IoT Fixed Focus Lens Market Size & Growth:

The IoT Fixed Focus Lens Market size was valued at USD 367.99 Million in 2024 and is projected to reach USD 526.46 Million by 2032, growing at a CAGR of 4.58% during 2025-2032.

To Get more information On IoT Fixed Focus Lens Market - Request Free Sample Report

This growing demand for IoT fixed focus lens in smart products, monitoring products, and automatic control products business provide an opportunity for growth of IoT focus lens market. These lenses are crucial for supporting real-time monitoring and enable image capture in IoT devices including automotive driver assistance systems, along with smart cameras, and home security systems. Small footprint, low power consumption and cost effectiveness make for an excellent candidate in embedded systems. Small footprint, low power consumption and cost effectiveness make for an excellent candidate in embedded systems. The demand is being driven in part by the rise of smart cities and connected infrastructure. Major participants are making new investments to innovate with better lens performance, image quality, and integration with AI-based analytics to take the market’s northward trend forward.

MWC Shanghai 2024’s scale with approximately 40,000 attendees, 6,500 companies, and strong international participation highlights the global need to shift from showcasing 5G tech to monetizing it. The presence of 1,200 C-suite executives and 400 speakers showcases the industry’s strategic pivot, concentrating not only on innovation but on building viable business models across telecom infrastructure and IoT integration.

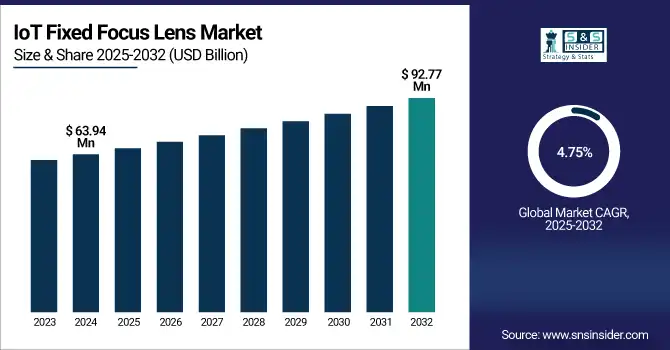

The U.S. IoT Fixed Focus Lens market size was valued at USD 63.94 Million in 2024 and is projected to reach USD 92.77 Million by 2032, growing at a CAGR of 4.75%. This growth is propelled by the increased application of smart devices with IOT-based automation and the surging requirement for compact, low power, and cost-efficient lenses in areas, such as smart cameras, automotive systems and medical imaging devices.

IoT Fixed Focus Lens Market Dynamics:

Drivers:

-

Impact of Advanced IoT Applications on the Demand for High-Performance Fixed-Focus Lenses Drive Market Expansion

The increasing use of IoT cameras, drones, smart speakers and fixed-point cameras will continue driving demand for high-performance, low power-consumption lenses. Integrating the latest technologies such as multi-GNSS positioning and high-resolution audio codecs into IoT systems further expands the functionalities of devices in many industries, such as security, automotive and healthcare. Since these technologies heavily depend on high quality, trustworthy images for real-time monitoring and object identification, the development of advanced lenses to satisfy the increasing performance and energy consumption constraints is of fundamental importance. This movement is driving the IoT fixed focus lens market trends, in which innovation is adapting to higher clarity of image quality and functions for various applications.

Sony's SPRESENSE™ IoT board computer delivers high-precision positioning, multi-GNSS support, and high-resolution audio capability in a compact format for low-power applications, including UAV, smart speakers, and industrial cameras. It delivers significant computing performance with six ARM® Cortex®-M4F processors, yet still is extremely energy efficient, bringing IoT device performance to a new level.

Restraints:

-

Trade-Off Between Cost and Performance Limits Widespread Adoption of IoT Fixed-Focus Lenses

In the IoT fixed focus lens market, achieving a balance between high performance and cost is a critical barrier. Although sharpness is key in applications including security, health care and automotive, the need for competitive pricing never goes away and a high-quality lens at the ‘right' price can ultimately make the difference. Manufacturers have to figure out how to adopt sophisticated lens designs without significantly increasing the manufacturing cost (which is not easy, considering how precise and good the lenses are). For this reason, a compromise between high contrast, bright lenses, and relative inexpensiveness is often made. It is this challenge that can restrict the mass availability of high-end solutions particularly on industries where budget is tight and volume production orders to manufacturers, thus stalling innovation in some areas of the market.

Opportunities:

-

Rising Demand for High-Quality IoT Devices Drives Market Opportunities for Fixed Lenses

The increasing deployments of IoT applications in security, automotive, and healthcare, among others have amplified the need for high quality IoT fixed-focus lens market growth. With IoT devices becoming increasingly important in these industries, the demand for the high-quality and cost-effective lenses needed to produce clear and dependable images is also increasing. For security systems, for instance, cameras used in such systems must have a better image quality of day and night. High-resolution lenses are required in the car industry, with applications including advanced driver-assistance systems (ADAS) and autonomous driving. Just as with corporations and government agencies, healthcare instruments require high definition imaging to provide accurate diagnostic data. These increasing needs generate substantial revenue opportunities for IoT-centered fixed lenses, having potential for differentiation and growth across these high-growth markets.

Foctek has developed a groundbreaking three-sensor short-wave infrared camera system, using prism light splitting, to address issues in spectral imaging for industrial sorting applications. This innovation ensures parallax-free images, enhancing object analysis in various industries.

Challenges:

-

Challenges in Ensuring Long-Term Reliability for IoT Fixed Focus Lenses Across Healthcare and Automotive Sectors

Long-term stability is a big challenge for IoT fixed-focus lenses, especially in areas, such as healthcare and automotive, which require stable performance. Such lenses must continue to maximize image quality and durability in use over time, including under use in rough conditions. In medicine and healthcare, whether this is accurate imaging in the case of medical devices, or in automotive, when driver assistance systems are a feature. It is critical that these lenses operate thought their service life. Optical properties of the lens may be influenced by environmental conditions, such as temperature changes, moisture conditions, and/or mechanical wear. The focus is on manufacturers to produce lenses that can hold their own under these conditions without letting image quality and sensor precision be compromised, resulting in effective operation for IoT devices in all types of applications and industries.

IoT Fixed Focus Lens Market Segmentation Analysis:

By Type

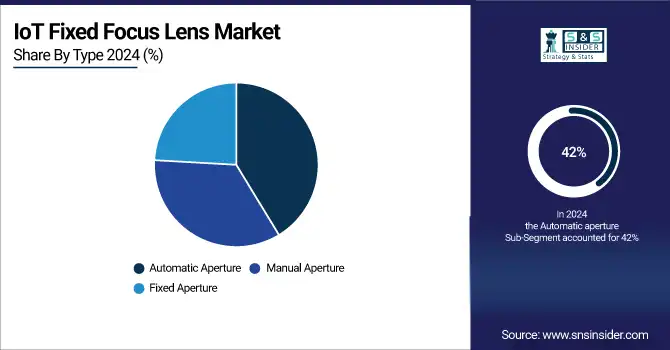

Automatic aperture segment held a dominant IoT fixed focus lens market share of around 42% in 2024 and is projected to experience fastest growth in the market during 2025-2032, at a CAGR of 7.69%. Rising need for a better image quality in different lighting conditions is a key factor driving the automatic aperture segment in the IoT fixed-focus lens market. Iris aperture lenses, with automatic aperture capabilities, allows for superior control of light to enhance clarity and precision in the image, for IoT devices in markets such as automotive, healthcare and security. The need for automated and adaptive forms of lenses having a better performance is increasing with the rapidly-proliferated IoT devices, further boosting the growth of the segment.

By Application

The Security Monitoring held a dominant IoT fixed focus lens market share of around 35% in 2024. This dominance is attributed to the growing requirement for real-time surveillance, increasing urban crime, and the rising penetration of smart surveillance systems in both, public and private sectors that require high quality and cost-effective imaging solutions with least complexity for focusing.

The Smart Transportation segment is expected to experience the fastest growth in the IoT fixed focus lens market over 2025-2032 with a CAGR of 7.39%. This growth is being driven by growing investments in smart city infrastructure, the need for advanced driver assistance systems (ADAS), and the deployment of IoT-based cameras in traffic management, vehicle recognition, and autonomous mobility systems that need reliable and resilient imaging systems.

IoT Fixed Focus Lens Market Regional Outlook:

In 2024, the Asia Pacific dominated the IoT fixed focus lens market and accounted for 44% of revenue share. This leadership is boosted by the extremely quick pace of industrialization and burgeoning urban surveillance networks in place, robust demand for smart home devices, and substantial investments in smart city infrastructure. The zone also has an established manufacturing base and a sizeable consumer electronics market.

Get Customized Report as per Your Business Requirement - Enquiry Now

In Asia Pacific region, China dominated IoT fixed focus lens market, owing toward the strong manufacturing capabilities and early adoption of IoT.

North America is projected to register the fastest CAGR of 5.77%during 2025-2032, North America is expected have high penetration of smart home technologies North America has greater number of the biggest IoT players followed by increasing investments for advanced surveillance systems and major regulatory players. Smart infrastructure and security system upgrades supported by various government programs drive the market growth in the region.

The U.S. holds the largest share in the IoT fixed focus lens market due to high adoption of smart devices, high technological infrastructure, and high security demand.

In 2024, Europe emerged as a promising region in the IoT fixed focus lens market, this growth is driven by increasing investments in smart city projects, rising demand for energy-efficient surveillance systems, and strong regulatory support for data security. Additionally, the region's focus on industrial automation and sustainable technologies boosts market adoption.

LATAM and MEA is experiencing steady growth in the IoT fixed focus lens market, as the rates of urbanization have been rapid and the need for cost-efficient security products has been increasing in the region along with the adoption of IoT-based technologies in both smart homes and city infrastructure. Moreover, initiatives by the government toward digitalization and public safety are contributing to the regional market growth.

Key Players Listed in the IoT Fixed Focus Lens Market are:

The IoT fixed focus lens market companies are Shenzhen Sinoseen Technology Co., Ltd., Largan Precision Co., Ltd., Asia Optical Co., Inc., Chicony Electronics Co., Ltd., Mantis Vision Ltd., Samsung Electro-Mechanics Co., Ltd., OMRON Corporation, Sony Corporation, Canon Inc., FOCtek Photonics Inc.. and Others.

Recent Developments:

-

In October 2024, Samsung Electro-Mechanics has developed a 200MP ultra-close-up camera module with a 12cm distance and 14.8x optical zoom. This innovation features a Super Macro lens, enhancing macro photography with improved focus and compact design for smartphones and automotive applications.

-

In March 2024, Sinoseen, a leading Chinese camera module manufacturer, has launched advanced products like the 5MP MIPI Camera Module and Night Vision USB Camera Module. These innovations support IoT, smart homes, and vehicle technology, enhancing imaging solutions in the IoT fixed focus lens market.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 367.99 Million |

| Market Size by 2032 | USD 526.46 Million |

| CAGR | CAGR of 4.58% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Fixed Aperture, Manual Aperture and Automatic Aperture) • By Application(Security Monitoring, Smart Home, Smart Transportation, Industrial Automation and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The IoT fixed focus lens market companies are Shenzhen Sinoseen Technology Co., Ltd., Largan Precision Co., Ltd., Asia Optical Co., Inc., Chicony Electronics Co., Ltd., Mantis Vision Ltd., Samsung Electro-Mechanics Co., Ltd., OMRON Corporation, Sony Corporation, Canon Inc., FOCtek Photonics Inc.. and Others. |