Direct to Chip Liquid Cooling Market Summary:

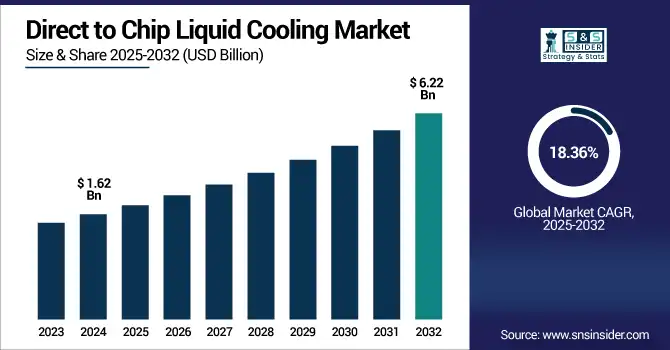

The Direct to Chip Liquid Cooling Market size was valued at USD 1.62 billion in 2024 and is expected to reach USD 6.22 billion by 2032, growing at a CAGR of 18.36% over the forecast period of 2025-2032. Direct to chip liquid cooling market trends are rising AI workloads, high-density servers, and data center sustainability. The adoption is accelerating due to superior thermal efficiency and reduced energy consumption over air cooling.

To Get more information on Direct to Chip Liquid Cooling Market - Request Free Sample Report

Growth of edge computing, non-centralized data center requirement, demand for scalable and modular cooling solutions are some of the opportunities driving the direct to chip liquid cooling market. This growth is also bolstered by increasing environmental regulations and green IT initiatives that are forcing enterprises to manage thermal more efficiently. New developments in material science have made reliability and adoption easier with corrosion-resistant cold plates and leak-proof fittings better than they used to be. Also, its integration with AI-based cooling control system allows for performance optimization in real time, increasing its attractiveness for enterprise, industrial, and hyperscale deployment.

-

AI and data center growth now consume 1–2% of global electricity, projected to reach 500 TWh by 2030 boosting adoption of liquid cooling for efficiency.

The U.S. direct to chip liquid cooling market size was valued at USD 0.45 billion in 2024 and is projected to grow at a CAGR of 18.03%, reaching USD 1.70 billion by 2032. The U.S. direct‑to‑chip liquid cooling market is growing due to the rapid growth of hyperscale and edge data centers, soaring AI and HPC workloads, growing energy efficiency mandates, and customized partnerships with IT providers.

Direct to Chip Liquid Cooling Market Dynamics:

Key Drivers:

-

AI and HPC Demands Drive Sustainable Direct to Chip Cooling Adoption in Hyperscale Data Centers Globally

Growing demand for high-performance computing (HPC) and AI workloads and dense server environments beyond the cooling capacity of traditional air systems have primarily driven the global Direct to chip liquid cooling market growth. Liquid cooling deployment is becoming important for hyperscale data centers and colocation providers, helping to minimize energy costs and improve resource management. Moreover, increased cost of electricity along with heightened climate change awareness has driven the governments to implement more stringent regulations, which drive enterprises to move toward sustainable cooling technologies.

-

Liquid cooling can reduce data center energy consumption by up to 50% compared to traditional air-based systems and lower average PUE from ~1.5 to as low as 1.04–1.10.

Restraints:

-

Retrofitting Challenges in Legacy Data Centers Restrain Global Adoption of Direct to Chip Liquid Cooling

The lack of complexity to retrofitting legacy data centers is one major restraint for global Direct to chip liquid cooling market. The common facilities are constructed on grounds, where air-based cooling infrastructure is already used, and therefore, it is easier to implement a gaseous-state cooling system, whereas incorporating a liquid cooling infrastructure would require major downtime or overall re-designing of the existing facility, which is technically and economically a very costly decision. This hampers adoption, especially for an enterprise with legacy assets that were not designed modularly or flexibly.

Opportunities:

-

Edge Data Centers and Green IT Goals Drive Innovation in Reliable Liquid Cooling Technologies Globally

Edge data centers are already being expanded in both remote and developing regions with corresponding opportunities as thermal performance becomes increasingly important. Smart sensors (integrated with AI on the control systems) and the use of materials highly resistant to corrosion are offering reliability and accessibility in equal measure. Innovation and collaboration will continue to enter through the door of Green IT initiatives and carbon-neutral goals globally.

-

Over 80% of new EU data centers are committed under the Climate Neutral Data Centre Pact to achieving 100% renewable energy usage by 2025 or 2030, including strict PUE and reuse targets.

Challenges:

-

Skilled Workforce Shortage and Regulatory Gaps Challenge Global Adoption of Liquid Cooling Technologies

The biggest issue is the limited access to science professionals which actually understand liquid cooling systems, fluid dynamics, and integrated thermal management. Even experts on redundancy, non-leakage, and legitimate system operation are needed to help it all operate without issue, and without incident. In addition, the global divergence in standard and compliance regarding liquid-type cooling infrastructure again has much to do with adoption impedance, unless regulatory regimes have built in certainty for next-gen data center cooling technologies in certain countries.

Direct to Chip Liquid Cooling Market Segmentation Analysis:

By Component

The segment for cold plates made up 40.6% of the total component share of the Direct to chip liquid cooling market in 2024 as they play a key role in an AI, HPC, and data center workloads due to their capability to provide high-efficiency, direct thermal transfer from high-power processors. It is more compact, scalable, and compatible with current server designs, which makes it easier for hyperscale and enterprise datacenter deployments.

The Coolant Distribution Units segment is expected to grow at the highest CAGR over 2025-2032. CDUs are becoming more popular as they allow for centralized and modular fluid use, which makes sense for big, dense computing. Real-time control of temperature, flow rate, and pressure enhances system safety and adaptability to changing cooling requirements.

By Application

The Direct to chip liquid cooling market was led by data centers in 2024, with a 46.5% market share, led by an increasing demand for effective thermal management solutions for hyper-scalable, and colocation data center environments. It all comes down to the fact that as server density and power consumption continually grow, traditional air cooling becomes a losing battle. Direct-to-chip l iquid cooling lowers PUE, decreases energy use, and facilitates energy efficiency essential elements of sustainability intent for large cloud providers and enterprise data centers.

The High-performance computing (HPC) segment is anticipated to achieve the highest CAGR over 2025-2032, attributed to the need for high thermal efficiency across compute-intensive applications. Many applications (AI modeling, scientific simulations and genomic research) generate substantial heat loads, thus advanced cooling technologies are needed. Direct-to-chip liquid cooling provides the reliability and performance required to keep things running in their ideal temperature, all without sacrificing processing time, making it perfect solution for national labs, research centers, and tech-forward industries capitalizing on the HPC boom.

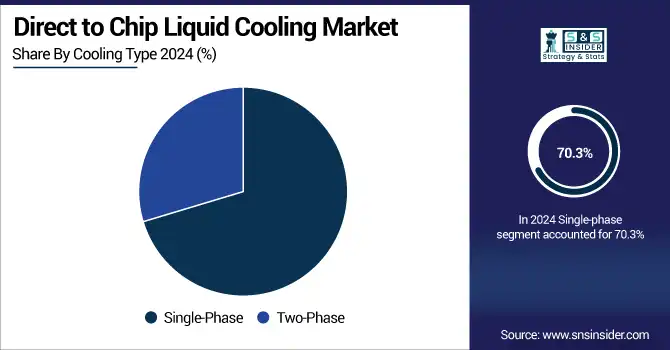

By Cooling Type

In 2024, the share of single-phase cooling in the Direct to chip liquid cooling market was 70.3%. The reason for its dominance is the ease of deployment, low cost, and it can run on existing server infrastructure. In this type of cooling solution, a liquid stays in the same phase during the cooling cycle, which makes it easier to handle, maintain, and allow for integrating into existing data center environments. Due to its history of low operational risk and solid reliability, this model is a common approach for hyperscale and enterprise data centers.

For the period of 2025-2032, the two-phase cooling is anticipated to experience the highest CAGR due to its much better thermal performance. This process actually utilizes the coolant change phase from liquid to vapor to transfer heat from high-performance processors more efficiently. This amounts to a big advantage in the capacity to manage larger heat concentrations, with less fluid flow, which is crucial for AI servers, HPC environments, and next-generation compute platforms.

By End-User

The direct to chip liquid cooling market is led by IT and Telecommunications, accounting for 52.6% of the market share in 2024. This leadership is propelled by strong growth in hyperscale and edge data centers, which support cloud computing, 5G infrastructure, and AI-based services. When server workloads are increasing, density is also, and more traditional cooling systems cannot keep up with performance and energy efficiency. It delivers a much-sought-after scalable and sustainable solution via direct-to-chip liquid cooling that positions it well ahead of the pack, catering primarily to large telecom operators and IT service providers processing large volumes of data with uptime and low latency in real-time.

During 2025-2032, the Healthcare sector is projected to have the fastest CAGR, owing to accelerated digitalization, the use of AI-supported diagnostic and medical imaging, and genomic research. Such applications utilize significant high-performance computing (HPC) environments with thermal output. Direct-to-chip liquid cooling provides accurate thermal management and other benefits of reliability, preventing mission-critical systems from experiencing performance dips.

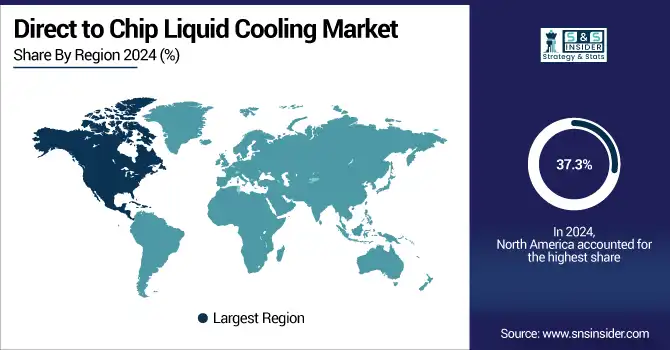

Direct to Chip Liquid Cooling Market Regional Outlook:

The North American Direct to chip liquid cooling market share accounted for around 37.3% in 2024 with early adoption by hyperscale data centers and AI infrastructure. Demand for advanced cooling technologies is being fueled by energy efficient operation, strict carbon regulations, and needs for high performance computing in the region. This trend continues with significant investment by major cloud providers, government research institutions, and AI-focused enterprises in direct-to-chip solutions for thermal performance and sustainability goals, solidifying the region's leadership in data infrastructure innovation.

Strong federal support for energy-efficient and sustainable data center operations, along with the concentration of hyperscale data centers, AI labs, and tech giants in the U.S., led to dominance in the North American market.

Direct to chip liquid cooling market in Asia Pacific is expected to grow at the fastest CAGR of 19.25% over the forecast period of 2025-2032. This spike is propelled by the continued growth of AI-powered data centers, increasing edge infrastructure, and the demand for high-performance computing. Accelerated adoption are led by strong government initiatives on Digitalization, Sustainability and Power Efficiency. And investments on next-gen cloud and colocation facilities are creating strong demand for advanced thermal management technologies such as direct-to-chip liquid cooling.

China dominated the Asia Pacific market owing to the rapid expansion of data centers, increasing investments in AI and HPC, and the Chinese government advocating policies promoting energy-efficient infrastructure in addition to deployment of advanced cooling systems across public and private infrastructure sectors.

The Direct to chip liquid cooling market in Europe is primarily driven by stringent environmental regulations, energy efficiency targets, and the growing adoption of green IT solutions in the regions. There is increasing demand for sustainable cooling technologies in data centers, research institutions, and enterprise computing environments in the region. The shift from traditional air cooling to liquid cooling is being sped up by government initiatives pushing for carbon neutrality and integration of renewable energy.

The Middle East & Africa and Latin America are also expected to be emerging markets for direct-to-chip liquid cooling, attributable to increasing investments in digital infrastructure and gradual adoption of edge and hyperscale data center development. With temperatures soaring and power shortfalls becoming an urgent concern, both regions are working to upgrade their energy efficiencies and greater assumptions of sustainability.

Get Customized Report as per Your Business Requirement - Enquiry Now

Direct to Chip Liquid Cooling Companies are:

Some of the major players in Global Direct to Chip Liquid Cooling Market are LiquidStack, Submer, ZutaCore, CoolIT Systems, Asetek, Supermicro, Lenovo, Dell, HPE, Fujitsu, IBM, Vertiv, Rittal, Schneider Electric, GRC, Iceotope, TAKADA, ExaScaler, Noctua Industrial Solutions, and Midas Green Technologies.

Recent Developments:

-

In November 2024, CoolIT Systems introduced the CHx1000, the world’s highest-density liquid‑to‑liquid Coolant Distribution Unit (CDU), optimized for NVIDIA Blackwell AI platforms.

-

In August 2024, LiquidStack opened a major new manufacturing facility and global HQ in Carrollton, Texas, scaling production for direct-to-chip CDUs and modular cooling systems.

-

In 2025, Asetek introduced the Ingrid cooler platform, promising near-silent operation and targeting workstation and gaming PC markets. Though not enterprise-level D2C, the innovation reflects cooling tech evolution.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.62 Billion |

| Market Size by 2032 | USD 6.22 Billion |

| CAGR | CAGR of 18.36% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Cold Plates, Coolant Distribution Units, Heat Exchangers, Pumps and Others) • By Application (Data Centers, High-Performance Computing, Telecommunications and Others) • By Cooling Type (Single-Phase and Two-Phase) • By End-User (IT and Telecommunications, BFSI, Healthcare, Government and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | LiquidStack, Submer, ZutaCore, CoolIT Systems, Asetek, Supermicro, Lenovo, Dell, HPE, Fujitsu, IBM, Vertiv, Rittal, Schneider Electric, GRC, Iceotope, TAKADA, ExaScaler, Noctua Industrial Solutions, and Midas Green Technologies. |