Customer Experience Analytics Market Report Scope & Overview:

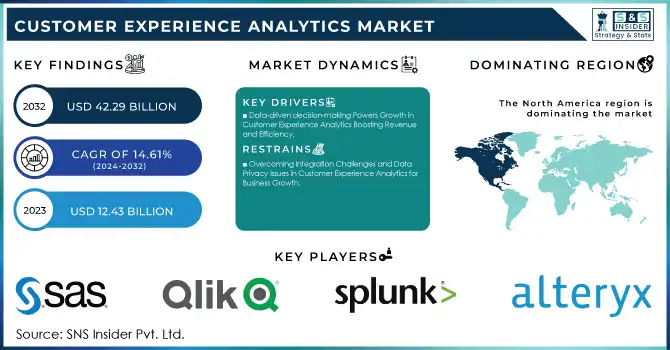

The Customer Experience Analytics Market size was valued at USD 12.43 billion in 2023 and is expected to reach USD 42.29 billion by 2032, growing at a CAGR of 14.61% over the forecast period of 2024-2032.

To get more information on Customer Experience Analytics Market - Request Free Sample Report

The market for Customer Experience Analytics (CEA) will grow due to the increasing focus on customer satisfaction and loyalty in a very competitive business environment. Organizations in all sectors acknowledge the significance of having insights into customer behavior, preferences, and frustrations to provide tailored experiences. The proliferation of digital platforms has created a trove of customer data. With these advancements, businesses are using sophisticated analytical tools including AI and machine learning for actionable data. Such insights facilitate process efficiencies, optimized touch-points, and proactive action based on customer expectations, ultimately driving retention and revenue.

By 2024, 72% of customers expect a response in an hour, and more than 50% will take their business to a competitor after a negative experience. Also, 86% of buyers will pay more for a better customer experience and 49% of customers make an impulse purchase after receiving a personalized experience. Conversational AI has proved to be vital and cost-efficient, which is also apparent from the 80% of executives who reported an increase in customer satisfaction after integrating conversational AI.

Moreover, the increasing popularity of omnichannel strategies has further boosted the demand for enhanced customer analytics solutions. Many companies are looking to integrate data across different touchpoints websites, social media, call centers, mobile apps, and many others. to provide a single view of the customer journey. Similarly, analytics tools for better customer engagement during times of crisis while sustaining data privacy due to regulatory compliance, especially in sectors including BFSI and healthcare, have borne investments.

In addition, the increasing adoption of cloud-based solutions resulting in the availability of analytics tools to small and medium enterprises are fueling market growth globally. The companies using omnichannel in 2024 grew 10% year on year and saw 10% higher average order values and 25% higher close rates. Here are the top three communication preferences for service requests 60% of customers prefer email, 58% prefer phone, and 48% prefer webchat. Third, the transition to the cloud for customer service is also accelerating, with 34% of organizations having fully moved to cloud contact centers or functioning as cloud-native.

Customer Experience Analytics Market Dynamics:

Key Drivers:

-

Data-driven Decision-making Powers Growth in Customer Experience Analytics Boosting Revenue and Efficiency

Growth of the Customer Experience Analytics (CEA) Market is Driven by Data-driven Decision Making by Enterprises Across Industries With businesses accumulating massive amounts of data from every customer interaction, they are in greater need of analytics solutions that can analyze those datasets. They are employing sophisticated, and even predictive data analytics to identify trends globally on the basis of sentiment, or opportunities for improvement, in real-time. It empowers businesses to respond in advance to customer needs, fix issues on the spot, and provide a much more personalized experience.

With organizations trying to create a niche in saturated markets, the ability to use customer data to further the decision-making process has become immensely important. It also results in better profits, customer satisfaction, and operational efficiency which has also been one of the important drivers responsible for the customer experience analytics market growth. Companies using data analytics saw revenue growth 8% higher and cost savings 10% higher in 2024. Some other highlights include 86% of customers will pay more for a great experience and an 80% revenue jump for companies focused on customer experience.

-

AI and ML Drive Revolution in Customer Experience Analytics Enhancing Sales Engagement and Operational Efficiency

Technology advancements in artificial intelligence (AI) and machine learning (ML) are changing the game in CEA. Level 4 – Automated Customer Analytics with AI and ML The application of AI and ML technologies in customer experience platforms is showing its place, as it provides an opportunity for businesses to automate the analysis of customer data to derive deeper insights into customer behavior. Subject Redefining Customer Experience with AI Virtual Assistant Technologies AI Technologies allows real-time predictive analytics, sentiment analysis, and personalized recommendations to help businesses create highly relevant and contextually appropriate customer experiences. With the evolution of AI-powered analytics tools, companies can take advantage of them to make better decisions, improve customer journeys, and strengthen customer service capabilities.

With the rising usage of AI and ML and an increasing need for reliant and smart solutions, the demand for customer experience analytics market offers them to be on a smooth trajectory. Online holiday sales reached USD 282 billion in 2024, rising nearly 4% year-on-year driven by AI-optimized shopping experiences. AI chatbots also experienced a 42% growth in consumer engagement and 80% of marketers globally adopted chatbots, with 40% quoting a better customer experience as a major reason. Additionally, 29% of the global IT professionals registered time savings and operational efficiency using AI and automation tools.

Restraints:

-

Overcoming Integration Challenges and Data Privacy Issues Hinder Market Expansion Globally

The lack of integration of the analytics tools with the existing systems is a major restraint in the Customer Experience Analytics (CEA) market. Most organizations are littered with legacy infrastructure or inconsistent platforms that prevent a holistic view and system from consolidating and analyzing customer data from numerous touchpoints. Such a lack of smooth integration can make analytics solutions less effective and also increase the time-to-market. As data breaches become more prevalent and with more stringent data privacy laws including GDPR and CCPA coming into force, organizations need to take care about where they get and how they manage personal customer data.

This provides new degrees of difficulty for companies trying to gather and process data, as they have to both drive value from the people they work with and be compliant. Furthermore, there is also a lack of skilled personnel to manage advanced analytics tools and visualize and interpret results, which can be particularly problematic for small and medium-sized companies that may not have relevant expertise at their disposal.

Customer Experience Analytics Market Segmentation Analysis:

By Touch Point

In 2023, call centers accounted for the largest customer experience analytics market share of 39.8% due to the fact that call centers serve as the main channel for customer interaction. Call centers are still the first point of contact in assisting organizations to resolve customer problems, answering queries, and providing support in various sectors including BFSI, healthcare, and retail. Customer interactions yield a significant amount of structured and unstructured data, such as call recordings, sentiment analysis, and feedback, all of which are a treasure trove of analytics.

Call centers have become the backbone of organizations, which are investing heavily to get data-driven insights out of the heaps of data coming out of call center activities, to get more out of the agent capabilities, improve customer satisfaction, predict future customer experience analytics market trends, and other stuff. In a customer-centric market, emphasizing strengthening customer engagement, and behavioral preference towards brand loyalty call centers will always remain a boon due to their capability of real-time and personalized support.

The web segment is forecast to achieve the highest CAGR over 2024–2032 owing to the changing customer behavior towards online components in tandem with digital transformation. With corporate websites and e-commerce platforms expanding their digital footprint, more customer data is being created by web analytics, user behavior tracking, and clickstream data every minute. Advanced Web Analytics tools not only help businesses understand their users better and know their needs but for a more competitive nature, also make you improve digital touchpoints and personalize them, ever-evolving.

In addition, the increasing number of mobile devices and the introduction of omnichannel approaches make web analytics even more significant. With the need to better understand the online customer journey in real time and the ability to stitch these insights into comprehensive customer experience strategies, the web segment will be a high-growth segment over the next few years.

By Solution

In 2023, social media analytical tools dominated the market and accounted for 43.8% market share which indicates the importance of social media in creating a customer experience. Social media platforms in particular (think Facebook, Instagram, Twitter, and LinkedIn) have become an essential way for businesses to connect with their customers, market their brand, and receive immediate feedback in real-time.

Social media activities, such as posts, comments, likes, and shares generate massive amounts of unstructured data, offering useful insights into customer sentiment, preferences, and changing trends. Companies take advantage of social media analytical tools transferring this medium for the perception of their brand, campaign effectiveness, and customer engagement. It comes with features of real-time insights and supported targeted marketing strategies, which justifies these tools to dominate the market.

The Data Management segment is predicted to experience the highest CAGR during 2024-2032, owing to the rising demand for centralized and efficient data processing. As customer experience analytics companies implement omnichannel formats, capturing and managing data from multiple touchpoints including social media, call centers, web, and face-to-face interactions becomes essential. Sophisticated data management solutions help companies aggregate, cleanse, and structure large data into actionable formats. These tools enable seamless integration with analytics platforms for richer customer intelligence and better decision-making.

Moreover, the growth of artificial intelligence (AI) and machine learning (ML) technologies depends largely on well-organized and accessible data which increases the need for more robust data management architectures. As businesses continue to prioritize having a unified view of the customer, we expect data management to serve as a backbone of customer experience strategies, driving rapid growth in the process.

By Industry Vertical

The Banking, Financial Services, and Insurance (BFSI) sector held the dominant market share of 35.7% in 2023 in the customer experience analytics market due to the growing need of the sector to adopt customer-centric behaviors to meet the high competition in providing personalized and efficient customer service. The BFSI sector is always under pressure to deliver better customer experience, quicker service delivery time, and remain compliant with very high regulatory standards. In such a situation, customer experience analytics offers banks, insurance companies, and other financial service providers the ability to understand customer behavior, predict needs, and provide personalized services. The sector utilizes analytics in managing customer interaction through multiple touchpoints, such as online banking, mobile apps, call centers, and physical branches, which adds to its substantial market share. Additionally, the increasing shift towards digital banking and well-established fintech solutions have highlighted the importance of data-driven insights, further solidifying the standing of BFSI.

The manufacturing sector is expected to grow at the highest CAGR between 2024-2032, owing to the rising adoption of Industry 4.0 technologies along with increasing digital transformation initiatives. With more manufacturers opting for smart factory solutions and adopting IoT and automation, the amount of customer and operational data is growing at lightning speed. Insights gained from customer feedback, product performance, and post-sales service are assisting manufacturers with product quality, supply chain efficiency, and customer service efficiency through customer experience analytics. Moreover, with manufacturing companies pursuing D2C and going more digital, the requirement for analytics tools to analyze customer experiences is increasing. Increased focus on customer-centricity along with a growing shift towards data-driven decision-making are supporting manufacturing as one of the rapidly growing sectors in the customer experience analytics market.

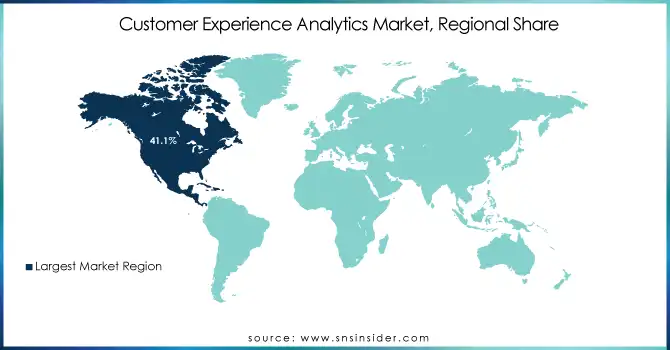

Customer Experience Analytics Market Regional Analysis:

North America accounted for the largest share of the customer experience analytics market, which was 41.1% in 2023, owing to advancement in technology infrastructure, increased digitalization, and rapid adoption of customer-centric business models in the region. Some of the biggest companies from the region in BFSI, retail, technology, and others, completely rely on customer experience analytics to maintain their competitive edge. An example of this is Amazon which leverages its customer data to provide high levels of personalization through recommendations and to optimize their supply chain for high customer satisfaction. Furthermore, Bank of America enhanced its mobile banking app and optimized customer interactions using customer experience analytics supported by AI-driven insights.

Asia Pacific is estimated to have the highest CAGR over 2024-2032 due to high digitalization, greater acceptance of e-commerce, and an increasing middle class as seen in China, India, and Japan. The region is undergoing a transition towards omnichannel strategies, resulting in higher adoption of customer experience analytics tools to remain competitive in a digitally connected world. An example of applying Artificial intelligence would be Alibaba, which uses big data analytics through all its e-commerce platforms to follow consumer trends, optimize marketing, and improve the customer experience. Likewise, Indian HDFC Bank is using analytics to know its customers, design operations, and tailor services to their needs, which is helping it to expand rapidly in the financial sector. The growing adoption of an AI and machine-learning foundation and technologies drives the growth of customer experience analytics in the Asia Pacific, especially in China and India.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players:

Some of the major customer experience analytics companies are:

-

Alteryx (Alteryx Designer, Alteryx Server)

-

SAS (SAS Viya, SAS Customer Intelligence)

-

Qlik (Qlik Sense, QlikView)

-

Splunk (Splunk Enterprise, Splunk Cloud)

-

Teradata (Teradata Vantage, Teradata IntelliCloud)

-

MicroStrategy (MicroStrategy Analytics, MicroStrategy Cloud)

-

Domo (Domo Business Cloud, Domo Data Science)

-

Sisense (Sisense Fusion, Sisense for Cloud Data Teams)

-

ThoughtSpot (ThoughtSpot Analytics, ThoughtSpot Cloud)

-

Tableau (Tableau Desktop, Tableau Server)

-

Microsoft Power BI (Power BI Desktop, Power BI Pro)

-

Salesforce (Salesforce Service Cloud, Salesforce Marketing Cloud)

-

Zendesk (Zendesk Support, Zendesk Chat)

-

HubSpot (HubSpot Service Hub, HubSpot Marketing Hub)

-

Freshworks (Freshdesk, Freshchat)

-

Zoho (Zoho Analytics, Zoho CRM)

-

Oracle (Oracle CX Cloud, Oracle Service Cloud)

-

Adobe (Adobe Experience Cloud, Adobe Analytics)

-

IBM (IBM Watson Analytics, IBM Customer Experience Analytics)

-

SAP (SAP Customer Experience, SAP Analytics Cloud)

Some of the Raw Material Suppliers for companies:

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

Google Cloud Platform (GCP)

-

IBM Cloud

-

Oracle Cloud

-

Dell Technologies

-

Hewlett Packard Enterprise (HPE)

-

Cisco Systems

-

Intel Corporation

-

NVIDIA Corporation

Recent Developments:

-

In July 2024, Alteryx unveiled major updates to its AI Platform for Enterprise Analytics, including new generative AI tools and enhanced features for data preparation, reporting, and cloud execution. The updates aim to streamline analytics workflows, boost efficiency, and support advanced AI-driven insights across industries.

-

In February 2024, SAS partnered with Carahsoft to provide advanced analytics, AI, and data management solutions to the U.S. government agencies. This collaboration aims to enhance data-driven decision-making and innovation across the public sector.

-

In August 2024, Splunk launched a GenAI summary feature on its search platforms, delivering quick, contextual overviews of relevant information. This enhancement allows users to access key insights faster, improving search efficiency on Splunk.com and docs.splunk.com.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.43 Billion |

| Market Size by 2032 | USD 42.29 Billion |

| CAGR | CAGR of 14.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Touch Point (Company Website, Branch, Call Center, Web) • By Solution (Data Management, Social Media Analytical Tools, Voice Of Customer, Web Analytical Tools, Dashboard & Reporting) • By Industry Vertical (BFSI, Healthcare, Manufacturing, IT Communication Service Provider, Travel & Hospitality) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alteryx, SAS, Qlik, Splunk, Teradata, MicroStrategy, Domo, Sisense, ThoughtSpot, Tableau, Microsoft Power BI, Salesforce, Zendesk, HubSpot, Freshworks, Zoho, Oracle, Adobe, IBM, SAP. |

| Key Drivers | • Data-driven decision-making Powers Growth in Customer Experience Analytics Boosting Revenue and Efficiency • AI and ML Drive Revolution in Customer Experience Analytics Enhancing Sales Engagement and Operational Efficiency |

| RESTRAINTS | • Overcoming Integration Challenges and Data Privacy Issues in Customer Experience Analytics for Business Growth |