MicroLED Display Market Size & Trends:

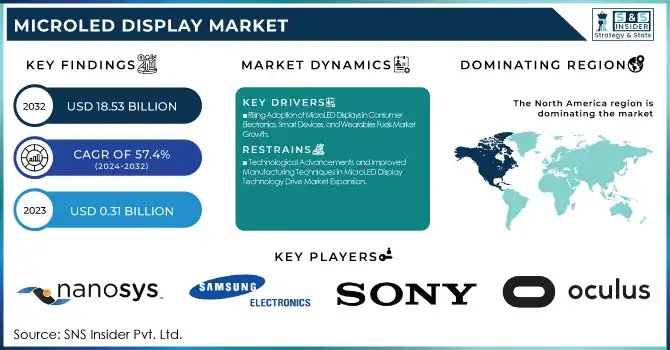

The MicroLED Display Market Size was valued at USD 0.31 Billion in 2023 and is expected to reach USD 18.53 Billion by 2032 and grow at a CAGR of 57.4% over the forecast period 2024-2032.

To get more information on MicroLED Display Market - Request Free Sample Report

The MicroLED Display Market is witnessing rapid growth and transformation, driven by advancements in display technology and a rising demand for high-performance visual experiences. MicroLED technology, which utilizes microscopic LEDs to create individual pixels, offers numerous benefits over traditional display technologies like OLED and LCD. These benefits include superior brightness, higher contrast ratios, energy efficiency, longer lifespan, and the ability to create seamless, large-format displays. As the technology matures and its adoption expands across various industries, the MicroLED display market is set to experience significant growth in the coming years.

MicroLED technology offers superior brightness, contrast, energy efficiency, and longer lifespan compared to traditional display technologies like OLED and LCD. This has led to its adoption in consumer electronics, automotive displays, digital signage, and AR/VR applications. For instance, the U.S. Department of Energy's report on Solid-State Lighting R&D Opportunities highlights the energy savings and performance benefits of LED technologies, which are foundational to MicroLED displays.

Additionally, the Energy Savings Estimates of Light Emitting Diodes in General Illumination Applications report underscores the growing market share of LED technologies in various applications, indicating a positive trend for MicroLED adoption. These developments suggest a robust trajectory for the MicroLED display market, with continued innovation and expanding applications across multiple industries.

MicroLED Display Market Dynamics

Key Drivers:

-

Rising Adoption of MicroLED Displays in Consumer Electronics, Smart Devices, and Wearables Fuels Market Growth

The growing demand for high-performance displays in consumer electronics is a key driver of the MicroLED display market. MicroLED technology offers superior picture quality, high brightness, energy efficiency, and long lifespan, making it highly attractive for devices such as televisions, smartphones, and smartwatches. Major electronics brands like Samsung and Apple are increasingly integrating MicroLED displays into their premium product lines, encouraging consumers to upgrade to devices featuring cutting-edge technology.

For instance, Samsung’s The Wall series of modular MicroLED displays for televisions and digital signage solutions has been a key breakthrough in the market, while Apple’s move toward MicroLED for future wearables promises further growth.

The MicroLED’s ability to deliver vibrant, sharp images without the drawbacks of OLED, such as burn-in, is appealing to both manufacturers and consumers. Additionally, MicroLED’s energy efficiency allows for longer device battery life, making it highly desirable for smart devices and wearables, where power consumption is a critical factor. As the demand for high-quality, energy-efficient, and durable displays continues to rise in the consumer electronics sector, the MicroLED display market is poised for robust growth.

-

Technological Advancements and Improved Manufacturing Techniques in MicroLED Display Technology Drive Market Expansion

Technological advancements in MicroLED display technology are significantly contributing to the market’s growth. Innovations such as increased pixel density, wider color gamuts, better contrast ratios, and improved energy efficiency have enhanced the performance of MicroLED displays. For example, recent improvements in Micro LED chip development, including smaller pixel sizes and optimized materials, have enabled the production of displays with higher brightness and more vibrant colors. Furthermore, advancements in MicroLED manufacturing techniques, particularly in mass production, have reduced the cost of these displays, making them more accessible to a wider range of industries. Additionally, MicroLED’s scalability, allowing seamless tiling of small modules to create larger displays, is opening up new opportunities in digital signage and entertainment. This technology is also being explored for applications in augmented reality (AR) and virtual reality (VR), where high-resolution displays are crucial for immersive experiences. Companies are continuously investing in R&D to overcome challenges related to manufacturing efficiency and cost reduction, thus driving the mass adoption of MicroLED technology. These technological innovations are set to significantly propel the MicroLED display market, providing new growth opportunities across multiple sectors, including consumer electronics, automotive, and healthcare.

Restrain:

-

High Production Costs and Challenges in Mass Manufacturing Limit Widespread Adoption of MicroLED Technology

Despite the numerous advantages of MicroLED technology, its high production costs remain a significant restraint in the widespread adoption of these displays. Unlike traditional OLED or LCDs, MicroLED displays require intricate manufacturing processes, including the precise placement of thousands of tiny MicroLED chips, which can be both time-consuming and expensive. The technology's complex manufacturing techniques, such as the transfer of micro LEDs onto substrates and the creation of seamless modules for larger displays, add to the overall cost. This makes MicroLED displays significantly more expensive than alternatives, limiting their accessibility to only high-end products or premium markets. As a result, many companies may hesitate to adopt MicroLED displays for mass-market devices like smartphones, televisions, or wearables, where price sensitivity is a major factor. Although the market is gradually seeing improvements in manufacturing efficiency, the high production costs remain a barrier to achieving economies of scale that would make MicroLED technology more affordable and accessible. Until these production challenges are addressed and the cost per unit decreases, the adoption of MicroLED displays will continue to be restricted to premium product segments.

MicroLED Display Market Segmentation Overview

By Panel Size

The Micro-Display segment of the MicroLED display market continues to dominate, holding the largest revenue share of 43% in 2023. Micro-displays are typically small panels used in various applications, such as wearable devices, virtual reality (VR), augmented reality (AR), and head-up displays (HUDs), owing to their ability to deliver high-resolution visuals in compact form factors.

Sony’s introduction of MicroLED displays in its PlayStation VR2 and plans for future MicroLED-based VR headsets are key examples of innovations driving growth in the micro-display sector. Additionally, companies like Plessey are developing MicroLED solutions for AR applications, aiming to bring enhanced visual experiences to wearable tech.

The small and medium-sized panels segment is poised for the highest CAGR in the forecasted period, driven by growing demand across multiple industries such as automotive displays, consumer electronics, and digital signage. MicroLED displays in these panel sizes offer excellent resolution, color accuracy, and brightness levels, which are vital for applications like digital signage, interactive kiosks, and premium televisions.

Additionally, AUO Corporation has been focusing on medium-sized MicroLED panels for automotive applications, such as in-car infotainment systems, where display clarity and flexibility are crucial. These innovations in small and medium-sized panels are in line with growing market demands for high-quality, energy-efficient displays in compact formats.

By Application

The Smartphones & Tablets segment leads the MicroLED display market with a dominant revenue share of 30% in 2023. MicroLED technology is gaining significant traction in mobile devices due to its superior characteristics, including vibrant colors, high contrast ratios, energy efficiency, and longevity. These attributes are crucial for smartphones and tablets, where power efficiency and display quality are paramount.

Samsung Electronics, a leader in the display market, has also made strides with its MicroLED-based Galaxy smartphones, showcasing the potential of the technology in mobile applications.

The television-sized panels segment is forecasted to experience the largest CAGR during the forecasted period, driven by the growing demand for ultra-high-definition (UHD) and large-format displays in the home entertainment sector. MicroLED technology is particularly suitable for large displays, providing exceptional image quality, high resolution, and the ability to be scaled seamlessly to any size.

Additionally, companies like LG Electronics are expected to expand their MicroLED offerings for large-scale TVs as the demand for ultra-premium home entertainment products grows. The television-sized panels segment benefits from MicroLED’s ability to achieve superior brightness and color accuracy, along with its longer lifespan and energy efficiency compared to traditional OLED and LCD technologies.

MicroLED Display Market Regional Analysis

In 2023, North America dominated the MicroLED display market, accounting for an estimated market share of around 40%. The dominance of North America can be attributed to the strong presence of key industry players such as Apple, Microsoft, Samsung, and Sony, as well as the rapid adoption of advanced display technologies in various sectors, including consumer electronics, automotive, and entertainment.

Furthermore, North America is home to various cutting-edge applications of MicroLED displays, particularly in the automotive industry, where major manufacturers are adopting MicroLED for in-car displays and infotainment systems. The region’s established tech infrastructure, along with robust R&D activities, further drives the growth of the MicroLED display market.

The Asia Pacific region is the fastest-growing market for MicroLED displays, with an estimated CAGR of 35% during the forecast period. This growth is driven by the increasing adoption of MicroLED technology in consumer electronics, including smartphones, televisions, and digital signage, especially in countries like China, Japan, and South Korea.

For instance, Samsung’s The Wall and LG’s MicroLED-based TVs have captured significant attention in the premium display market. Additionally, China’s rapid technological advancements and strong government support for innovation have enabled local companies to boost production and reduce costs, making MicroLED technology more accessible.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the MicroLED Display Market are:

-

Apple (US) - (MicroLED Displays)

-

Oculus VR (US) - (VR Headsets)

-

Sony (Japan) - (Crystal LED Display System)

-

Samsung Electronics (South Korea) - (MicroLED TVs)

-

X-Celeprint (Ireland) - (MicroLED Manufacturing Solutions)

-

Nanosys (US) - (Quantum Dot Enhancement Film)

-

Jade Bird Display (China) - (MicroLED Displays)

-

Aledia (European Union) - (MicroLED Solutions)

-

Mikro Mesa (US) - (MicroLED Components)

-

Verlase Technologies (US) - (MicroLED Solutions)

-

Allos Semiconductors (Germany) - (MicroLED Chips)

List of suppliers that provide raw materials and components for the Microled Display Market:

-

Corning Inc.

-

3M

-

Avery Dennison

-

Nanosys

-

Samsung Materials

-

Taiwan Semiconductor Manufacturing Company (TSMC)

-

Mitsubishi Chemical Corporation

-

Cree, Inc.

-

Kopin Corporation

-

Plessey Semiconductors

Recent Trends

-

In September 2023, Sony introduced VERONA, an advanced Crystal LED display designed specifically for virtual production needs, offering filmmakers enhanced quality and improved efficiency for in-camera VFX applications.

-

In January 2024, Innolux Corp introduced the world’s first 53-inch QD color conversion AM-Micro LED seamless tiling displays. These displays feature a seamless tiling module technology, allowing for the assembly of displays in any size. This breakthrough innovation meets the growing market demand for high-quality, ultra-wide, and ultra-tall displays, ranging from 110 to 200 inches.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.31 Billion |

| Market Size by 2032 | USD 18.53 Billion |

| CAGR | CAGR of 57.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Panel Size (Micro-Display, Small & Medium Sized Panels, Large Panels) • By Application (Smartwatches, NTE Devices, Televisions, Heads-Up Display, Smartphones & Tablets, Monitors & Laptops, Digital Signage) • By Vertical (Consumer Electronics, Entertainment & Advertisement, Automotive, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oculus VR, Sony, Samsung Electronics, X-Celeprint, Nanosys, Aledia, Mikro Mesa, Verlase Technologies, Allos Semiconductors, AET Displays Limited, AUO Corporation, JBD – Jade Bird Display, LG Electronics, Micledi, Plessey, PRP Optoelectronics Ltd., Tianma Microelectronics Co., Ltd., Innolux Corp |

| Key Drivers | • Rising Adoption of MicroLED Displays in Consumer Electronics, Smart Devices, and Wearables Fuels Market Growth. • Technological Advancements and Improved Manufacturing Techniques in MicroLED Display Technology Drive Market Expansion. |

| Restraints | • High Production Costs and Challenges in Mass Manufacturing Limit Widespread Adoption of MicroLED Technology. |