Pico Projector Market Size & Growth:

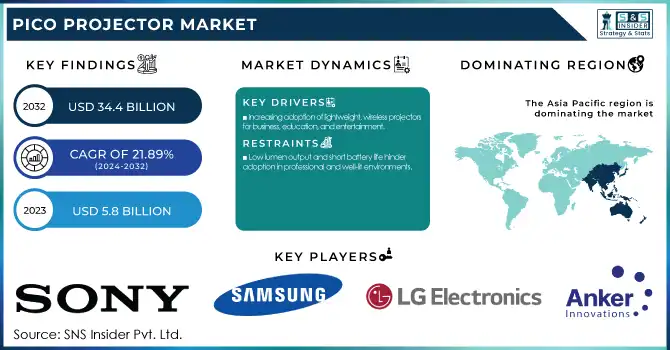

The Pico Projector Market Size was valued at USD 5.8 Billion in 2023 and is expected to reach USD 34.4 Billion by 2032, growing at a CAGR of 21.89% from 2024-2032. The Pico Projector Market is expanding rapidly, driven by the growing demand for portable and high-performance projection solutions. Global Pico Projector Shipments, by Region highlight regional adoption trends, with Asia-Pacific leading due to strong manufacturing infrastructure and consumer interest. Miniaturization and Performance Trends showcase advancements in laser and LED technology, enhancing brightness, resolution, and battery efficiency.

To Get more information on Pico Projector Market - Request Free Sample Report

Manufacturing Capacity Utilization (2023) reflects production scalability, particularly in key hubs like China and Taiwan. Supply Chain and Component Sourcing Metrics analyze material availability, semiconductor dependencies, and cost fluctuations. The report further explores innovations such as AR/VR integration, wireless connectivity, and AI-powered enhancements, shaping the future of pico projectors.

Pico Projector Market Dynamics

Drivers

-

Increasing adoption of lightweight, wireless projectors for business, education, and entertainment.

One of the main factors driving the Pico Projector Market is the rising demand for lightweight and portable display solutions. These projectors are designed for business professionals, educators, and entertainment users who need high-performance projection devices with easy portability. Further increase for the demand due to increasing remote work, online education, and outdoor entertainment. Moreover, with the evolution of LED and laser technology, the brightness, resolution, and battery life have also been improved. Supported by increasing wireless connectivity along with smartphones, tablets, and laptops, the market expansion. Miniature projectors have continually been scaled down and thus are emerging as a consumer choice for high functionality in a domestically integrable form factor.

Restraints

-

Low lumen output and short battery life hinder adoption in professional and well-lit environments.

While the pico projector market is still dealing with the key difficulty of good brightness level and battery life limitation, despite many trends that lead to progress in the field. While normal projectors will give you high-lumen outputs for big presentations and bright rooms, most pico projectors deliver far lower brightness levels that will wash out in bright environments. Moreover, compact designs limit battery size, leading to less time on the job. Although advances in laser and LED technology are promising improved performance, existing products simply cannot touch the projection-system efficiency that will always be inherent in conventionally-configured systems. These trade-offs obstruct adoption, specifically in use instances requiring consistent and excellent performances such as professional and educational purposes.

Opportunities

-

Advancements in AR, VR, and smart displays are expanding applications for pico projectors.

Pico projectors paired with augmented reality, virtual reality, and smart devices will be a major growth opportunity. The functions of these projectors are becoming ever broader, with innovations like gesture control, AI-powered enhancements, and holographic projections redefining standard uses. Increased need for interactive displays in gaming, retail, and automotive heads-up displays are also adding to market opportunities. Moreover, manufacturers are targeting embedded solutions for smartphones and smart glasses to improve portability and convenience. The success of AR and mixed reality experiences will fuel the development of high-resolution, ultra-compact projectors with seamless connectivity, which in turn will continue to reinforce the market growth.

Challenges

-

Costly components and semiconductor shortages impact affordability and production scalability.

Pico projectors are seen as a premium choice compared to typical alternatives because of the high cost incurred in making the miniaturized projection components. Even though these models deliver an exceptional experience, they demand semiconductor chips, optical components, and advanced display goodies, and this adds to production complexity and the price. In addition, global supply chain disruption, chip shortage, and raw material restraint adversely affected the scalability of manufacturing and postponed product launches but increased cost. Such factors prove rather difficult for manufacturers to compete with affordable but high-performance solutions. Moving past these challenges needs technology, particularly when it comes to low-cost production, substitute raw materials, and sustainable sourcing for the market to survive in the long term.

Pico Projector Market Segmentation Analysis

By Technology

The Digital light processing segment dominated the market and held the highest revenue market share in 2023. This segment growth is driven by the benefits of DLP technology, where micro mirrors are used to regulate the light and provide the image with color fidelity and brightness. These mirrors can also quickly switch on and off, which modulates the light at the input and generates sharp images.

The Holographic laser projection technology is likely to grow at the fastest CAGR. The metaverse provides bright and realistic pictures, and an interactive experience, having a list of applications across industries. Without a doubt, holographic projection makes the viewing experience more aesthetic by creating more unique visuals and enhancing your engagement. By allowing easy access to small projectors, this tech is invaluable for product demonstrations, speeches, or interactive marketing campaigns.

By Product

In 2023, the standalone segment dominated the market and accounted for significant revenue share. These projectors enable connections to laptops, smartphones, or tablets. DirecTV says that their more sophisticated pico projectors include Wi-Fi and Bluetooth for wireless streaming of content from devices like your smartphone and tablet, as well as from the cloud.

A USB segment is predicted to register the fastest CAGR during the forecast period. This segment is also growing in the market due to the ease of use as these projectors get power directly from the USB port of a device like a laptop, smartphone, or tablet device. This means they do not require an external power supply and can be used at any time and anywhere for presentations and entertainment. On the plus side, several USB pico projectors are intended to be compatible with reasonably common operating systems and computers by making use of a USB port.

By Compatibility

In 2023, the smartphones segment dominated the market and accounted for significant revenue share. With pico projectors, smartphone users can simply mirror their smartphone screens onto the pico projectors and then use them to make presentations, play videos, and share multimedia files directly from their mobile devices, enhancing the convenience and flexibility, where it will become an extension of smartphones for both professional and personal use.

The digital camera segment is expected to register the fastest CAGR during the forecast period. The compatibility with the digital camera enables a photographer and videographer to view images and videos on the larger screen right after taking the shot, without the use of a computer or some extra display equipment.

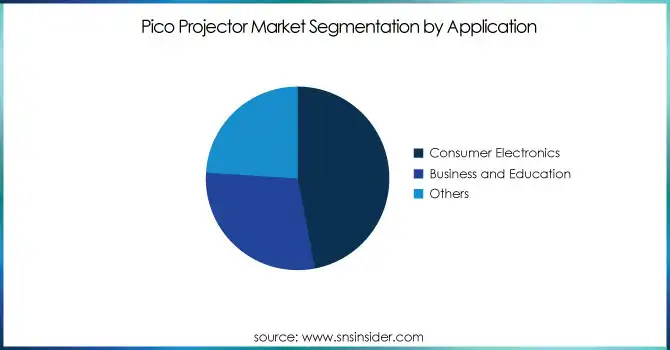

By Application

The consumer electronic segment dominated the market and accounted for 47% of revenue share in 2023. Growing demand for portable and versatile entertainment solutions keeps the consumer electronics segment up. Pico projectors are the perfect answer because they combine large-screen viewing on an ultra-small and easily manoeuvrable scale, with the ability to convert any environment into a theatre and enjoy movies, gaming and streaming from a mobile device.

The business & education segment is expected to grow with the fastest CAGR over the forecast period. With the work from home regime in place for most of us, the advance in onset of a culture that calls for field presentations and collaboration makes people want to take their work along with wider screens wherever they go, which in turn drives the demand for small and portable pico projectors. RPX is often used for projectors for presentations, training sessions, seminars, or conferences that allow flexibility in communication and interaction.

Pico Projector Market Regional Outlook

In 2023, the Asia Pacific segment dominated the market and accounted for 37% of revenue share. Asia Pacific pico projectors market is driven by the rising population, rapid advancement of technology, and growing consumer electronic industry in nations like China, Japan, South Korea, and India. Increasing portable and flexible display solutions for home entertainment, games, and mobile viewing is also contributing towards the growth of Pico projectors in the region.

The North America region is expected to record the fastest growth during the forecast period. Pico projectors enable users to project content for presentations, instruction, watching videos, or sharing media with others anywhere. It provides fully functional and convenience, which is fueling its adoption across several industries, such as education, healthcare, business, and entertainment in the North American region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Sony – MP-CD1 Mobile Projector

-

Samsung – The Freestyle Portable Projector

-

LG Electronics – LG CineBeam PF50KA

-

Anker Innovations – Nebula Capsule II

-

Optoma – Optoma ML750ST

-

Epson – Epson EF-100

-

AAXA Technologies – AAXA P7 Mini Projector

-

ViewSonic – ViewSonic M1+

-

BenQ – BenQ GS2

-

Philips – Philips PicoPix Max

-

Kodak – Kodak Luma 350

-

ZTE Corporation – ZTE Spro 2 Smart Projector

-

XGIMI – XGIMI MoGo Pro+

-

Vivitek – Vivitek Qumi Q8

-

PicoBit – PicoBit S Projector

Recent Developments

-

In September 2024, Anker's Nebula brand introduced two new projectors: the Capsule Air and the Cosmos 4K SE. The Capsule Air is a compact, lightweight projector with a 720p resolution and 150 ANSI lumens brightness, designed for portability and convenience. The Cosmos 4K SE offers a higher-end experience with 1,800 ANSI lumens and 4K UHD resolution, catering to home theater enthusiasts.

-

In October 2024, JMGO unveiled the Picoflix, a portable projector designed for easy transport and horizontal use. Priced at $599, the Picoflix features a 1080p LED light source with 450 ANSI lumens brightness, suitable for dark conditions. Its unique design includes an integrated rotating gimbal for easy aiming at screens or walls.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.8 Billion |

| Market Size by 2032 | USD 34.4 Billion |

| CAGR | CAGR of 21.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (USB, Embedded, Media Player, Stand-alone) • By Technology (Digital Light Processing, Liquid Crystal on Silicon, Laser Beam Steering, Holographic Laser Projection) • By Compatibility (Laptop/Desktop, Smartphones, Digital Cameras, Portable Media Players, Others) • By Application (Consumer Electronics, Business and Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sony, Samsung, LG Electronics, Anker Innovations, Optoma, Epson, AAXA Technologies, ViewSonic, BenQ, Philips, Kodak, ZTE Corporation, XGIMI, Vivitek, PicoBit. |