Oil and Gas Refining Industry Market Size & Analysis:

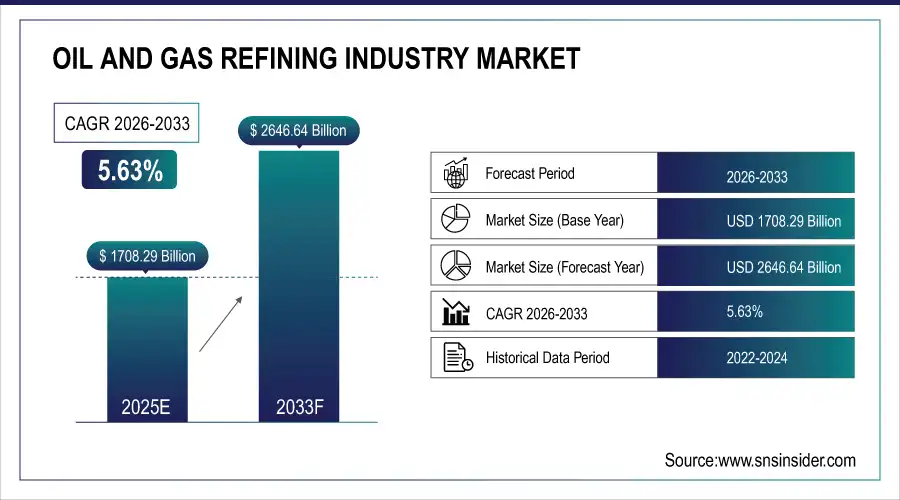

The Oil and Gas Refining Industry Market size was valued at USD 1708.29 Billion in 2025E and is expected to reach USD 2646.64 Billion by 2033, registering a CAGR of 5.63% during 2026–2033.

The market is witnessing robust transformation driven by increasing global energy demand, expansion of refinery capacity, and advancements in process optimization technologies. Integration of digital monitoring, carbon management systems, and sustainable refining methods are enhancing operational efficiency and environmental compliance across the refining sector.

Oil and Gas Refining Industry Market Size and Forecast:

-

Market Size in 2025E: USD 1708.29 Billion

-

Market Size by 2033: USD 2646.64 Billion

-

CAGR: 5.63% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Oil and Gas Refining Industry Market - Request Free Sample Report

Key Oil and Gas Refining Industry Market Trends:

-

Rising investments in refinery modernization to enhance efficiency and meet stringent environmental regulations.

-

Increasing adoption of digital twins, AI analytics, and predictive maintenance across refining operations.

-

Expansion of capacity in emerging economies to cater to growing fuel and petrochemical needs.

-

Shift toward processing renewable and sustainable feedstocks to reduce emissions.

-

Rapid technological advancements in hydrocracking and hydrotreating units for higher product yield.

-

Growing integration of carbon capture and hydrogen recovery units in refineries to meet decarbonization targets.

U.S. Oil and Gas Refining Industry Market Insights:

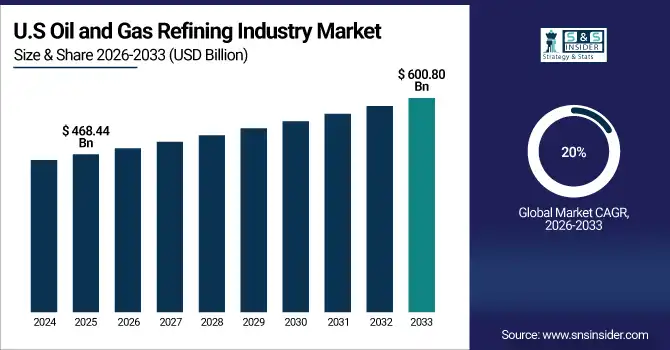

The U.S. Oil and Gas Refining Industry Market size was USD 468.44 billion in 2025E and is expected to reach USD 600.80 billion by 2033. According to a study, modernization initiatives and refined fuel demand growth have resulted in over 20% upgrades in refinery throughput capacity across major U.S. plants. This cause, intensifying domestic fuel usage, effects the adoption of digital automation and emission reduction strategies. These developments support optimized performance and enhance refinery margin efficiency while strengthening energy security.

Oil and Gas Refining Industry Market Drivers

-

Increasing Integration of Cleaner Fuel Technologies Accelerates Refining Industry Modernization

Growing environmental regulations and the demand for low-sulfur, cleaner fuels are driving global refiners toward adopting cleaner processing technologies. This cause, stringent emissions norms across major economies, effects rapid development and deployment of advanced catalysts, CCR (Continuous Catalytic Reforming) units, and desulfurization systems. Incorporating such technologies helps limit greenhouse gas emissions while maintaining product quality and yield. Refiners are investing heavily in process energy optimization to enhance compliance and reduce environmental footprints, supporting market expansion across automotive and industrial fuel applications.

For example, in May 2025, Indian Oil Corporation commissioned a hydrocracker unit at Paradip Refinery, enabling production of ultra-low sulfur diesel to meet Bharat Stage (BS-VI) norms, demonstrating progress toward eco-efficient refining processes.

Oil and Gas Refining Industry Market Restraints

-

High Capital Intensity and Long Payback Periods Limit Refinery Expansion Pace

While modernization offers environmental and efficiency benefits, refinery expansion projects face significant financial constraints due to high setup costs and extended payback cycles. This cause, heavy capital requirements for hydroprocessing and emission reduction technologies, effects slower adoption in developing economies and delays in capacity additions. Refining projects often require complex environmental clearances and high maintenance costs, impacting profit margins for independent operators. The financial burden also creates entry barriers for smaller players, restraining overall market expansion despite increasing global energy demand.

For example, in January 2024, several refineries in Latin America postponed upgrade projects due to soaring costs of hydrogen generation and carbon capture technologies, impacting production efficiency and investment confidence in the region.

Oil and Gas Refining Industry Market Opportunities:

-

Growing Low-Carbon Hydrogen and Biofuel Integration Sparks New Refining Market Growth

Rising decarbonization mandates are creating significant opportunities for refineries integrating low-carbon hydrogen and biofuel production. This cause, global shift toward renewable energy transition, effects strategic collaborations between oil majors and technology providers to retrofit existing infrastructure. Co-processing bio-feedstocks reduces emissions, diversifies fuel portfolios, and improves refinery economics through sustainable output. The integration of renewable hydrogen and circular carbon systems ensures refiners remain relevant in a rapidly evolving energy transition landscape.

For example, in June 2025, Chevron announced the expansion of its Pasadena Refinery to include renewable diesel processing, enabling a capacity boost of over 90,000 barrels per day using bio-feedstock, marking a key clean fuel milestone in the refining industry.

Oil and Gas Refining Industry Market Segment Analysis:

By Complexity, Deep Conversion Refineries Dominate While Conversion Refineries Register Fastest Growth

The Deep Conversion segment holds 45% of revenue share in 2025E, driven by rising crude quality challenges and the need for maximum residue upgrading. This cause, growing heavy crude feedstock processing, effects the expansion of hydrocrackers and coking units globally. Technological advancements in catalytic cracking and residue hydroprocessing enhance fuel yields and product diversification, strengthening refinery margins and overall industry profitability.

The Conversion segment, expanding at the fastest CAGR of 9.78% during 2026–2033, benefits from increasing investments in upgrading semi-complex facilities to integrated conversion units. This cause, rising middle distillate demand, effects the modernization of fluid catalytic cracking and reforming units. Enhanced fuel blend flexibility and improved product output reinforce global refining competitiveness and operational efficiency.

By Application, Transportation Leads While Aviation Registers Fastest Growth

The Transportation segment dominates with 36% revenue share in 2025E, driven by rapid vehicular fuel consumption and growing urban mobility trends. This cause, increasing reliance on road logistics, effects continued expansion of gasoline and diesel production in refineries worldwide, strengthening demand for midstream supply and efficient blending technologies.

The Aviation segment records the highest growth at a 10.99% CAGR, boosted by rising global air traffic and sustainable aviation fuel (SAF) initiatives. This cause, increasing low-emission aviation targets, effects significant refinery investment toward SAF co-processing and hydrogen-based jet fuel production, accelerating industry transformation and sustainability progress.

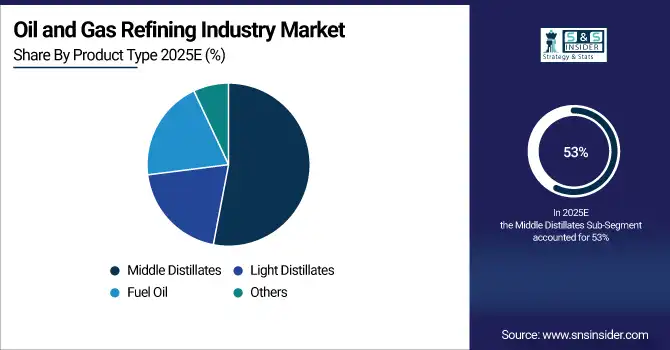

By Product, Middle Distillates Lead While Light Distillates Grow Fastest

Middle Distillates capture 53% revenue share in 2025E, driven by growing demand for diesel, kerosene, and jet fuel across transport and industry. This cause, robust global logistics activity, effects expansion of hydrodesulfurization and dewaxing units, ensuring yield optimization and improved distillate quality.

Light Distillates witness the fastest growth, supported by expanding petrochemical demand and gasoline blending flexibility. This cause, increasing consumption in passenger mobility and industrial feedstock, effects higher production of naphtha and LPG, positioning this segment at the forefront of downstream development.

By Fuel Type, Gasoline Leads While Kerosene Registers Fastest Growth

Gasoline holds 43% revenue share in 2025E, driven by high automotive demand and economic recovery across major economies. This cause, increasing light vehicle ownership, effects expansion in alkylation and isomerization capabilities to improve octane ratings and fuel performance.

Kerosene, projected to register the fastest growth rate, benefits from surging aviation recovery and clean jet fuel blending advancements. This cause, revival in passenger air traffic, effects widening refinery investment in kerosene hydrofining and SAF integration, supporting decarbonized aviation operations.

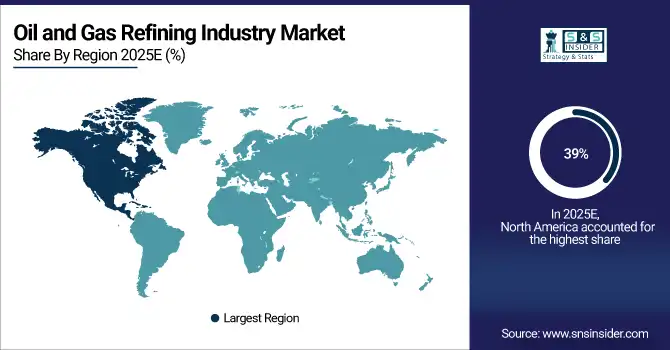

North America Oil and Gas Refining Industry Market Insights

In 2025E, North America dominates the Oil and Gas Refining Industry Market with an estimated 39% share, driven by advanced technology adoption and refinery modernization programs. The region benefits from strong regulatory support for clean energy integration, expansion of upgrading units, and digital refinery operations. The presence of large-scale, technologically advanced refineries ensures high efficiency, stable crude supply, and a competitive advantage in global refining trade.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Leads North America Oil and Gas Refining Industry Market with Technological Leadership

The U.S. leads the North American oil and gas refining industry market due to its large, advanced refinery complexes and reliable crude supply. Its expertise in processing renewable fuels positions it as a technological leader in the industry. Continuous investments in carbon capture and hydrogen integration enhance environmental performance while modernizing operations. These initiatives improve efficiency, reduce emissions, and enable adoption of cutting-edge technologies. Combined, they strengthen the U.S.’s global competitiveness, ensuring it remains a key player in both traditional and low-carbon refining markets.

Asia Pacific Oil and Gas Refining Industry Market Insights

Asia Pacific is the fastest-growing oil and gas refining region, with an estimated CAGR of 8.60%, driven by rising energy demand, rapid industrialization, and large-scale refinery expansions. Growing fuel consumption and petrochemical requirements are promoting the creation of integrated refinery-petrochemical hubs. Supportive government policies, coupled with technological advancements, are accelerating capacity growth and operational efficiency. These factors position the region for significant market expansion, making Asia Pacific a key contributor to global refining development and a hub for innovative, large-scale refinery and petrochemical projects.

China Drives Asia Pacific Refining Market Growth

China leads the Asia Pacific market through advanced catalytic technologies, massive refining capacity, and supportive energy policies. Strategic investments in green hydrogen, fuel efficiency, and large-scale refinery projects reinforce China’s leadership in regional refining.

Europe Oil and Gas Refining Industry Market Insights

Europe maintains a strong position in the oil and gas refining market, propelled by energy transition policies and refinery decarbonization efforts. Strict emission regulations drive the adoption of advanced technologies, circular fuel production, and hydrogen co-processing. These measures enhance sustainability, reduce environmental impact, and modernize refinery operations. By integrating low-carbon solutions and innovative processes, European refineries align with net-zero targets while maintaining efficiency and competitiveness in the global market, positioning the region as a leader in sustainable refining practices.

Germany Leads Europe Oil and Gas Refining Industry Market Expansion

Germany leads Europe’s oil and gas refining market through advanced refineries that prioritize low-carbon feedstock integration and hydrogen co-processing. Continuous modernization of facilities ensures operational efficiency and supports the adoption of cutting-edge technologies. By aligning closely with the EU’s net-zero goals, Germany reduces emissions while maintaining high production standards. These strategic initiatives enhance the country’s sustainability credentials and reinforce its competitive advantage, making Germany a key driver of Europe’s transition toward cleaner, more efficient, and technologically advanced refining operations.

Latin America and Middle East & Africa (MEA) Oil and Gas Refining Industry Market Insights

Latin America and MEA maintain steady growth in refining, supported by modernization programs, stable crude reserves, and export-oriented production. Investments in hydroprocessing, heavy crude conversion, and renewable fuel integration are enhancing refinery efficiency and sustainability.

Brazil and UAE Lead Refining Market Growth in Their Regions

Brazil drives Latin America’s refining market through modernization of refinery complexes and increased hydroprocessing capacity. In MEA, the UAE leads with integrated refinery-petrochemical projects, optimizing production and supporting global export demand.

Competitive Landscape for the Oil and Gas Refining Industry Market:

China National Petroleum Corporation (CNPC)

CNPC is a leading global energy firm with extensive refining, petrochemical, and integrated downstream operations. The company operates large-scale refineries across China, implementing advanced hydroprocessing and digital plant management technologies. Its refining strategy focuses on achieving energy efficiency, reduced carbon intensity, and expansion into renewable fuel integration.

-

In February 2025, CNPC launched a low-carbon refining initiative integrating bio-feedstock blending and CO₂ recycling systems across its Dalian refinery to enhance emissions performance.

Indian Oil Corporation Limited (IOCL)

Indian Oil operates India’s largest refining network, encompassing multiple complexes integrating hydrocracking, aromatic production, and desulfurization units. Its refining upgrades enhance cleaner fuel output and energy optimization aligned with national emission norms.

-

In May 2025, IOCL commissioned its hydrogen production unit at Panipat Refinery, supporting green fuel hydrogen integration and low-carbon refining strategies.

ExxonMobil Corporation

ExxonMobil is a global leader in refining operations, known for high-efficiency technologies and advanced catalyst usage. The company operates strategically across the U.S. and Asia, investing in low-carbon hydrogen, carbon capture units, and process optimization to ensure sustainable growth.

-

In July 2025, ExxonMobil advanced its Beaumont Refinery expansion, increasing crude processing by 250,000 barrels per day to supply cleaner transportation fuels.

Chevron Corporation

Chevron integrates upstream and downstream operations, delivering energy-efficient refining solutions through continuous process innovations and renewable integration. Its refining sites emphasize energy recovery systems, hydrocracking, and fuel flexibility.

-

In June 2025, Chevron’s El Segundo Refinery launched renewable diesel production operations, contributing to emission reduction commitments and sustainable fuel supply targets.

Oil and Gas Refining Industry Companies are:

-

China National Petroleum Corporation

-

ExxonMobil Corporation

-

Chevron Corporation

-

Hindustan Petroleum Corporation Limited

-

PJSC Lukoil Oil Company

-

Petróleos de Venezuela, S.A.

-

Reliance Industries Limited

-

Marathon Petroleum Corporation

-

BP PLC

-

Royal Dutch Shell PLC

-

Saudi Aramco

-

TotalEnergies SE

-

Phillips 66

-

Valero Energy Corporation

-

Eni S.p.A.

-

Repsol S.A.

-

Sinopec (China Petroleum & Chemical Corporation)

-

Petrobras

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 1708.29 Billion |

| Market Size by 2032 | US$ 2646.64 Billion |

| CAGR | CAGR of 5.63 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Complexity (Topping, Hydro-Skimming, Conversion, Deep Conversion) • By Application (Transportation, Aviation, Marine Bunker, Petrochemical, Residential & Commercial, Agriculture, Electricity, Rail & Domestic Waterways, Others) • By Product (Light Distillates, Middle Distillates, Fuel Oil, Others) • By Fuel Type (Gasoline, Gasoil, Kerosene, LPG, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | China National Petroleum Corporation, Indian Oil Corporation Limited, ExxonMobil Corporation, Chevron Corporation, Hindustan Petroleum Corporation Limited, PJSC Lukoil Oil Company, Petróleos de Venezuela, S.A., Reliance Industries Limited, Marathon Petroleum Corporation, BP PLC, Bharat Petroleum Corporation Limited, Royal Dutch Shell PLC, Saudi Aramco, TotalEnergies SE, Phillips 66, Valero Energy Corporation, Eni S.p.A., Repsol S.A., Sinopec (China Petroleum & Chemical Corporation), Petrobras. |