Distribution Transformer Market Report Scope & Overview:

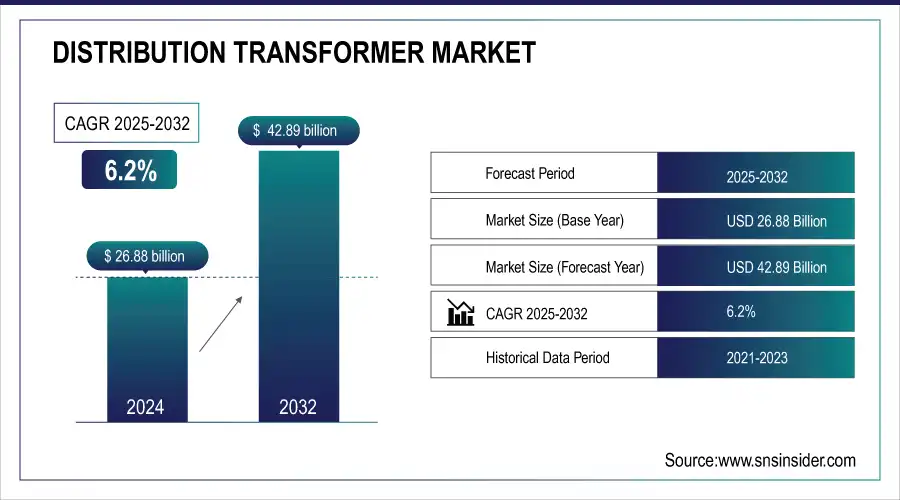

The Distribution Transformer Market size was valued at USD 26.88 billion in 2024 and is expected to grow to USD 42.89 billion by 2032 and grow at a CAGR of 6.2% over the forecast period of 2025-2032.

Distribution transformers are devices that convert high-voltage electricity into low-voltage electricity, which is used by industries as well as households. Distribution transformers are used in power generation, transmission, and distribution. Low-voltage electric power generation is cost-effective but can cause high line currents and transmission of high line currents leads to more line losses. Distribution transformers are utilized in distribution networks to transform electricity to a level (11kV, 6.6 kV, 3.3 kV, 440V, 230V) that is used by an end-user and usually is rated lower than 200MVA.

Get more information on Distribution Transformer Market - Request Sample Report

Distribution Transformer Market Size and Forecast:

-

Market Size in 2024: USD 26.88 Billion

-

Market Size by 2032: USD 42.89 Billion

-

CAGR: 6.2% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Distribution Transformer Market Trends:

-

Rising integration of smart grid technologies drives demand for advanced distribution transformers with monitoring and control capabilities.

-

Growing adoption of renewable energy sources accelerates the need for transformers supporting decentralized power generation and grid stability.

-

Increasing urbanization and infrastructure expansion boost the deployment of compact and efficient distribution transformers in residential and commercial applications.

-

Shift toward energy-efficient transformers reduces transmission losses and aligns with global sustainability and carbon-reduction targets.

-

Digital monitoring systems and IoT-enabled transformers improve predictive maintenance, fault detection, and operational efficiency.

-

Government regulations and eco-design mandates encourage the adoption of low-loss, environmentally friendly distribution transformers.

-

Growing demand for electrification in rural areas fosters expansion of distribution networks and transformer installations.

-

Advancements in solid-state and dry-type transformer technologies expand applications in sensitive and indoor environments.

A distribution transformer is also referred to as an isolation transformer. The structure of the distribution transformer is the same as an ordinary transformer. The components of distribution transformers are an Oil indicator, oil tank, conservator, Buchholz relay, breather unit, temperature detector, thermal relay, pressure relief device, radiator, and bushing.

Distribution Transformer Market Drivers:

-

Distribution Transformer Market Growth Fueled by Urbanization and Renewable Integration

The Distribution Transformer Market is witnessing significant growth driven by rising electricity demand in both developed and developing countries. Rapid urbanization, industrialization, and continuous infrastructure investments are pushing governments and utilities to modernize and expand electrical grids. Distribution transformers are vital as they ensure efficient voltage regulation and reliable power delivery to residential, commercial, and industrial sectors. Additionally, the global shift toward renewable energy, particularly solar and wind, is accelerating market expansion. As renewable power sources are increasingly integrated into grids, transformers are essential to manage fluctuating loads and ensure stability. The combined impact of infrastructure development, electrification initiatives, and clean energy adoption positions distribution transformers as a cornerstone of global energy sustainability.

Distribution Transformer Market Restraints:

-

Repair Practices Limit Adoption of Advanced Distribution Transformers

The practice of repairing old transformers instead of replacing them with new, efficient models has negatively affected the Distribution Transformer Market. Many end-users choose short-term cost savings through repairs, which reduces the overall demand for new transformer installations. However, this approach limits the adoption of advanced, energy-efficient technologies that enhance grid reliability and sustainability. Aging transformers often operate with lower efficiency and higher maintenance costs, ultimately affecting long-term performance. By avoiding investment in modern solutions, companies risk operational inefficiencies and regulatory challenges. Encouraging replacement with advanced models would not only drive market growth but also ensure improved energy efficiency, reduced losses, and long-term cost savings, benefiting both businesses and the industry’s development.

Distribution Transformer Market Opportunities:

-

Government Investments Drive Expansion of the Distribution Transformer Market

Increasing government investment in the expansion of electricity networks is a key driver for the Distribution Transformer Market. As countries work to meet rising electricity demand from urbanization, industrialization, and rural electrification, governments are allocating significant funds to upgrade and expand transmission and distribution infrastructure. This investment leads to the installation of new distribution transformers that ensure reliable, efficient, and safe power delivery to end-users. Additionally, renewable energy integration projects supported by public funding require advanced transformers to manage fluctuating power flows. These initiatives not only improve grid stability but also support sustainable energy goals. As a result, government-backed projects create substantial opportunities for manufacturers and accelerate long-term growth across the distribution transformer industry.

Distribution Transformer Market Segmentation Analysis:

By Mounting Location, Pad Transformers Lead Market, While Underground Vault Transformers Register Fastest Growth

The Pad segment dominated the distribution transformer market with the largest revenue share of 47% in 2024. This dominance is due to their widespread use in urban and suburban settings, where above-ground installations offer easy access for maintenance and reliable service delivery. Utilities and manufacturers continue to innovate pad-mounted transformers with advanced monitoring and eco-friendly insulation oils, ensuring efficiency and compliance. As urbanization accelerates, the demand for pad-mounted systems strengthens their leadership in the global distribution transformer market.

The Underground Vault segment is projected to grow at the fastest CAGR of 13.66% during the forecast period. The surge is driven by increasing adoption in densely populated cities, where underground infrastructure reduces visual clutter and enhances safety. Growing investments in smart grids and underground utility networks further boost demand. Manufacturers are developing compact, high-efficiency vault transformers that support urban resilience and sustainability. This rising preference for underground systems positions the segment as a major growth driver in the distribution transformer market.

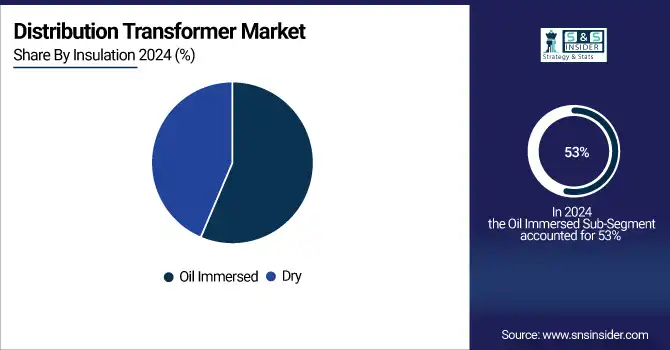

By Insulation, Oil Immersed Transformers Lead Market While Dry Transformers Register Fastest Growth

The Oil Immersed segment dominated the distribution transformer market with the largest revenue share of 53% in 2024. Their dominance stems from high cooling efficiency, durability, and suitability for heavy-load applications in utilities and industries. Oil-immersed designs support long operational lifespans and reliable performance in outdoor environments. Continuous product innovation, including biodegradable insulating oils and smart monitoring systems, reinforces adoption. Their proven track record ensures oil-immersed transformers remain the preferred choice across large-scale distribution networks worldwide.

The Dry segment is forecasted to grow at the fastest CAGR of 13.71% during the forecast period. Rising safety concerns and strict environmental regulations are accelerating the adoption of dry-type transformers, which eliminate fire hazards and oil leakage risks. Increasing installation in commercial buildings, hospitals, and renewable energy projects strengthens demand. Manufacturers are enhancing designs with epoxy resin and advanced cooling systems for improved performance. This focus on eco-friendly and safe alternatives positions dry transformers as a rapidly expanding segment within the distribution transformer market.

By Phase, Three-Phase Transformers Lead Market While Single-Phase Transformers Register Fastest Growth

The Three-Phase segment dominated the distribution transformer market with the largest revenue share of 47% in 2024. This dominance is due to their critical role in industrial operations, utilities, and large-scale power distribution networks. Three-phase transformers deliver high efficiency, balanced load management, and reduced energy losses, making them the preferred choice for bulk power transmission. Manufacturers are introducing digital monitoring features and eco-efficient insulation technologies, further strengthening their widespread adoption in modern grid infrastructure.

The Single-Phase segment is expected to grow at the fastest CAGR during the forecast period. Growth is fueled by rising adoption in rural electrification programs, residential areas, and small commercial units. Single-phase transformers provide cost-effective and efficient power distribution in low-demand applications. Advancements in compact, energy-efficient designs are enabling wider penetration in developing regions. Government initiatives to expand electricity access worldwide further accelerate demand, making single-phase transformers an attractive growth segment in the distribution transformer market.

By End-Users, Utility Transformers Lead Market While Industrial Transformers Register Fastest Growth

The Utility segment dominated the distribution transformer market with the largest revenue share of 53% in 2024. Utilities rely heavily on distribution transformers to ensure consistent electricity supply, grid reliability, and support for renewable energy integration. The increasing focus on smart grid deployment, coupled with demand for energy-efficient distribution systems, is driving higher installations. Product innovations such as IoT-enabled monitoring systems and eco-friendly insulation are boosting adoption, cementing the role of utility transformers in the global power distribution landscape.

The Industrial segment is forecasted to grow at the fastest CAGR during the forecast period. Expansion of manufacturing facilities, mining operations, and heavy industries is driving demand for robust transformers capable of handling high-capacity loads. Industrial transformers ensure stable voltage regulation, minimize downtime, and optimize production efficiency. Continuous product development in energy-efficient designs and digital control features supports adoption. As global industrialization accelerates, demand for distribution transformers in industrial applications strengthens, positioning the segment as a key growth driver in the market.

By Voltage, Medium Voltage Transformers Lead Market While Low Voltage Transformers Register Fastest Growth

The Medium Voltage segment dominated the distribution transformer market with the largest revenue share of 53% in 2024. Their dominance is attributed to widespread usage in urban power distribution, commercial complexes, and renewable energy integration. Medium-voltage transformers balance efficiency, reliability, and scalability for modern grids. Manufacturers are innovating with smart sensors, eco-friendly oils, and compact designs to enhance performance. The segment’s central role in ensuring stable electricity supply across multiple sectors secures its market-leading position globally.

The Low Voltage segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by expanding residential applications, small commercial enterprises, and microgrid projects. Low-voltage transformers provide cost-effective power distribution with increasing adoption in smart homes and renewable energy systems. Manufacturers are focusing on compact, efficient, and safe designs tailored to end-user needs. Rising electrification in emerging economies further boosts demand, positioning low-voltage transformers as the fastest-growing segment in the distribution transformer market.

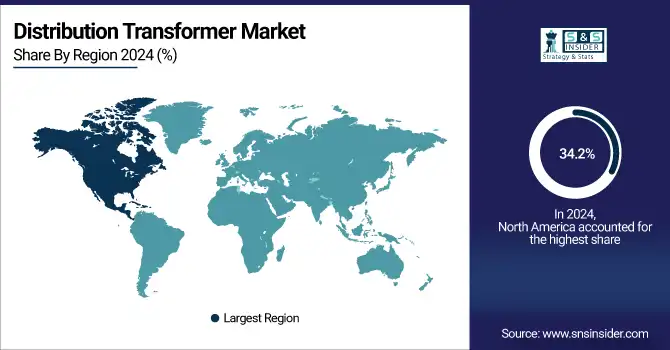

Distribution Transformer Market Regional Analysis:

North America Dominates the Distribution Transformer Market in 2024

North America holds an estimated 34.2% market share in 2024, driven by rapid grid modernization, smart meter deployment, and renewable energy integration. This causes utilities to replace aging infrastructure with efficient, eco-friendly distribution transformers to ensure reliability, regulatory compliance, and grid stability.

Get Customized Report as per your Business Requirement - Request For Customized Report

-

United States Leads North America’s Distribution Transformer Market

The U.S. dominates due to its advanced utility infrastructure, large-scale smart grid investments, and growing electrification needs across residential, commercial, and industrial sectors. Federal and state policies encourage modernization of outdated transformers, while strict energy-efficiency regulations accelerate the adoption of eco-friendly designs. With strong domestic manufacturing players such as GE and Eaton, coupled with heavy investments in renewable integration, the U.S. secures its leadership position. Its advanced R&D ecosystem, regulatory support, and large-scale electrification projects reinforce its dominance in the North American distribution transformer market.

Asia Pacific is the Fastest-Growing Region in the Distribution Transformer Market in 2024

The region is expected to grow at a CAGR of ~7.6% from 2025–2032, driven by rapid urbanization, smart city projects, and massive electrification programs. This causes governments and utilities to deploy large-scale distribution transformers to meet surging energy demand and renewable integration goals.

-

China Leads Asia Pacific’s Distribution Transformer Market

China dominates the Asia Pacific market with extensive investments in renewable energy integration, grid expansion, and government-led electrification initiatives. Its large-scale manufacturing capabilities lower costs, enabling both domestic deployment and exports. National projects such as “New Infrastructure Development” push widespread adoption of smart and medium-voltage transformers. Rising urbanization, industrial expansion, and rural electrification further strengthen demand. By combining strong policy backing with advanced manufacturing and technology adoption, China establishes itself as the powerhouse of the Asia Pacific distribution transformer market.

Europe Distribution Transformer Market Insights, 2024

Europe is witnessing strong growth in distribution transformers, fueled by strict EU decarbonization goals, renewable energy integration, and aging grid replacement. Germany’s focus on renewable energy transition, efficiency regulations, and grid modernization accelerates the adoption of smart and eco-friendly distribution transformers across Europe.

-

Germany Leads Europe’s Distribution Transformer Market

Germany dominates due to its robust industrial base, advanced energy transition strategy (Energiewende), and strong regulatory framework supporting green technologies. Heavy investments in renewable integration, coupled with smart grid projects, boost demand for efficient transformers. German manufacturers like Siemens lead innovation in eco-efficient, digitally enabled transformer solutions. By combining industrial expertise, regulatory alignment, and advanced technology, Germany reinforces its leadership in Europe’s distribution transformer landscape.

Middle East & Africa and Latin America Distribution Transformer Market Insights, 2024

The Distribution Transformer Market in the Middle East & Africa and Latin America is expanding steadily, driven by rising electricity demand, infrastructure development, and renewable adoption. The UAE leads MEA with heavy investments in smart grids and renewable energy integration, while Brazil drives Latin America with grid modernization, industrialization, and large-scale electrification programs. Government-led energy projects, international partnerships, and private investments accelerate demand. Growing emphasis on sustainability, efficiency, and reliable electricity access positions both regions as emerging but vital contributors to global market growth.

Competitive Landscape for Distribution Transformer Market:

ABB

ABB is a Switzerland-based global leader in electrification and automation solutions, with a strong presence in the distribution transformer market. The company offers advanced oil-filled, dry-type, and digital-ready distribution transformers designed for efficiency, reliability, and sustainability. ABB focuses on smart grid integration and eco-friendly materials to align with global carbon reduction goals. Its role in the market is critical, providing innovative transformer technologies for utilities, industries, and renewable energy projects worldwide.

-

In 2025, ABB launched its latest eco-efficient “TXpert™ Hub” digital transformer monitoring system, improving real-time diagnostics and operational reliability for distribution networks.

Siemens

Siemens AG, headquartered in Germany, is one of the leading players in the distribution transformer sector, providing advanced solutions tailored to energy efficiency and grid modernization. The company’s portfolio includes liquid-immersed, dry-type, and digital transformers, widely used in smart grids and renewable integration. Siemens emphasizes digitalization and low-loss designs, ensuring reliable power distribution for urban, industrial, and rural applications. Its strong global presence reinforces its competitive position.

-

In 2025, Siemens unveiled a new line of digital-ready distribution transformers with advanced IoT sensors, enabling predictive maintenance and enhanced grid connectivity.

Schneider Electric

Schneider Electric, based in France, is a global leader in energy management and automation. Its distribution transformer portfolio focuses on sustainability, high efficiency, and smart monitoring capabilities. Schneider plays a crucial role in delivering solutions for utilities, infrastructure, and industrial applications. By integrating IoT-based monitoring systems, the company helps optimize transformer lifecycle management, reducing downtime and operating costs.

-

In 2025, Schneider Electric expanded its EcoStruxure™ platform, integrating digital monitoring for distribution transformers to support decarbonization and grid resilience initiatives.

General Electric (GE)

GE, headquartered in the U.S., holds a strong position in the distribution transformer market, offering high-performance and digitally enabled solutions. GE’s transformers are designed for high efficiency, minimal losses, and adaptability in renewable and grid expansion projects. Its role in the market is strengthened by a wide product portfolio and long-standing global customer relationships.

-

In 2025, GE launched its new “Green Transformer” line using biodegradable ester fluids, addressing sustainability and stricter energy-efficiency regulations in Europe and North America.

Mitsubishi Electric Corporation

Mitsubishi Electric Corporation, based in Japan, is a key player in the distribution transformer market, with a focus on high-quality, technologically advanced solutions. The company specializes in environmentally friendly, low-loss transformers suitable for smart grid applications and renewable energy integration. Mitsubishi’s competitive edge lies in its precision engineering and innovation in eco-friendly insulation materials and digital monitoring.

-

In 2025, Mitsubishi Electric introduced its next-generation low-carbon footprint transformers, designed with advanced insulation systems to meet stringent energy efficiency standards in Asia-Pacific markets.

Distribution Transformer Market Key Players:

-

B.H.E.L.

-

Trench Group

-

ABB

-

Mehru Electrical & Mechanical Engineers (P) Ltd.

-

Siemens

-

EMEK Electrical Industry Inc.

-

CG Power and Industrial Solutions Limited

-

Schneider Electric

-

Toshiba

-

PFIFFNER Distribution Transformers Ltd.

-

G.E.

-

Amran Inc.

-

Eaton

-

Mitsubishi Electric Corporation

-

Indian Transformers Company Ltd.

-

Hitachi Energy Ltd.

-

Toshiba Energy Systems & Solutions Corporation

-

Hyundai Electric (Hyosung Heavy Industries)

-

Hammond Power Solutions

-

Crompton Greaves (CG Power & Industrial Solutions Ltd.)

| Report Attributes | Details |

| Market Size in 2024 | US$ 26.88 Bn |

| Market Size by 2032 | US$ 42.89 Bn |

| CAGR | CAGR of 6.2% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Mounting Location (Pole, Pad, Underground Vault) • By Phase (Single-phase, Three-phase), By Insulation (Dry, Oil Immersed) • By Voltage (Low Voltage, Medium Voltage, High Voltage) • By End-User (Residential, Commercial, Industrial, Utility) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Trench Group, ABB, Mehru Electrical & Mechanical Engineers (P) Ltd., Siemens, EMEK Electrical Industry Inc., CG Power and Industrial Solutions Limited, Schneider Electric,Toshiba, PFIFFNER Distribution Transformers Ltd., G.E., Amran Inc.,, Eaton, Mitsubishi Electric Corporation, Indian Transformers Company Ltd., B.H.E.L. |