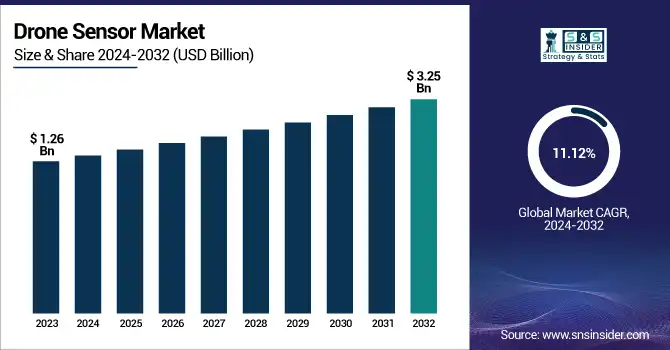

Drone Sensor Market Size & Growth Trends:

The Drone Sensor Market Size was valued at USD 1.26 Billion in 2023 and is expected to reach USD 3.25 Billion by 2032 and grow at a CAGR of 11.12% over the forecast period 2024-2032. Growing fleet operability, increased sensor integration, enhanced user experience, and AI-driven autonomy are revolutionizing the Drone Sensor Market. Different types of modern drones possess lots of high-precision sensors for obstacle detection, navigation, and data acquisition. Improved sensor fusion ensures performance in a wider range of environments, improving robustness.

Market adoption is being influenced by user experience metrics including ease of control, sensor accuracy, and durability. At the same time, AI-powered autonomous functions, such as real-time decision-making and predictive maintenance, are also changing drone processes. Temperature control presents new sensor innovation The growth of smart UAV deployment in defense, logistics, agriculture, and beyond is leading innovation in sensor technology for applications such as smart agriculture, precision airdrop, and combat reconnaissance.

To Get more information on Drone Sensor Market - Request Free Sample Report

Drone Sensor Market Dynamics

Key Drivers:

-

The Drone Sensor Market Soars with AI, Smart Sensors, and Expanding UAV Applications in Defense and Industry

The drone sensor market is booming due to the advancement of autonomous technology, the growing adoption of drones in defense, and the increasing deployment of commercial drones. UAVs (Unmanned Aerial Vehicles) are extensively used by military and defense organizations for surveillance, reconnaissance, and combat missions which bolsters the need for high-performance sensors including inertial, image, and position sensors. Moreover, owing to the rapid growth of UAV applications in end-use industries, such as agriculture, logistics, and infrastructure inspection, there is an increase in the demand for smart sensors that help improve navigation in the air, ground, or sea, data acquisition, and motion detection. Additionally, the rising need for real-time data collection, and analysis supported by Artificial intelligence (AI), high-resolution imaging, etc. is also pushing the market growth.

Restrain:

-

Regulatory Hurdles High Costs and Battery Limits Challenge Drone Sensor Adoption in Urban and Commercial Use

Stringent government regulations and airspace restrictions are some of the key restraining factors that are hampering the adoption of drones, particularly in urban and restricted airspace environments. Another regulatory challenge for drone-based applications is privacy concerns associated with high-resolution imaging and surveillance drones. Moreover, costly manufacturing and operational costs of advanced sensors LI-DAR, and Hyperspectral imaging sensors, especially come up with affordability problems for small-scale commercial, and consumer drone end-users The battery limits and high power consumption still pose significant problems since sensor-heavy operations drain more drone batteries and affect flight time.

Opportunity:

-

Consumer Drones AI Sensor Fusion and Smart Regulations Unlock New Growth Opportunities in Drone Sensors

In the avenue, the main opportunity is found in the consumer drone market, which is starting to gain traction in the arena with decreasing prices and more user-friendly designs. Recent advances in artificial intelligence (AI), edge computing, and sensor fusion are opening the door to new types of more efficient, autonomous, and multifunctional drone use cases. LiDAR, hyperspectral imaging, and thermal are bringing in new market opportunities with applications in environmental monitoring, and disaster management. Moreover, the progressive regulatory framework supporting commercial and smart city implementations for drones is likely to offer sustainable growth opportunities for the sensor players over the forecast period.

Challenges:

-

Sensor Reliability Cybersecurity and Standardization Challenges Threaten Drone Performance and Widespread Adoption

The other big challenge is related to the erratic behavior of sensors, which can also be hacked in the case of autonomous drones. Problems, like drifting of sensors, incorrect positioning, and lack of environmental adaptability, will not only degrade the performance of drones, especially in defense applications like military tracking or EM rescue but will also lead to their non-viability. Furthermore, the absence of standard communication protocols and interoperability across sensor manufacturers hinders integration and scalability. Strong climates such as excessive temperatures and excessive precipitation can cause drone sensors to malfunction. These challenges will be overcome through ongoing R&D investments, stronger cybersecurity, and regulatory reform that enables the widespread use of drones.

Drone Sensor Market Segment Analysis

By Type of Sensor

The segment of image sensors was the leader, having a share of 30.6% of the total market in 2023. Aerial photography, surveillance, mapping, and precision agriculture are some of the key areas where image sensors are extensively used, resulting in high adoption of image sensors. Commercial, military, and industrial organizations have begun using drones with high resolution and multispectral imaging to the maximum capacities.

The inertial sensors segment is projected to register the highest CAGR over the forecast period (2024-2032), due to the increasing need for enhanced navigation, stability, and motion-tracking autonomous drones. These sensors improve the accuracy of the flight making them vital for defense, logistics, and industrial UAVs.

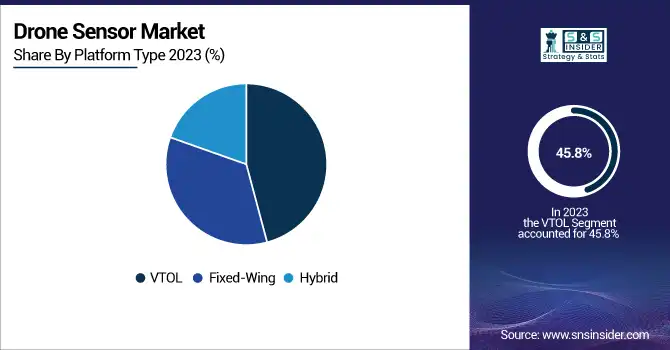

By Platform Type

In 2023, VTOL will contribute to the largest share of the total drone sensor market, at 45.8%. This class of drones which is short for vertical take-off and landing is common in the defense, commercial, and industrial space as they can carry out surveillance, delivery, and inspection tasks and still take off and land in locations that do not have runways. It is the unique simplicity with which they work and the work they do that has always kept the demand for such machines in the market.

The hybrid drone segment is expected to witness the fastest CAGR during 2024 to 2032, owing to the rise of applications for long-endurance missions and multi-functional operations. Hybrid drones, as the name suggests, come with the advantages of both VTOL and fixed-wing designs, having long flight ranges and less efficiency due to the transformation.

By Technology

In 2023, the remotely operated segment accounted for 73.8% of the total drone sensor market share. Often, these drones find their usage in military, commercial, and industrial applications because of their reliability, human control capability, and regulatory compliance. Their dominant market position stems from their significant involvement in surveillance, inspection, and delivery services.

The fully autonomous is anticipated to expand the fastest CAGR during the forecast period (2024 - 2032) owing to the rapid advancements in artificial intelligence and machine learning capabilities, as well as better sensor fusion technologies. Logistics, Defense, Smart Applications Examples The autonomous drone features better efficiency, lowering operational costs, and the possibility of real-time decision-making.

By Application

Navigations held the largest revenue share of 37.7% in 2023. Navigation sensors are one of the important sensors for drones such as GPS, IMUs, and altimeters which help to keep the drone stable, and well-positioned and also plan the routes. The tremendous demand in the market can be justified by their wide applications in military, commercial & industrial sectors.

The segment of data acquisition is estimated to register the highest CAGR between 2024 & 2032, owing to elevating requirements for on-the-go data collection, mapping, & remote sensing. Multiple sectors are adopting sophisticated imaging, LiDAR, and thermal sensors to improve efficiency and decision-making, for example, agriculture, construction, and environmental monitoring.

By End Use

The drone sensor market share in the military segment was 41.9% in 2023. This rise in drone adoption in defense is fueled due to their importance in surveillance, reconnaissance, border security, and combat operations. Militaries around the world are pouring money into high-tech drones with next-gen sensors to help them be smarter and more capable in the air with fewer warm bodies.

The consumer segment is estimated to register the most lucrative CAGR from 2024-2032, due to increased consumer interest towards recreational drones, aerial photography, and FPV racing. This is the result of advancements in affordability, AI-driven automation, and compact designs enabling lower-cost drones to enter the hands of hobbyists and tech enthusiasts.

Drone Sensor Market Regional Overview

North America held the largest share of the drone sensor market at 37.7% of the total market in 2023. In the region, leadership is propelled by large defense budgets, technology, and commercial uptake. Drones are heavily utilized by the U.S. military for surveillance, reconnaissance, and combat operations, leading to increased utilization of sophisticated sensors. Furthermore, firms like Amazon and UPS are also testing drone delivery systems, providing additional impetus for new sensor developments in ultra-compact and lightweight navigation, imaging, and data acquisition sensors. On the other side, the Federal Aviation Administration (FAA) is also a key player in the development of drone regulations that will allow commercial drone usage over a wider range of applications from agriculture, to infrastructure inspection, and public safety.

Asia-Pacific is expected to register the largest CAGR between 2024 and 2032, owing to the growing investments in drone technology and increasing defense budgets and commercial applications in the developing nations of the region China is one of the leading manufacturers of drones in the world, with the widely known world leader in consumer and commercial drones, DJI. At the same time, the drone ecosystem in India is taking off, and governments are encouraging drone usage in agriculture, logistics, and infrastructure monitoring. The demand for advanced sensors is propelled further by drone providers in Japan and South Korea for smart metropolis initiatives, catastrophe management, and industrial automation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Drone Sensor Market are:

-

DJI (Mavic 3)

-

AeroVironment (Switchblade)

-

Skydio (Skydio 2)

-

Parrot SA (Anafi USA)

-

Yuneec International (Typhoon H)

-

Intel Corporation (Falcon 8+)

-

Draganfly (Commander 3XL)

-

Insitu (ScanEagle)

-

Delair (Delair UX11)

-

Hubsan (Zino Mini Pro)

-

TE Connectivity (Pressure Sensors)

-

InvenSense (ICU-10201 Ultrasonic Sensor)

-

Bosch Sensortec GmbH (BMA580 Accelerometer)

-

Teledyne FLIR LLC (R80D SkyRaider)

-

Trimble Inc. (GNSS Receivers)

Recent Trends

-

In January 2025, DJI unveiled the DJI Flip, a lightweight, foldable drone with a 48MP camera, 4K/60fps recording, and AI tracking, designed for vloggers and content creators.

-

In February 2025, AeroVironment introduced the JUMP 20-X, a modular VTOL drone with AI-powered autonomy, 13-hour endurance, and enhanced maritime capabilities, at IDEX 2025, aiming to expand global partnerships.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.26 Billion |

| Market Size by 2032 | USD 3.25 Billion |

| CAGR | CAGR of 11.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Inertial Sensor, Image Sensor, Position Sensor, Current Sensor, Others) • By Platform Type (VTOL, Fixed-Wing, Hybrid) • By Technology (Remotely Operated, Semi-autonomous, Fully Autonomous) • By Application (Navigation, Data Acquisition, Motion Detection, Air Pressure Measurement, Others) • By End Use (Consumer, Commercial, Military, Government & Law Enforcement) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DJI, AeroVironment, Skydio, Parrot SA, Yuneec International, Intel Corporation, Draganfly, Insitu, Delair, Hubsan, TE Connectivity, InvenSense, Bosch Sensortec GmbH, Teledyne FLIR LLC, Trimble Inc. |