Data Storage Market Report Scope & Overview:

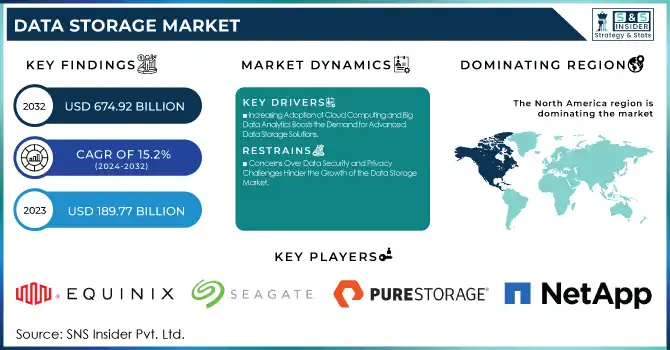

The Data Storage Market Size was valued at USD 189.77 Billion in 2023 and is expected to reach USD 674.92 Billion by 2032 and grow at a CAGR of 15.2% over the forecast period 2024-2032. The market can include technology adoption rates, such as cloud, software-defined, and hybrid storage. Key statistics could cover global data generation volumes, trends in cloud migration, and increasing demand for data protection solutions. Additionally, highlighting investment trends in edge computing, storage hardware advancements like SSDs and NVMe, and customer behavior towards security, scalability, and cost-effectiveness can add valuable context. Industry-specific data, particularly in sectors like healthcare, BFSI, and media, provides further actionable insights.

Get more information on Data Storgae Market - Request Free Sample Report

Market Dynamics

Key Driver:

-

Increasing Adoption of Cloud Computing and Big Data Analytics Boosts the Demand for Advanced Data Storage Solutions

The growing adoption of cloud computing and big data analytics is a primary driver for the data storage market. As organizations generate vast amounts of data, there is a higher demand for scalable and efficient storage solutions that can manage, secure, and process this information. The integration of AI, machine learning, and IoT also intensifies data volume, which further pushes businesses to adopt robust storage infrastructures like cloud, hybrid, and software-defined storage. This surge in data usage promotes the need for advanced storage technologies to ensure smooth data operations and business continuity.

Restraint:

-

Concerns Over Data Security and Privacy Challenges Hinder the Growth of the Data Storage Market

the data storage market is an increasing concern over data security and privacy. As businesses transition to cloud and hybrid storage models, the threat of data breaches, unauthorized access, and data theft becomes a significant challenge. Governments and organizations must comply with stringent data protection regulations, such as GDPR, which complicates the process of data storage management. These concerns deter some companies from fully embracing advanced storage solutions and drive up the costs associated with implementing robust security measures, ultimately slowing down market growth.

Opportunity:

-

Emerging Technologies Like Edge Computing and 5G Provide New Opportunities for Data Storage Market Growth

Emerging technologies such as edge computing and 5G networks present significant growth opportunities for the data storage market. As these technologies require real-time data processing and low-latency storage solutions, the demand for distributed storage systems and edge storage infrastructure is expected to increase. Edge computing brings data processing closer to the source, minimizing the need for centralized storage solutions and creating new avenues for storage innovation. Additionally, 5G’s high-speed capabilities can further accelerate the demand for fast, scalable, and secure data storage solutions.

Challenge:

-

Rapid Technological Advancements in Storage Hardware and Software Pose Challenges for Data Storage Market Adaptation

The rapid pace of technological advancements in storage hardware and software presents a challenge for the data storage market. Organizations face difficulties in keeping up with frequent upgrades and maintaining compatibility between older and newer technologies. With the constant emergence of faster, more efficient storage solutions, companies must regularly invest in new infrastructure, leading to increased operational costs. Furthermore, as technologies evolve, ensuring smooth transitions and minimizing data disruptions during system upgrades becomes increasingly complex, particularly for enterprises with large-scale storage requirements.

Segment Analysis

By Storage Medium

In 2023, the Cloud Storage segment accounted for 43% of the total revenue share in the data storage market, solidifying its dominance. This growth is driven by the increasing demand for scalable and cost-effective solutions, with companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud leading the charge. AWS continues to innovate with product updates like Amazon S3 Glacier for archiving, while Microsoft launched Azure Storage for high-performance workloads.

These advancements align with growing trends in businesses adopting cloud solutions to handle the surge in data volumes, further pushing cloud storage as a crucial element of digital transformation. The expansion of hybrid and multi-cloud environments is also a key trend, allowing companies to optimize their data storage by combining cloud-based solutions with on-premises infrastructure. As companies embrace AI, big data, and IoT technologies, the need for cloud storage to manage vast data sets is expected to escalate, reinforcing its central role in the data storage market.

By Enterprise Size

In 2023, the Large Enterprises segment dominated the data storage market, accounting for 52% of the total revenue share. This dominance is driven by the increasing demand for large-scale, reliable, and high-performance storage solutions to manage vast amounts of business-critical data. These innovations meet the specific needs of large enterprises in industries like banking, healthcare, and manufacturing. The shift toward hybrid cloud and AI-driven storage solutions is further enhancing the market’s expansion, allowing enterprises to optimize their data storage systems while maintaining data security and compliance.

The Mid-Size Enterprises segment is poised for the highest growth rate, with a projected CAGR of 16.36% during the forecast period. This growth is driven by mid-sized companies’ increasing reliance on cloud-based and hybrid storage solutions to manage their expanding data needs affordably. With these advancements, mid-sized enterprises can now enjoy the flexibility and performance of large-scale storage systems without the high costs, fostering further adoption of data storage technologies.

By Industry

In 2023, the BFSI segment led the data storage market, capturing 25% of the total revenue share. The BFSI sector is particularly reliant on high-performance, secure, and scalable storage solutions to handle vast amounts of sensitive financial data, ensure regulatory compliance, and maintain system uptime. The increasing shift to cloud storage, combined with innovations in AI and blockchain, has further intensified the need for more secure, efficient storage systems in this sector, driving continued growth in data storage adoption.

The Healthcare and Life Sciences segment is projected to grow at the highest CAGR of 17.37% within the forecast period, driven by the increasing demand for secure storage solutions to manage patient data, medical records, and research datasets. The rising adoption of electronic health records (EHR) and medical IoT devices has fueled the need for highly scalable, reliable, and compliant storage solutions, making the healthcare sector a rapidly growing driver for the data storage market.

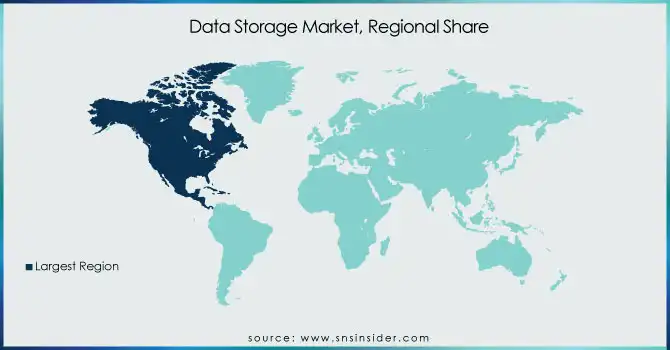

Regional Analysis

In 2023, North America dominated the data storage market, holding the largest market share due to the high adoption of advanced technologies and digital transformation across industries. The region's robust infrastructure and presence of major technology companies like IBM, Dell, and Amazon Web Services (AWS) further support this dominance. North America also leads in sectors such as BFSI and healthcare, which require reliable and scalable storage solutions, making it the leading region in terms of market share.

Asia Pacific is the fastest-growing region in the data storage market, with an estimated CAGR of 16.83% during the forecast period. This rapid growth is fueled by the increasing demand for cloud storage, AI, and IoT technologies, along with significant investments in data infrastructure across countries like China, India, and Japan. The growing e-commerce, manufacturing, and healthcare sectors in these regions further drive the adoption of scalable storage solutions, positioning Asia Pacific as a key player in the data storage market’s expansion.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the Data Storage Market are:

-

NetApp (ONTAP Data Management Software, NetApp AFF All Flash Arrays)

-

Pure Storage (FlashArray//C, Pure1 Cloud Data Services)

-

Seagate Technology (Exos X16 Hard Drives, Seagate Lyve Cloud Storage)

-

Equinix (Equinix Metal, Equinix Cloud Exchange Fabric)

-

Huawei Investment & Holding (OceanStor Dorado All-Flash Storage, Huawei FusionStorage Software)

-

IBM Corporation (IBM FlashSystem, IBM Spectrum Virtualize)

-

Amazon Web Services (Amazon S3 Cloud Storage, Amazon Elastic Block Store (EBS))

-

Dell Technologies (Dell Unity XT, Dell PowerMax)

-

Hewlett Packard Enterprise (HPE Nimble Storage, HPE 3PAR StoreServ Storage)

-

Hitachi Vantara LLC (Hitachi Virtual Storage Platform, Hitachi Data Instance Director)

-

Western Digital (WD Red NAS Hard Drives, Western Digital My Cloud)

-

NETGEAR (NETGEAR ReadyNAS, NETGEAR Insight Cloud Management)

-

Biomemory (Biomemory Data Storage Solutions, Biomemory Cloud Backup)

Recent Development:

-

In January 2024, Ugreen announced a partnership with Intel during the launch of its NASync Network Attached Storage devices at the 2024 ES. This collaboration was aimed at integrating Intel processors to enhance storage efficiency and decision-making capabilities, providing advanced features powered by AI to improve daily work and life experiences.

-

In October 2024, NetApp's CEO emphasized that the company should not be referred to solely as a storage company, as it now focuses more on providing data management solutions and digital transformation services. They aim to innovate beyond traditional storage, aiming to align more closely with the evolving tech and business landscapes.

-

In November 2024, Pure Storage introduced its GenAI Pod to accelerate AI innovation by providing a full-stack solution for generative AI initiatives. The new product includes validated designs for easy deployment and integration, addressing challenges related to AI infrastructure. Pure also announced the certification of its FlashBlade//S500 with NVIDIA DGX SuperPOD for large-scale AI deployments.

-

In December 2023, Biomemory introduced DNA Cards, the first-ever DNA data storage available for public use. These credit card-sized cards, with a capacity of 1 KB, demonstrated the practicality of molecular computing as a sustainable alternative to traditional silicon chipsets, boasting a minimum lifespan of 150 years.

-

October 2023 saw the launch of Hitachi Vantara's Hitachi Virtual Storage Platform One, a modernized version of its traditional data storage portfolio. This solitary hybrid cloud data platform was designed to address the complex challenges faced by IT leaders looking to scale data and modernize applications across critical, multi-cloud, and distributed hybrid infrastructure.

-

In August 2023, NetApp expanded its partnership with Google Cloud to offer improved storage performance and cloud flexibility. The introduction of Google Cloud NetApp Volumes as a fully managed first-party service allowed for seamless integration of businesses' critical workloads, including demanding use cases like VMware and SAP, without the need for refactoring or process redesign.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 189.77 Billion |

| Market Size by 2032 | US$ 674.92 Billion |

| CAGR | CAGR of 15.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Storage Medium (Direct Attached Storage, Network Attached Storage, Software Defined Storage, Hyper-Converged Storage, Cloud Storage [Public, Private, Hybrid], Storage Area Network) • By Enterprise Size (Mid-Size, SoHo, Large Enterprises) • By Industry (BFSI, IT and Telecommunication, Healthcare and Life Sciences, Manufacturing, Retail and Consumer Goods, Governments & Public Sector, Media and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NetApp, Inc., Pure Storage, Inc., Seagate Technology Holdings Public Limited Company, Equinix, Inc., Huawei Investment & Holding Co., Ltd., IBM Corporation, Amazon Web Services, Inc., Dell Technologies Inc., Hewlett Packard Enterprise Company, Hitachi Vantara LLC (Hitachi Ltd.), Western Digital Corporation, NETGEAR, Inc., Biomemory |