Waste Heat Recovery System Market Report Scope & Overview:

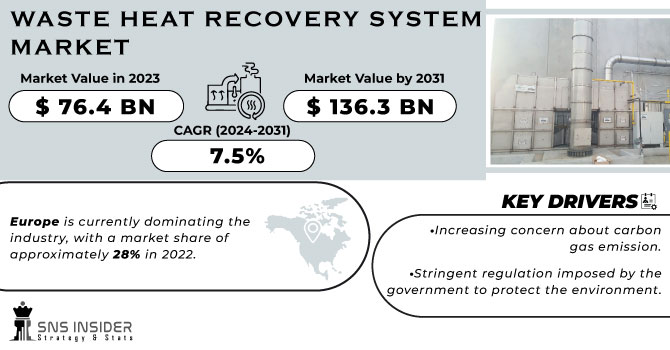

The Waste Heat Recovery System Market was estimated at USD 66.26 billion in 2023 and is expected to reach USD 137.40 billion by 2032, with a growing CAGR of 8.44% over the forecast period 2024-2032. This report offers a comprehensive analysis of the Waste Heat Recovery System Market, focusing on key operational and technological metrics such as energy efficiency improvement rates, installed capacity and utilization trends, and downtime and maintenance data. It explores technological adoption trends across regions, highlighting the growing shift towards advanced waste heat recovery solutions. Additionally, it provides insights into the export/import trends of waste heat recovery equipment, revealing shifts in global supply chains. This data helps to identify the most dynamic regions and evolving operational efficiencies in the market.

Get More Information on Waste Heat Recovery System Market - Request Sample Report

Market Dynamics

Drivers

-

Rising industrialization and strict energy efficiency mandates are driving the adoption of waste heat recovery systems to reduce energy costs and carbon emissions.

The Waste Heat Recovery System Market is experiencing significant growth due to rapid industrialization and stringent energy efficiency mandates. As industries grow, the need for sustainable energy solutions has also grown, resulting in the implementation of waste heat recovery systems in various sectors, including manufacturing, oil & gas, chemicals, and power generation. Market growth is further bolstered with strict regulations being set by governments across the globe to minimize energy and carbon emission waste. Furthermore, increasing energy prices are forcing industries to improve the efficiency of processes by recycling and reusing waste heat. Technological innovation such as these have improved system efficiency— organic Rankine cycle (ORC) and thermoelectric generators have demonstrated, among others, that they are capable of being increasingly widely applicable. For example, there is a trend for waste heat recovery systems to be integrated with renewable energy systems to achieve an even greater level of sustainability. The investments in energy-efficient technologies are increasing, and with that, the market is set to witness healthy growth during the coming years, especially in the emerging economies having accelerated industrialization.

Restraint

-

The high initial investment and ongoing maintenance costs of waste heat recovery systems make adoption challenging, especially for SMEs with limited financial resources.

The installation of waste heat recovery systems requires a substantial initial investment, covering costs for advanced heat exchangers, turbines, piping, and installation. This high capital requirement can be an important blockage. Plus, adding these systems to existing industrial setups often requires significant alterations that also drive up costs. Even with installation, regular maintenance is necessary to maintain peak performance, which brings additional running costs. Maintaining heat exchangers, boilers, and thermoelectric components requires special personnel with technical skills, which further increases long-term costs. Even more, sectors facing varying waste heat sources find it difficult to fund investment, given that inconsistent heat supply hampers system performance. Waste heat recovery systems can provide long-term energy savings and operational efficiencies, but high upfront investment and high operating cost remain the two key factors limiting their penetration in the market, especially for small scale enterprise.

Opportunities

-

The growing adoption of waste heat recovery systems across industries like oil & gas, chemicals, and food processing is driven by the need for energy efficiency, cost reduction, and sustainability.

The adoption of waste heat recovery systems is expanding across various end-use industries, including oil & gas, chemicals, and food processing, due to the growing need for energy efficiency and cost reduction. In the oil & gas industry, waste heat recovery finds application in refineries and petrochemical facilities, where it helps to enhance operational effectiveness and mitigate fuel use. The chemical industry utilizes these to absorb excess heat from production processes to strengthen sustainability and reduce volumes of emissions. Likewise, in the food processing industry, waste heat recovery is used to improve the thermodynamic efficiency of drying, baking, and sterilization operations. With increasingly tighter environmental regulations and the cost of energy rising, new opportunities for advanced heat recovery technologies are in demand across many industries. The growing focus on energy conservation, along with government initiatives encouraging sustainable practices, is also driving the acceptance of waste heat recovery among various industrial sectors, thereby enhancing the growth potential of the market.

Challenges

-

Low-temperature heat recovery faces efficiency challenges due to limited heat transfer, material constraints, and high costs, restricting its widespread adoption.

Recovering heat from low-temperature sources presents significant technical challenges due to the limited efficiency of existing heat recovery technologies. Conventional systems (heat exchangers, thermoelectric generators, etc.) are ineffective at recovering and converting low-grade heat (below 150°C) into usable energy. The heat is transferred to a mechanical system that uses the temperature differential to perform work, either generating electricity or pumping heat, but the low temperature differential in HDE removes these options for profitable heat transfer/power generation. Moreover, the materials used in heat recovery systems are expected to be able to resist thermal cycling and corrosion, adding the expenses. Recent technologies such as Organic Rankine cycle (ORC) and advanced phase-change materials (PCMs) offer a potential solution; however, their application is limited due to high investment costs and lower efficiencies than conventional systems. Addressing these obstacles will necessitate progress in materials science, system design, and novel methods to improve the efficiency of heat conversion. Overcoming these obstacles is critical for optimal waste heat use and enhancing energy efficiency in industries.

Segmentation Analysis

By Application

The Power & Steam Generation segment dominated with a market share of over 48% in 2023, due to its extensive adoption across industries such as power plants, refineries, and chemical processing. These industries produce a lot of waste heat which could be efficiently reclaimed and used to create electricity or even steam in order to increase overall energy efficiency. Growing interest in sustainability and increasingly strict energy efficiency regulations are also driving demand for waste heat recovery in power and steam generation. Moreover, rapid industrialization and rising demand for economical energy solutions lead to the growth of the segment. This application becomes a focus on energy optimization by saving on fuel consumption, decreasing operational expense, and reducing carbon emissions through the use of advanced heat recovery technologies.

By End-Use

The petroleum refinery segment dominated with a market share of over 32% in 2023, due to its high energy consumption and vast potential for heat recovery. Refineries engage in energy-intensive processes including distillation, catalytic cracking and reforming, which create significant waste heat. It makes energy efficiency incorporating waste heat recovery boilers in these units results in reduced fuel consumption, operational costs and carbon footprint. In addition, increasing environmental regulations and the growing demand for sustainable energy solutions fuel adoption. Refinery heat recovery is used to support cogeneration, steam generation, and preheating etc.3. Heat recovery is one of the key strategies to optimize the fuel consumption in the refineries. Waste heat recovery systems will continue to be a critical investment in refining as refiners focus on optimizing their operations and regulations regarding world-wide emissions.

By Phase System

The Liquid-Liquid Phase System segment dominated with a market share of over 42% in 2023, due to its superior efficiency in capturing and utilizing waste heat from various industrial processes. Many industries including chemical manufacturing, petroleum refining & power generation heavily depend on this system to maximize energy efficiency and lower operating cost. This system improves thermal efficiency and reduces energy loss by conductive heat exchange between two liquid streams. The increasing focus on sustainability, energy efficiency, and strict environmental laws drives the adoption of the New Technologies. The Liquid-Liquid Phase System is forming an indispensable foundation for the future of the waste heat recovery market, as industries search for cost-effective solutions to both boost productivity whilst minimising carbon emissions.

Key Regional Analysis

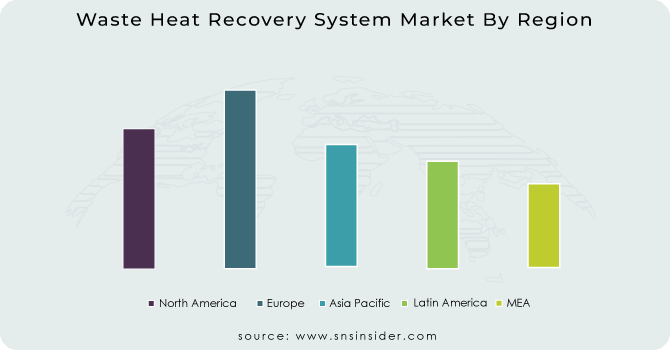

Europe region dominated with a market share of over 32% in 2023, primarily due to stringent environmental regulations and sustainability policies set by the European Union. These regulations motivate industries to embrace energy-efficient technologies to minimize carbon emissions as well as optimize overall energy consumption. Moreover, another key driver for the adoption of industrial waste heat recovery systems in Europe is its well-established industry base with robust manufacturing activity (automotive and chemical) that can gain the most from these solutions. High investments for energy-efficient system integration in both government and private sectors are a major factor for the market growth owing to incentives for emissions norm compliance and operational efficiency. They compel renewable energy integration while reducing costs. Europe maintains its position as the world's leading market for waste heat recovery systems in different sectors, sustained by robust technological advancements and regulatory support.

North America is experiencing rapid growth in the Waste Heat Recovery System Market, driven by rising energy costs and the increasing need for energy-efficient solutions across industries. Companies across the region are increasingly embracing sustainable energy technologies in a bid to both lower operational costs and satisfy tough environmental regulations. In manufacturing, power generation, and other energy-intensive industries, government support supplements the funding and execution of waste heat recovery systems through programs and tax incentives. Furthermore, the increasing technological innovations and rising awareness towards reducing the carbon footprint is driving to adopt the solution for heat recovery across the industries. North America is expected to be the fastest-growing waste heat recovery system market, owing to robust industrial growth and aggressive sustainability efforts.

Need any customization research on Waste Heat Recovery System Market - Enquiry Now

Some of the major key players in the Waste Heat Recovery System Market

-

Siemens AG (Heat Recovery Steam Generators, WHR Boilers)

-

Mitsubishi Heavy Industries, Ltd (Steam Turbines, Heat Recovery Systems)

-

General Electric (Heat Recovery Steam Generators, WHR Solutions)

-

ABB (Heat Exchangers, Industrial Waste Heat Recovery Solutions)

-

Boustead International Heaters (WHR Boilers, Fired Heaters)

-

Forbes Marshall (Waste Heat Boilers, Heat Exchangers)

-

Promec Engineering (Waste Heat Recovery Units, Heat Exchangers)

-

Terrapin (Organic Rankine Cycle (ORC) Systems, Heat Recovery Solutions)

-

Wood Plc (Amec Foster Wheeler) (Waste Heat Boilers, Heat Recovery Units)

-

Climeon (Low-Temperature Waste Heat Recovery Systems, ORC Technology)

-

Bosch Industries (Waste Heat Boilers, Heat Recovery Steam Generators)

-

Kessel GmbH (Industrial Heat Exchangers, Heat Recovery Systems)

-

AURA GmbH & Co. (ORC Systems, Industrial Waste Heat Recovery)

-

Exergy S.p.A. (ORC Power Plants, Waste Heat Recovery Solutions)

-

IHI Corporation (Heat Recovery Steam Generators, Industrial Boilers)

-

Echogen Power Systems (Supercritical CO₂ Waste Heat Recovery, Power Generation Systems)

-

Thermax Ltd. (Waste Heat Boilers, Heat Recovery Systems)

-

Ormat Technologies (ORC-based Waste Heat Recovery, Geothermal Power Solutions)

-

Econotherm Ltd. (Heat Pipes, Waste Heat Recovery Systems)

-

Kelvion (Plate Heat Exchangers, Air Preheaters)

Suppliers for (Waste heat recovery boilers, thermal oil heaters, steam turbines) on Waste Heat Recovery System Market

-

Urjatherm Industries Pvt. Ltd.

-

Transparent Energy Systems Private Ltd. (TESPL)

-

Thermin Power

-

Thermin Energy System Pvt. Ltd.

-

Opel Energy Systems

-

Nikhil Technochem Pvt. Ltd.

-

Forbes Marshall

-

Thermax Limited

-

RAJ Waste Heat Recovery Boilers

-

Heat Matrix Group

Siemens AG-Company Financial Analysis

Recent Development

In April 2024: Climeon announced a partnership with Franman to expand its presence in Greece. Simultaneously, Climeon introduced its advanced Organic Rankine Cycle (ORC) waste heat-to-power technology, aimed at improving energy efficiency for shipbuilders and vessel owners as they combat climate change. The company is confident that this innovation will enhance sustainability in the maritime industry and contribute to the growing demand for eco-friendly solutions.

In September 2023: Solex acquired Econotherm Ltd., a UK-based leader in waste heat recovery technology. This acquisition strengthens Solex's ability to help clients reduce primary energy consumption in industrial production. Econotherm specializes in heat exchange across gas, liquid, and solid-to-solid systems.

| Report Attributes | Details |

| Market Size in 2023 | USD 66.26 Billion |

| Market Size by 2032 | USD 137.40 Billion |

| CAGR | CAGR of 8.44% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Pre Heating, Power & Steam Generation, Others) • By End-use (Petroleum Refinery, Power, Cement, Chemical, Metal Production & Casting, Pulp & Paper, Other) • By Phase System (Liquid-liquid phase system, Liquid gas phase system, Thermal regeneration) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG, Mitsubishi Heavy Industries, Ltd., General Electric, ABB, Boustead International Heaters, Forbes Marshall, Promec Engineering, Terrapin, Wood Plc (Amec Foster Wheeler), Climeon, Bosch Industries, Kessel GmbH, AURA GmbH & Co., Exergy S.p.A., IHI Corporation, Echogen Power Systems, Thermax Ltd., Ormat Technologies, Econotherm Ltd., Kelvion. |