Industrial Separator Market Report Scope & Overview:

Get More Information on Industrial Separator Market - Request Sample Report

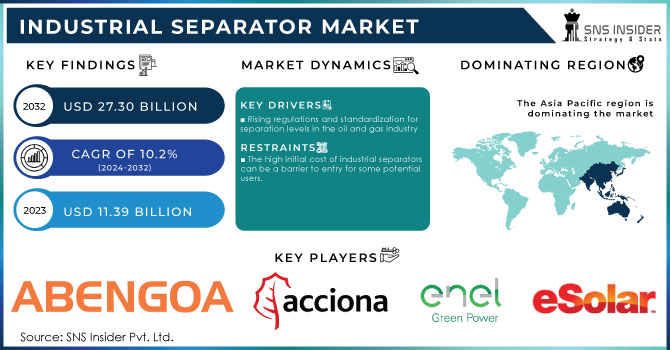

The Industrial Separator Market size was USD 11.39 billion in 2023 and is expected to reach USD 27.30 billion by 2032, growing at a CAGR of 10.2% over the forecast period of 2024-2032.

The industrial separator market is experiencing growth, fueled by a confluence of factors. the resurgence of oil and gas exploration and production, with activity expanding to deep sea and ultra-deepwater locations, as well as targeting unconventional resources like tight gas and shale gas. This translates to a growing demand for oil and gas separation equipment, as these processes require efficient separation of valuable hydrocarbons from unwanted materials. i3 Energy PLC awarded Baker Hughes an oilfield contract to conduct drilling in the North Sea, reflecting this trend. environmental concerns are playing a significant role. Stringent regulations and a growing focus on safe water disposal and reuse are pushing the adoption of industrial separators in oil and gas production. This ensures environmentally responsible practices and minimizes potential pollution. the rising consumption of natural gas, As a cleaner-burning fuel with applications in power generation, cooking, and electricity production, the demand for natural gas is rapidly increasing. According to the Energy Information Administration, the US alone consumed approximately 89.1 billion cubic feet per day of natural gas in 2023.

MARKET DYNAMICS

KEY DRIVERS:

-

Rising regulations and standardization for separation levels in the oil and gas industry

Stricter regulations demanding cleaner production processes necessitate efficient oil and water separation. This translates directly to a greater need for industrial separators within oil and gas facilities. Secondly, standardization ensures consistent separation levels across the industry. This creates a predictable demand for separators that meet these newly established performance benchmarks. Essentially, these regulations and standards act in tandem, pushing and pulling on the demand lever simultaneously, resulting in a robust growth trajectory for the industrial separator market.

RESTRAIN:

-

The high initial cost of industrial separators can be a barrier to entry for some potential users.

-

Fluctuations in oil prices can cause oil and gas companies to tighten or loosen their exploration project budgets

The upfront investment for industrial separators can be a hurdle for some potential buyers. Setting up these systems can be expensive, encompassing not just the separator itself but also any necessary installation equipment and ongoing maintenance. The price tag can be particularly daunting for larger or more complex separators. While the long-term benefits are undeniable, including improved efficiency and environmental compliance, the initial financial outlay can be a significant obstacle for some companies. These benefits might involve reduced waste, lower operating costs, and a more environmentally responsible production process.

OPPORTUNITY:

-

Natural gas is experiencing surging demand across the market.

-

Technological advancements in separators are making them more energy-efficient, attracting new investments to the market.

Natural gas is experiencing a rise in demand, driven by its versatility across power generation, heating, and industrial applications. Compared to traditional fuels like coal or oil, natural gas offers a significant environmental benefit: lower emissions, which aligns perfectly with growing concerns about sustainability. Beyond its environmental advantages, natural gas boasts exceptional efficiency, delivering impressive energy output relative to the amount used. This surging demand for natural gas presents a golden opportunity for the industrial separator market. These separators are essential for processing natural gas by removing unwanted impurities like water and oil before they enter pipelines or get used.

CHALLENGES:

-

The rising demand for industrial separators fuels competition, potentially squeezing profit margins for manufacturers.

As more players enter the market to capitalize on the growth, competition for contracts and market share heats up. This increasingly competitive landscape can put pressure on profit margins. Manufacturers might resort to price reductions to win contracts, potentially leading to lower profits per unit sold. To navigate this competitive environment, companies will likely focus on strategies like product differentiation, innovation, and optimizing production efficiency to maintain profitability. Those who can effectively balance these factors will be best positioned to thrive in the flourishing industrial separator market.

IMPACT OF RUSSIA UKRAINE WAR

The impact of Russia-Ukraine has created uncertainty in the industrial separator market. Russia the major oil and gas producer, could dampen demand for separators used in those industries. Disruptions in the global supply chain further complicate matters, potentially causing shortages of raw materials and components needed for separator production, leading to price hikes and delays. the war has also triggered a focus on energy security. This could lead to a rise in investment in alternative energy sources like biofuels, which require industrial separators during processing. Rising oil and gas prices due to the war might incentivize increased exploration and production activities, creating a continued demand for separators in these sectors. The interplay of these opposing forces makes the market outlook difficult to predict.

IMPACT OF ECONOMIC DOWNTURN

Economic downturns have slowed down the overall industrial separator market. Companies reduce their spending, leading to delays or cancellations of capital projects that often rely on industrial separators. This led to a decline in demand. Economic slumps often trigger a decrease in oil and gas prices, causing a domino effect. Lower prices incentivize less exploration and production, reducing the need for separators used in these processes. Environmental regulations, another driver for separators in areas like water treatment, might also see reduced spending as governments and companies prioritize immediate economic concerns. Existing facilities still require maintenance and repairs, creating a baseline demand for replacement separators.

SEGMENTATION ANALYSIS:

By Application

-

Centrifugal Separators

-

Cyclone Separators

-

Gas-Liquid Separators

-

Liquid-Liquid Separators

-

Others

The centrifugal separators segment dominated the industrial separator market in 2023. Their effectiveness in removing liquid mist from oil or gas makes them a valuable tool. Centrifugal separators work by utilizing centrifugal force. As the gas stream spins at high velocity within the separator, the liquid mist is forced outwards against the container walls. This heavier liquid then falls due to gravity and collects in a designated section below, while the purified gas remains in the center of the vortex. This efficient separation process is widely used across industries, and the continued demand for cleaner oil and gas products is expected to propel the growth of the centrifugal separator segment within the industrial separator market.

By End-User

-

Chemical

-

Mining

-

Power

The oil and gas segment is leading the industrial separators market in 2023. due to its exceptional ability to separate oil from water and waste products. This demand is fueled by the dramatic rise in global crude oil production, particularly in countries like Saudi Arabia, Iran, and China. This trend is expected to continue, creating a strong market for industrial separators within the oil and gas sector. Beyond oil and gas, industrial separators play a vital role in the power industry as well. Here, they are used to separate various fluids like boiler feed water, turbine discharge, and even gasses like nitrogen and carbon dioxide produced during desulfurization processes. This versatility ensures continued demand for industrial separators across numerous applications.

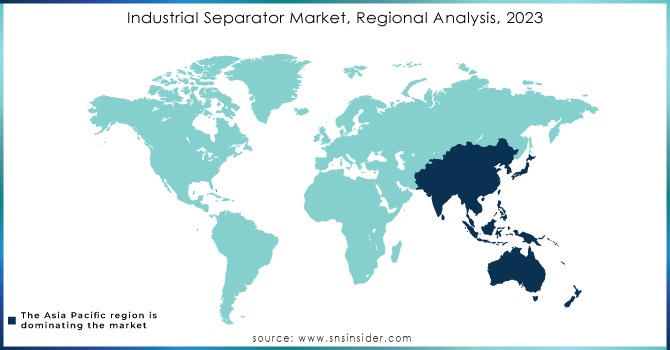

REGIONAL ANALYSIS

The Asia Pacific region dominated the industrial separator market in 2023, driven by a powerful combination of factors. increased investments in industrial infrastructure are fueling the need for efficient separation technologies. Growing environmental concerns are prompting stricter regulations and a focus on sustainable practices, creating a favorable environment for industrial separators. This region boasts a well-established industrial sector with a growing emphasis on energy efficiency, further propelling market growth. China holds the largest market share due to its massive industrial base. India is experiencing the fastest market growth as it rapidly expands its industrial capabilities. Europe is the second-largest market share, driven by rapid industrialization in emerging Eastern European nations.

Do You Need any Customization Research on Industrial Separator Market - Enquire Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

The Major Players are Abengoa Solar SA (Spain), Acciona Energy (Spain), GE Renewable Energy (France), TSK Flagsol Engineering GmbH (Germany), Enel Green Power (Italy), BrightSource Energy (US), Attantica Yield PLO (UK), eSolar inc. (US), SolarReserve (US), ACWA Power (Saudi Arabia), Chiyoda Corporation (Japan), Alsolen (Morocco), Soligua (Italy), and other players.

RECENT DEVELOPMENTS

-

In April 2024: The power and renewable energy businesses created the independent public company GE Vernova, focused on electricity, wind, and electrification. GE itself transitioned to become GE Aerospace, concentrating on aviation. Both companies, along with GE Healthcare (separated in 2023), are now independent publicly traded entities.

-

In January 2023: Alfa Laval, a frontrunner in separator technology, launched the industry's first biofuel-ready separators. This innovation addresses the growing demand for sustainable solutions in the marine industry, as biofuels offer a way to reduce carbon emissions from ships.

-

In May 2023: GEA, another key player, announced a significant investment. By the end of 2024, they plan to invest €50 million to upgrade their German centrifuge production facilities. This expansion suggests they anticipate a rise in demand for separators, potentially driven by the increasing use of biofuels.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.39 Bn |

| Market Size by 2032 | US$ 27.30 Bn |

| CAGR | CAGR of 10.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Magnetic Separators, Centrifugal Separators, Cyclone Separators, Gas-Liquid Separators, Liquid-Liquid Separators, And Others) • By End-User (Power, Chemical, Oil & Gas, Mining, And Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Abengoa Solar, SA (Spain), Acciona Energy (Spain), GE Renewable Energy (France), TSK Flagsol Engineering GmbH (Germany), Enel Green Power (Italy), BrightSource Energy (US), Attantica Yield PLO (UK), eSolar inc. (US), SolarReserve (US), ACWA Power (Saudi Arabia), Chiyoda Corporation (Japan), Alsolen (Morocco), Soligua (Italy), |

| Key Drivers | • Rising regulations and standardization for separation levels in the oil and gas industry |

| Key Restraints | • The high initial cost of industrial separators can be a barrier to entry for some potential users. • Fluctuations in oil prices can cause oil and gas companies to tighten or loosen their exploration project budgets |