $3 billion in digital media infrastructure, to support cloud-based MAM solutions; The investment is to enable the scaling up of storage and processing capacities, essential for handling larger amounts of digital media with the advent on over-the-top (OTT) platforms as well as content creators based solely in-digital.

-

Cloudinary has announced enhancements to its programmable media API and enterprise media asset management (MAM) solution in December 2023, including additions that improve tools for automated image editing at a massive scale. These upgrades are engineered to boost digital asset time-to-market and provide a simple yet effective way for both tech-savvy users as well as non-technical ones. The improvements also foster employee autonomy and efficiency, thus improving media management.

-

In May 2022, Arvato Systems upgraded VidiNet, its cloud-based media services platform adding technology capabilities to add metadata on new recorded videos and images. Cataloging and retrieval of media assets were significantly faster and more efficient, creating a better bookend-to-end solution for overall media asset management workflows.

Key Players

Key Service Providers:

-

Adobe Systems Incorporated (Adobe Premiere Pro, Adobe Creative Cloud)

-

IBM Corporation (IBM Aspera, IBM Watson Media)

-

Oracle Corporation (Oracle Content Management, Oracle Cloud Infrastructure)

-

Microsoft Corporation (Azure Media Services, Microsoft Stream)

-

Cloudinary (Media Optimizer, Programmable Media API)

-

Avid Technology, Inc. (Avid MediaCentral, Avid Nexis)

-

Dalet Digital Media Systems (Dalet Galaxy five, Dalet Flex)

-

Widen Enterprises (Widen Collective, Widen Media Asset Management)

-

Vimeo, Inc. (Vimeo OTT, Vimeo Enterprise)

-

Arvato Systems (VidiNet, Media Management Cloud)

Users of MAM Services

-

The Walt Disney Company

-

Netflix, Inc.

-

BBC (British Broadcasting Corporation)

-

Warner Bros. Discovery, Inc.

-

NBCUniversal Media, LLC

-

ViacomCBS (now Paramount Global)

-

Sony Pictures Entertainment

-

Hulu, LLC

-

Spotify Technology S.A.

-

Fox Corporation

| Report Attributes | Details |

| Market Size in 2023 | USD 1.7 Bn |

| Market Size by 2032 | USD 5.6 Bn |

| CAGR | CAGR of 14.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Organization Size (SMEs (Small and Medium Enterprises), and Large Enterprises) • By Deployment (On-Premise, Cloud) • By End-User (Media and Entertainment, BFSI, Government, Healthcare, Retail, Manufacturing, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adobe Systems Incorporated, IBM Corporation, Oracle Corporation, Microsoft Corporation, Cloudinary, Avid Technology, Inc., Dalet Digital Media Systems, Widen Enterprises, Vimeo, Inc., Arvato Systems |

| Key Drivers | • Cloud-based MAM systems offer flexibility, scalability, and cost-efficiency, allowing media companies to store, manage, and distribute assets without hefty infrastructure costs. This trend is accelerating cloud adoption for media management. • Audiences expect personalized content experiences across various platforms. MAM solutions enable seamless content distribution to multiple channels and devices, enhancing viewer engagement and loyalty. • With the rise of digital platforms, OTT services, and social media, there is a growing demand for efficient management of media assets. Content creators and broadcasters require robust MAM systems to handle large volumes of video, audio, and image files. |

| Market Restraints | • The upfront cost of implementing MAM systems, especially for on-premise solutions, can be a barrier for smaller media companies, limiting widespread adoption. • Storing sensitive media assets on cloud-based MAM platforms raises concerns over data security, with increasing risks of cyberattacks and breaches. |