Distributed Control Systems Market Size:

Get More Information on Distributed Control Systems Market - Request Sample Report

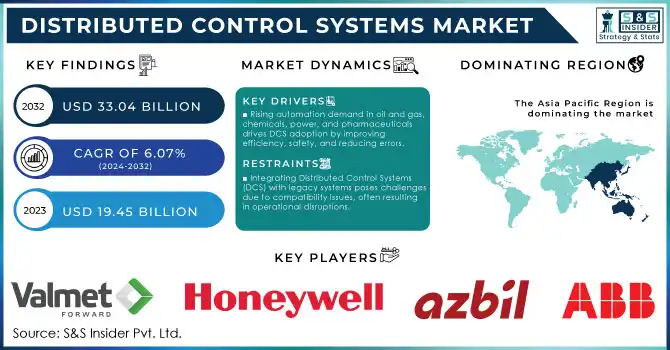

The Distributed Control Systems Market size was valued at USD 19.45 Billion in 2023. It is expected to grow to USD 33.04 Billion by 2032 and grow at a CAGR of 6.07% over the forecast period of 2024-2032.

The integration of Distributed Control Systems (DCS) has significantly transformed process management across various industries. This system utilizes multiple controllers to oversee and coordinate different sections of a facility, fostering a decentralized approach that enhances flexibility, reliability, and efficiency. The architecture of a DCS typically includes human-machine interfaces (HMIs), controllers, sensors, and robust communication networks, which collaboratively ensure optimal industrial performance. A key benefit of DCS is its capability to deliver real-time data, which is crucial for informed decision-making. This immediate access to information enhances operational transparency and enables rapid responses to anomalies, effectively minimizing downtime. Furthermore, contemporary DCS solutions harness advanced technologies like artificial intelligence (AI) and machine learning, which aid in predictive maintenance and overall operational optimization. By integrating analytics, companies can extract deeper insights into their processes, ultimately improving productivity and reducing operational costs.

| Types of Distributed Control Systems | Description | Commercial Products |

| Process Control DCS | Systems designed to monitor and control industrial processes, optimizing production efficiency and safety. | Honeywell, Siemens, Emerson |

| Batch Control DCS | Systems that manage batch processes by controlling sequences of operations and ensuring quality. | ABB, Rockwell Automation |

| Safety Instrumented Systems (SIS) | Systems that provide safety functions, including emergency shutdowns, to prevent hazardous events. | Schneider Electric, Yokogawa |

| Integrated Control Systems | Systems that combine various control functions into a single interface for streamlined operations. | Siemens, GE Digital |

| Remote Monitoring and Control Systems | DCS solutions that allow for the remote management of operations and monitoring of system performance. | Mitsubishi Electric, Honeywell |

| Advanced Process Control (APC) | Systems that use algorithms and modeling to improve process efficiency and product quality. | AspenTech, Siemens |

| Fieldbus-based DCS | DCS utilizing fieldbus technology for improved communication between control systems and field devices. | Yokogawa, Emerson |

| Virtualized DCS | Systems that operate in a virtualized environment for enhanced flexibility, scalability, and reduced hardware costs. | Schneider Electric, ABB |

The industry is also witnessing a trend towards more user-friendly interfaces and the integration of Internet of Things (IoT) technologies, which enhance connectivity and facilitate better data sharing across systems. The growing push for automation in sectors such as oil and gas, chemicals, and manufacturing is driving the demand for sophisticated DCS solutions that can adapt to changing operational needs. The companies that implement these systems often report operational cost reductions of up to 20% due to improved energy management and resource allocation. Furthermore, organizations experience a notable increase in system reliability, with unplanned outages decreasing by around 30%. Additionally, the enhanced monitoring capabilities of DCS can lead to a 15% reduction in maintenance costs through better scheduling and resource management. As industries continue to embrace digital transformation, the adoption of DCS is set to expand, playing a crucial role in the future of process control and automation.

MARKET DYNAMICS

DRIVERS

-

The rising demand for automation in sectors like oil and gas, chemicals, power generation, and pharmaceuticals boosts DCS adoption by enhancing operational efficiency, minimizing human error, and improving safety.

The increasing demand for automation across various sectors, particularly oil and gas, chemicals, power generation, and pharmaceuticals, significantly drives the adoption of Distributed Control Systems (DCS). These systems are vital for enhancing operational efficiency, as they streamline processes, minimize downtime, and optimize resource utilization. In the oil and gas sector, DCS facilitates real-time monitoring and control of complex operations, leading to quicker decision-making and improved production rates. This capability is essential in high-risk environments, where safety is paramount; automated systems can detect anomalies and potential hazards, thereby reducing human error and enhancing overall safety standards. In chemical manufacturing, the implementation of DCS can improve process efficiency by as much as 30%, ensuring consistent product quality and reducing waste. Similarly, in power generation, DCS plays a crucial role in managing energy distribution and grid control, enhancing reliability and reducing outages by 20-30%. This is particularly important as renewable energy sources are expected to represent nearly 50% of the power generation mix by 2032. The pharmaceutical industry also benefits from DCS by ensuring compliance with stringent regulatory standards; studies indicate that automated control systems can reduce compliance issues by up to 50%. As industries increasingly recognize the value of automation for achieving operational excellence and safety, the demand for DCS continues to rise, positioning these systems as critical components in navigating the challenges of a rapidly evolving market landscape.

-

The rising need for process optimization drives industries to adopt Distributed Control Systems (DCS), which facilitate real-time monitoring and control, ultimately reducing costs and enhancing productivity.

The rising need for process optimization is a significant driver in various industries as companies seek to enhance efficiency and minimize operational costs. Distributed Control Systems (DCS) play a crucial role in this pursuit by offering real-time monitoring and control capabilities. By leveraging DCS, organizations can streamline their operations, leading to improved productivity and reduced waste. According to research, organizations that implement DCS solutions can achieve up to a 30% reduction in operational costs. Moreover, real-time data analytics provided by DCS allow businesses to identify bottlenecks and inefficiencies, facilitating timely decision-making and proactive problem-solving. As industries continue to adopt advanced technologies, the integration of DCS becomes increasingly vital in maintaining a competitive edge. Furthermore, DCS enhances process reliability and safety, mitigating the risks associated with human error and equipment failure. In the chemical industry, DCS can automate hazardous processes, ensuring safer operations while maintaining compliance with stringent regulations. This shift toward process optimization not only benefits individual companies but also contributes to broader economic efficiency and sustainability goals. As organizations increasingly recognize the value of optimizing their processes, the demand for DCS solutions is expected to grow, making them essential tools in the quest for operational excellence.

RESTRAIN

-

Integrating Distributed Control Systems (DCS) with legacy systems poses challenges due to compatibility issues, often resulting in operational disruptions.

Integrating Distributed Control Systems (DCS) with existing systems and technologies presents significant challenges for organizations. One major concern is ensuring compatibility with legacy systems, which can be outdated and lack the necessary interfaces to connect seamlessly with modern DCS solutions. This complexity often leads to operational disruptions, as the integration process may require extensive modifications to existing infrastructure. For example, nearly 50% of industrial organizations report facing integration issues when adopting new technologies, with about 30% indicating that these challenges resulted in project delays or increased costs. Additionally, the diverse nature of control systems across different industries can complicate integration efforts, as varying standards and protocols can hinder smooth communication. The complexity is further amplified by the need for real-time data exchange and system interoperability, which are critical for effective process management. Organizations may also struggle to align their IT and operational technology (OT) teams, leading to a lack of cohesive strategy during the integration phase. This misalignment can contribute to inadequate training and support for personnel, exacerbating the challenges faced during implementation. To mitigate these risks, companies must invest in thorough planning, robust testing, and skilled personnel to navigate the integration process successfully. Ultimately, the successful integration of DCS with existing systems is crucial for enhancing operational efficiency, and organizations must proactively address these complexities to fully realize the benefits of advanced control systems.

KEY SEGMENTATION ANALYSIS

By Component

In 2023, the hardware segment accounted for an impressive revenue share of 52.6% within the market. This segment includes essential advanced hardware components such as high-performance controllers, input/output (I/O) modules, and communication devices, all critical for managing intricate industrial processes. These components allow for the handling of multiple I/O points and facilitate seamless integration with various systems. Recent innovations in processors, sensors, and communication devices have led to significant improvements in performance, reliability, and efficiency within distributed control systems. Advanced controllers can now process data up to 30% faster than previous models, while new communication technologies enhance connectivity and data transfer speeds. These advancements enable more effective control strategies and significantly boost system responsiveness, which is crucial for modern industrial operations.

KEY REGIONAL ANALYSIS

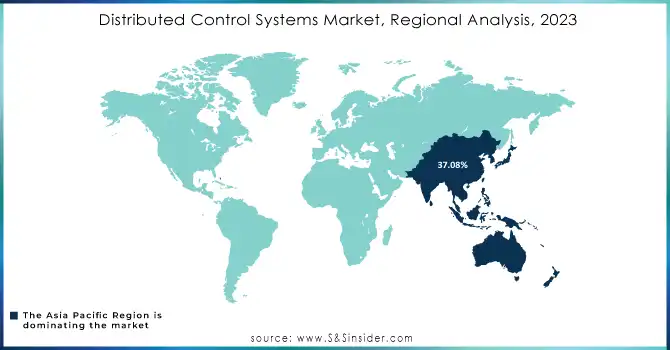

In 2023, the Asia Pacific region dominated the market share over 37.08% of the share, primarily driven by rapid industrialization in emerging economies like India and China. This surge in DCS adoption is closely linked to substantial investments in renewable energy projects across the region, fueling the demand for sophisticated control systems to effectively manage complex energy infrastructures. With approximately 60% of industries in these countries expected to adopt DCS solutions by 2032, the trend underscores the increasing need for operational efficiency and automation. Moreover, the annual growth of over 25% in smart grid technologies highlights the region's reliance on DCS for overseeing distributed generation sources. Government initiatives aimed at reducing carbon emissions further support this growth, with over 70% of such programs requiring advanced DCS capabilities for monitoring and control.

In 2023, North America solidified its position as a fastest growing region in the Distributed Control Systems (DCS) market, contributing a significant share of overall revenue. This success is driven by advanced analytics and IoT integration, allowing over 60% of industrial firms to collect real-time data, enhancing operational efficiency and predictive maintenance strategies. With approximately 45% of manufacturing firms planning to boost investments in digital technologies, the region's proactive digitization approach fosters innovation across sectors like oil and gas, pharmaceuticals, and food processing. Nearly 70% of companies recognize DCS as essential for regulatory compliance, particularly in safety and quality standards. Furthermore, the energy sector's investment in renewable projects has increased by 30%, emphasizing the importance of DCS in managing decentralized systems.

Need Any Customization Research On Distributed Control Systems Market - Inquiry Now

KEY PLAYERS

Some of the major key players of Distributed Control Systems Market

-

ABB (800xA DCS)

-

Azbil Corporation (Yamatake DCS)

-

Emerson Electric Co (DeltaV DCS)

-

General Electric Company (Mark VIe DCS)

-

Honeywell International Inc. (Experion DCS)

-

Valmet (Valmet DNA DCS)

-

MITSUBISHI HEAVY INDUSTRIES, LTD. (DCS for Power Generation)

-

NovaTech, LLC (D/3 DCS)

-

OMRON Corporation (Sysmac DCS)

-

Rockwell Automation (PlantPAx DCS)

-

Schneider Electric (EcoStruxure DCS)

-

Siemens (SIMATIC PCS 7 DCS)

-

Toshiba International Corporation (TOSLINE DCS)

-

Yokogawa Electric Corporation (Centum VP DCS)

-

Honeywell Process Solutions (C300 Controller)

-

KROHNE Group (OPTIMASS DCS)

-

Endress+Hauser (Fieldgate DCS)

-

National Instruments (NI Industrial DCS)

-

B&R Industrial Automation (Automation Studio DCS)

-

FANUC Corporation (FANUC Robotics DCS)

Suppliers for Integration of advanced process control and automation solutions. Their Experion PKS platform excels in scalability and flexibility for diverse industries of Distributed Control Systems Market:

-

Honeywell Process Solutions

-

Emerson Electric Co.

-

Siemens AG

-

ABB Ltd.

-

Rockwell Automation

-

Schneider Electric

-

Yokogawa Electric Corporation

-

Mitsubishi Electric

-

General Electric (GE)

-

KROHNE Group

RECENT DEVELOPMENT

In February 2024: LyondellBasell has chosen Emerson to upgrade its control systems at the Wesseling facility in Germany. This modernization will enhance operations at the butadiene production and ethylene cracker plant using advanced automation technologies.

In May 2023: Emerson introduced its NextGen Smart Firewall to enhance perimeter security for the DeltaV distributed control system (DCS). This firewall is designed for easy installation and maintenance across various industries, ensuring robust security.

In February 2023: ABB launched its Ability Symphony Plus DCS system aimed at the water and power generation sectors. This system offers secure access to a broader digital ecosystem, improving plant performance and efficiency while allowing users to monitor their fleet.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 19.45 Billion |

| Market Size by 2032 | USD 33.04 Billion |

| CAGR | CAGR of 6.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Application (Continuous Process, Batch Process) • By End Use (Chemicals, Metals and Mining, Oil & Gas, Pharmaceuticals, Power Generation, Pulp & Paper, Food & Beverages,Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, Azbil Corporation, Emerson Electric Co, General Electric Company, Honeywell International Inc., Valmet, MITSUBISHI HEAVY INDUSTRIES, LTD., NovaTech, LLC, OMRON Corporation, Rockwell Automation, Schneider Electric, Siemens, Toshiba International Corporation, Yokogawa Electric Corporation, Honeywell Process Solutions, KROHNE Group, Endress+Hauser, National Instruments, B&R Industrial Automation, FANUC Corporation. |

| Key Drivers | • The rising demand for automation in sectors like oil and gas, chemicals, power generation, and pharmaceuticals boosts DCS adoption by enhancing operational efficiency, minimizing human error, and improving safety. • The rising need for process optimization drives industries to adopt Distributed Control Systems (DCS), which facilitate real-time monitoring and control, ultimately reducing costs and enhancing productivity. |

| RESTRAINTS | • Integrating Distributed Control Systems (DCS) with legacy systems poses challenges due to compatibility issues, often resulting in operational disruptions. |