DNA Data Storage Market Size & Trends:

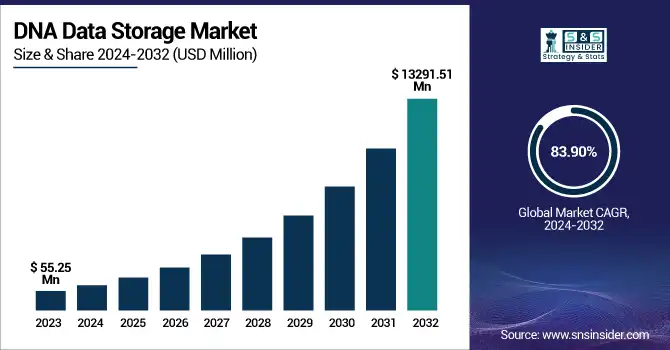

The DNA Data Storage Market was valued at USD 55.25 million in 2023 and is expected to reach USD 13291.51 million by 2032, growing at a CAGR of 83.90% over the forecast period 2024-2032. DNA data storage provides high data density and is efficient, it can hold a significant amount of data in a small physical volume. The scalability and affordability of DNA storage are continually progressing with the technological advancements in DNA synthesis, sequencing, and encoding.

To Get more information on DNA Data Storage Market - Request Free Sample Report

It provides high levels of data integrity and data has the potential to be stored for bath centuries without decay. This has made it a great choice for archiving such important data. DNA storage is also being studied for Artificial Intelligence (AI) and Big Data, answering massive data problems for big data generation. With many data centers, the U.S. is number one in DNA data storage, which brightly predicts the demand for DNA sequencing solutions. Investments from the government in genomic data management (for example, Canada's announced USD 11.32 million funding for 2023) will create even more demand for innovative storage technologies.

The U.S. DNA Data Storage Market is estimated to be USD 15.78 Million in 2023 and is projected to grow at a CAGR of 83.56%. The U.S. has remained the largest country in the DNA data storage market as it is investing heavily in research & development, government funding & the collaboration of biotechnology firms with technology firms. The big players are taking steps with the technologies of DNA synthesis and sequencing while the sectors like healthcare and finance looking for sustainable data storage solutions.

DNA Data Storage Market Dynamics

Key Drivers:

-

DNA Data Storage Market Growth Driven by Digital Data Surge Sustainability and Technological Advancements

With the fast-growing digital data production and the drawbacks of conventional storage media, the DNA data storage market is propelling. The extreme data density of DNA, which can hold petabytes worth of information in a single gram, makes it an ideal candidate for long-term archival solutions. Demand from key industries like biotechnology, healthcare, government, and media require secure, high-information-stability, energy-efficient data storage, and we adopted our strategy with this in mind. Furthermore, growing investments by corporate giants, universities, and research organizations are expediting technological development, lowering the cost of sequencing, and promoting commercialization. The growing focus on green and sustainable data centers also drives up interest in DNA storage, which is very low-energy for long-term storage.

Restrain:

-

Standardization Challenges and Knowledge Gaps Hindering Growth in the DNA Data Storage Market

Lack of standardization on platforms and technologies is one of the key restraints in the DNA data storage market. Because the space is still nascent, there are no accepted protocols or encoding formats for the process of writing information into DNA or reading information– causing incompatibility and dysfunction between sectors. Also, a lack of knowledge on DNA data storage and a shortage of awareness by end users slow down, the adoption. The technology is still perceived as complex, and few IT professionals are accustomed to handling biological materials in a conventional setting, so the hesitancy continues for many industries. The lack of this knowledge inhibits growth and market size potential in fields other than biotechnology and the academic setting.

Opportunity:

-

Growing Demand for Sustainable Storage Drives DNA Data Storage Market Growth and Commercial Opportunities

DNA data storage market owing to rise in demand for sustainable and energy-efficient data storage. Corporate giants, universities, and research organizations allowing vast investments into this nascent technology opens avenues for commercial uses in areas such as pharmaceuticals, government, and finance. Also, as the technology matures, new opportunities for use in AI and big data analytics applications are expected to develop DNA storage as a good candidate for managing huge datasets. Demand for DNA-based systems will also be driven by the push towards greening data centers, and the need for long-term stable and secure storage solutions, providing a big opportunity for these companies to grow.

Challenges:

-

Speed Scalability and Security Challenges Hinder Widespread Adoption of DNA Data Storage Technology

There are also speed and scalability challenges related to DNA data storage. Today, DNA reading and writing are orders of magnitude slower than traditional storage, which cannot support fast data access or real-time workloads. Also, the long-term reliability of synthetic DNA in natural environments has yet to be proven. One of the technological challenges is maintaining data integrity over decades or centuries, especially without strong, automated error-checking and correction systems. The implications of storing sensitive data in biological formats will not only raise security and ethical concerns, particularly in finance, defense, and healthcare but also affect regulation and societal aspects of life.

DNA Data Storage Industry Segmentation Analysis

By Type

In 2023, the cloud-based segment held the largest DNA data storage market share, contributing to over 58.3% of the total share. This dominance is due to factors such as the growing number of biotechnology companies, research organizations, and enterprises that are opting for cloud infrastructure to ensure scalability and access to data storage solutions from a remote location. For large-scale applications involving genomic and archival data, cloud platforms provide flexibility, reduced initial cost of infrastructure, and the intrinsic advantages of cloud environments enabled by advanced analytics and AI tools.

The on-premises segment is expected to grow at the fastest CAGR during 2024 – 2032, owing to the rising need for data security, customization, and regulatory compliance. To achieve complete control over sensitive information and preserve data privacy, government bodies, defense organizations, and financial institutions are finding meaning in on-premises DNA storage solutions. Moreover, DNA storage hardware and local infrastructure are progressing thereby making the on-prem deployments possible to accelerate adoption with security-critical sectors.

By Technology

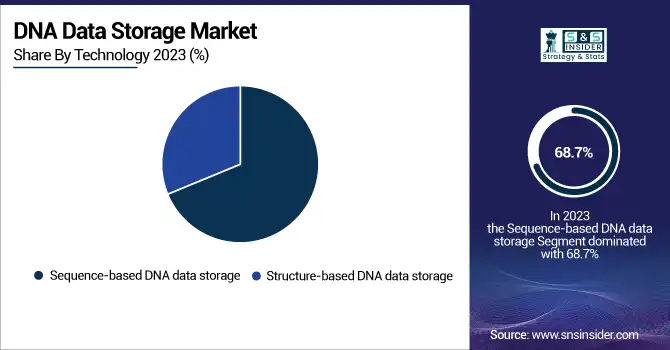

The majority of the revenue share was accounted for sequence-based DNA data storage, which accounted for 68.7% in 2023. It dominates largely due to its technological maturity and proven ability to high-bandwidth data at scale in a lossless manner. By encoding binary to nucleotides, the approach has been researched and demonstrated in various pilot projects by several major tech firms and universities. Moreover, its compatibility with existing DNA sequencing technologies further reinforces its suitability for archival purposes.

The fastest CAGR segment from 2024 to 2032 is structure-based DNA data storage. A new approach that extracts data at the three-dimensional structure level of DNA molecules, instead of the sequence. Increased storage density, improved read speeds, and possibly reduced error rates are all on the table. Improvements in nanotechnology and molecular engineering technology R&D are now enabling structure-based methods to be well-suited for next-generation, high-density, and high-rate data storage applications.

By End User

The biotechnology & healthcare segment accounted for the largest share of 38.6% in 2023, owing to the need to store large amounts of genomics data, precision medicine, clinical data, and medical research data. As a result, the inherent characteristics of DNA-based data storage long data retention, precision, and secure storage solutions make it an ideal solution for the healthcare sector. Moreover, the boom in personalized medicine and genomic sequencing has acted as an additional catalyst for biotech and medical institutions to employ ultra-high-capacity storage technologies.

Government & defense is expected to develop at the fastest CAGR between 2024 and 2032. Increasing security concerns over data safety, sustainability, and national data autonomy are driving the growth of this sector. DNA data storage is being investigated by governments and defense agencies as a secure, non-tamperable alternative to conventional systems for classifying archival or mission-critical data. This is a very sensitive sector and the potential that the technology has for long-term preservation with minimal maintenance makes it uniquely valuable.

DNA Data Storage Market Regional Outlook

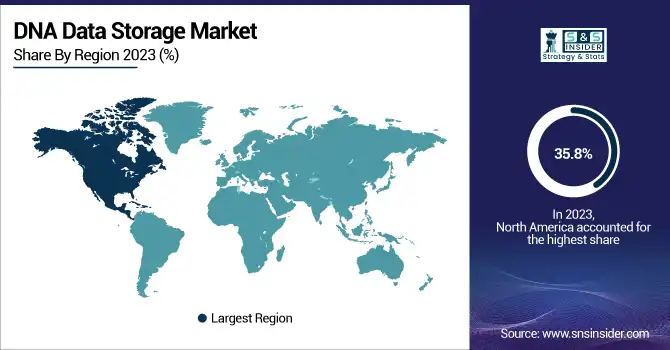

The DNA data storage market share in North America is 35.8% due to the presence of strong R&D, advanced infrastructure, and substantial investments by the government and private sectors in 2023. Having been home to big techs such as Microsoft and Twist Bioscience is significantly responsible for the region at the forefront. There are some applications developed using DNA data storage technology in the real world such as Microsoft has collaboration with the University of Washington to build a fully automated DNA data storage system prototype that they are working to develop. The U.S. National Human Genome Research Institute, for instance, has been offering funding toward synthetic biology projects that enhance the development of DNA-based data storage in the region.

Asia Pacific is estimated to witness the highest compound annual growth rate (CAGR) from 2024 to 2032 owing to a surge in investments in genomic biotechnology and digital infrastructure. China, Japan, and India are in the midst of a massive push into new data storage and genomics. China contains the largest genomics company in the world, BGI Group, which has been researching synthetic DNA storage techniques to cope with large genomic data sets. Likewise, Japan is nurturing a university-focused tech partnership ecosystem, and India is boasting a growing biotech ecosystem and a plethora of government-backed digital initiatives that would make for a fertile ground for the widespread adoption of DNA-based storage solutions shortly.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players Listed in the DNA Data Storage Market are:

-

Microsoft (Project Silica)

-

Twist Bioscience (DNA Data Storage Platform)

-

Illumina (NovaSeq DNA sequencer)

-

Thermo Fisher Scientific (Ion Torrent Genexus System)

-

Catalog Technologies (Shannon DNA Storage Platform)

-

IBM (DNA Fountain Coding Strategy)

-

Helixworks (Digital DNA Drive)

-

Iridia (Electrochemical DNA Writer)

-

GenScript (gBlocks Gene Fragments)

-

Quantum Corporation (DNA Archival Storage Research)

-

Zymo Research (ZR DNA/RNA Shield)

-

Oxford Nanopore Technologies (MinION Sequencer)

-

Evonetix (Thermal Control DNA Synthesis Chip)

-

DNA Script (SYNTAX Platform)

-

Southwestern University & Microsoft Research Collaboration (Long-term DNA Archival Storage).

Recent Development

-

In August 2024, Twist Bioscience and bitBiome announced a strategic collaboration to launch a unique enzyme screening kit for biocatalysis, aimed at enhancing pharmaceutical production.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 55.25 Million |

| Market Size by 2032 | USD 13291.52 Million |

| CAGR | CAGR of 83.90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cloud, On-premises) • By Technology (Sequence-based DNA data storage, Structure-based DNA data storage) • By End User (Biotechnology & healthcare, Banking & finance, Government & defense, Media & entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, Twist Bioscience, Illumina, Thermo Fisher Scientific, Catalog Technologies, IBM, Helixworks, Iridia, GenScript, Quantum Corporation, Zymo Research, Oxford Nanopore Technologies, Evonetix, DNA Script, Southwestern University & Microsoft Research Collaboration. |