Digital Shipyard Market Report Scope & Overview:

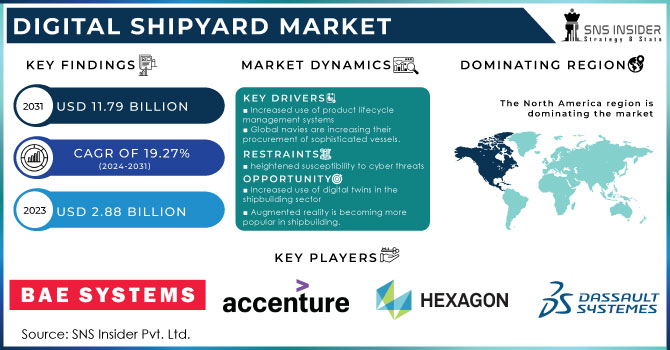

The Digital Shipyard Market Size was valued at USD 2.88 billion in 2023 and is expected to reach USD 11.79 billion by 2031 with a growing CAGR of 19.27% over the forecast period 2024-2031.

To get more information on Digital Shipyard Market - Request Free Sample Report

The digital shipyard aims to transform the shipyard company from top to bottom by employing the appropriate technologies to achieve strategic objectives. From the shipyard's boardroom to the shop floor. The way forward is to restructure the entire organisational ecosystem as well as business processes throughout the lifespan. The creation of a digital shipyard is an intriguing potential for major shipyards. The purpose of the digital shipyard is to improve the maritime industry's operating efficiency and effectiveness, making it safer, faster, and smarter.

This has a considerable cost and time impact, making it easy to recognise a genuine benefit to shipyard operations during design, building, and servicing. The size of the Digital Shipyard Market is predicted to rise greatly in the next years as global trade and tourism activities via ships expand. A digital shipyard is hired to incorporate various digital technologies, such as AR/VR and IoT, into a shipyard to improve operating efficiency. The global Digital Shipyard Market is expanding rapidly as a result of a surge in process automation.

MARKET DYNAMICS

KEY DRIVERS

-

Increased use of product lifecycle management systems

-

Global navies are increasing their procurement of sophisticated vessels.

RESTRAINTS

-

heightened susceptibility to cyber threats

OPPORTUNITIES

-

Increased use of digital twins in the shipbuilding sector

-

Augmented reality is becoming more popular in shipbuilding.

CHALLENGES

-

Acquisition of digital shipyard software solutions is expensive.

IMPACT OF COVID-19

Shipyards have been compelled to halt all shipbuilding operations due to a government-imposed lockdown following the COVID-19 epidemic.

Ship builders are experiencing short-term operating challenges as a result of supply chain interruption caused by the government's efforts to slow the spread of COVID-19.

Shipyard digitalization initiatives have been halted due to a lack of labour due to travel restrictions enforced by countries to combat the COVID-19 pandemic.

Naval shipbuilding projects such as submarines and destroyers are prone to delays because to delays in the acquisition of cutting-edge equipment and components required for such naval vessels, as governments face financial challenges under the COVID-19 scenario.

According to projections, the robotic process automation segment will lead the digital shipbuilding market by 2028. Robot process automation is the use of AI employees or software robots to automate certain business operations. It is the use of technology to allow businesses to manipulate computer software or robots to automate certain business activities. They are intended to provide direct profitability, execute repetitive jobs, and interface with other corporate systems in the same way that humans do. The market for robotic process automation in digital shipbuilding is being driven by an increase in demand for advanced and time-saving solutions.

The manufacturing & planning category is predicted to expand the most in the digital shipyard industry by 2028. Manufacturing and planning is a crucial component in the implementation of the digital shipyard idea. Various intelligent technologies, such as additive manufacturing, robotic process automation, cloud computing and master data management, and blockchain, are used in the process.

The market is divided into two types: military shipyards and commercial shipyards. Due to recent rise in marine tourism, the commercial shipyards type is leading the market and is predicted to grow significantly during the projection period. As a result, there will be a greater demand for commercial vessels. As a result, firms are projected to make significant investments in commercial shipyards in the near future.

The market is divided into three categories based on capacity: small shipyards, medium shipyards, and large shipyards. The medium shipyards segment has dominated the market and is expected to grow at a faster volume rate. The medium sector includes cruise ships, naval ships, ferries, and passenger ships.

The fully digital shipyard segment dominated the market in 2021 and is expected to grow at the fastest CAGR during the forecast period due to increased acquisition of modern warships by navies such as China, India, and the United States.

Shipyard Semi-Digital Due to increased shipyard modernization plans, the industry is likely to grow at a high rate during the projection period.

Shipyard that is partially digital The growing development of connected and autonomous ships that enable digital technology is likely to promote the segment's growth.

KEY MARKET SEGMENTATION

By Digitalization Level

-

Partially Digital

-

Semi Digital

-

Fully Digital

By Capacity

-

Small Shipyard

-

Medium Shipyard

-

Large Shipyard

By Process

-

Training & Simulation

-

Design & Engineering

-

Research & Development

-

Maintenance & Support

-

Manufacturing & Planning

By Shipyard Type

-

Military

-

Commercial

By Technology

-

Block Chain

-

Artificial Intelligence

-

Augmented & Virtual Reality

-

Others

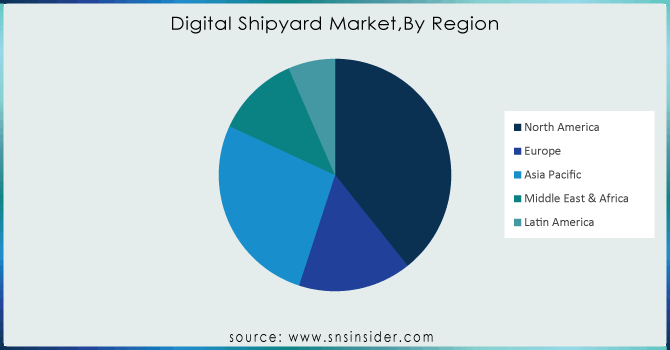

REGIONAL ANALYSIS

Because of the presence of firms such as Altair Engineering, Inc. and IBM Corporation, North America dominated the industry over the projected time.

Europe The region's expanding maritime tourism, as well as the region's main marine enterprises' increased development of autonomous and connected ships, are likely to boost market expansion.

Asia-Pacific During the forecast period, this region's market is expected to grow at the fastest rate. The region's rising seaborne trade is likely to fuel market expansion in the region.

The Middle East The development of new ports in the Middle East is likely to drive regional market growth.

Extreme cybersecurity threats in nations such as Mexico, South Africa, and Brazil are projected to fuel regional market growth.

Need any customization research on Digital Shipyard Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are BAE Systems, Accenture, Hexagon., IFS AB, Dassault Systemes, Siemens, Altair Engineering Inc., Kranendonk Smart Robotics, Pemamek Ltd., Inmarsat PLC., and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.88 Billion |

| Market Size by 2031 | US$ 11.79 Billion |

| CAGR | CAGR of 19.27% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Digitalization Level (Partially Digital, Semi Digital and Fully Digital) • By Capacity (Small Shipyard, Medium Shipyard and Large Shipyard) • By Process (Training & Simulation, Design & Engineering, Research & Development, Maintenance & Support and Manufacturing & Planning) • By Shipyard Type (Military and Commercial) • By Technology (Cloud Computing, Block Chain, Artificial Intelligence, Big, Data Analytics, Augmented & Virtual Reality and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BAE Systems, Accenture, Hexagon., IFS AB, Dassault Systemes, Siemens, Altair Engineering Inc., Kranendonk Smart Robotics, Pemamek Ltd., Inmarsat PLC., and other players. |

| DRIVERS | • Increased use of product lifecycle management systems • Global navies are increasing their procurement of sophisticated vessels. |

| RESTRAINTS | • heightened susceptibility to cyber threats |